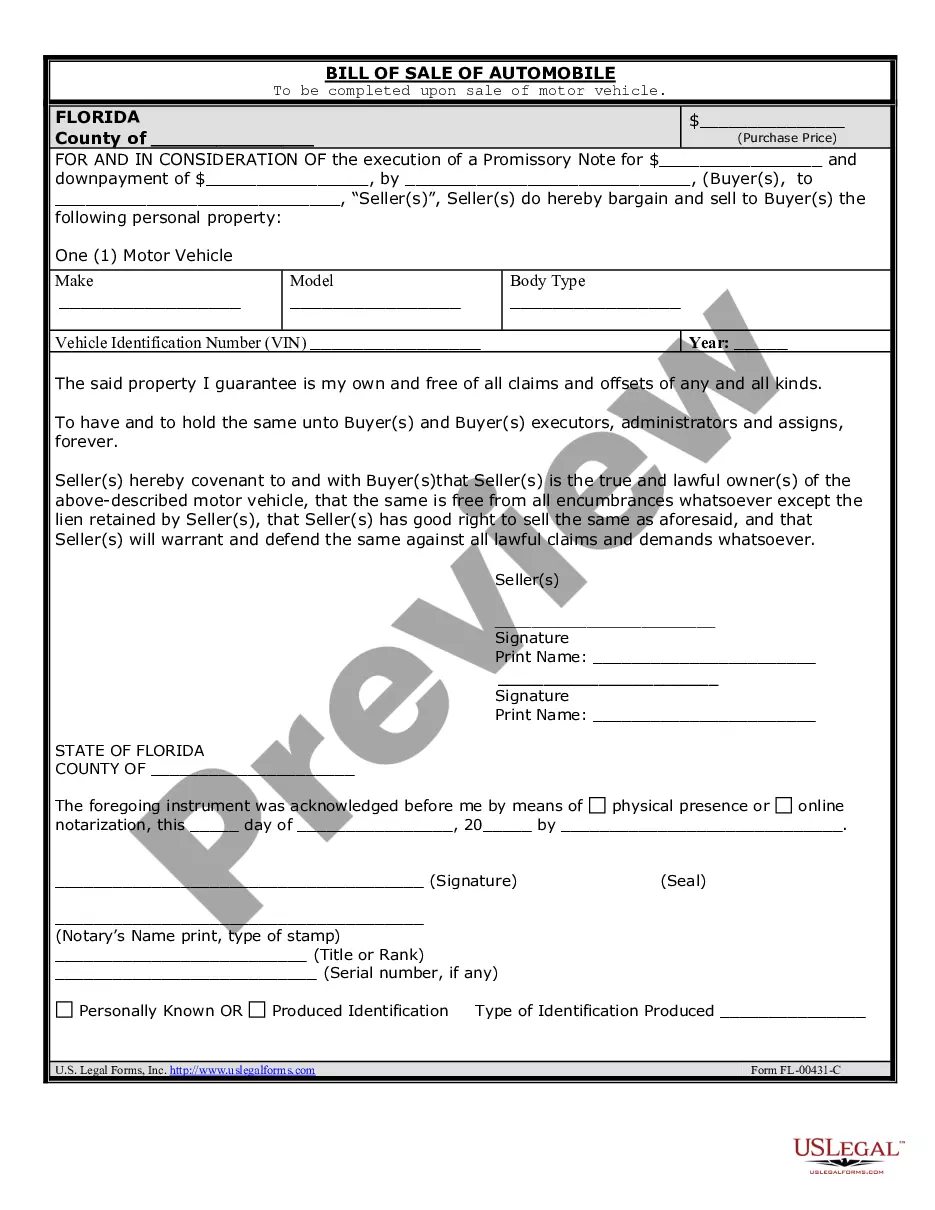

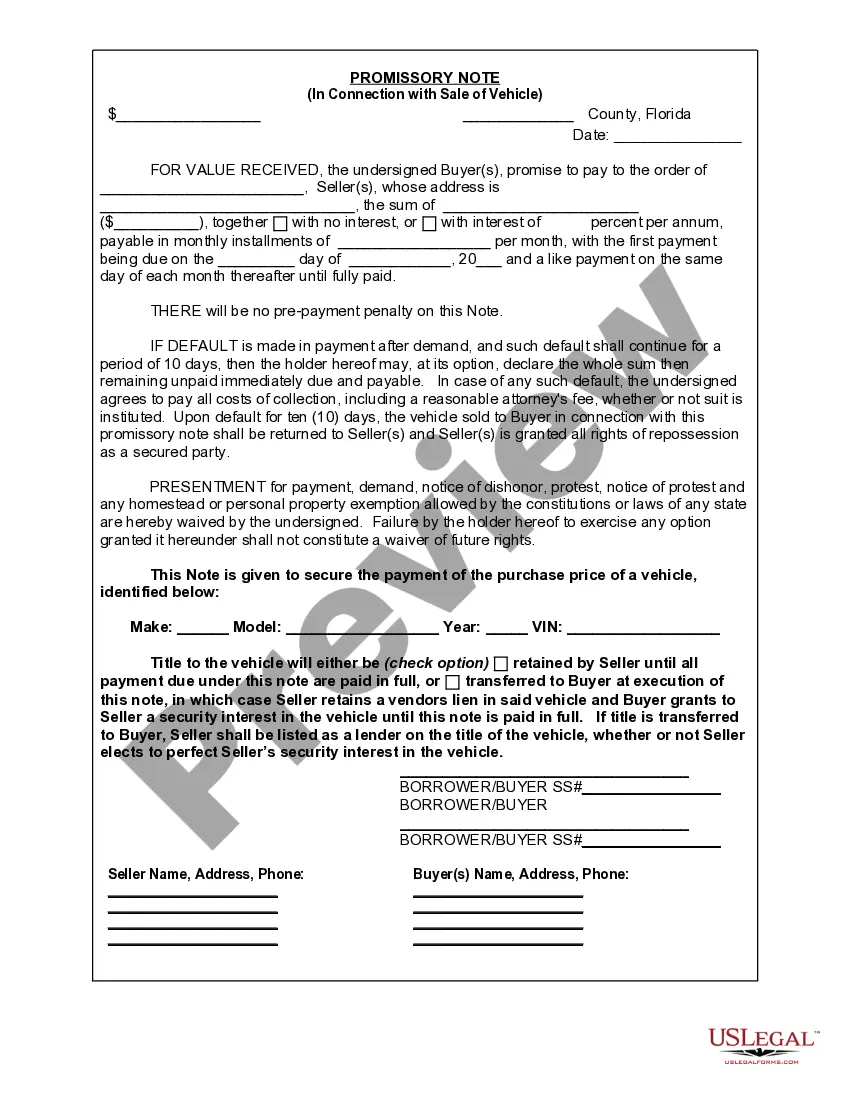

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Hollywood Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller for the purchase of a vehicle. It serves as evidence of a debt and establishes the repayment terms, including the amount borrowed, interest rate, repayment schedule, and consequences for default. There are two main types of Hollywood Florida Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: This type of promissory note includes collateral, typically the vehicle being purchased, which serves as security for the loan. In the event of default, the seller has the right to repossess the vehicle to recover the debt. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type of note does not require collateral. It is based solely on the borrower's promise to repay the loan. However, if the borrower defaults, the seller may have to pursue legal action to recover the debt. Keywords: Hollywood Florida, Promissory Note, Sale of Vehicle, Automobile, loan agreement, legal document, debt, repayment terms, interest rate, repayment schedule, consequences for default, secured promissory note, unsecured promissory note, collateral, repossession, borrower, seller, legal action, purchase.A Hollywood Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller for the purchase of a vehicle. It serves as evidence of a debt and establishes the repayment terms, including the amount borrowed, interest rate, repayment schedule, and consequences for default. There are two main types of Hollywood Florida Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: This type of promissory note includes collateral, typically the vehicle being purchased, which serves as security for the loan. In the event of default, the seller has the right to repossess the vehicle to recover the debt. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type of note does not require collateral. It is based solely on the borrower's promise to repay the loan. However, if the borrower defaults, the seller may have to pursue legal action to recover the debt. Keywords: Hollywood Florida, Promissory Note, Sale of Vehicle, Automobile, loan agreement, legal document, debt, repayment terms, interest rate, repayment schedule, consequences for default, secured promissory note, unsecured promissory note, collateral, repossession, borrower, seller, legal action, purchase.