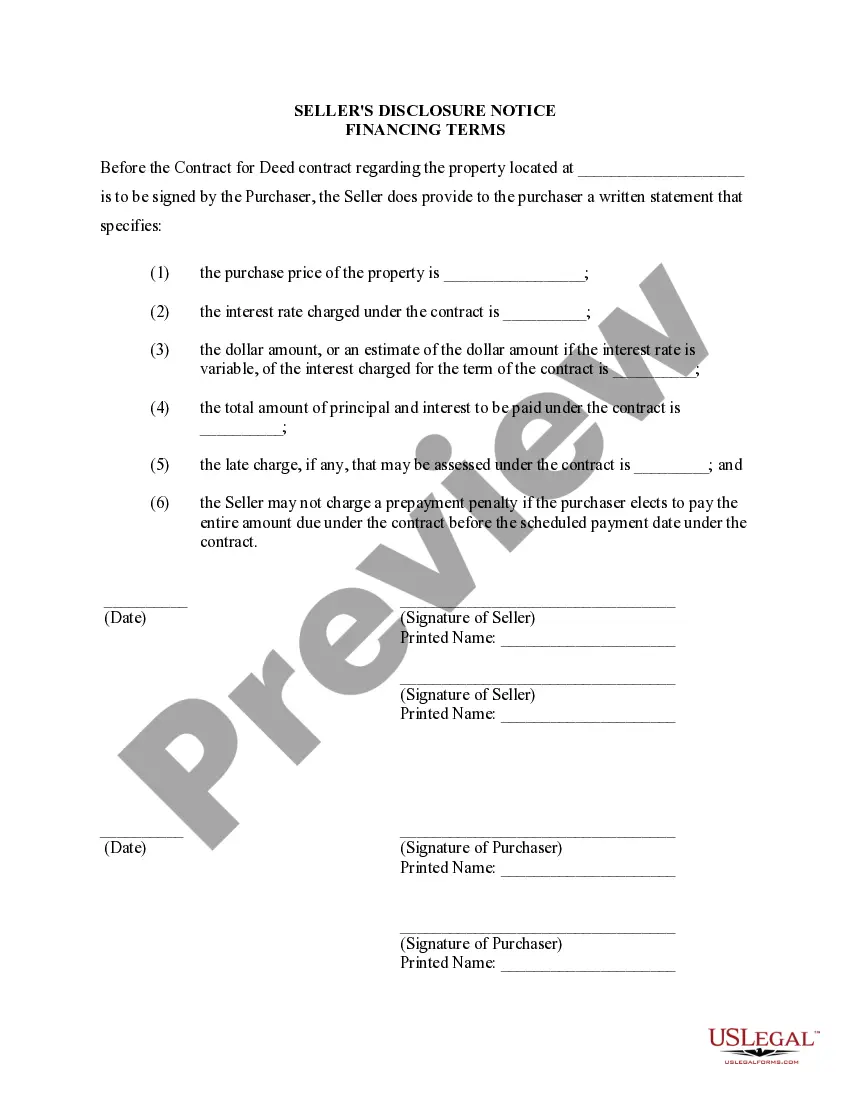

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Coral Springs Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the financing terms associated with the sale of a residential property. This disclosure serves as a transparent communication tool between the seller and the buyer, ensuring both parties are aware and agree to the specific terms of the financing arrangement. In the context of Coral Springs, Florida, there may be different variations or types of Seller's Disclosure of Financing Terms for Residential Property, including: 1. Fixed or Variable Interest Rate: This specifies whether the interest rate for the financing arrangement is fixed or variable. A fixed interest rate remains unchanged throughout the contract period, while a variable interest rate may fluctuate based on market conditions. 2. Down Payment and Deposit: The disclosure will elaborate on the required down payment amount and any additional deposits necessary to secure the property in connection with the Land Contract. Buyers need to be aware of the specific financial obligations they must meet upfront. 3. Payment Schedule and Amount: This section outlines the structure of the payment schedule, including frequency (monthly, bi-monthly), due dates, and the total amount due. It may also mention any potential penalties for late payments. 4. Terms of Default: In case either party fails to meet their obligations, there should be a clear explanation of the consequences. This may include specifics on potential penalties, rights of the non-defaulting party, and dispute resolution procedures. 5. Transfer of Ownership: The disclosure should outline when and how the ownership of the property will be transferred from the seller to the buyer. It may include details about the conditions and requirements for a successful transfer, such as completion of payment or compliance with specific terms. 6. Prepayment and Early Termination: If the financing terms allow for prepayment or early termination of the contract, these conditions should be stated clearly in the disclosure. It may mention any associated fees or penalties for such actions. 7. Seller's Financing Disclosure Statement: This section provides additional information about the seller's financing terms, which includes the seller's responsibilities, any liens or encumbrances on the property, and any disclosures required by state or local laws. 8. Legal and Financial Advice: The disclosure might emphasize the importance of seeking legal and financial advice before entering into the Land Contract. It would express that both parties understand the implications of the financing terms and have sought appropriate professional counsel. When completing a Coral Springs Florida Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed a/k/a Land Contract, it is crucial for both the seller and the buyer to thoroughly review and understand the terms disclosed. This helps ensure that both parties enter into the transaction with a clear understanding of their rights and responsibilities, promoting a smooth and mutually beneficial real estate transaction.The Coral Springs Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the financing terms associated with the sale of a residential property. This disclosure serves as a transparent communication tool between the seller and the buyer, ensuring both parties are aware and agree to the specific terms of the financing arrangement. In the context of Coral Springs, Florida, there may be different variations or types of Seller's Disclosure of Financing Terms for Residential Property, including: 1. Fixed or Variable Interest Rate: This specifies whether the interest rate for the financing arrangement is fixed or variable. A fixed interest rate remains unchanged throughout the contract period, while a variable interest rate may fluctuate based on market conditions. 2. Down Payment and Deposit: The disclosure will elaborate on the required down payment amount and any additional deposits necessary to secure the property in connection with the Land Contract. Buyers need to be aware of the specific financial obligations they must meet upfront. 3. Payment Schedule and Amount: This section outlines the structure of the payment schedule, including frequency (monthly, bi-monthly), due dates, and the total amount due. It may also mention any potential penalties for late payments. 4. Terms of Default: In case either party fails to meet their obligations, there should be a clear explanation of the consequences. This may include specifics on potential penalties, rights of the non-defaulting party, and dispute resolution procedures. 5. Transfer of Ownership: The disclosure should outline when and how the ownership of the property will be transferred from the seller to the buyer. It may include details about the conditions and requirements for a successful transfer, such as completion of payment or compliance with specific terms. 6. Prepayment and Early Termination: If the financing terms allow for prepayment or early termination of the contract, these conditions should be stated clearly in the disclosure. It may mention any associated fees or penalties for such actions. 7. Seller's Financing Disclosure Statement: This section provides additional information about the seller's financing terms, which includes the seller's responsibilities, any liens or encumbrances on the property, and any disclosures required by state or local laws. 8. Legal and Financial Advice: The disclosure might emphasize the importance of seeking legal and financial advice before entering into the Land Contract. It would express that both parties understand the implications of the financing terms and have sought appropriate professional counsel. When completing a Coral Springs Florida Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed a/k/a Land Contract, it is crucial for both the seller and the buyer to thoroughly review and understand the terms disclosed. This helps ensure that both parties enter into the transaction with a clear understanding of their rights and responsibilities, promoting a smooth and mutually beneficial real estate transaction.