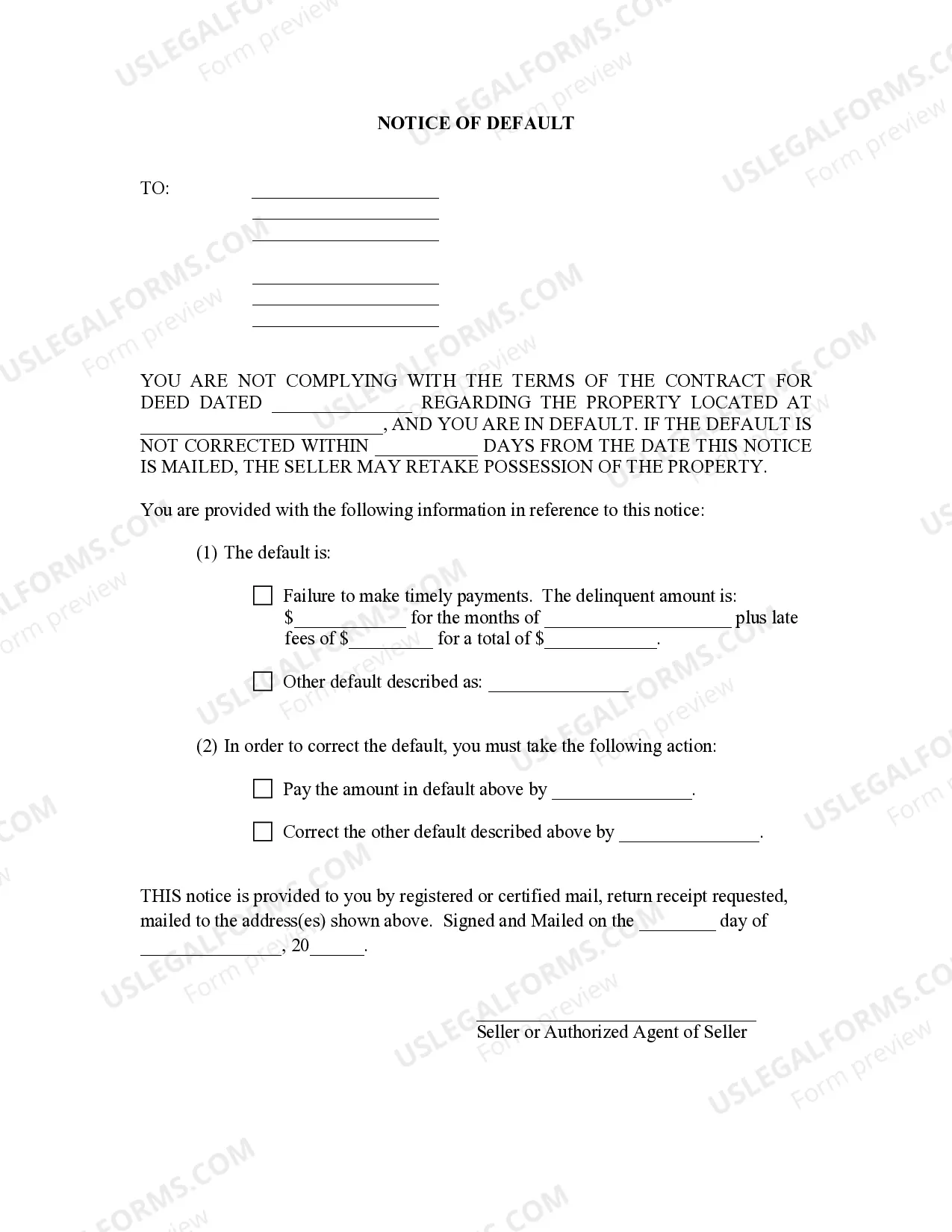

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Title: Understanding the West Palm Beach Florida General Notice of Default for Contract for Deed Introduction: The West Palm Beach Florida General Notice of Default for Contract for Deed is an important legal document that serves as a notice to parties involved in a contract for deed when a default has occurred. This detailed description will explain the purpose of this notice, its legal significance, and the different types of defaults that can occur in West Palm Beach, Florida. 1. Purpose of the West Palm Beach Florida General Notice of Default: The purpose of this notice is to notify all parties involved in a contract for deed that a default has taken place. It serves as an official record that triggers certain legal actions and outlines the steps to be taken following the default. 2. Legal Significance: The West Palm Beach Florida General Notice of Default for Contract for Deed holds great legal significance and must comply with the state's laws and regulations regarding defaults. It outlines the rights and obligations of both the buyer and seller, protects the rights of the buyer in case of unfair actions by the seller, and provides an opportunity for the parties involved to rectify the default. 3. Types of Defaults in West Palm Beach, Florida: a. Payment Default: This occurs when the buyer fails to make the agreed-upon payments within the specified timeframe. The notice will specify the amount due, the grace period provided, and the consequences if the default is not cured. b. Property Maintenance Default: This type of default occurs when the buyer neglects to maintain the property or violates any maintenance-related clauses specified in the contract for deed. It may include failure to address repairs, landscaping issues, or violations of homeowner association bylaws. c. Violation of Other Contractual Terms: This type of default happens when the buyer breaches any other contractual terms, such as lease provisions, property use restrictions, or failure to disclose important information related to the property. d. Insurance or Tax Default: If the buyer neglects to pay property taxes or fails to maintain adequate insurance coverage, it could lead to a default. The notice outlines the actions to be taken to rectify these defaults and avoid legal consequences. Conclusion: Understanding the West Palm Beach Florida General Notice of Default for Contract for Deed is crucial in protecting the rights and interests of both the buyer and seller. By familiarizing yourself with the different types of defaults and their potential consequences, you can ensure that you act promptly and efficiently to resolve any defaults and avoid further legal complications.Title: Understanding the West Palm Beach Florida General Notice of Default for Contract for Deed Introduction: The West Palm Beach Florida General Notice of Default for Contract for Deed is an important legal document that serves as a notice to parties involved in a contract for deed when a default has occurred. This detailed description will explain the purpose of this notice, its legal significance, and the different types of defaults that can occur in West Palm Beach, Florida. 1. Purpose of the West Palm Beach Florida General Notice of Default: The purpose of this notice is to notify all parties involved in a contract for deed that a default has taken place. It serves as an official record that triggers certain legal actions and outlines the steps to be taken following the default. 2. Legal Significance: The West Palm Beach Florida General Notice of Default for Contract for Deed holds great legal significance and must comply with the state's laws and regulations regarding defaults. It outlines the rights and obligations of both the buyer and seller, protects the rights of the buyer in case of unfair actions by the seller, and provides an opportunity for the parties involved to rectify the default. 3. Types of Defaults in West Palm Beach, Florida: a. Payment Default: This occurs when the buyer fails to make the agreed-upon payments within the specified timeframe. The notice will specify the amount due, the grace period provided, and the consequences if the default is not cured. b. Property Maintenance Default: This type of default occurs when the buyer neglects to maintain the property or violates any maintenance-related clauses specified in the contract for deed. It may include failure to address repairs, landscaping issues, or violations of homeowner association bylaws. c. Violation of Other Contractual Terms: This type of default happens when the buyer breaches any other contractual terms, such as lease provisions, property use restrictions, or failure to disclose important information related to the property. d. Insurance or Tax Default: If the buyer neglects to pay property taxes or fails to maintain adequate insurance coverage, it could lead to a default. The notice outlines the actions to be taken to rectify these defaults and avoid legal consequences. Conclusion: Understanding the West Palm Beach Florida General Notice of Default for Contract for Deed is crucial in protecting the rights and interests of both the buyer and seller. By familiarizing yourself with the different types of defaults and their potential consequences, you can ensure that you act promptly and efficiently to resolve any defaults and avoid further legal complications.