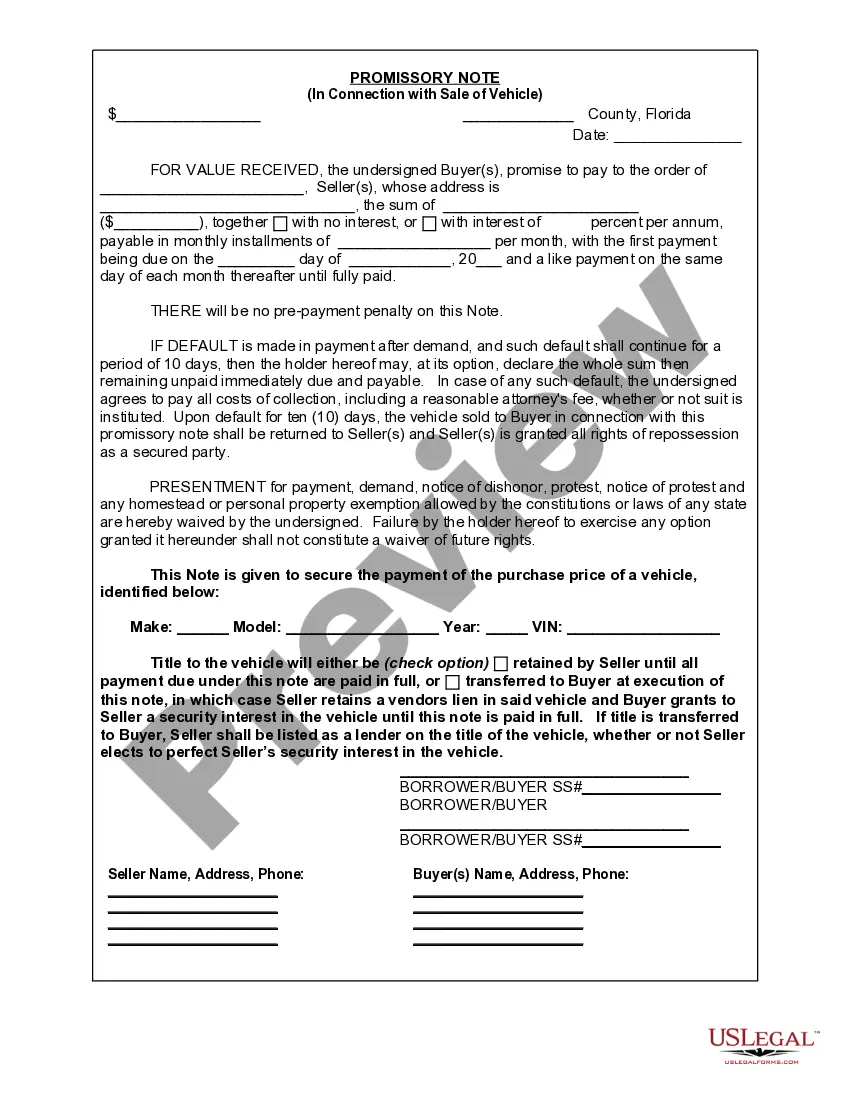

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note in connection with the sale of a vehicle or automobile in Cape Coral, Florida is a legal document that outlines the terms and conditions of a financial agreement between the buyer and the seller. It acts as evidence of the buyer's promise to repay the seller a specific sum of money over an agreed-upon period of time, including any applicable interest or fees. The Cape Coral Florida Promissory Note in Connection with Sale of Vehicle or Automobile secures the transaction and establishes the roles and responsibilities of both parties involved. It is crucial to create a detailed and accurate promissory note to protect the interests of both the buyer and the seller. The key elements typically found in a Cape Coral Florida Promissory Note in Connection with Sale of Vehicle or Automobile include: 1. Identification of Parties: The note should clearly identify the buyer and seller, including their legal names, addresses, and contact information. 2. Vehicle Details: A description of the vehicle being sold, including the make, model, year, Vehicle Identification Number (VIN), mileage, and any other pertinent details. 3. Purchase Price: The total amount agreed upon for the vehicle, including any down payment made by the buyer. 4. Payment Terms: The repayment schedule, installment amounts, due dates, and any applicable interest rates or finance charges. 5. Late Payment Penalties: Any penalties, additional charges, or interest rate adjustments that may be incurred if the buyer fails to make timely payments. 6. Security Interest: If the seller retains a security interest in the vehicle until the full payment is received, it should be clearly stated in the promissory note. 7. Default and Remedies: The actions that will be taken in the event of default, such as repossession or legal actions, and any associated costs or fees. 8. Governing Law: The promissory note should state that it is governed by Cape Coral, Florida laws. 9. Signatures: The buyer and seller must both sign and date the promissory note to make it a legally binding agreement. Different types of Cape Coral Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations based on the specific terms agreed upon by the parties involved. For instance, if the buyer and seller opt for a balloon payment, where a large final payment is due at the end of the payment term, this should be clearly stated in the promissory note. Additionally, if the seller offers financing options, such as an installment plan with no interest, that would also require a specific type of promissory note. Creating a comprehensive and accurate Cape Coral Florida Promissory Note in Connection with Sale of Vehicle or Automobile is essential to ensure a smooth transaction and protect the interests of both parties involved in the sale. Legal advice and guidance from a professional may be beneficial to ensure the document meets all legal requirements and adequately captures the agreed-upon terms.A promissory note in connection with the sale of a vehicle or automobile in Cape Coral, Florida is a legal document that outlines the terms and conditions of a financial agreement between the buyer and the seller. It acts as evidence of the buyer's promise to repay the seller a specific sum of money over an agreed-upon period of time, including any applicable interest or fees. The Cape Coral Florida Promissory Note in Connection with Sale of Vehicle or Automobile secures the transaction and establishes the roles and responsibilities of both parties involved. It is crucial to create a detailed and accurate promissory note to protect the interests of both the buyer and the seller. The key elements typically found in a Cape Coral Florida Promissory Note in Connection with Sale of Vehicle or Automobile include: 1. Identification of Parties: The note should clearly identify the buyer and seller, including their legal names, addresses, and contact information. 2. Vehicle Details: A description of the vehicle being sold, including the make, model, year, Vehicle Identification Number (VIN), mileage, and any other pertinent details. 3. Purchase Price: The total amount agreed upon for the vehicle, including any down payment made by the buyer. 4. Payment Terms: The repayment schedule, installment amounts, due dates, and any applicable interest rates or finance charges. 5. Late Payment Penalties: Any penalties, additional charges, or interest rate adjustments that may be incurred if the buyer fails to make timely payments. 6. Security Interest: If the seller retains a security interest in the vehicle until the full payment is received, it should be clearly stated in the promissory note. 7. Default and Remedies: The actions that will be taken in the event of default, such as repossession or legal actions, and any associated costs or fees. 8. Governing Law: The promissory note should state that it is governed by Cape Coral, Florida laws. 9. Signatures: The buyer and seller must both sign and date the promissory note to make it a legally binding agreement. Different types of Cape Coral Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations based on the specific terms agreed upon by the parties involved. For instance, if the buyer and seller opt for a balloon payment, where a large final payment is due at the end of the payment term, this should be clearly stated in the promissory note. Additionally, if the seller offers financing options, such as an installment plan with no interest, that would also require a specific type of promissory note. Creating a comprehensive and accurate Cape Coral Florida Promissory Note in Connection with Sale of Vehicle or Automobile is essential to ensure a smooth transaction and protect the interests of both parties involved in the sale. Legal advice and guidance from a professional may be beneficial to ensure the document meets all legal requirements and adequately captures the agreed-upon terms.