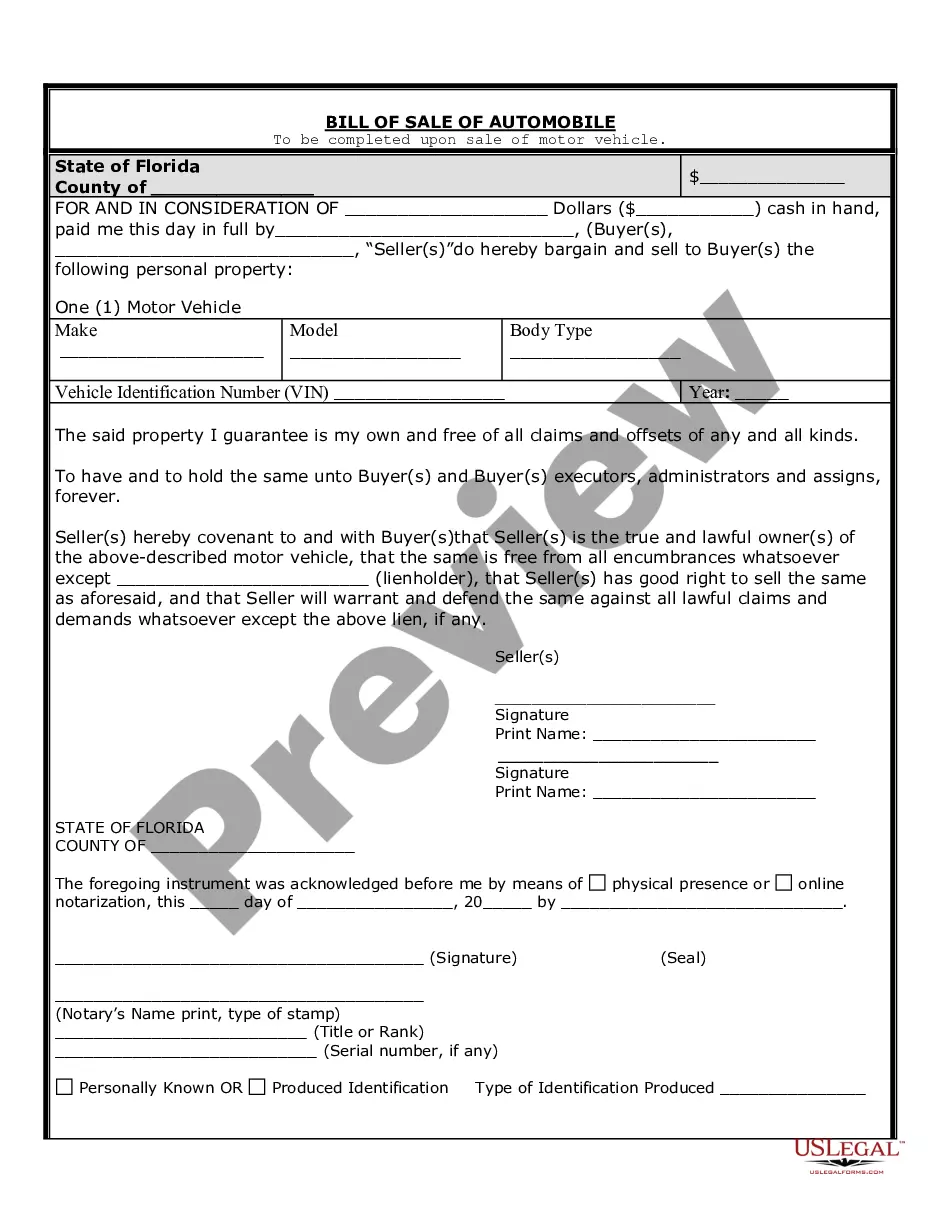

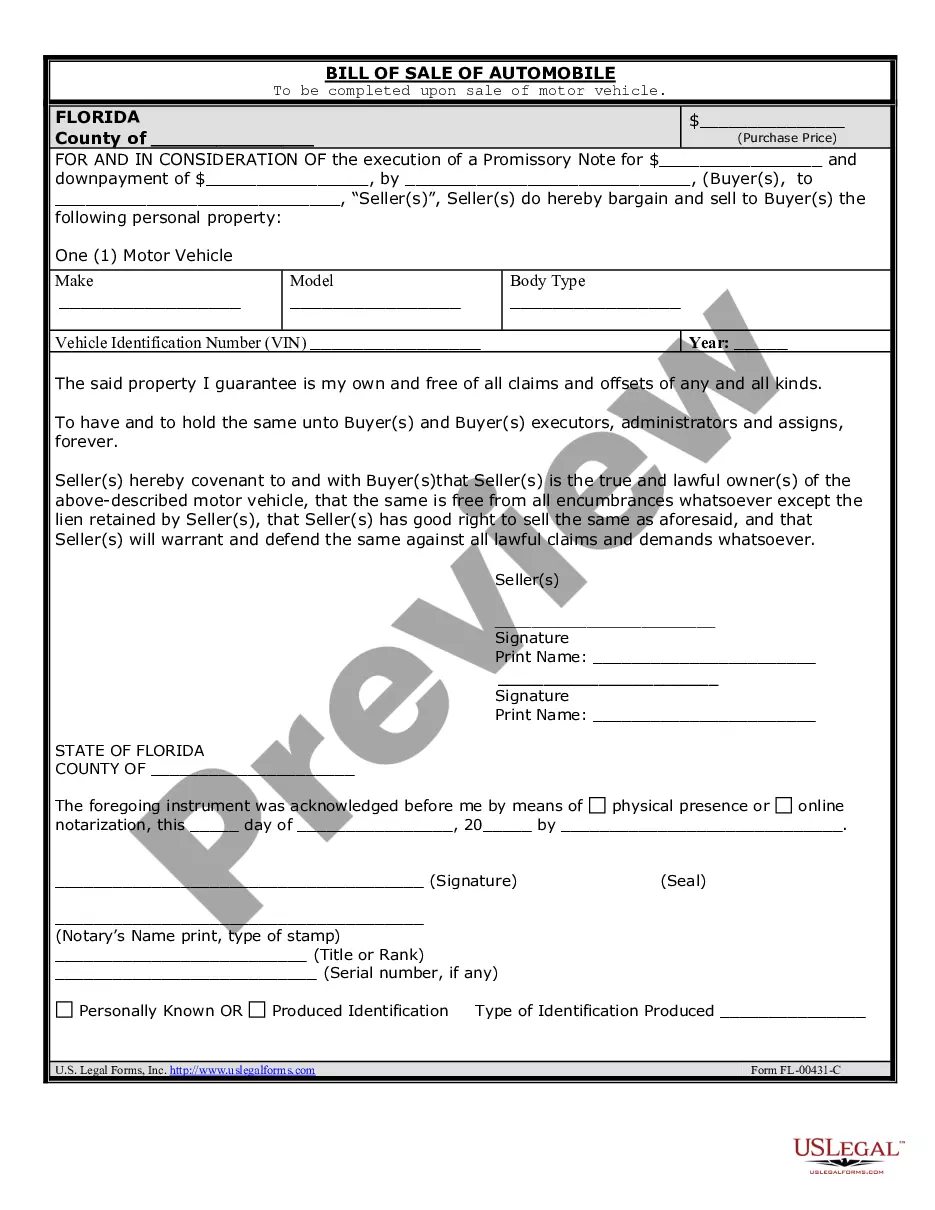

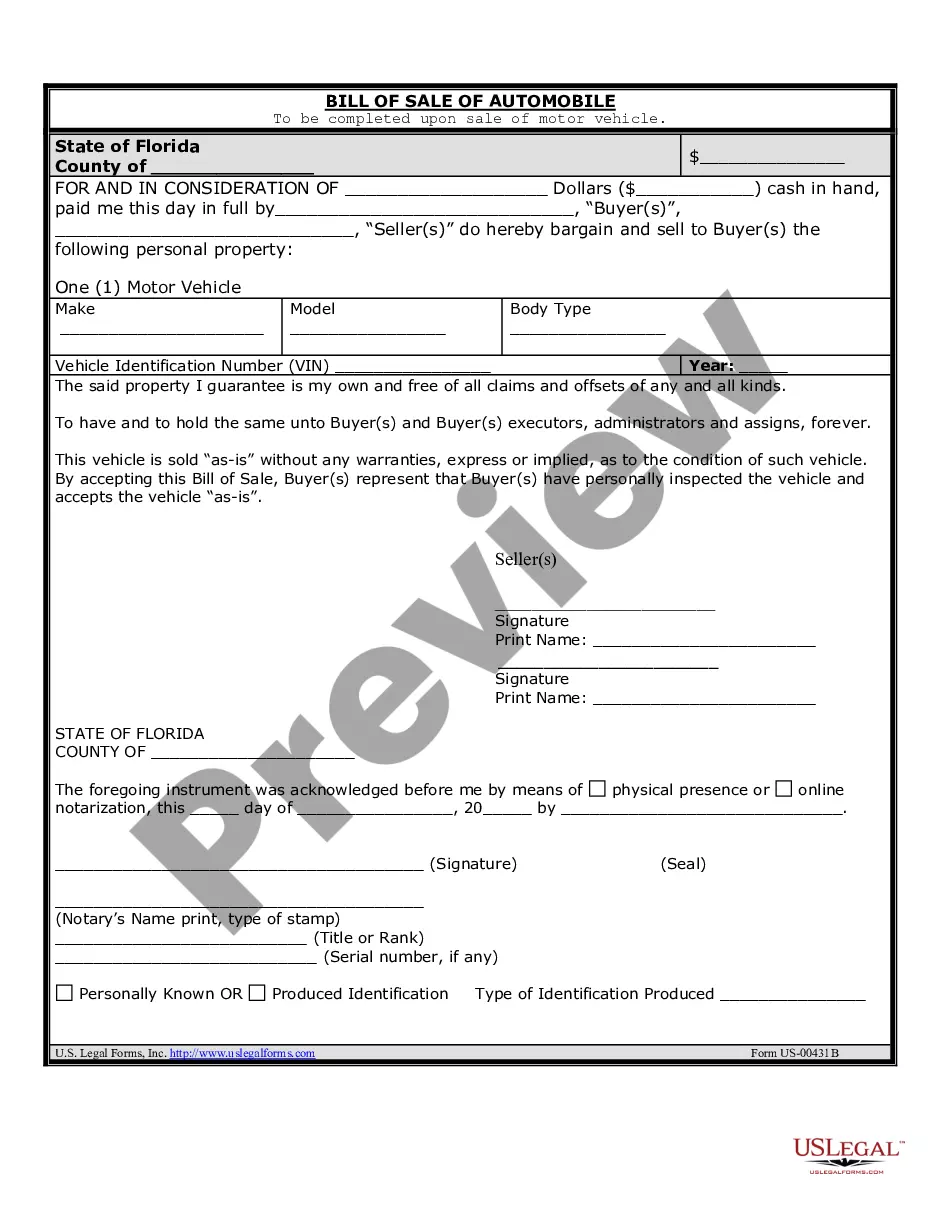

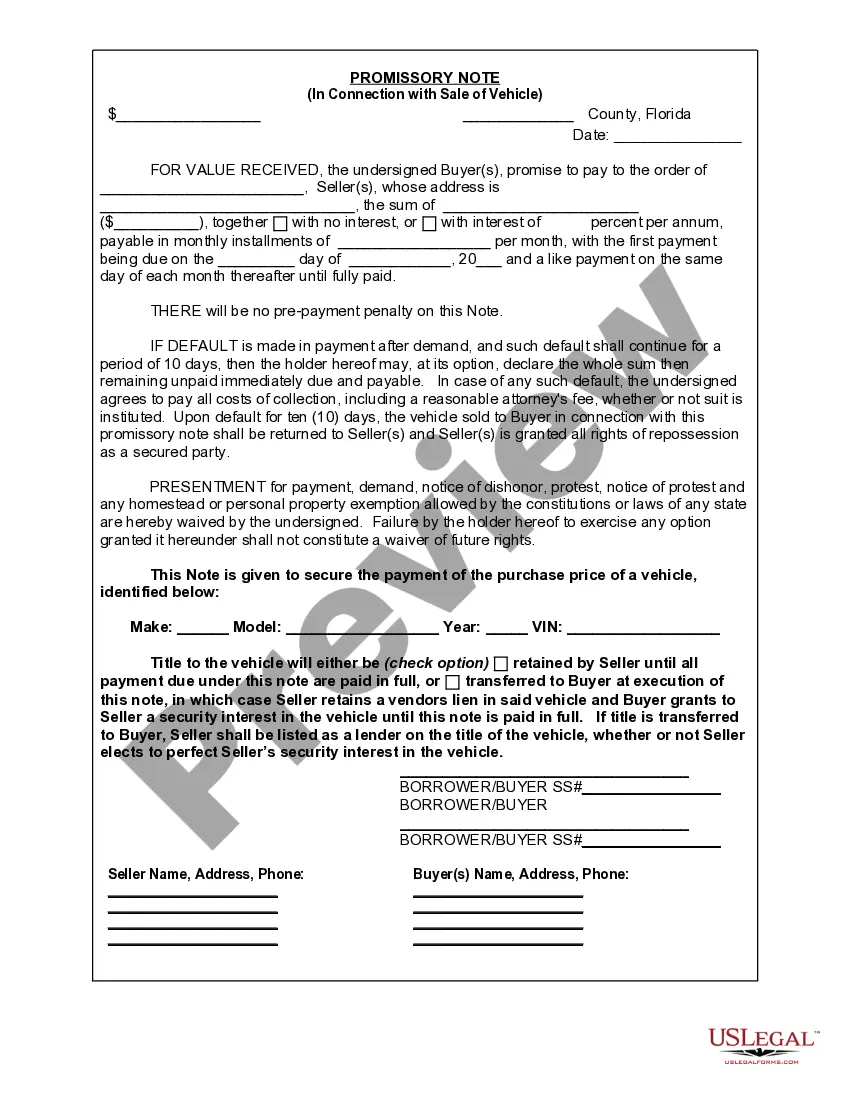

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Fort Lauderdale Florida Promissory Note in Connection with the Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller when purchasing a vehicle. This document serves as evidence of the loan commitment and provides protection to both parties involved in the transaction. The Fort Lauderdale Florida Promissory Note typically includes the following key elements: 1. Parties: It identifies the buyer and the seller, including their legal names and addresses. 2. Vehicle Information: It includes details about the automobile being sold, such as the make, model, year, vehicle identification number (VIN), and any relevant registration information. 3. Loan Amount: The promissory note specifies the total amount borrowed by the buyer from the seller, which usually includes the purchase price, taxes, and any additional fees or charges. 4. Interest Rate: This section outlines the interest rate applied to the loan, either as a fixed percentage or a variable rate. It also specifies the method used for interest calculations, such as simple interest or compound interest. 5. Repayment Terms: The note defines the terms of repayment, including the agreed-upon installment amounts, frequency (e.g., monthly, bi-monthly), and the duration of the loan. It may also mention any applicable grace periods, late payment penalties, or prepayment options. 6. Default and Remedies: This section explains the consequences in case of a default or breach of the agreement by either party. It outlines the remedies available to the non-defaulting party, such as repossession of the vehicle or legal action, as well as any associated costs or fees. Different types of Fort Lauderdale Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Secured Promissory Note: This type of promissory note includes a clause stating that the vehicle being purchased is used as collateral for the loan. In case of default, the seller may have the right to repossess the vehicle. 2. Unsecured Promissory Note: In this case, the promissory note does not include any collateral, meaning the seller mainly relies on the buyer's promise to repay the loan. However, the seller may still pursue legal action in the event of default. 3. Installment Sale Agreement: This type of promissory note breaks down the loan amount into equal installments over a specified period. Both the principal and interest are divided among the installments, allowing for more manageable payments. The Fort Lauderdale Florida Promissory Note in Connection with the Sale of Vehicle or Automobile is a vital legal document that ensures the smooth execution of a vehicle purchase transaction. It protects the interests of both the buyer and seller, establishes agreed upon terms, and provides a clear outline for repayment.A Fort Lauderdale Florida Promissory Note in Connection with the Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller when purchasing a vehicle. This document serves as evidence of the loan commitment and provides protection to both parties involved in the transaction. The Fort Lauderdale Florida Promissory Note typically includes the following key elements: 1. Parties: It identifies the buyer and the seller, including their legal names and addresses. 2. Vehicle Information: It includes details about the automobile being sold, such as the make, model, year, vehicle identification number (VIN), and any relevant registration information. 3. Loan Amount: The promissory note specifies the total amount borrowed by the buyer from the seller, which usually includes the purchase price, taxes, and any additional fees or charges. 4. Interest Rate: This section outlines the interest rate applied to the loan, either as a fixed percentage or a variable rate. It also specifies the method used for interest calculations, such as simple interest or compound interest. 5. Repayment Terms: The note defines the terms of repayment, including the agreed-upon installment amounts, frequency (e.g., monthly, bi-monthly), and the duration of the loan. It may also mention any applicable grace periods, late payment penalties, or prepayment options. 6. Default and Remedies: This section explains the consequences in case of a default or breach of the agreement by either party. It outlines the remedies available to the non-defaulting party, such as repossession of the vehicle or legal action, as well as any associated costs or fees. Different types of Fort Lauderdale Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Secured Promissory Note: This type of promissory note includes a clause stating that the vehicle being purchased is used as collateral for the loan. In case of default, the seller may have the right to repossess the vehicle. 2. Unsecured Promissory Note: In this case, the promissory note does not include any collateral, meaning the seller mainly relies on the buyer's promise to repay the loan. However, the seller may still pursue legal action in the event of default. 3. Installment Sale Agreement: This type of promissory note breaks down the loan amount into equal installments over a specified period. Both the principal and interest are divided among the installments, allowing for more manageable payments. The Fort Lauderdale Florida Promissory Note in Connection with the Sale of Vehicle or Automobile is a vital legal document that ensures the smooth execution of a vehicle purchase transaction. It protects the interests of both the buyer and seller, establishes agreed upon terms, and provides a clear outline for repayment.