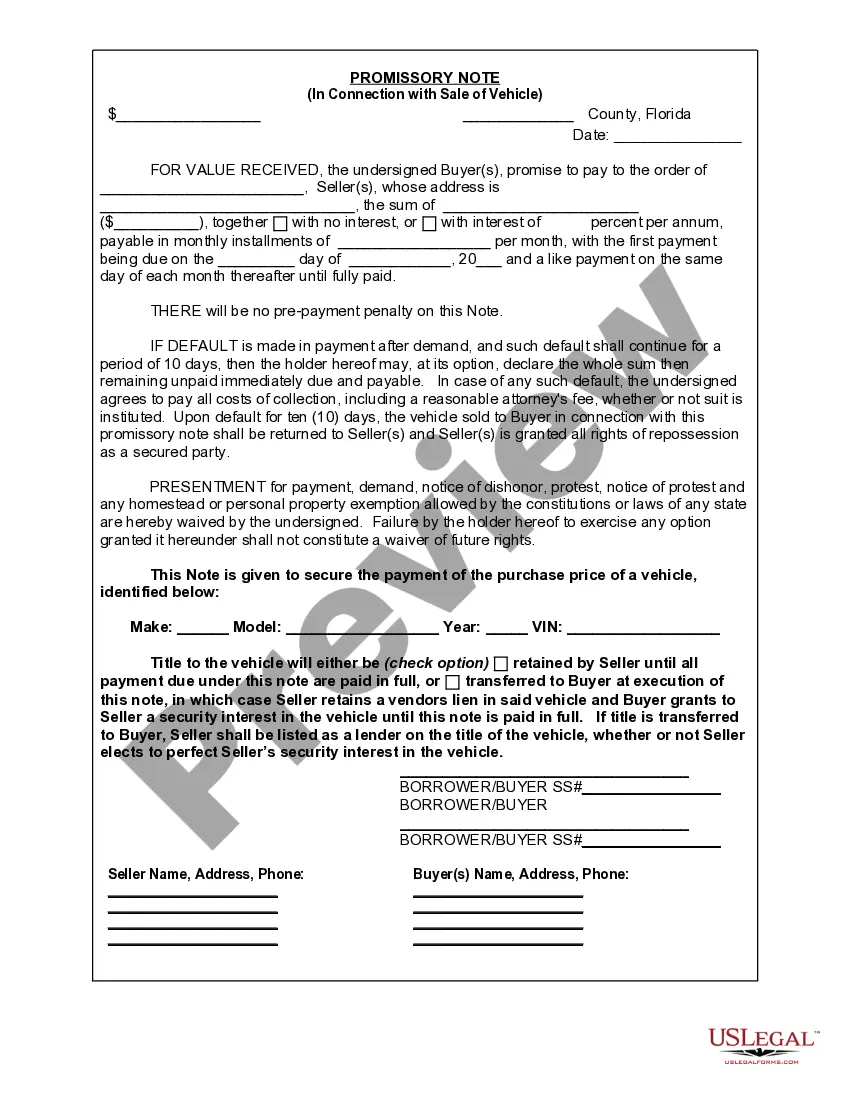

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

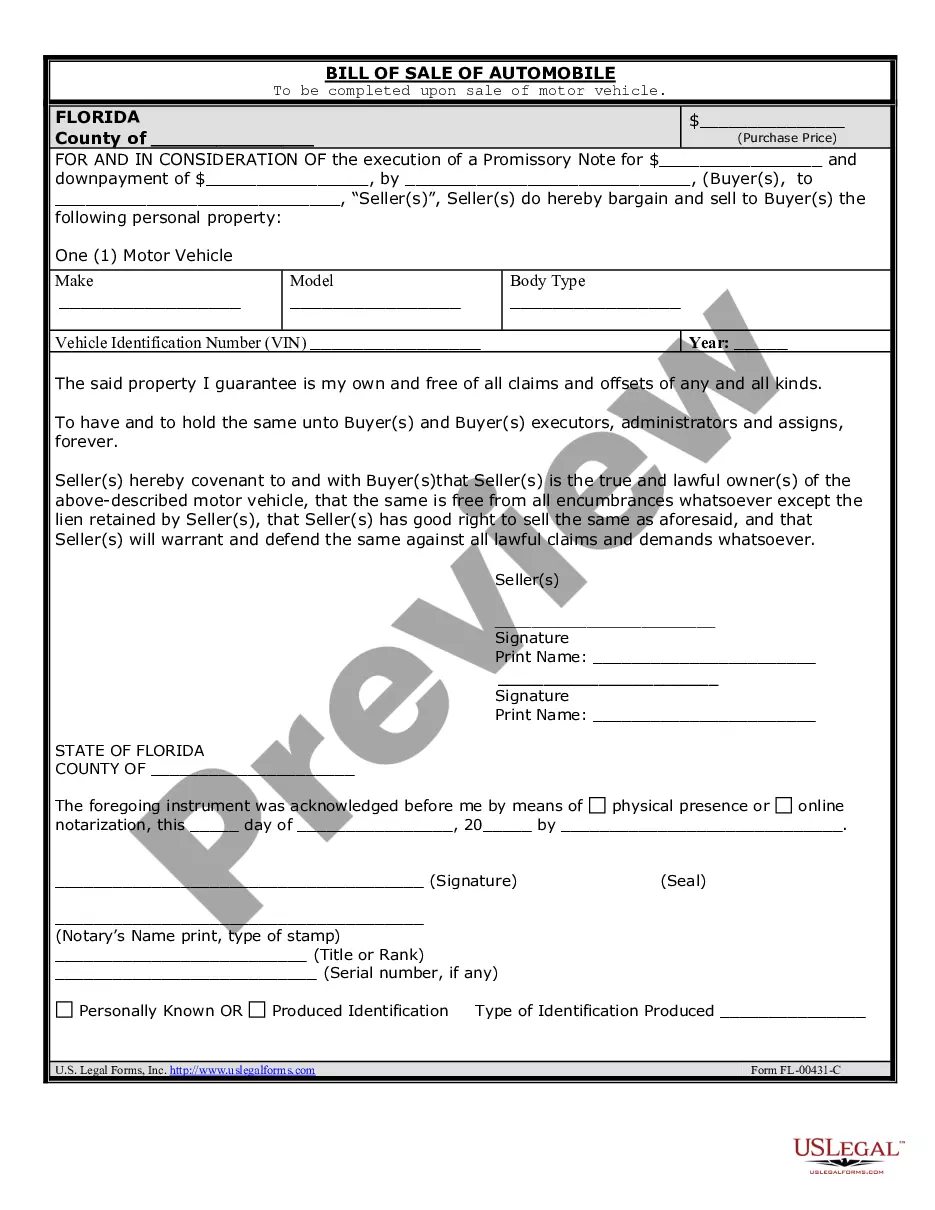

Miami Gardens Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document used in vehicle sales transactions in Miami Gardens, Florida. This note outlines the terms and conditions under which the buyer agrees to make payments to the seller for the purchase of the vehicle, including any interest and fees. The Miami Gardens Florida Promissory Note in Connection with Sale of Vehicle or Automobile typically includes the following details: 1. Parties Involved: The note identifies the parties involved, namely the buyer and the seller. 2. Vehicle Details: The note specifies the make, model, year, and Vehicle Identification Number (VIN) of the automobile being sold. 3. Purchase Price: The note states the agreed-upon purchase price of the vehicle. 4. Payment Schedule: This section outlines the payment terms, including the amount and frequency of payments, such as weekly, bi-weekly, monthly, etc. 5. Interest Rate: If applicable, the note may include an interest rate that will be applied to the remaining balance. The interest rate must comply with Florida state laws. 6. Late Payment Penalties: It is common for the note to include provisions for late payment penalties, such as charging a certain percentage of the outstanding balance as a fee for each late payment. 7. Repossession Clause: A repossession clause may be included in the note, giving the seller the right to repossess the vehicle in the event of non-payment or default. 8. Default Remedies: The note specifies the actions that can be taken by the seller upon the buyer's default, including entering a judgment and recovering attorney fees and costs. 9. Signatures: Both the buyer and the seller must sign and date the promissory note to make it legally enforceable. Different types of Miami Gardens Florida Promissory Note in Connection with Sale of Vehicle or Automobile may include variations to suit specific needs. Some common variations include: 1. Secured Promissory Note: This type of note includes a provision where the buyer pledges collateral (the vehicle) to secure the payment. It gives the seller the right to repossess the vehicle in case of default. 2. Balloon Payment Promissory Note: This note structure involves regular payments with a large final payment, called a balloon payment, usually due at the end of the term. 3. Installment Promissory Note: This type of note outlines regular, equal payments over a set period of time until the entire purchase price and interest are paid off. 4. Personal Guarantee Promissory Note: When the buyer is a legal entity, this type of note includes a provision where an individual assumes responsibility for payment if the entity defaults. It is important to consult with a legal professional or use a reputable promissory note template specifically designed for Miami Gardens, Florida, to ensure compliance with state laws and for any specific requirements related to the sale of vehicles or automobiles in the area.Miami Gardens Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document used in vehicle sales transactions in Miami Gardens, Florida. This note outlines the terms and conditions under which the buyer agrees to make payments to the seller for the purchase of the vehicle, including any interest and fees. The Miami Gardens Florida Promissory Note in Connection with Sale of Vehicle or Automobile typically includes the following details: 1. Parties Involved: The note identifies the parties involved, namely the buyer and the seller. 2. Vehicle Details: The note specifies the make, model, year, and Vehicle Identification Number (VIN) of the automobile being sold. 3. Purchase Price: The note states the agreed-upon purchase price of the vehicle. 4. Payment Schedule: This section outlines the payment terms, including the amount and frequency of payments, such as weekly, bi-weekly, monthly, etc. 5. Interest Rate: If applicable, the note may include an interest rate that will be applied to the remaining balance. The interest rate must comply with Florida state laws. 6. Late Payment Penalties: It is common for the note to include provisions for late payment penalties, such as charging a certain percentage of the outstanding balance as a fee for each late payment. 7. Repossession Clause: A repossession clause may be included in the note, giving the seller the right to repossess the vehicle in the event of non-payment or default. 8. Default Remedies: The note specifies the actions that can be taken by the seller upon the buyer's default, including entering a judgment and recovering attorney fees and costs. 9. Signatures: Both the buyer and the seller must sign and date the promissory note to make it legally enforceable. Different types of Miami Gardens Florida Promissory Note in Connection with Sale of Vehicle or Automobile may include variations to suit specific needs. Some common variations include: 1. Secured Promissory Note: This type of note includes a provision where the buyer pledges collateral (the vehicle) to secure the payment. It gives the seller the right to repossess the vehicle in case of default. 2. Balloon Payment Promissory Note: This note structure involves regular payments with a large final payment, called a balloon payment, usually due at the end of the term. 3. Installment Promissory Note: This type of note outlines regular, equal payments over a set period of time until the entire purchase price and interest are paid off. 4. Personal Guarantee Promissory Note: When the buyer is a legal entity, this type of note includes a provision where an individual assumes responsibility for payment if the entity defaults. It is important to consult with a legal professional or use a reputable promissory note template specifically designed for Miami Gardens, Florida, to ensure compliance with state laws and for any specific requirements related to the sale of vehicles or automobiles in the area.