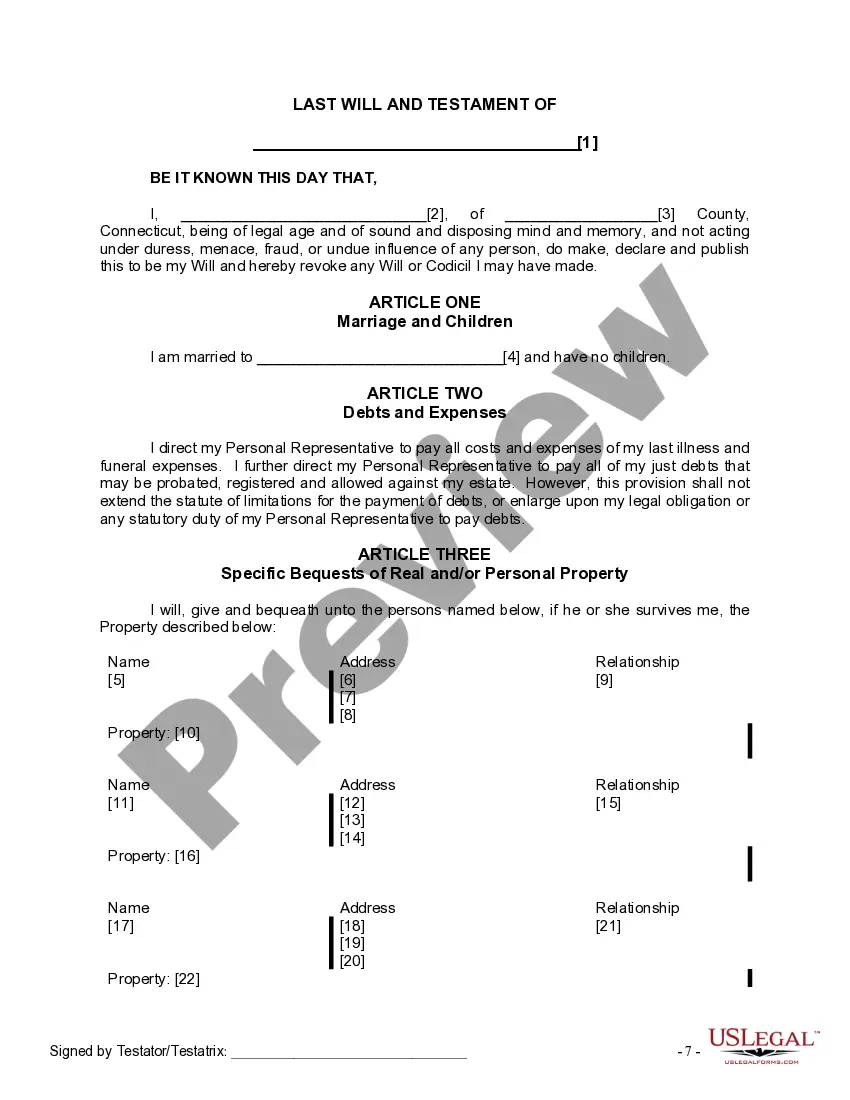

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

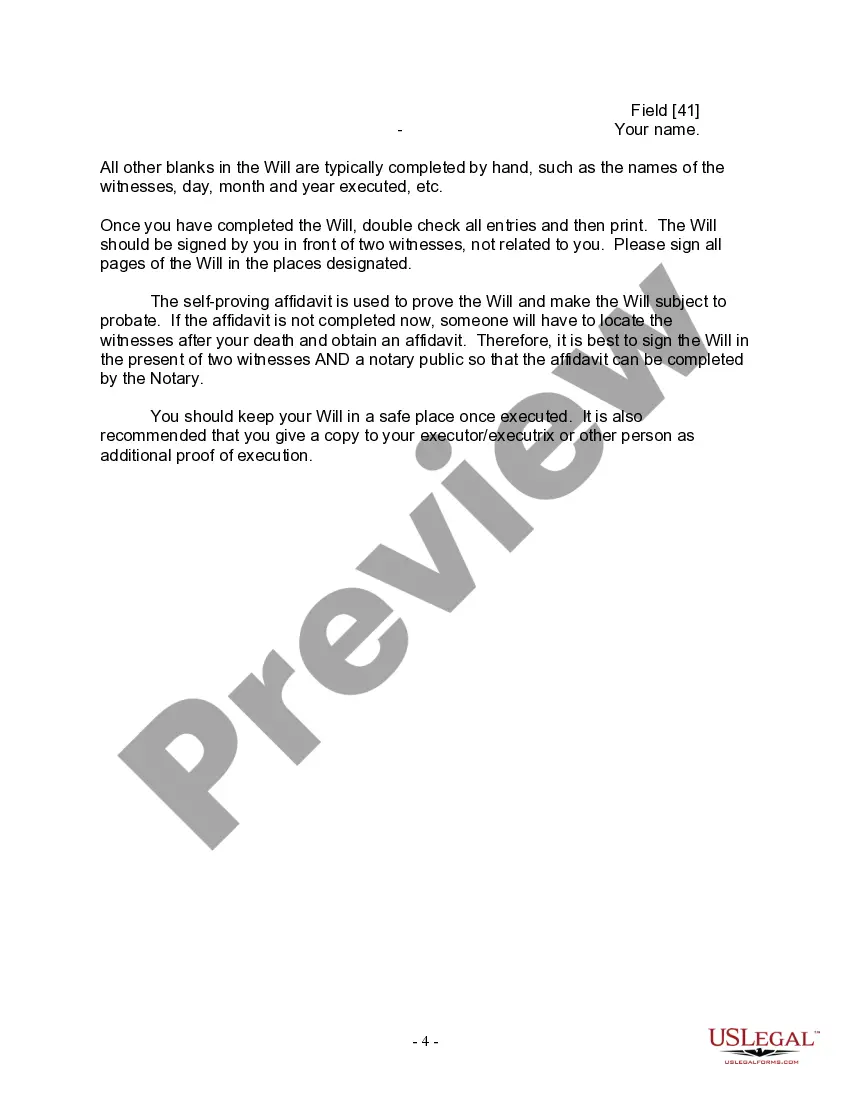

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

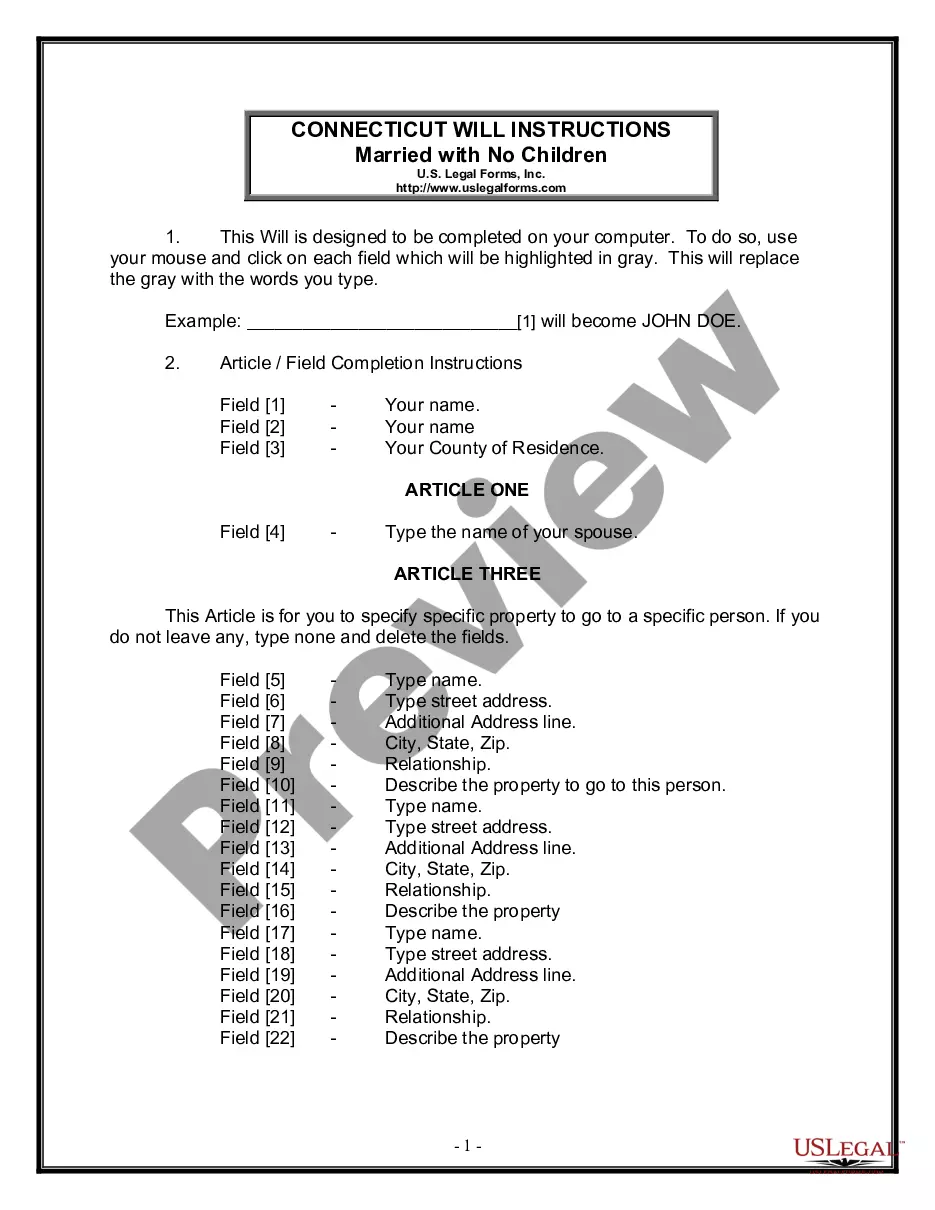

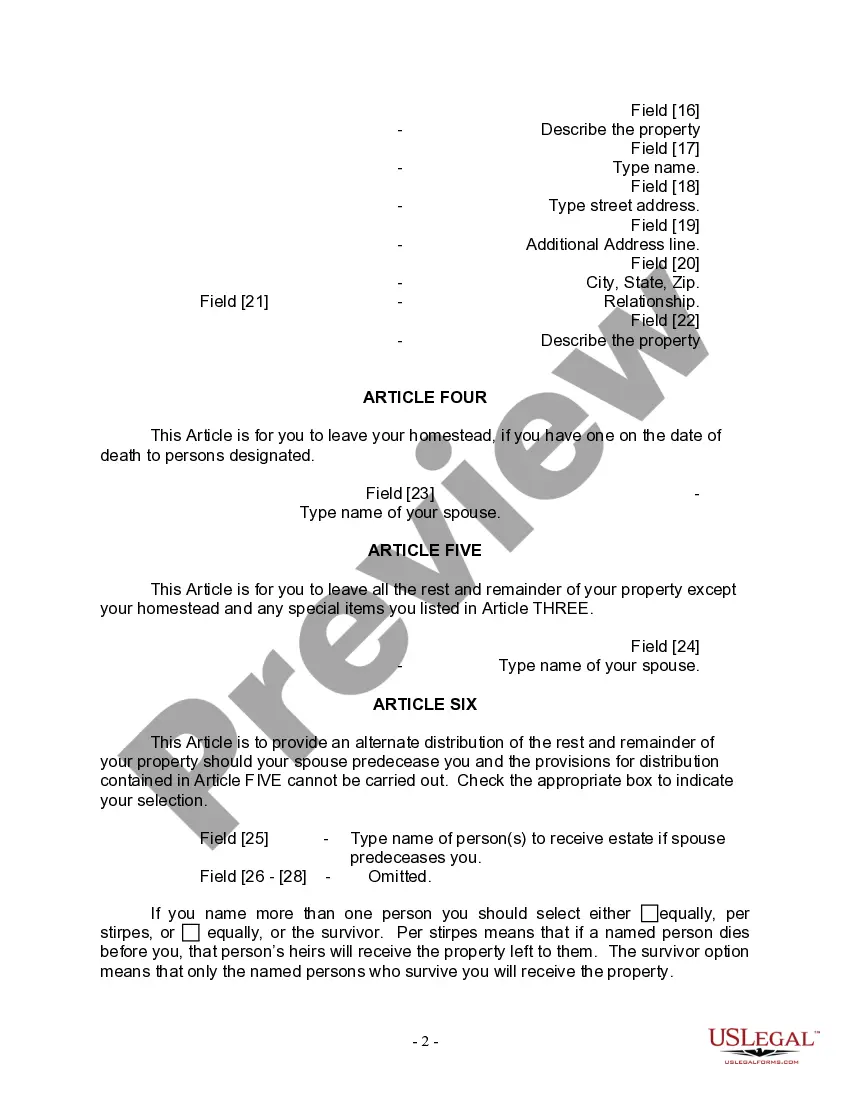

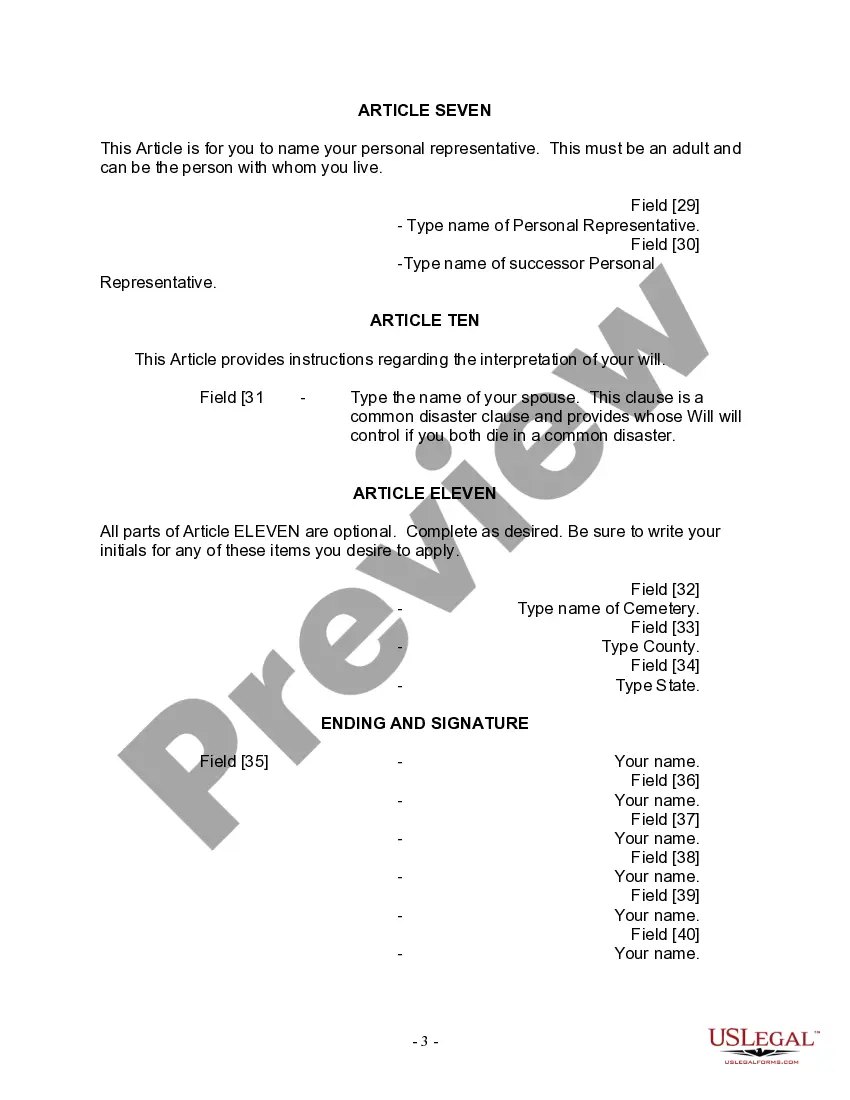

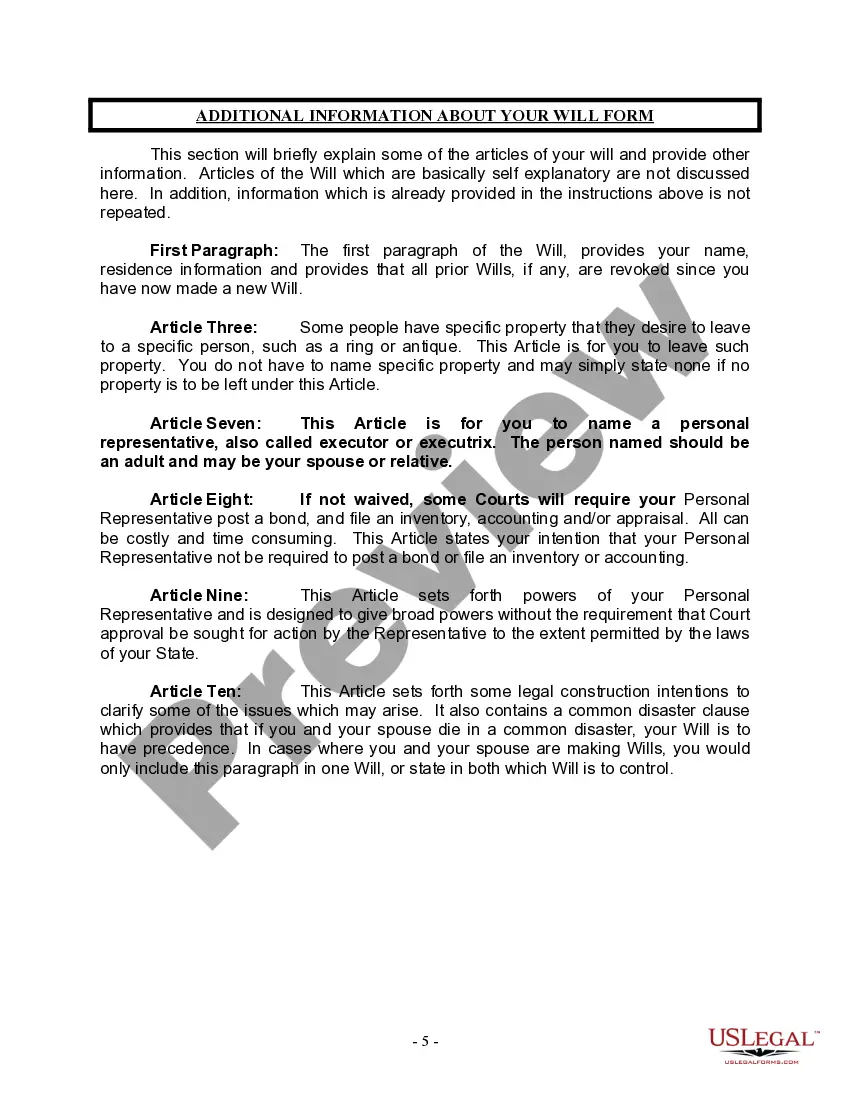

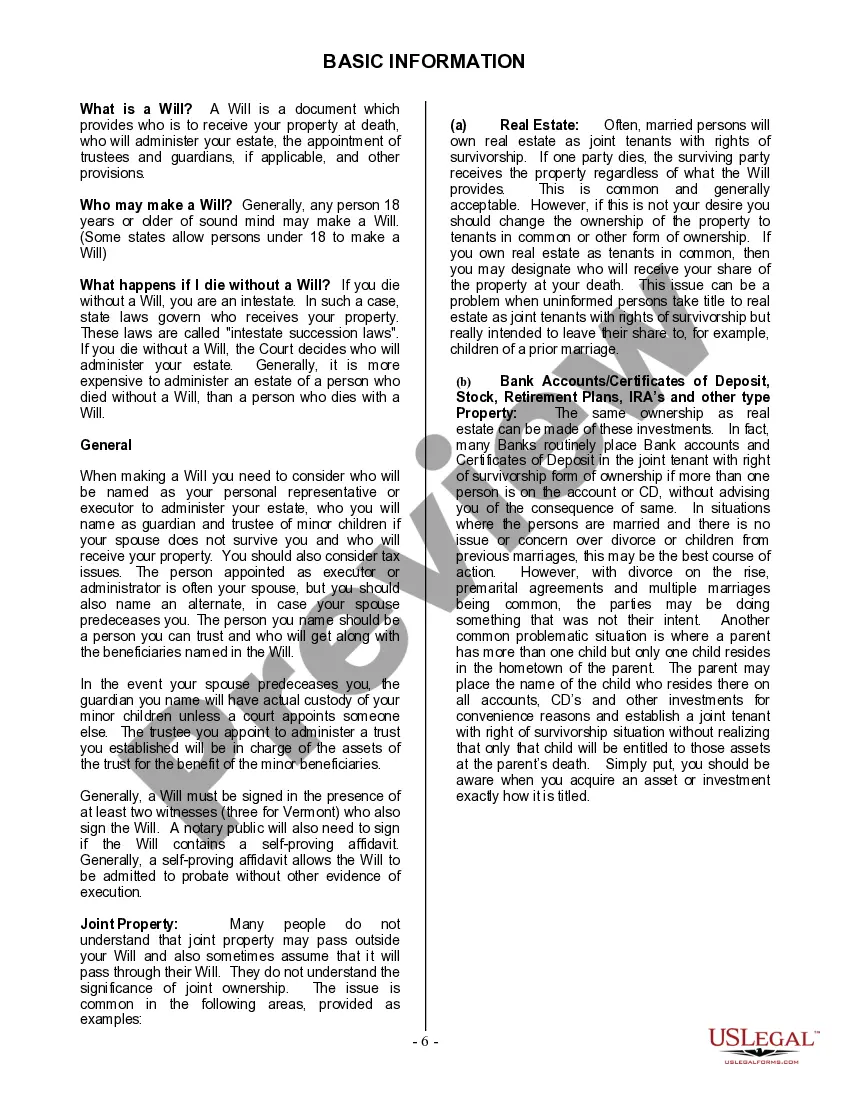

Waterbury Connecticut Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows individuals in Waterbury, Connecticut, who are married and have no children, to outline their final wishes and ensure the proper distribution of their assets after their passing. This form serves as a crucial tool in estate planning and preserving the testator's legacy. This particular Last Will and Testament form caters specifically to married individuals who do not have any children. It is important to note that there may be variations or alternative forms of this legal document available, depending on the specific requirements or preferences of the individuals involved. However, some key elements and considerations you may find in this type of Last Will and Testament form include: 1. Identifying Information: The form typically begins with the testator's personal details, such as their full legal name, address, and marital status. 2. Appointment of Executor: In this section, the testator may designate a trusted person to serve as the executor or personal representative of their estate. This individual will be responsible for carrying out the instructions set forth in the will. 3. Asset Distribution: Here, the testator can outline how their assets, including real estate, bank accounts, investments, personal belongings, and any other valuable property, should be distributed among their surviving spouse, other family members, or even charitable organizations. 4. Alternate Beneficiaries and Contingency Plans: To safeguard against unforeseen circumstances, the testator may name alternate beneficiaries to inherit their assets if the primary beneficiaries are no longer alive or willing to accept the bequest. 5. Identification of Guardians: Since the testator has no children, this section may not be relevant to this particular Last Will and Testament form. However, if the testator wishes to appoint guardians for any dependents, such as minor siblings, nieces, nephews, or pets, they can do so here. 6. Termination of Previous Wills: The form may include a provision for revoking any prior wills or codicils, ensuring that the current Last Will and Testament is the most current and legally binding document. 7. Witnesses and Signatures: To ensure the validity of the Last Will and Testament, it is crucial to have witnesses sign the document in the presence of the testator and each other. The specific legal requirements for the number of witnesses may vary by jurisdiction. Creating a Last Will and Testament is an essential step in securing your loved ones' future and ensuring your assets are distributed according to your wishes. It is advisable to seek guidance from an experienced attorney in Waterbury, Connecticut, to ensure compliance with applicable laws and regulations.Waterbury Connecticut Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows individuals in Waterbury, Connecticut, who are married and have no children, to outline their final wishes and ensure the proper distribution of their assets after their passing. This form serves as a crucial tool in estate planning and preserving the testator's legacy. This particular Last Will and Testament form caters specifically to married individuals who do not have any children. It is important to note that there may be variations or alternative forms of this legal document available, depending on the specific requirements or preferences of the individuals involved. However, some key elements and considerations you may find in this type of Last Will and Testament form include: 1. Identifying Information: The form typically begins with the testator's personal details, such as their full legal name, address, and marital status. 2. Appointment of Executor: In this section, the testator may designate a trusted person to serve as the executor or personal representative of their estate. This individual will be responsible for carrying out the instructions set forth in the will. 3. Asset Distribution: Here, the testator can outline how their assets, including real estate, bank accounts, investments, personal belongings, and any other valuable property, should be distributed among their surviving spouse, other family members, or even charitable organizations. 4. Alternate Beneficiaries and Contingency Plans: To safeguard against unforeseen circumstances, the testator may name alternate beneficiaries to inherit their assets if the primary beneficiaries are no longer alive or willing to accept the bequest. 5. Identification of Guardians: Since the testator has no children, this section may not be relevant to this particular Last Will and Testament form. However, if the testator wishes to appoint guardians for any dependents, such as minor siblings, nieces, nephews, or pets, they can do so here. 6. Termination of Previous Wills: The form may include a provision for revoking any prior wills or codicils, ensuring that the current Last Will and Testament is the most current and legally binding document. 7. Witnesses and Signatures: To ensure the validity of the Last Will and Testament, it is crucial to have witnesses sign the document in the presence of the testator and each other. The specific legal requirements for the number of witnesses may vary by jurisdiction. Creating a Last Will and Testament is an essential step in securing your loved ones' future and ensuring your assets are distributed according to your wishes. It is advisable to seek guidance from an experienced attorney in Waterbury, Connecticut, to ensure compliance with applicable laws and regulations.