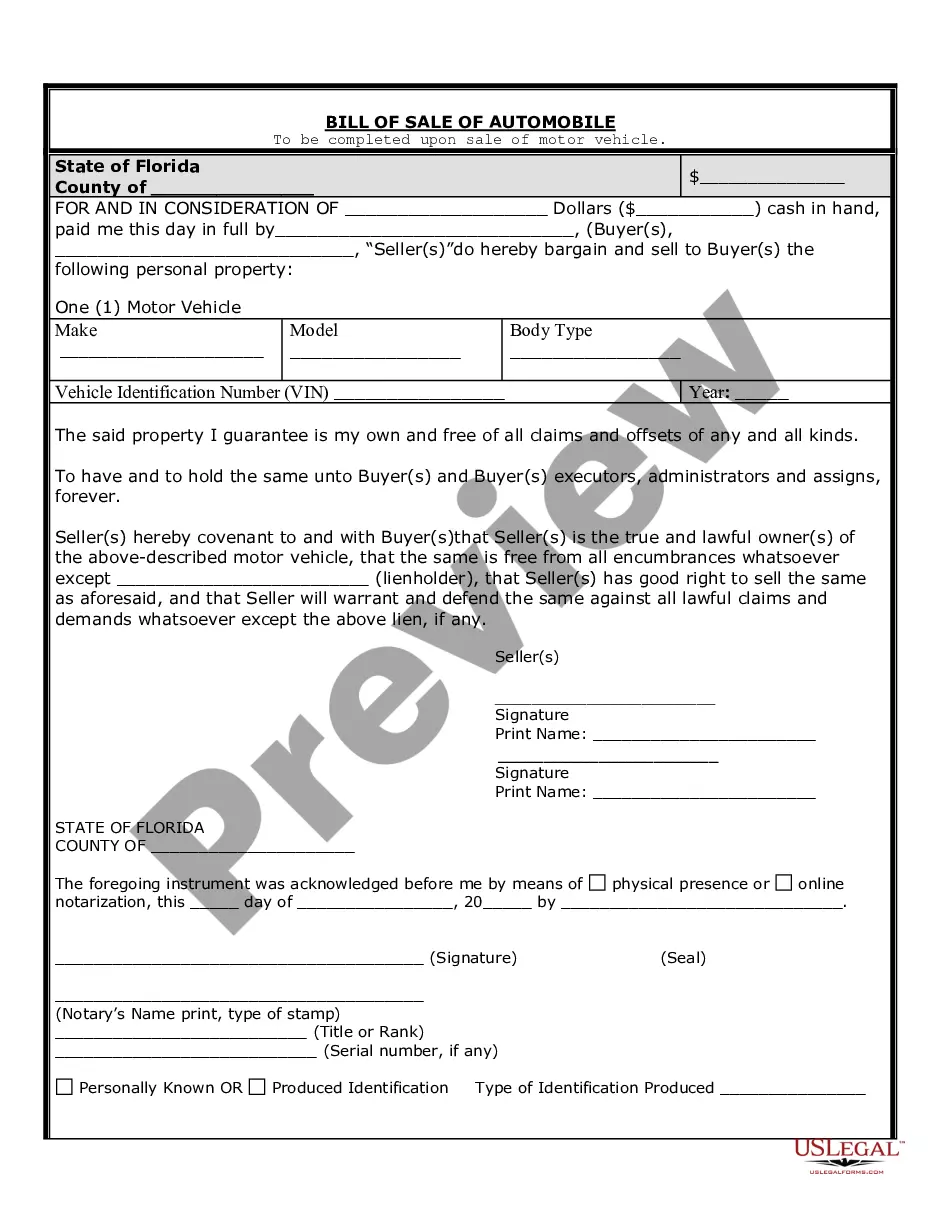

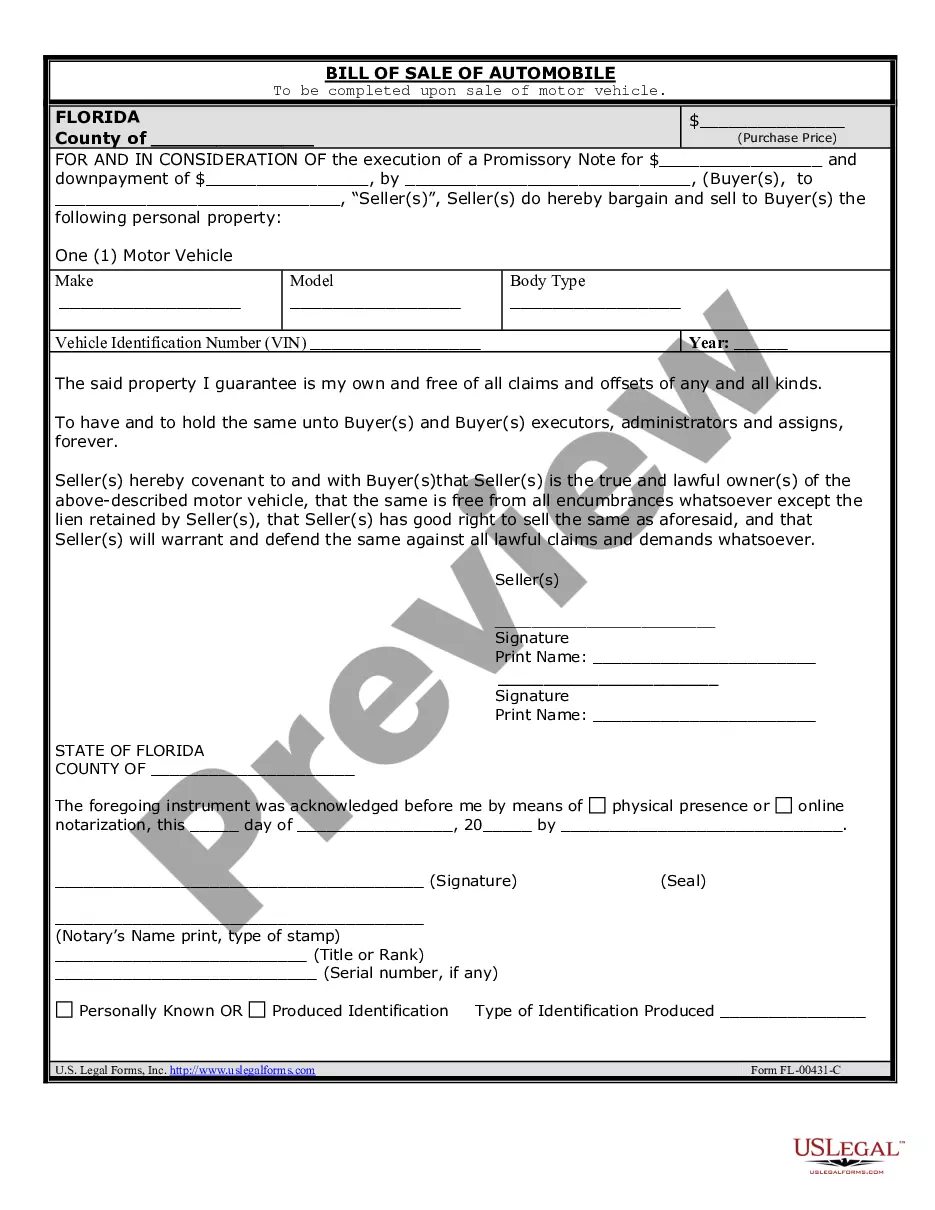

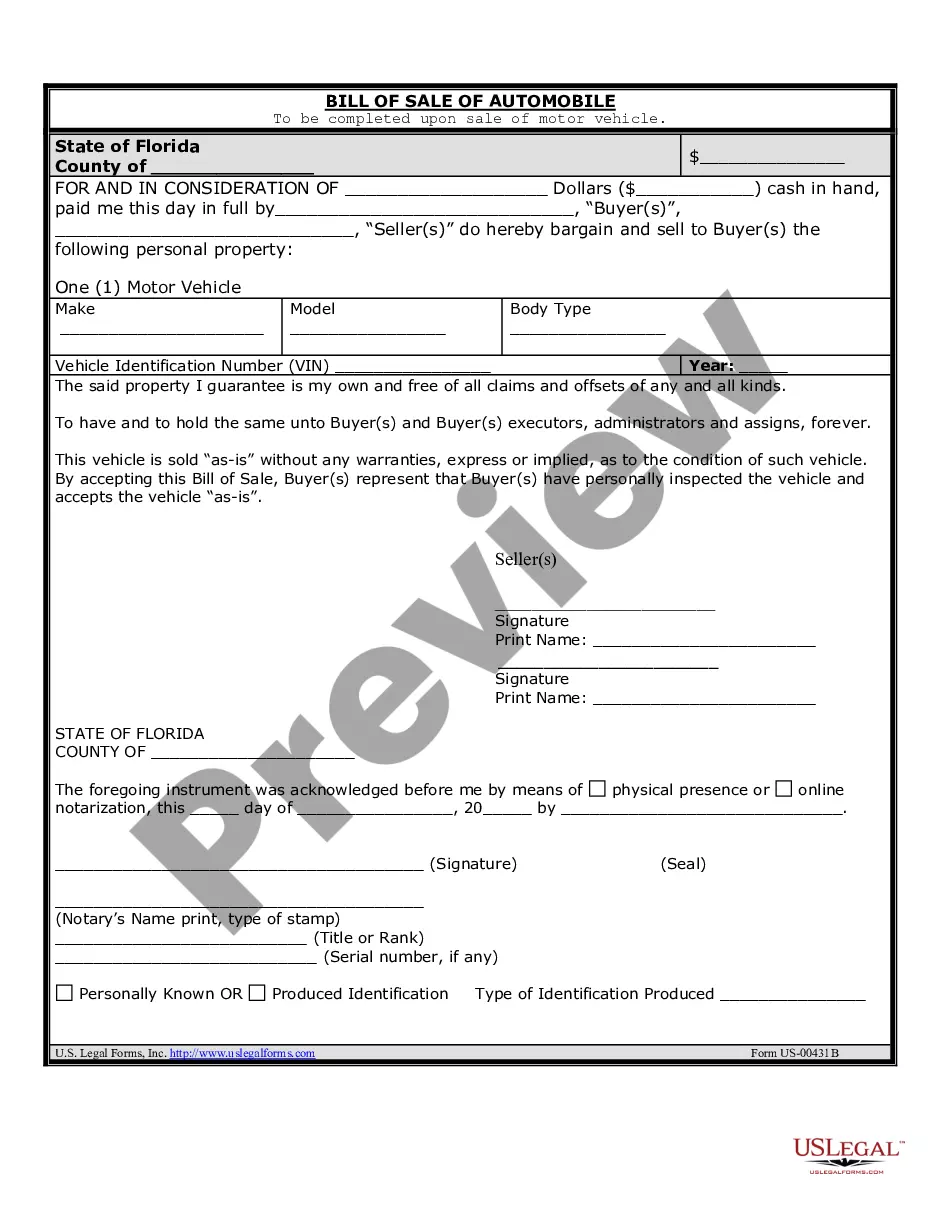

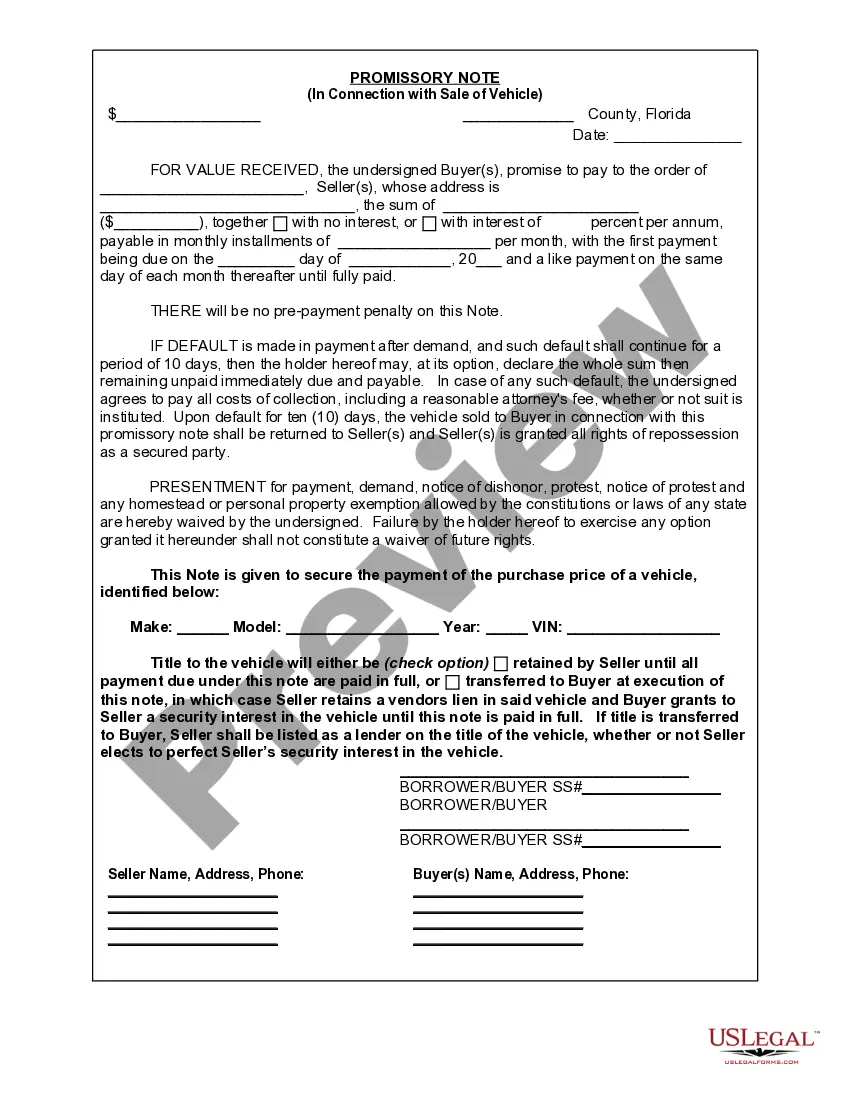

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Gainesville Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller in a vehicle or automobile transaction. This promissory note acts as an official record of the financial agreement and serves as a protection for both parties involved. When selling a vehicle in Gainesville, Florida, it is common for the buyer to require financing to complete the purchase. In these cases, a promissory note is used to establish the loan agreement between the buyer and seller. By signing this document, the buyer agrees to repay the seller in regular installments over a specified period. The Gainesville Florida Promissory Note typically includes several key details. Firstly, it clearly identifies both the buyer and the seller, providing their full names, contact information, and addresses. The make, model, and identification number of the vehicle are also mentioned for accurate identification. The promissory note includes the loan amount or total purchase price, which is the agreed-upon value of the vehicle. It specifies the interest rate, if applicable, and the repayment terms such as the number of installments, their amounts, and the due dates. Additionally, any penalties for late or missed payments may be addressed within the note. In Gainesville, Florida, there can be variations of the Promissory Note in Connection with Sale of Vehicle or Automobile. Some common types include: 1. Simple Promissory Note: This type of promissory note outlines the basic terms of the loan, such as the loan amount, interest rate, and repayment schedule, without including additional clauses or terms. 2. Secured Promissory Note: In this type of promissory note, the buyer offers collateral to secure the loan. If the buyer defaults, the seller can claim the collateral, often the vehicle itself, as a form of repayment. 3. Balloon Promissory Note: A balloon promissory note involves smaller regular payments over the repayment period, with a large final payment (balloon payment) due at the end. This type of note allows the buyer to have more manageable payments during the term but requires a larger payment at the end. 4. Acceleration Clause Promissory Note: This type of note includes an acceleration clause, which allows the seller to demand immediate full payment of the outstanding loan balance if the buyer defaults on the agreed-upon terms. In conclusion, a Gainesville Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a critical document in vehicle transactions by providing a legally binding agreement between the buyer and seller. This note outlines various terms, including repayment amounts, interest rates, and due dates, to ensure that both parties adhere to the agreed-upon terms. Different types of promissory notes may be used based on specific circumstances, such as secure loan collateral, balloon payments, or acceleration clauses.A Gainesville Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller in a vehicle or automobile transaction. This promissory note acts as an official record of the financial agreement and serves as a protection for both parties involved. When selling a vehicle in Gainesville, Florida, it is common for the buyer to require financing to complete the purchase. In these cases, a promissory note is used to establish the loan agreement between the buyer and seller. By signing this document, the buyer agrees to repay the seller in regular installments over a specified period. The Gainesville Florida Promissory Note typically includes several key details. Firstly, it clearly identifies both the buyer and the seller, providing their full names, contact information, and addresses. The make, model, and identification number of the vehicle are also mentioned for accurate identification. The promissory note includes the loan amount or total purchase price, which is the agreed-upon value of the vehicle. It specifies the interest rate, if applicable, and the repayment terms such as the number of installments, their amounts, and the due dates. Additionally, any penalties for late or missed payments may be addressed within the note. In Gainesville, Florida, there can be variations of the Promissory Note in Connection with Sale of Vehicle or Automobile. Some common types include: 1. Simple Promissory Note: This type of promissory note outlines the basic terms of the loan, such as the loan amount, interest rate, and repayment schedule, without including additional clauses or terms. 2. Secured Promissory Note: In this type of promissory note, the buyer offers collateral to secure the loan. If the buyer defaults, the seller can claim the collateral, often the vehicle itself, as a form of repayment. 3. Balloon Promissory Note: A balloon promissory note involves smaller regular payments over the repayment period, with a large final payment (balloon payment) due at the end. This type of note allows the buyer to have more manageable payments during the term but requires a larger payment at the end. 4. Acceleration Clause Promissory Note: This type of note includes an acceleration clause, which allows the seller to demand immediate full payment of the outstanding loan balance if the buyer defaults on the agreed-upon terms. In conclusion, a Gainesville Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a critical document in vehicle transactions by providing a legally binding agreement between the buyer and seller. This note outlines various terms, including repayment amounts, interest rates, and due dates, to ensure that both parties adhere to the agreed-upon terms. Different types of promissory notes may be used based on specific circumstances, such as secure loan collateral, balloon payments, or acceleration clauses.