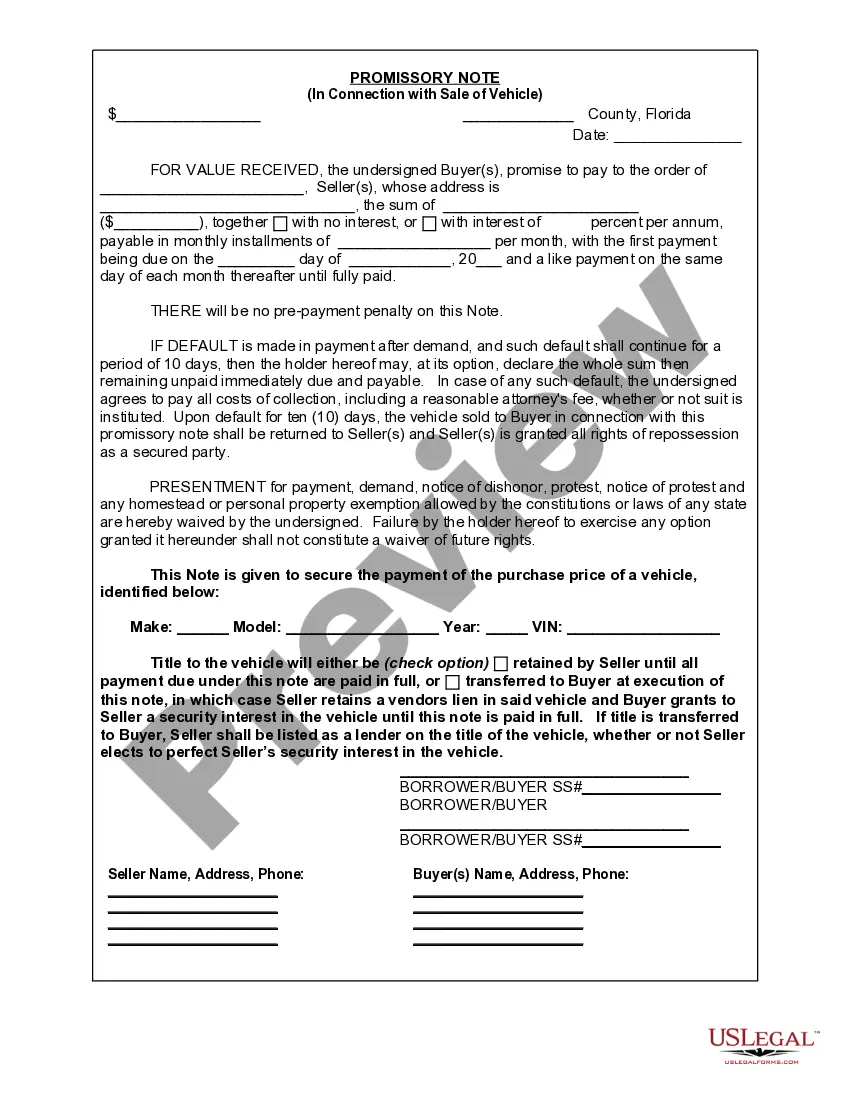

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Pompano Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding agreement between a buyer and a seller that outlines the terms and conditions of a vehicle sale where the buyer agrees to make regular payments to the seller until the full purchase price is paid. This document serves as proof of the transaction and protects the interests of both parties involved. The Pompano Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile includes important details such as the identities of the buyer and seller, vehicle information (make, model, year, VIN number), purchase price, down payment (if any), finance charges (if applicable), payment schedule, interest rate (if applicable), and any other relevant terms and conditions. By signing this note, the buyer acknowledges their responsibility to repay the outstanding amount in a timely manner and agrees to follow the agreed-upon payment plan. It also allows the seller to take legal action if the buyer defaults on their payments. Different types of Pompano Beach Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is a basic agreement stating the buyer's commitment to repay the seller within a specified period, usually through installment payments. 2. Balloon Promissory Note: This type of promissory note includes smaller regular payments over a specific period, with a larger "balloon" payment due at the end. It is common for car loans. 3. Secured Promissory Note: In this case, the loan is secured by the vehicle itself. If the buyer fails to fulfill the payment obligations, the seller retains the right to repossess the vehicle. 4. Interest-Free Promissory Note: This type of note excludes any interest charges, making it a convenient option for buyers who prefer to avoid accruing additional costs. However, it is important to ensure the total purchase price is agreed upon and outlined in the note. When creating a Pompano Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile, it is important to consult with a legal professional to ensure all applicable laws and regulations are adhered to. This will provide both the buyer and seller with peace of mind and protect their interests throughout the transaction process.A Pompano Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding agreement between a buyer and a seller that outlines the terms and conditions of a vehicle sale where the buyer agrees to make regular payments to the seller until the full purchase price is paid. This document serves as proof of the transaction and protects the interests of both parties involved. The Pompano Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile includes important details such as the identities of the buyer and seller, vehicle information (make, model, year, VIN number), purchase price, down payment (if any), finance charges (if applicable), payment schedule, interest rate (if applicable), and any other relevant terms and conditions. By signing this note, the buyer acknowledges their responsibility to repay the outstanding amount in a timely manner and agrees to follow the agreed-upon payment plan. It also allows the seller to take legal action if the buyer defaults on their payments. Different types of Pompano Beach Florida Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is a basic agreement stating the buyer's commitment to repay the seller within a specified period, usually through installment payments. 2. Balloon Promissory Note: This type of promissory note includes smaller regular payments over a specific period, with a larger "balloon" payment due at the end. It is common for car loans. 3. Secured Promissory Note: In this case, the loan is secured by the vehicle itself. If the buyer fails to fulfill the payment obligations, the seller retains the right to repossess the vehicle. 4. Interest-Free Promissory Note: This type of note excludes any interest charges, making it a convenient option for buyers who prefer to avoid accruing additional costs. However, it is important to ensure the total purchase price is agreed upon and outlined in the note. When creating a Pompano Beach Florida Promissory Note in Connection with Sale of Vehicle or Automobile, it is important to consult with a legal professional to ensure all applicable laws and regulations are adhered to. This will provide both the buyer and seller with peace of mind and protect their interests throughout the transaction process.