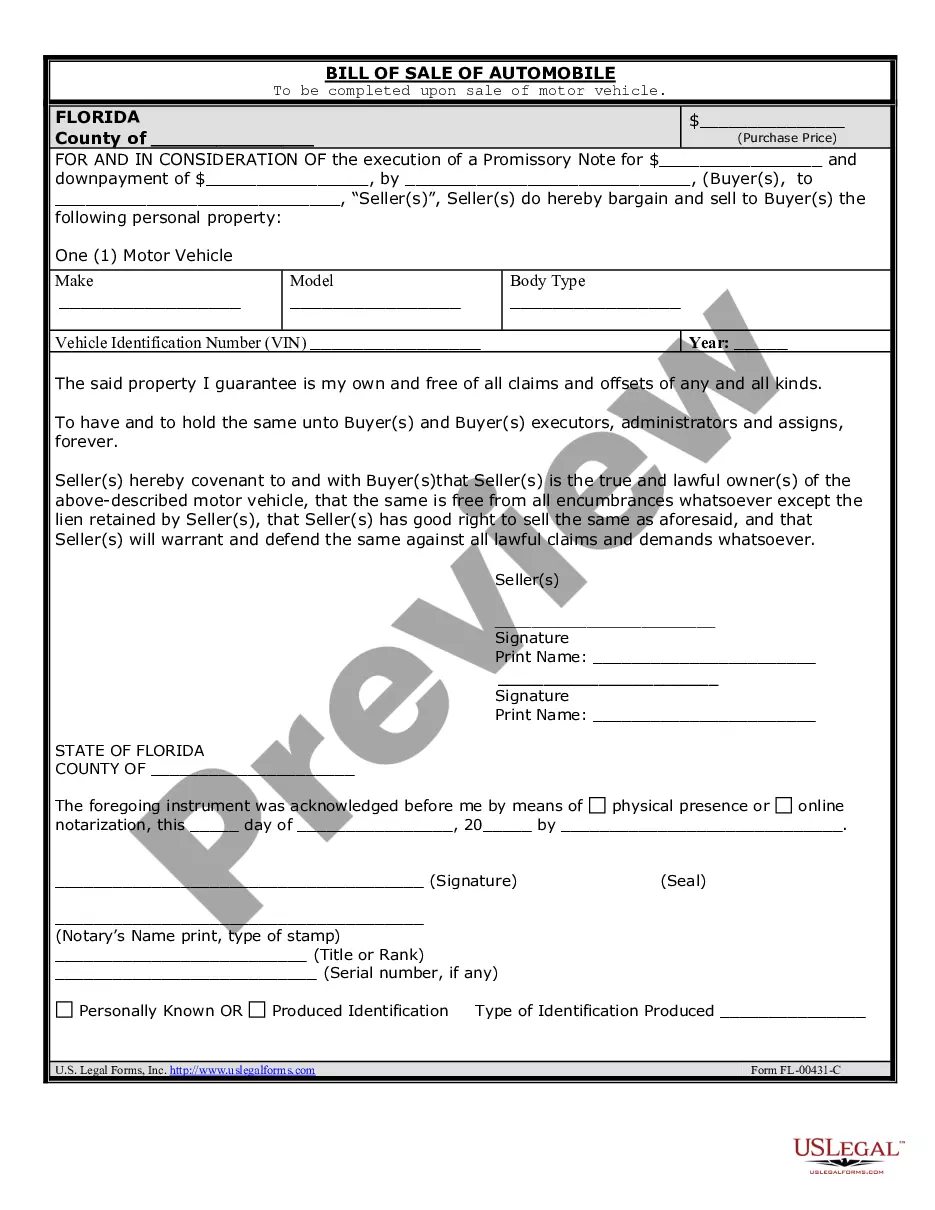

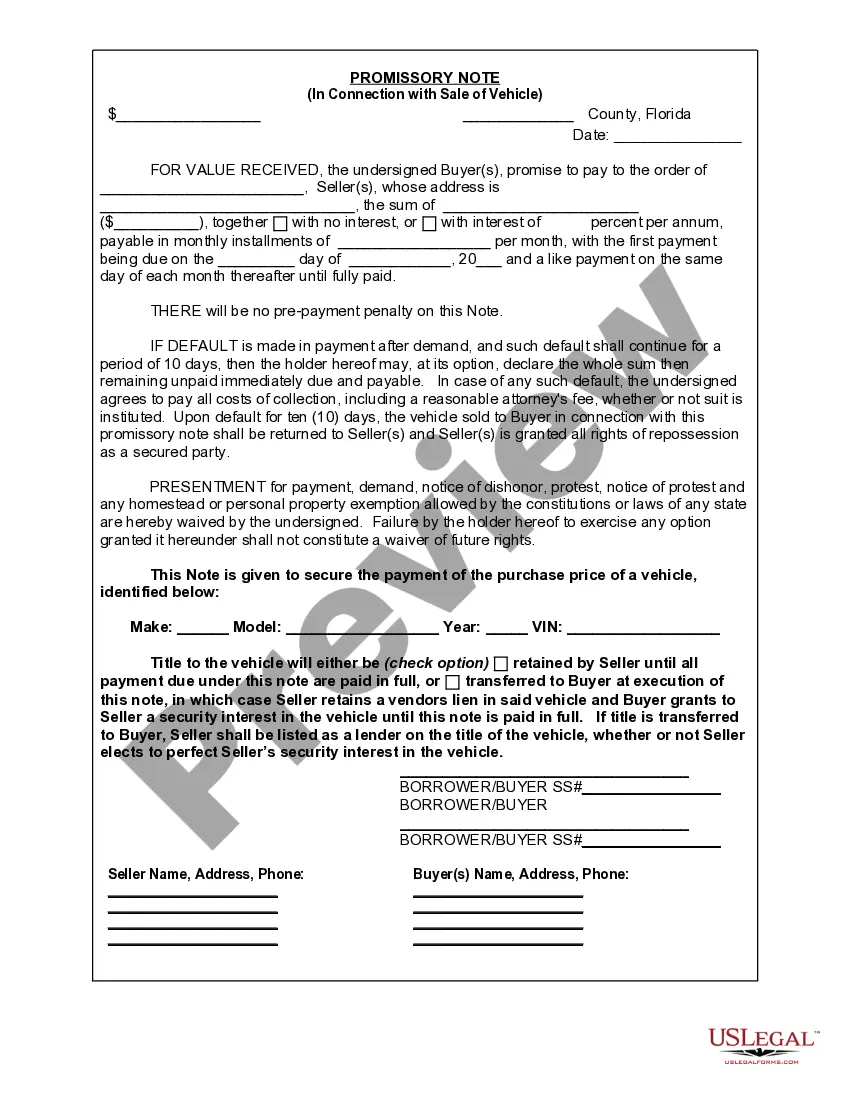

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Palm Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as an agreement and a promise by the buyer to repay the seller the agreed-upon amount for the vehicle purchase. This promissory note is specifically designed for the state of Florida and more specifically for transactions occurring in Palm Beach County. It ensures that both parties fully understand their rights, obligations, and the consequences of defaulting on the payment. The Palm Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile typically includes the following details: 1. Identification of Parties: The names, addresses, and contact information of both the buyer and seller are clearly mentioned. It is vital to provide accurate details to avoid any confusion or disputes in the future. 2. Vehicle Information: This section describes the vehicle being sold, including its make, model, year, color, identification number, and any additional features or modifications. Accurate vehicle information is essential to ensure both parties are referring to the same vehicle. 3. Terms of Payment: The total purchase price of the vehicle, the down payment (if applicable), and the agreed-upon interest rate (if any) are clearly stated. The payment schedule, including the number of installments and their due dates, is also outlined. 4. Security Agreement: In some cases, the seller may require additional security to protect their investment. This section explains any collateral provided, such as the vehicle itself, and the consequences of defaulting on the payment. It also includes provisions regarding insurance coverage, maintenance, and potential penalties for damage to the vehicle. 5. Default and Remedies: This section defines the actions that can be taken in case of default, including repossession of the vehicle, legal action, and the payment of attorney fees or other expenses incurred as a result of collection efforts. Different types of Palm Beach Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations in payment terms, interest rates, or additional clauses tailored to the specific needs of the parties involved. For example, a Balloon Payment Promissory Note may have lower monthly installments with a lump-sum payment due at the end of the loan period. A Down Payment Promissory Note may require a substantial down payment upfront. It is crucial to consult with a legal professional or utilize a trusted template to ensure that the promissory note accurately reflects the agreement and complies with the specific laws and regulations applicable in Palm Beach County, Florida.

A Palm Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as an agreement and a promise by the buyer to repay the seller the agreed-upon amount for the vehicle purchase. This promissory note is specifically designed for the state of Florida and more specifically for transactions occurring in Palm Beach County. It ensures that both parties fully understand their rights, obligations, and the consequences of defaulting on the payment. The Palm Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile typically includes the following details: 1. Identification of Parties: The names, addresses, and contact information of both the buyer and seller are clearly mentioned. It is vital to provide accurate details to avoid any confusion or disputes in the future. 2. Vehicle Information: This section describes the vehicle being sold, including its make, model, year, color, identification number, and any additional features or modifications. Accurate vehicle information is essential to ensure both parties are referring to the same vehicle. 3. Terms of Payment: The total purchase price of the vehicle, the down payment (if applicable), and the agreed-upon interest rate (if any) are clearly stated. The payment schedule, including the number of installments and their due dates, is also outlined. 4. Security Agreement: In some cases, the seller may require additional security to protect their investment. This section explains any collateral provided, such as the vehicle itself, and the consequences of defaulting on the payment. It also includes provisions regarding insurance coverage, maintenance, and potential penalties for damage to the vehicle. 5. Default and Remedies: This section defines the actions that can be taken in case of default, including repossession of the vehicle, legal action, and the payment of attorney fees or other expenses incurred as a result of collection efforts. Different types of Palm Beach Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations in payment terms, interest rates, or additional clauses tailored to the specific needs of the parties involved. For example, a Balloon Payment Promissory Note may have lower monthly installments with a lump-sum payment due at the end of the loan period. A Down Payment Promissory Note may require a substantial down payment upfront. It is crucial to consult with a legal professional or utilize a trusted template to ensure that the promissory note accurately reflects the agreement and complies with the specific laws and regulations applicable in Palm Beach County, Florida.