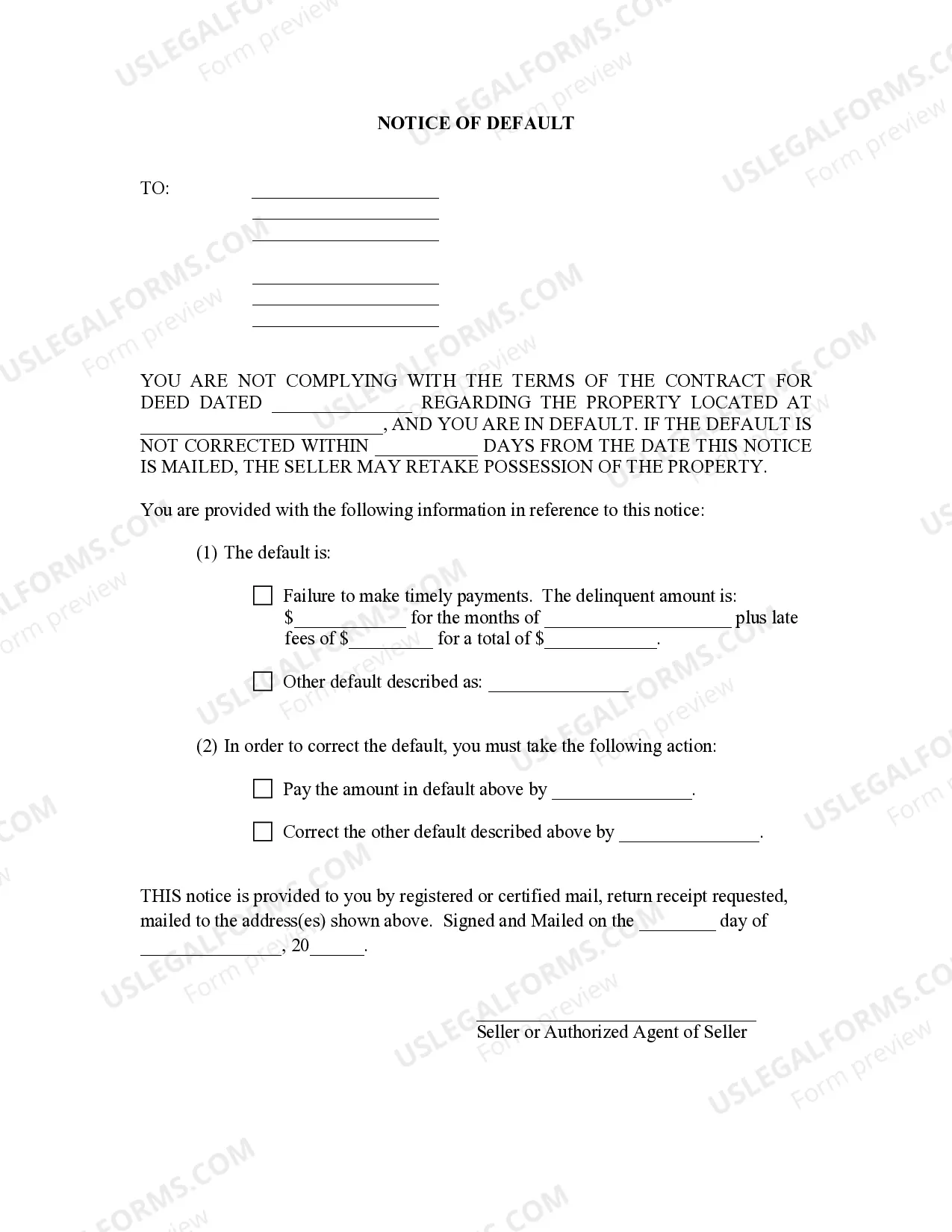

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Pompano Beach Florida General Notice of Default for Contract for Deed is an important legal document that plays a crucial role in real estate transactions. This notice is usually served by the lender to the borrower, indicating that they have defaulted on their contractual obligations regarding a property purchased through a contract for deed. The purpose of the Pompano Beach Florida General Notice of Default for Contract for Deed is to formally notify the borrower about their default and to give them an opportunity to remedy the situation within a specified timeframe. In most cases, this notice is issued when the borrower fails to make timely payments as outlined in the contract. There are several types of Pompano Beach Florida General Notice of Default for Contract for Deed, each addressing different aspects of the default situation: 1. Payment Default: This type of notice is issued when the borrower fails to make their scheduled payments on time. It specifies the amount due, including any penalties or late fees, and sets a deadline for the borrower to cure the default. 2. Breach of Contract: In the event that the borrower fails to meet other obligations outlined in the contract, such as property maintenance or insurance requirements, a notice of default for breach of contract may be issued. This notifies the borrower of their breach and provides an opportunity to rectify the situation. 3. Default Cure: In some cases, the Pompano Beach Florida General Notice of Default for Contract for Deed may also include a default cure provision. This allows the borrower to cure their default by making the past due payments and any associated fees within a specific timeframe, thus avoiding further legal action. It is important for borrowers to take the General Notice of Default for Contract for Deed seriously as it may result in the lender initiating foreclosure proceedings. Failure to respond to the notice or remedy the default within the given period can lead to the loss of the property and damage to the borrower's credit score. In summary, the Pompano Beach Florida General Notice of Default for Contract for Deed is a critical document that alerts borrowers of their default on a contract for deed. It serves as a warning and provides an opportunity for the borrower to rectify the default and prevent further legal actions.Pompano Beach Florida General Notice of Default for Contract for Deed is an important legal document that plays a crucial role in real estate transactions. This notice is usually served by the lender to the borrower, indicating that they have defaulted on their contractual obligations regarding a property purchased through a contract for deed. The purpose of the Pompano Beach Florida General Notice of Default for Contract for Deed is to formally notify the borrower about their default and to give them an opportunity to remedy the situation within a specified timeframe. In most cases, this notice is issued when the borrower fails to make timely payments as outlined in the contract. There are several types of Pompano Beach Florida General Notice of Default for Contract for Deed, each addressing different aspects of the default situation: 1. Payment Default: This type of notice is issued when the borrower fails to make their scheduled payments on time. It specifies the amount due, including any penalties or late fees, and sets a deadline for the borrower to cure the default. 2. Breach of Contract: In the event that the borrower fails to meet other obligations outlined in the contract, such as property maintenance or insurance requirements, a notice of default for breach of contract may be issued. This notifies the borrower of their breach and provides an opportunity to rectify the situation. 3. Default Cure: In some cases, the Pompano Beach Florida General Notice of Default for Contract for Deed may also include a default cure provision. This allows the borrower to cure their default by making the past due payments and any associated fees within a specific timeframe, thus avoiding further legal action. It is important for borrowers to take the General Notice of Default for Contract for Deed seriously as it may result in the lender initiating foreclosure proceedings. Failure to respond to the notice or remedy the default within the given period can lead to the loss of the property and damage to the borrower's credit score. In summary, the Pompano Beach Florida General Notice of Default for Contract for Deed is a critical document that alerts borrowers of their default on a contract for deed. It serves as a warning and provides an opportunity for the borrower to rectify the default and prevent further legal actions.