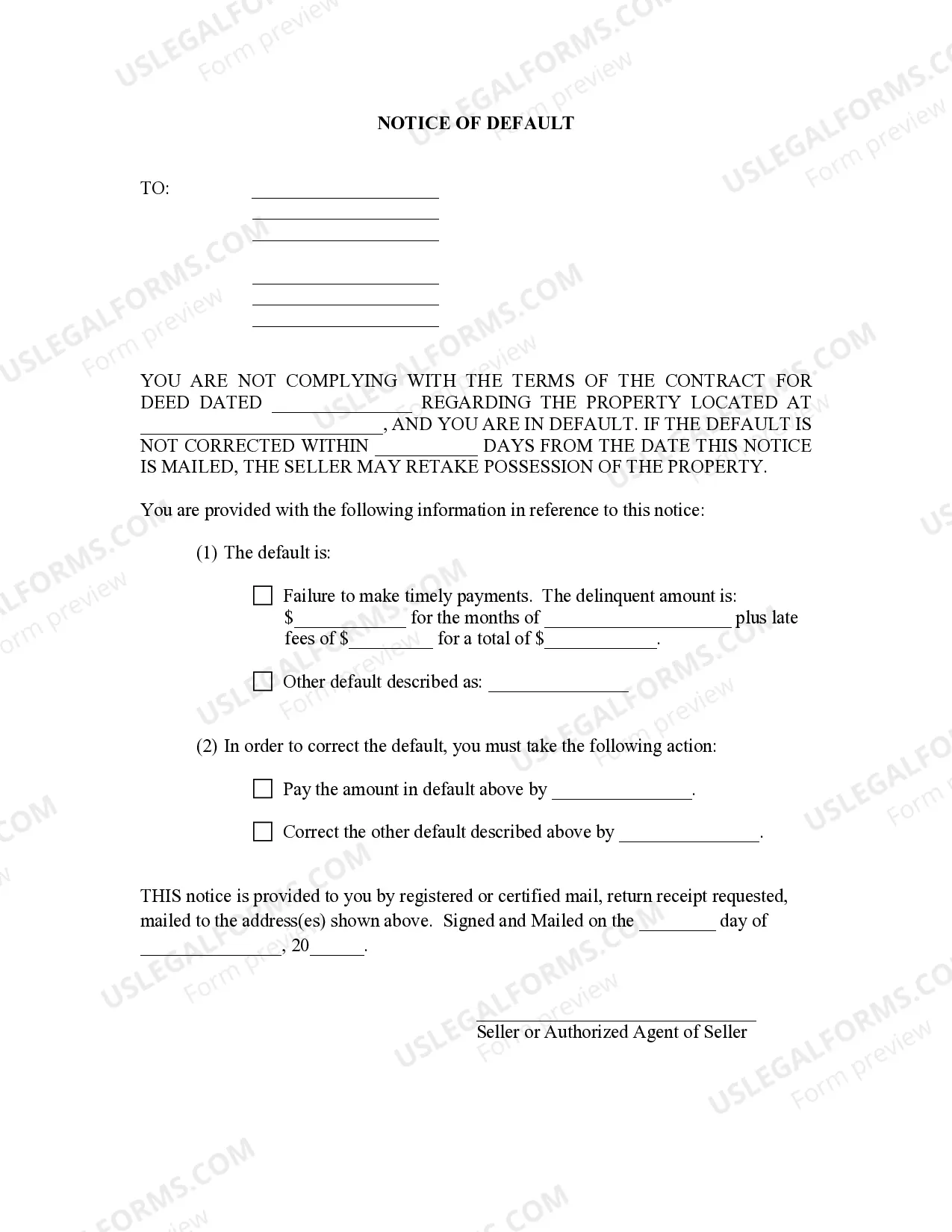

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Title: Miramar, Florida — General Notice of Default for Contract for Deed Explained Introduction: In Miramar, Florida, a General Notice of Default for a Contract for Deed serves as a crucial legal document that outlines the actions to be taken when a party defaults on a contract for deed agreement. This informative article provides a detailed description of what a Notice of Default entails, explaining its significance in protecting the rights and interests of both the seller and the buyer involved in a Contract for Deed transaction. Additionally, we will touch upon the different types of Notices of Default that may exist in a Miramar, Florida context. I. Understanding the Notice of Default for Contract for Deed: The Notice of Default for a Contract for Deed is a legal document required in the state of Florida to notify the buyer of the default and to prompt them to take appropriate steps to rectify the situation. This notice is typically issued by the seller, also known as the vendor, to the buyer, referred to as the Vendée. II. Content and Purpose of the Notice of Default: 1. Clear Identification: The Notice of Default should clearly identify the parties involved, including their names, addresses, and contact information. This ensures that the notice reaches the intended recipient promptly. 2. Reason for Default: The notice must provide a detailed explanation of the reason for default, outlining any specific breach of contract terms, such as missed payments or failure to meet other obligations under the agreement. 3. Cure Period: A crucial component of the Notice of Default is specifying a reasonable time frame, known as the cure period, within which the buyer must rectify the default. This period allows the buyer the opportunity to catch up on payments or fulfill their contractual obligations. 4. Consequences of Failure to Cure: The consequences of failing to cure the default within the stipulated cure period should be mentioned in the notice. This may include the initiation of foreclosure proceedings or termination of the contract, potentially leading to the return of the property to the seller. III. Types of Miramar, Florida General Notice of Default for Contract for Deed: 1. Notice of Default for Missed Payments: This type of notice is issued when the buyer fails to make timely payments as specified in the agreed-upon contract for deed. 2. Notice of Default for Breach of Contract: This notice is used when the buyer violates the terms and conditions of the contract in ways other than payments, such as failure to maintain the property, unauthorized alterations, or any other contractual breach. 3. Notice of Default for Failure to Fulfill Obligations: This type of notice is sent when the buyer fails to meet other obligations stipulated in the contract, such as the payment of property taxes, homeowner association fees, insurance premiums, or failure to maintain adequate insurance coverage. Conclusion: In Miramar, Florida, the General Notice of Default for a Contract for Deed plays a vital role in communicating the buyer's default to the seller and outlining necessary steps for resolution. By providing detailed information on the nature of default, specified cure periods, and potential consequences, this notice helps maintain clarity, transparency, and fairness within Contract for Deed transactions. Proper attention to contractual obligations and communication is essential for both buyers and sellers to ensure a smooth and successful real estate transaction.Title: Miramar, Florida — General Notice of Default for Contract for Deed Explained Introduction: In Miramar, Florida, a General Notice of Default for a Contract for Deed serves as a crucial legal document that outlines the actions to be taken when a party defaults on a contract for deed agreement. This informative article provides a detailed description of what a Notice of Default entails, explaining its significance in protecting the rights and interests of both the seller and the buyer involved in a Contract for Deed transaction. Additionally, we will touch upon the different types of Notices of Default that may exist in a Miramar, Florida context. I. Understanding the Notice of Default for Contract for Deed: The Notice of Default for a Contract for Deed is a legal document required in the state of Florida to notify the buyer of the default and to prompt them to take appropriate steps to rectify the situation. This notice is typically issued by the seller, also known as the vendor, to the buyer, referred to as the Vendée. II. Content and Purpose of the Notice of Default: 1. Clear Identification: The Notice of Default should clearly identify the parties involved, including their names, addresses, and contact information. This ensures that the notice reaches the intended recipient promptly. 2. Reason for Default: The notice must provide a detailed explanation of the reason for default, outlining any specific breach of contract terms, such as missed payments or failure to meet other obligations under the agreement. 3. Cure Period: A crucial component of the Notice of Default is specifying a reasonable time frame, known as the cure period, within which the buyer must rectify the default. This period allows the buyer the opportunity to catch up on payments or fulfill their contractual obligations. 4. Consequences of Failure to Cure: The consequences of failing to cure the default within the stipulated cure period should be mentioned in the notice. This may include the initiation of foreclosure proceedings or termination of the contract, potentially leading to the return of the property to the seller. III. Types of Miramar, Florida General Notice of Default for Contract for Deed: 1. Notice of Default for Missed Payments: This type of notice is issued when the buyer fails to make timely payments as specified in the agreed-upon contract for deed. 2. Notice of Default for Breach of Contract: This notice is used when the buyer violates the terms and conditions of the contract in ways other than payments, such as failure to maintain the property, unauthorized alterations, or any other contractual breach. 3. Notice of Default for Failure to Fulfill Obligations: This type of notice is sent when the buyer fails to meet other obligations stipulated in the contract, such as the payment of property taxes, homeowner association fees, insurance premiums, or failure to maintain adequate insurance coverage. Conclusion: In Miramar, Florida, the General Notice of Default for a Contract for Deed plays a vital role in communicating the buyer's default to the seller and outlining necessary steps for resolution. By providing detailed information on the nature of default, specified cure periods, and potential consequences, this notice helps maintain clarity, transparency, and fairness within Contract for Deed transactions. Proper attention to contractual obligations and communication is essential for both buyers and sellers to ensure a smooth and successful real estate transaction.