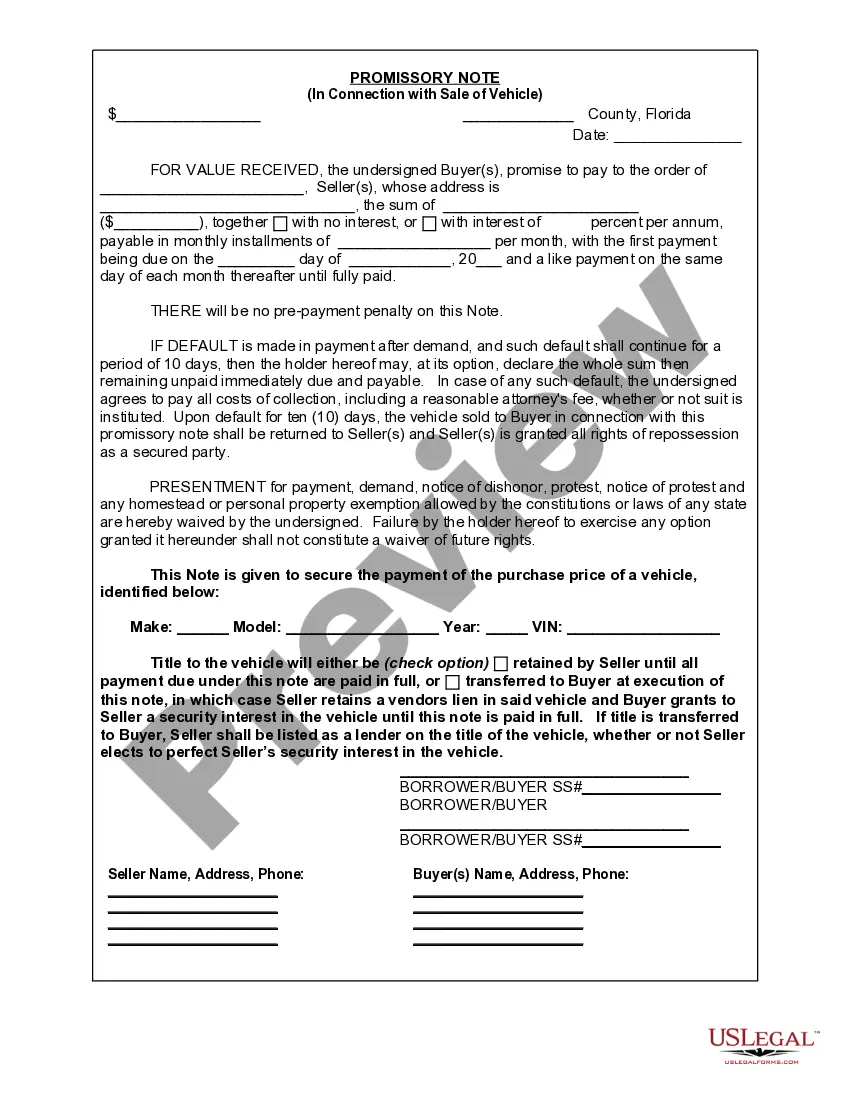

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Miramar Florida Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle. This note serves as evidence of a loan agreement, stating that the buyer agrees to repay the seller the agreed-upon amount for the vehicle in scheduled installments over a specified period of time. The document contains various essential details, including the names and contact information of both parties, the vehicle's description (make, model, year, and identification number), the agreed purchase price, and the terms of repayment. It also includes clauses that protect both parties' interests, such as specifying late payment penalties, vehicle's maintenance responsibilities, and provisions for default and repossession of the vehicle. There are a few different types of Miramar Florida Promissory Notes in Connection with the Sale of a Vehicle or Automobile, each with slight variations based on the unique circumstances of the agreement. Some of these types include: 1. Installment Promissory Note: This type specifies that the payment will be made in regular installments over a predetermined period, typically with interest included. 2. Balloon Promissory Note: This note structure allows for lower monthly payments during the specified term, but a larger lump sum (balloon payment) at the end of the term. 3. Secured Promissory Note: This type of note includes a provision that allows the seller to claim the vehicle in case of default by the buyer. 4. Unsecured Promissory Note: This note does not secure the vehicle as collateral, but it still legally binds the buyer to repay the agreed-upon amount. 5. Cosigner Promissory Note: In cases when the buyer might have a lower credit score or financial instability, a cosigner may be required. This note involves both the buyer and a cosigner agreeing to repay the loan. When drafting a Miramar Florida Promissory Note in Connection with the Sale of a Vehicle or Automobile, it is recommended to consult an attorney to ensure compliance with relevant state and federal laws.A Miramar Florida Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle. This note serves as evidence of a loan agreement, stating that the buyer agrees to repay the seller the agreed-upon amount for the vehicle in scheduled installments over a specified period of time. The document contains various essential details, including the names and contact information of both parties, the vehicle's description (make, model, year, and identification number), the agreed purchase price, and the terms of repayment. It also includes clauses that protect both parties' interests, such as specifying late payment penalties, vehicle's maintenance responsibilities, and provisions for default and repossession of the vehicle. There are a few different types of Miramar Florida Promissory Notes in Connection with the Sale of a Vehicle or Automobile, each with slight variations based on the unique circumstances of the agreement. Some of these types include: 1. Installment Promissory Note: This type specifies that the payment will be made in regular installments over a predetermined period, typically with interest included. 2. Balloon Promissory Note: This note structure allows for lower monthly payments during the specified term, but a larger lump sum (balloon payment) at the end of the term. 3. Secured Promissory Note: This type of note includes a provision that allows the seller to claim the vehicle in case of default by the buyer. 4. Unsecured Promissory Note: This note does not secure the vehicle as collateral, but it still legally binds the buyer to repay the agreed-upon amount. 5. Cosigner Promissory Note: In cases when the buyer might have a lower credit score or financial instability, a cosigner may be required. This note involves both the buyer and a cosigner agreeing to repay the loan. When drafting a Miramar Florida Promissory Note in Connection with the Sale of a Vehicle or Automobile, it is recommended to consult an attorney to ensure compliance with relevant state and federal laws.