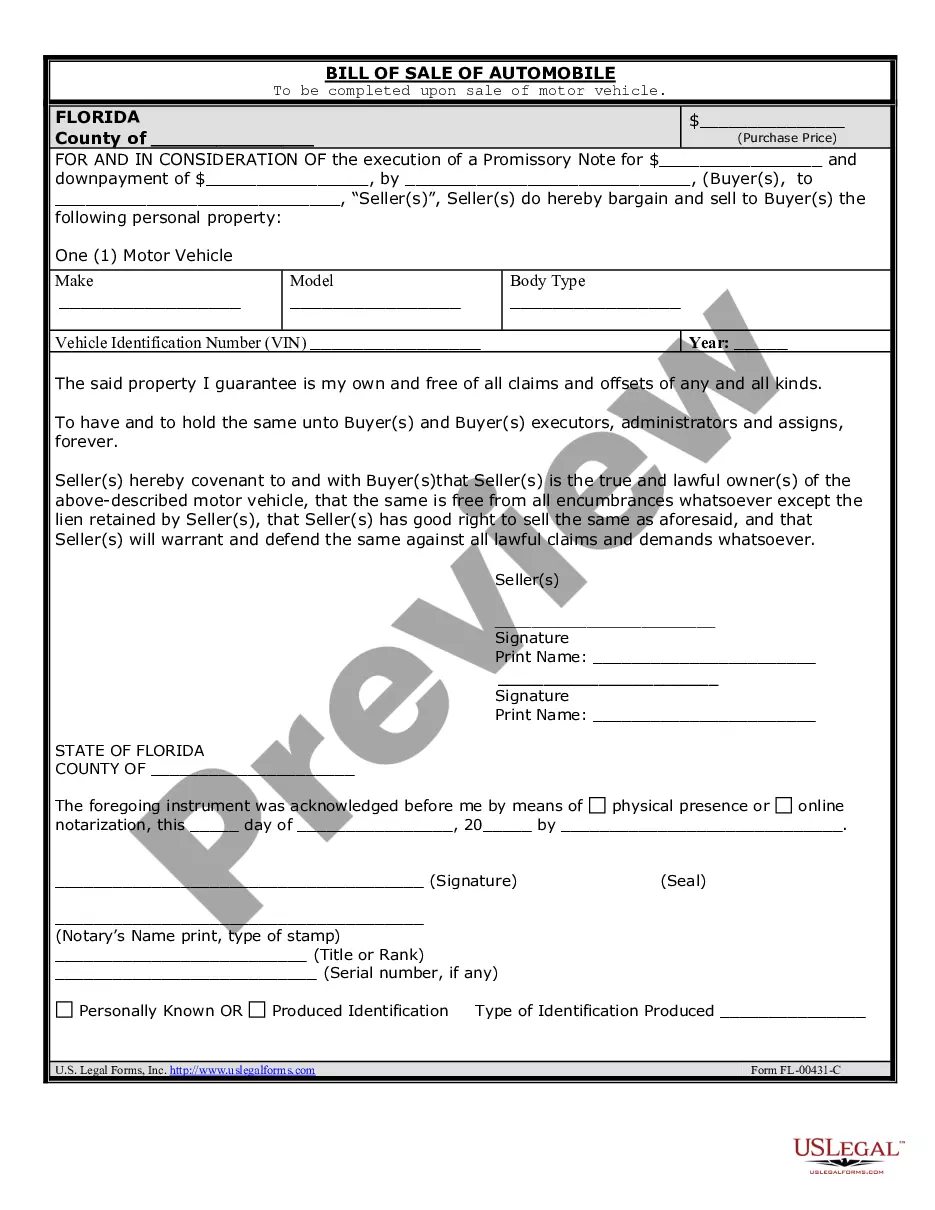

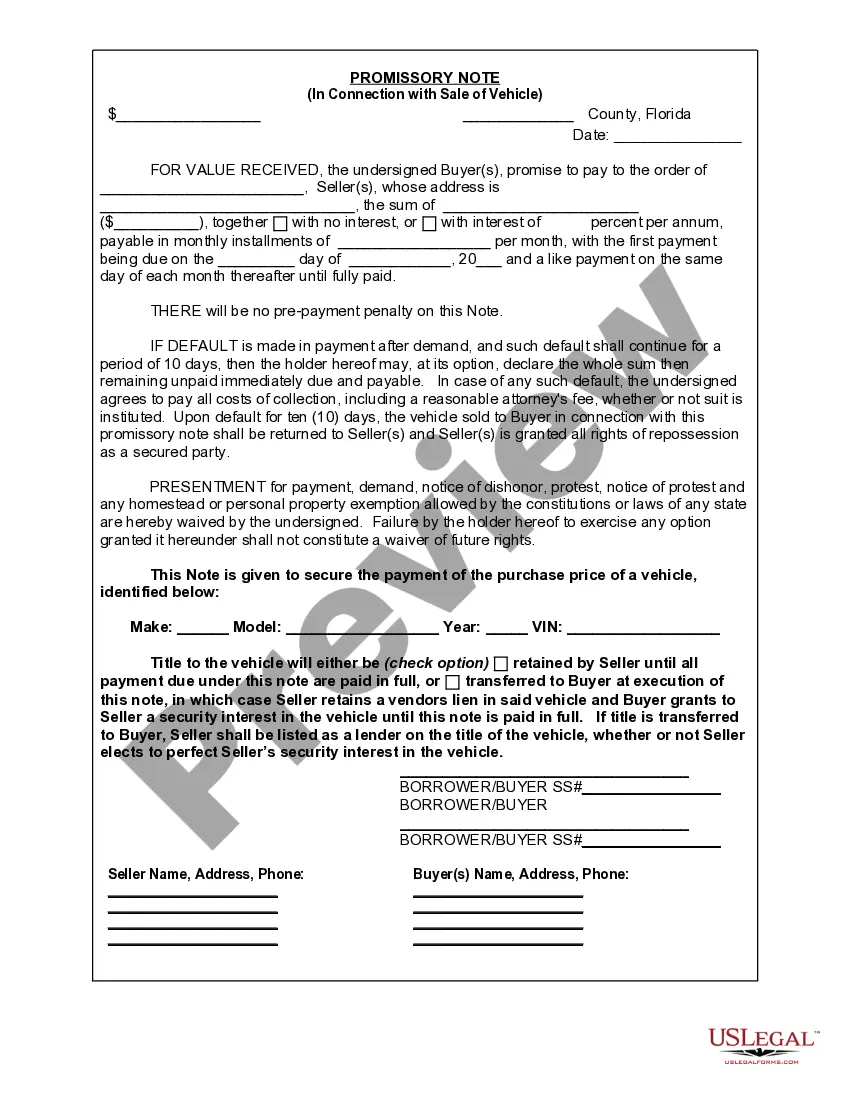

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Florida Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are looking for a legitimate form template, it’s incredibly challenging to select a superior platform than the US Legal Forms website – likely the most extensive online repositories.

With this collection, you can obtain a vast array of form examples for business and personal needs categorized by types and states, or keywords.

With our enhanced search feature, acquiring the latest Orange Florida Promissory Note in Relation to Sale of Vehicle or Automobile is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal to finalize the registration process.

Obtain the template. Select your format and download it to your device. Make modifications. Fill out, edit, print, and sign the acquired Orange Florida Promissory Note in Relation to Sale of Vehicle or Automobile. Every template you save in your account has no expiration and is permanently yours. You can always access them via the My documents section, so if you need to retrieve another copy for editing or printing, feel free to return and save it again at any time. Utilize the US Legal Forms professional library to access the Orange Florida Promissory Note in Relation to Sale of Vehicle or Automobile you were looking for, along with a multitude of other professional and state-specific samples on a single platform!

- Additionally, the accuracy of each document is validated by a team of professional attorneys who routinely examine the templates on our site and update them in line with the most recent state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you have to do to obtain the Orange Florida Promissory Note in Relation to Sale of Vehicle or Automobile is to Log In to your account and select the Download option.

- If this is your first experience using US Legal Forms, simply follow the instructions below.

- Ensure you have located the example you need. Review its description and utilize the Preview feature to examine its content. If it doesn’t fulfill your requirements, use the Search box at the top of the page to find the appropriate document.

- Verify your choice. Click the Buy now option. Then, choose your desired subscription plan and provide information to create an account.

Form popularity

FAQ

Recording a promissory note in Florida is not required, but it is often advisable. This action can help clarify the terms of the agreement and protect both parties involved. If you are drafting an Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile, consider the advantages of recording for peace of mind.

In Florida, a promissory note does not have to be recorded for it to be valid. However, if the note is related to a secured transaction, such as with an automobile, recording it can strengthen your legal position. Always consider the benefits of securing your Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile.

A promissory note can be deemed invalid in Florida for several reasons. Factors like a lack of essential elements, inability to identify involved parties, or non-compliance with legal requirements can lead to invalidation. Ensure that your Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile meets all criteria to remain enforceable.

While it is not mandatory to record a promissory note, doing so can be beneficial. Recording an Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile helps establish a clear public record of the transaction. This can be critical in preventing misunderstandings or disputes later.

A promissory note does not usually need to be filed in a public office. However, if you want to secure your rights, you might consider filing it with the local clerk’s office in Orange County. This filing can provide additional protection should disputes arise in the future.

Reporting a promissory note is typically not required unless it involves income or tax implications. In the case of an Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile, you should consult with a tax professional. They can guide you regarding the specific requirements related to your financial situation.

In Florida, promissory notes do not typically require notarization to be valid. However, having your Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile notarized can add an extra layer of authenticity and protection. It is advisable to consult legal advice or use reliable services like US Legal Forms to guarantee your document meets all necessary guidelines. This step can reassure both parties that the agreement is legitimate and enforceable.

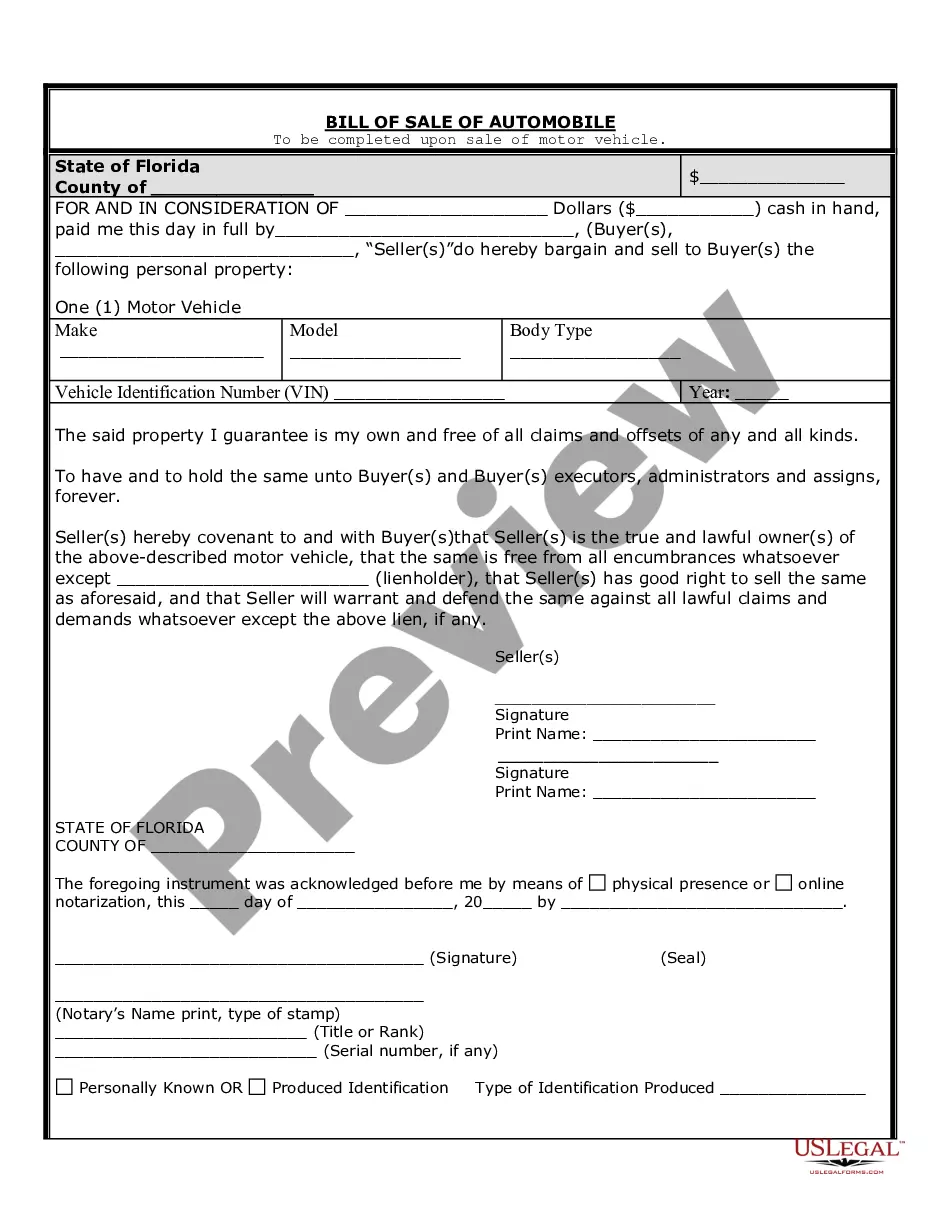

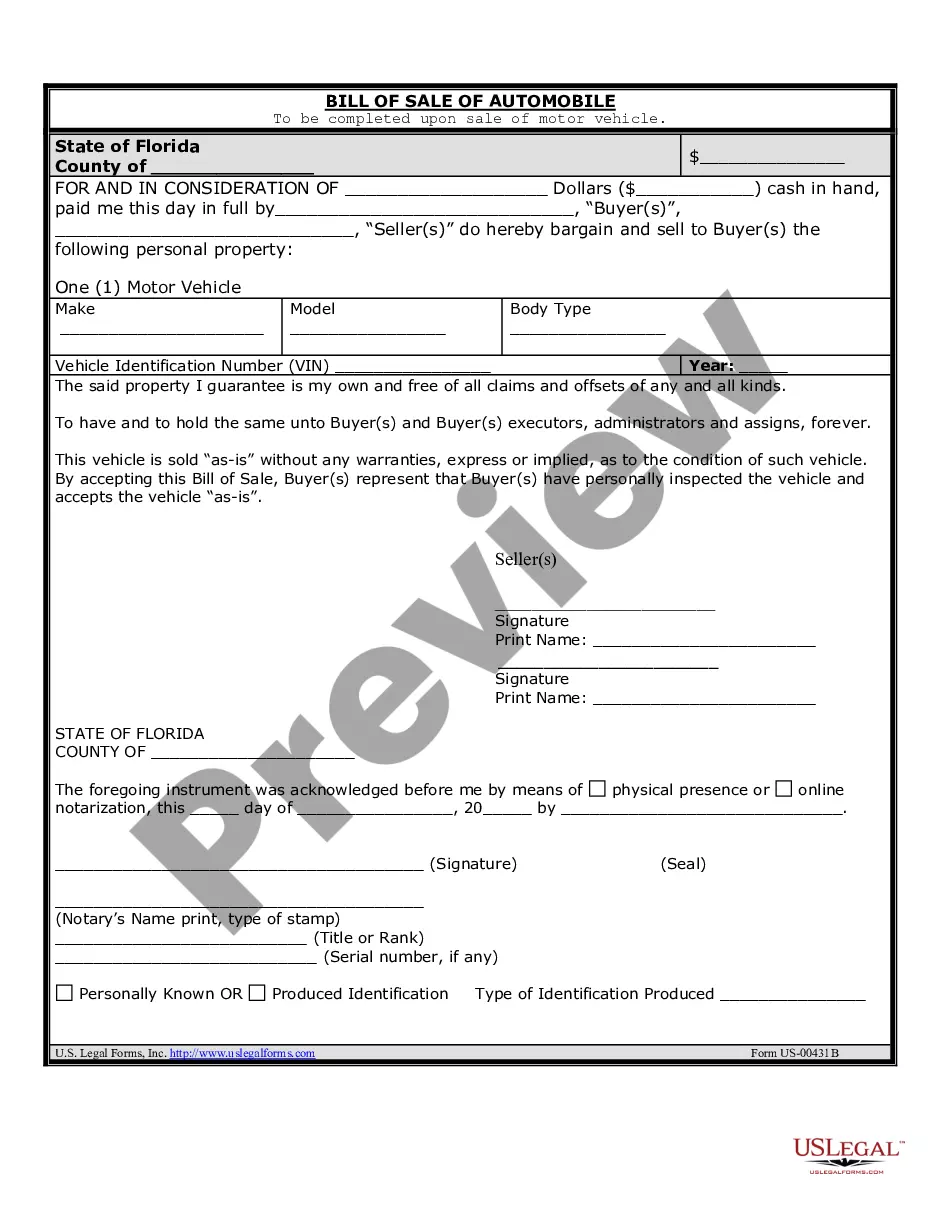

To fill the Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile, start by clearly identifying the buyer and seller. Input the sale amount, interest rate, and payment schedule. It is crucial to include specific details about the vehicle, such as the make, model, and VIN. You can use platforms like US Legal Forms to access templates that simplify this process and ensure compliance with Florida regulations.

In Florida, an Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile must include several key elements. It should state the amount owed, the interest rate if applicable, and the repayment schedule. Furthermore, both parties must sign the note, and it's advisable to have it notarized for added security. Online platforms like uslegalforms can provide you with the necessary templates to ensure compliance with Florida laws.

To obtain a copy of your Orange Florida Promissory Note in Connection with Sale of Vehicle or Automobile, start by checking with the lender or person who financed the sale. They often retain copies of these documents for their records. If you cannot reach them, consider visiting uslegalforms, where you can find templates and forms that may help you recreate a copy based on your prior agreement.