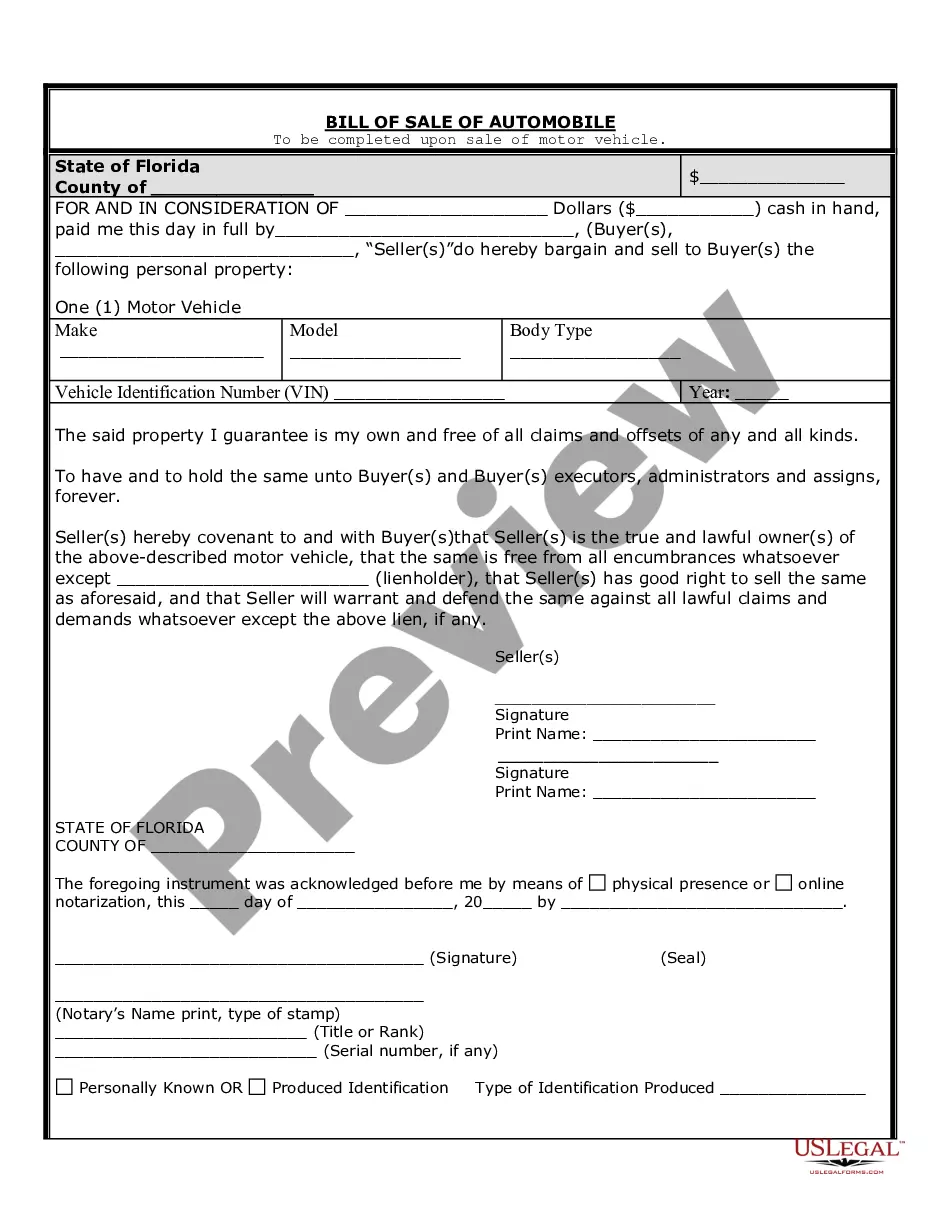

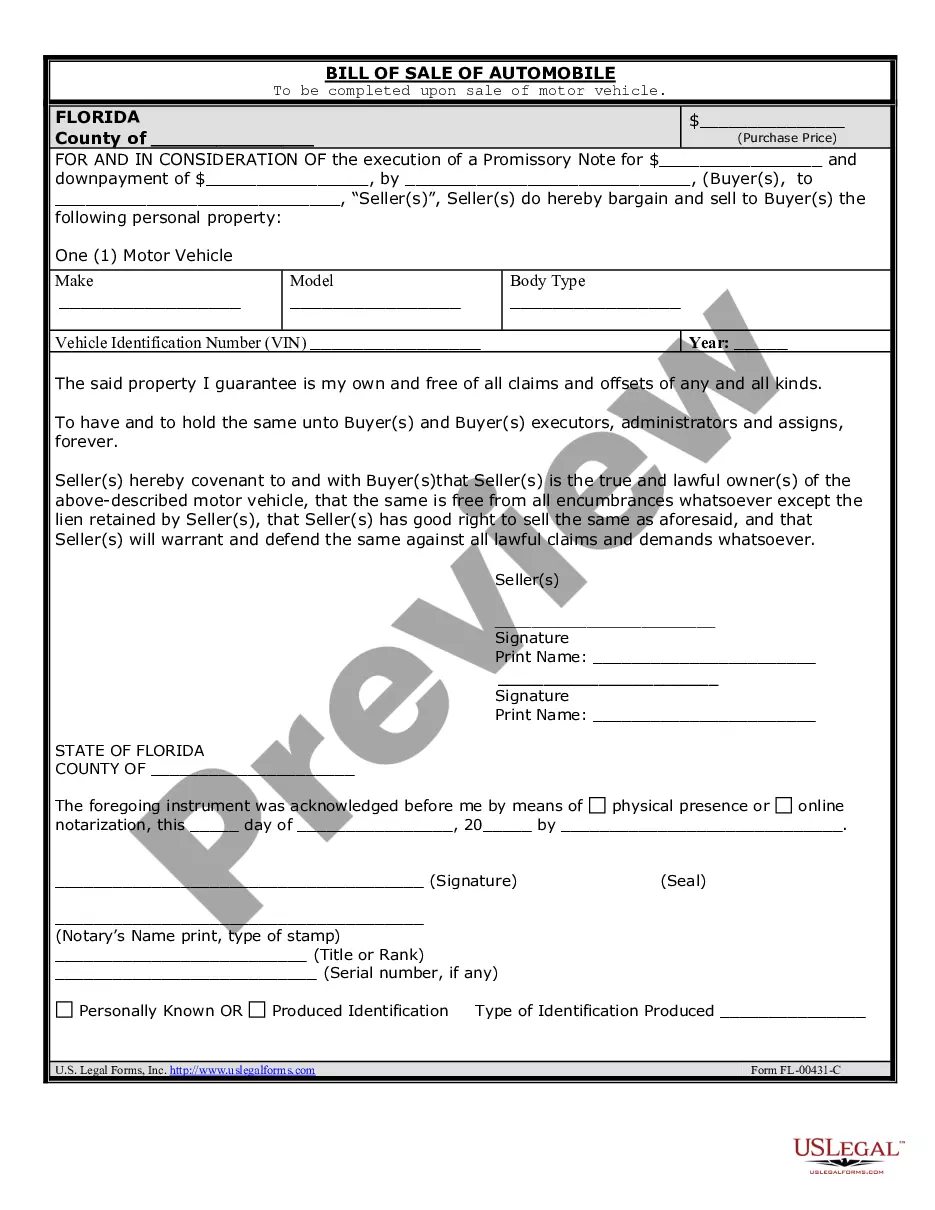

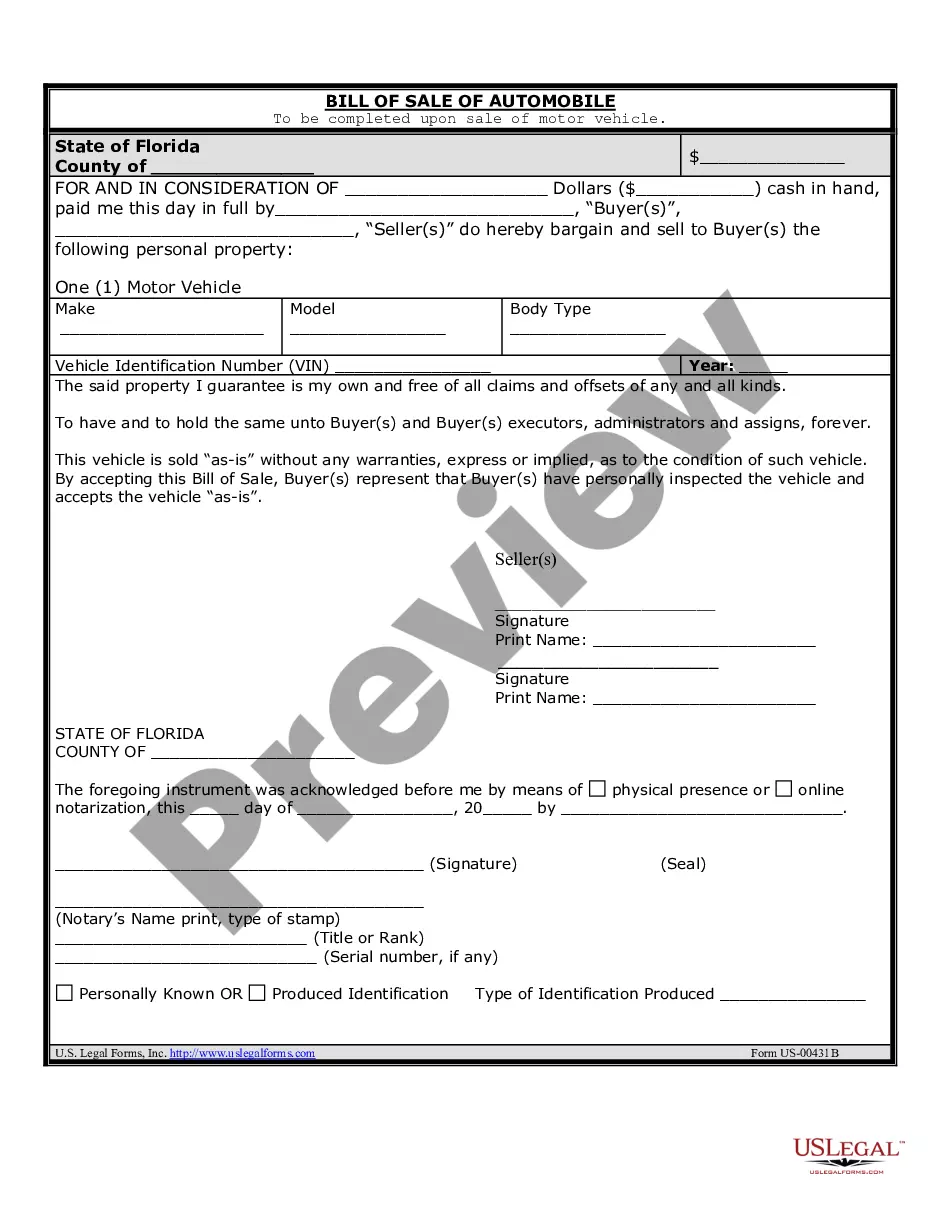

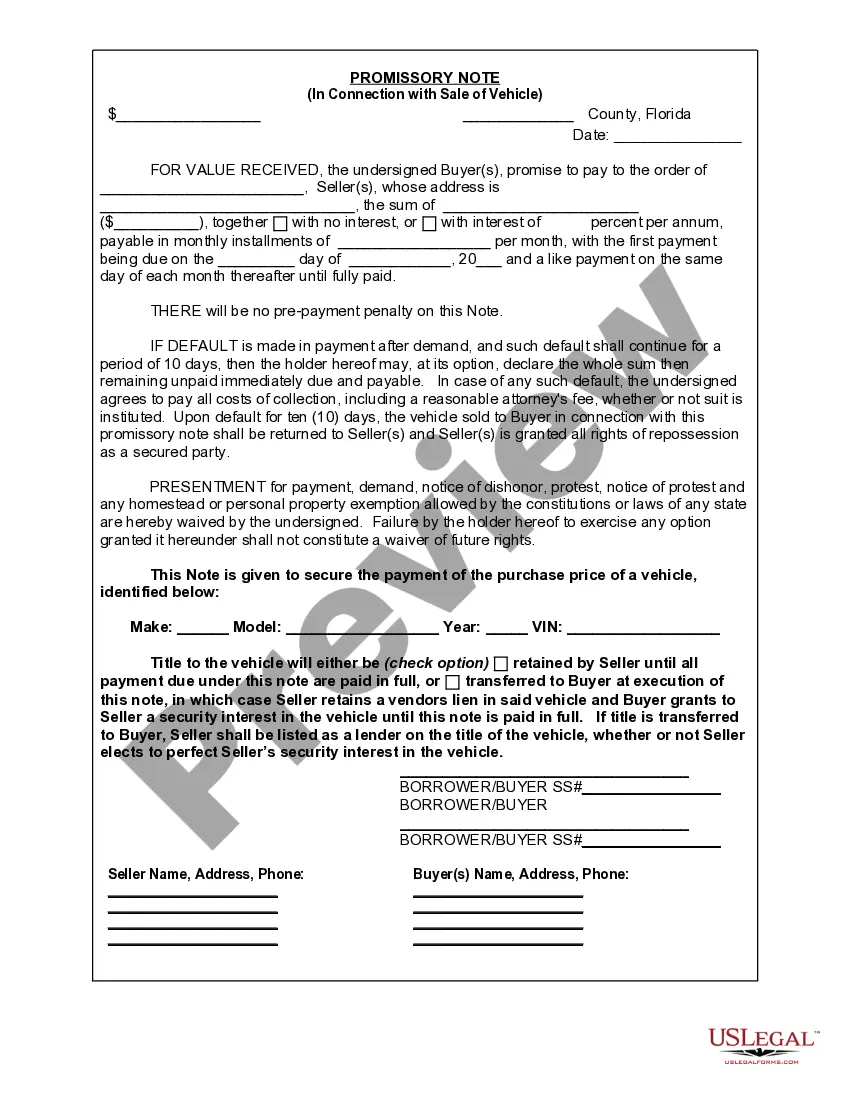

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Broward Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement for the purchase of a vehicle in Broward County, Florida. It serves as a written promise from the borrower to repay the lender a specific amount of money, typically for the purchase of a car, over a specified period of time. The Promissory Note is a vital document that protects the interests of both parties involved in the transaction. It includes detailed information such as the names and addresses of the buyer (borrower) and the seller (lender), the description of the vehicle being purchased, the loan amount, the interest rate, the repayment schedule, and any potential penalties or late fees. There are various types of Broward Florida Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used depending on the specific requirements and preferences of the parties involved. Some common types may include: 1. Simple Promissory Note: This is a straightforward agreement between the buyer and the seller, stating the loan amount, repayment terms, and any necessary legal language. 2. Secured Promissory Note: In this type of note, the lender may require the borrower to provide collateral, such as the vehicle being purchased, as security in case of default on the loan. 3. Installment Promissory Note: This type of note outlines a structured repayment plan, specifying the amount and frequency of the payments. It ensures that the loan is repaid in regular installments. 4. Balloon Promissory Note: This note involves regular monthly payments for a set period, followed by a one-time larger payment known as a "balloon payment" at the end of the loan term. 5. Adjustable Rate Promissory Note: This note allows for changes in the interest rate over time, based on a predetermined formula or index. 6. Joint Promissory Note: In situations where more than one person is involved in the purchase of a vehicle, a joint promissory note can be used to outline the responsibilities and obligations of each party in repaying the loan. 7. Personal Guaranty Promissory Note: Sometimes, a third party may provide a personal guaranty, ensuring that the loan will be repaid even if the borrower defaults. This type of note adds an extra layer of security for the lender. It is essential for both buyers and sellers in Broward County, Florida, to understand the purpose and terms of a Promissory Note when engaging in the sale of a vehicle. Consulting with a legal professional specialized in contracts and automobile sales is recommended to ensure compliance with local laws and regulations.A Broward Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement for the purchase of a vehicle in Broward County, Florida. It serves as a written promise from the borrower to repay the lender a specific amount of money, typically for the purchase of a car, over a specified period of time. The Promissory Note is a vital document that protects the interests of both parties involved in the transaction. It includes detailed information such as the names and addresses of the buyer (borrower) and the seller (lender), the description of the vehicle being purchased, the loan amount, the interest rate, the repayment schedule, and any potential penalties or late fees. There are various types of Broward Florida Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used depending on the specific requirements and preferences of the parties involved. Some common types may include: 1. Simple Promissory Note: This is a straightforward agreement between the buyer and the seller, stating the loan amount, repayment terms, and any necessary legal language. 2. Secured Promissory Note: In this type of note, the lender may require the borrower to provide collateral, such as the vehicle being purchased, as security in case of default on the loan. 3. Installment Promissory Note: This type of note outlines a structured repayment plan, specifying the amount and frequency of the payments. It ensures that the loan is repaid in regular installments. 4. Balloon Promissory Note: This note involves regular monthly payments for a set period, followed by a one-time larger payment known as a "balloon payment" at the end of the loan term. 5. Adjustable Rate Promissory Note: This note allows for changes in the interest rate over time, based on a predetermined formula or index. 6. Joint Promissory Note: In situations where more than one person is involved in the purchase of a vehicle, a joint promissory note can be used to outline the responsibilities and obligations of each party in repaying the loan. 7. Personal Guaranty Promissory Note: Sometimes, a third party may provide a personal guaranty, ensuring that the loan will be repaid even if the borrower defaults. This type of note adds an extra layer of security for the lender. It is essential for both buyers and sellers in Broward County, Florida, to understand the purpose and terms of a Promissory Note when engaging in the sale of a vehicle. Consulting with a legal professional specialized in contracts and automobile sales is recommended to ensure compliance with local laws and regulations.