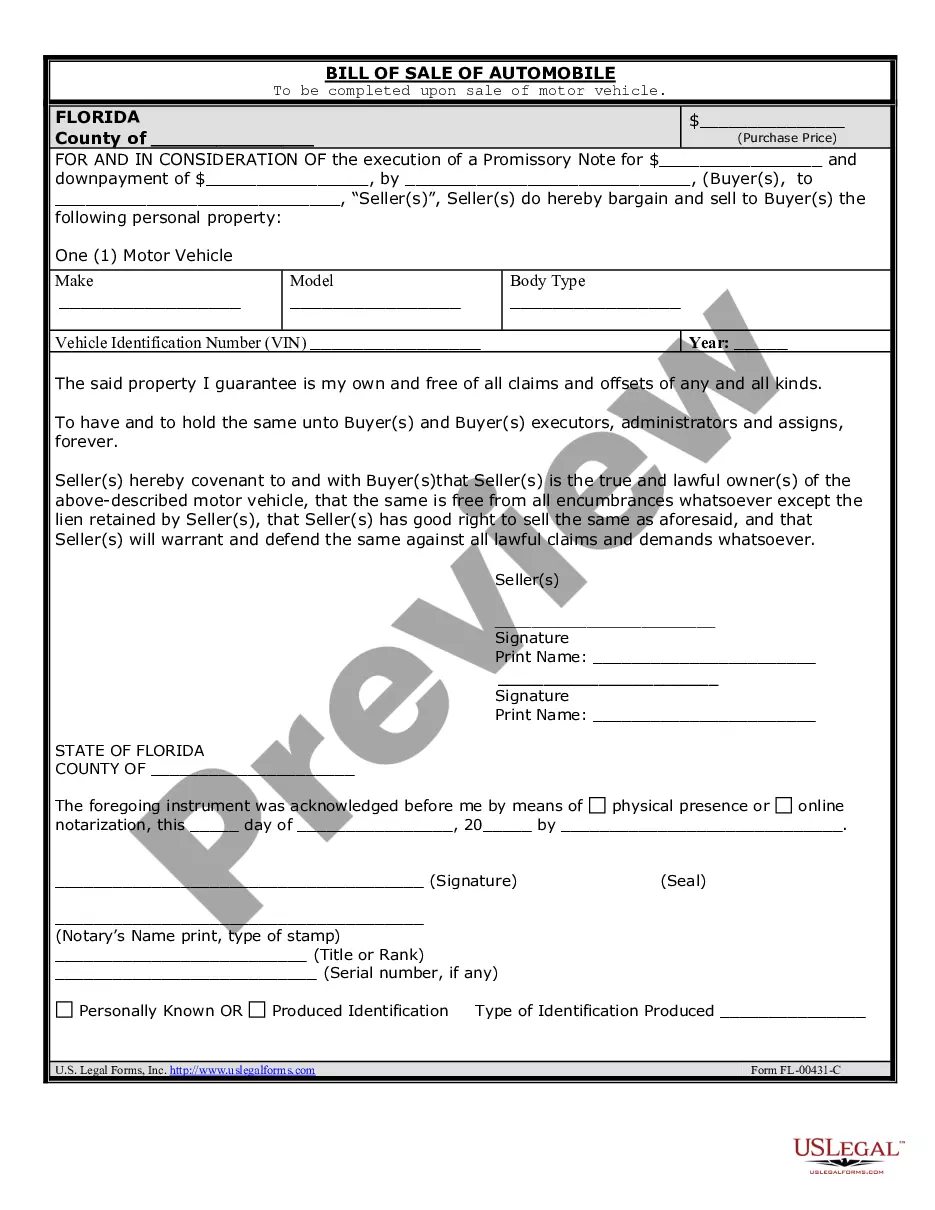

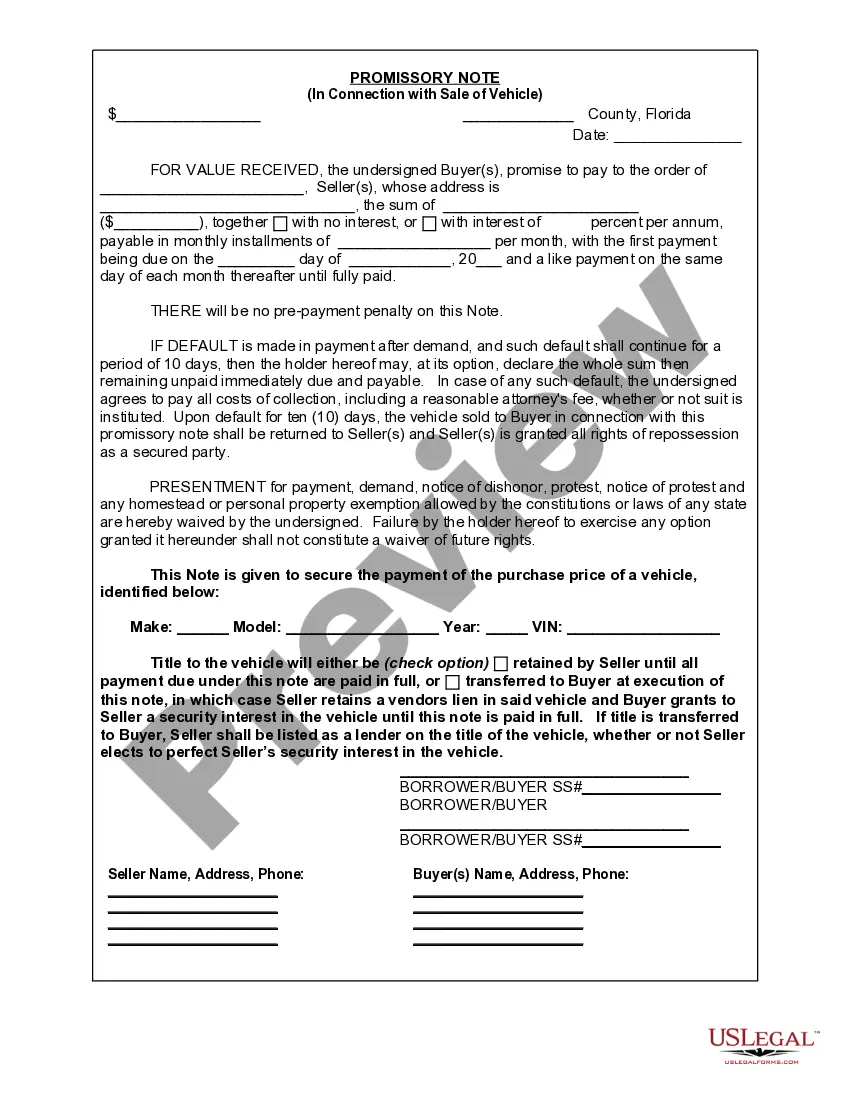

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legally binding document that outlines the terms and conditions of a loan or a debt repayment plan in connection with the sale of a vehicle or automobile in Orlando, Florida. It ensures that both the buyer and seller are aware of their obligations and protects their rights during the transaction. Here is a comprehensive description of different types of promissory notes commonly used in Orlando, Florida, for the sale of vehicles or automobiles. 1. Orlando Florida Promissory Note with Installment Payments: This type of promissory note is commonly used when the buyer and seller agree upon a fixed number of payments to be made over a specific period. The terms will include details such as the amount financed, interest rate, installment amount, and the due date of each payment. 2. Orlando Florida Promissory Note with Balloon Payment: In some cases, the buyer may opt for a promissory note with a balloon payment. This means that the buyer agrees to make lower monthly installments throughout the loan term but will be required to make a larger final payment (the balloon payment) at the end of the loan term. 3. Orlando Florida Promissory Note with Variable Interest Rate: When the interest rate is not fixed, a promissory note with a variable interest rate may be utilized. The interest rate on these notes fluctuates based on market conditions, usually tied to an index such as the prime rate or LIBOR. The promissory note will state how often the interest rate will be adjusted, such as annually or monthly. 4. Orlando Florida Promissory Note secured by Collateral: In cases where the seller wants additional security, a promissory note secured by collateral might be employed. This means that the vehicle itself will act as collateral for the loan. If the buyer defaults on the repayment, the seller can repossess the vehicle to recover the outstanding debt. 5. Orlando Florida Promissory Note with Co-signer: In situations where the buyer's creditworthiness is uncertain, a promissory note with a co-signer may be necessary. This involves a third party who guarantees the repayment of the loan. If the buyer fails to fulfill their obligations, the co-signer becomes responsible for the debt. It is essential to consult an attorney or use a template specifically designed for Orlando, Florida, when drafting a promissory note in connection with the sale of a vehicle or automobile. This will ensure that the document complies with all applicable laws and adequately protects the rights of both buyer and seller.A promissory note is a legally binding document that outlines the terms and conditions of a loan or a debt repayment plan in connection with the sale of a vehicle or automobile in Orlando, Florida. It ensures that both the buyer and seller are aware of their obligations and protects their rights during the transaction. Here is a comprehensive description of different types of promissory notes commonly used in Orlando, Florida, for the sale of vehicles or automobiles. 1. Orlando Florida Promissory Note with Installment Payments: This type of promissory note is commonly used when the buyer and seller agree upon a fixed number of payments to be made over a specific period. The terms will include details such as the amount financed, interest rate, installment amount, and the due date of each payment. 2. Orlando Florida Promissory Note with Balloon Payment: In some cases, the buyer may opt for a promissory note with a balloon payment. This means that the buyer agrees to make lower monthly installments throughout the loan term but will be required to make a larger final payment (the balloon payment) at the end of the loan term. 3. Orlando Florida Promissory Note with Variable Interest Rate: When the interest rate is not fixed, a promissory note with a variable interest rate may be utilized. The interest rate on these notes fluctuates based on market conditions, usually tied to an index such as the prime rate or LIBOR. The promissory note will state how often the interest rate will be adjusted, such as annually or monthly. 4. Orlando Florida Promissory Note secured by Collateral: In cases where the seller wants additional security, a promissory note secured by collateral might be employed. This means that the vehicle itself will act as collateral for the loan. If the buyer defaults on the repayment, the seller can repossess the vehicle to recover the outstanding debt. 5. Orlando Florida Promissory Note with Co-signer: In situations where the buyer's creditworthiness is uncertain, a promissory note with a co-signer may be necessary. This involves a third party who guarantees the repayment of the loan. If the buyer fails to fulfill their obligations, the co-signer becomes responsible for the debt. It is essential to consult an attorney or use a template specifically designed for Orlando, Florida, when drafting a promissory note in connection with the sale of a vehicle or automobile. This will ensure that the document complies with all applicable laws and adequately protects the rights of both buyer and seller.