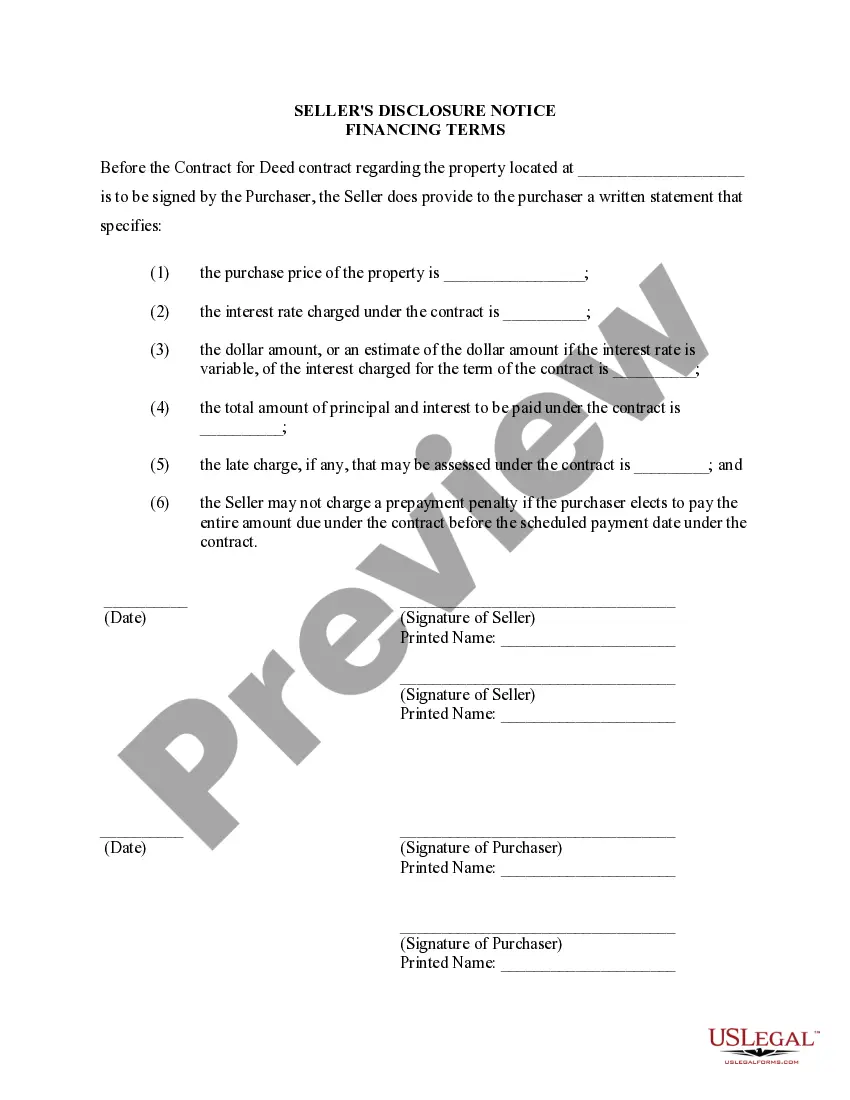

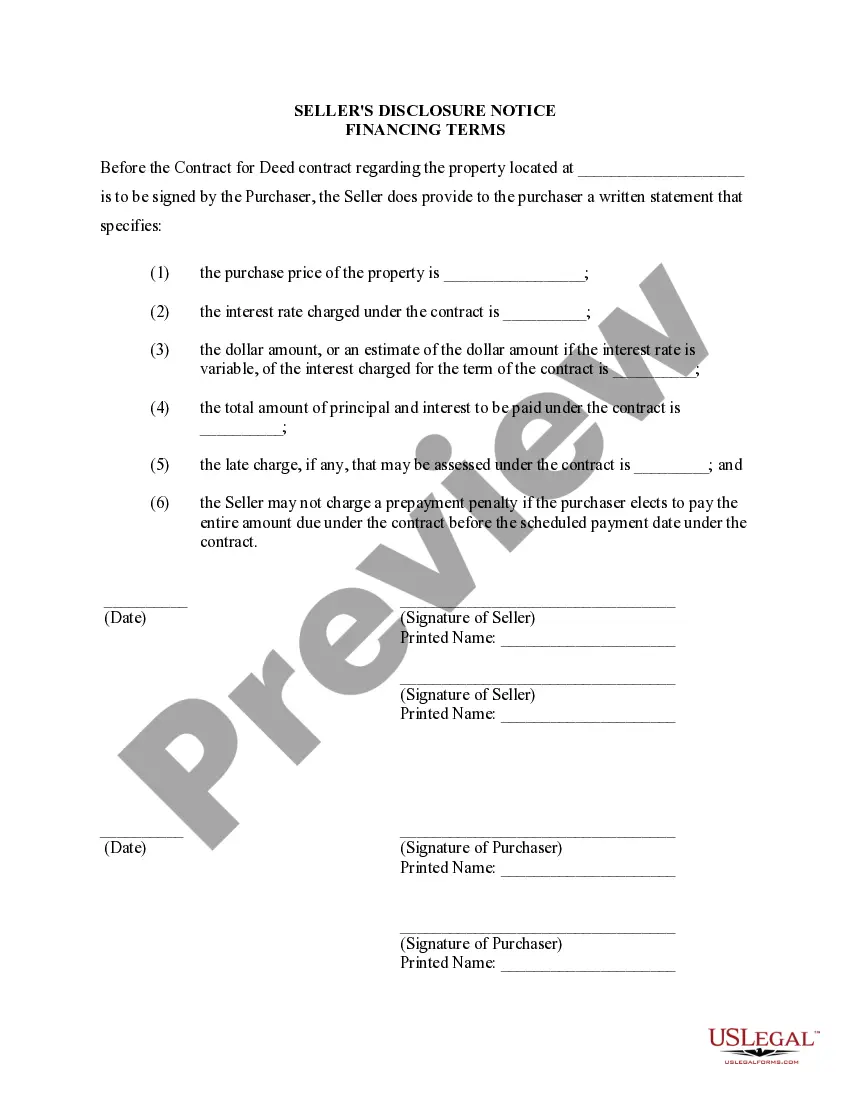

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Miami-Dade Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines crucial information regarding the financing terms associated with the sale of residential property in Miami-Dade County. It is designed to provide transparency and protect the interests of both the seller and the buyer in the transaction. The disclosure contains various key details, which may vary depending on the type of financing arrangement agreed upon. The following are some examples of different types of Miami-Dade Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract: 1. Traditional Mortgage Financing: This type of financing involves a buyer securing a mortgage loan from a bank or financial institution to purchase the residential property. The seller's disclosure in this case would outline the terms of the mortgage, including the interest rate, loan duration, payment schedule, and any additional fees or charges. 2. Seller Financing: In this arrangement, the seller acts as the lender and provides financing to the buyer directly. The seller's disclosure would detail the specific terms agreed upon, such as the interest rate, loan duration, payment schedule, any balloon payments, and any other relevant financial terms. 3. Lease-to-Own Contracts: Under this type of financing, the buyer agrees to rent the property for a set period with the option to purchase it at the end. The seller's disclosure would include the terms of the lease, such as the rental amount, duration, rent credits (if any), and the purchase price and terms for the eventual transfer of ownership. 4. Rent-to-Own Contracts: Similar to lease-to-own contracts, rent-to-own agreements allow the buyer to rent the property with the option to purchase it in the future. However, in this case, a portion of the monthly rent typically goes towards the eventual purchase price. The seller's disclosure would outline the rental terms, the option price, the timeframe for exercising the option, and any additional terms related to the purchase. 5. Land Contract or Agreement for Deed: This type of financing involves the buyer making regular installment payments directly to the seller until the purchase price is fully paid. The seller retains legal title to the property until the buyer completes all the payments. The seller's disclosure would detail the purchase price, the installment payment schedule, any interest charges, and the consequences of default or early termination. In conclusion, the Miami-Dade Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a comprehensive document that outlines the financing terms associated with the sale of residential property. Its purpose is to ensure transparency and protect the interests of both parties involved in the transaction. The specific terms contained within the disclosure may vary depending on the type of financing arrangement agreed upon.Miami-Dade Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines crucial information regarding the financing terms associated with the sale of residential property in Miami-Dade County. It is designed to provide transparency and protect the interests of both the seller and the buyer in the transaction. The disclosure contains various key details, which may vary depending on the type of financing arrangement agreed upon. The following are some examples of different types of Miami-Dade Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract: 1. Traditional Mortgage Financing: This type of financing involves a buyer securing a mortgage loan from a bank or financial institution to purchase the residential property. The seller's disclosure in this case would outline the terms of the mortgage, including the interest rate, loan duration, payment schedule, and any additional fees or charges. 2. Seller Financing: In this arrangement, the seller acts as the lender and provides financing to the buyer directly. The seller's disclosure would detail the specific terms agreed upon, such as the interest rate, loan duration, payment schedule, any balloon payments, and any other relevant financial terms. 3. Lease-to-Own Contracts: Under this type of financing, the buyer agrees to rent the property for a set period with the option to purchase it at the end. The seller's disclosure would include the terms of the lease, such as the rental amount, duration, rent credits (if any), and the purchase price and terms for the eventual transfer of ownership. 4. Rent-to-Own Contracts: Similar to lease-to-own contracts, rent-to-own agreements allow the buyer to rent the property with the option to purchase it in the future. However, in this case, a portion of the monthly rent typically goes towards the eventual purchase price. The seller's disclosure would outline the rental terms, the option price, the timeframe for exercising the option, and any additional terms related to the purchase. 5. Land Contract or Agreement for Deed: This type of financing involves the buyer making regular installment payments directly to the seller until the purchase price is fully paid. The seller retains legal title to the property until the buyer completes all the payments. The seller's disclosure would detail the purchase price, the installment payment schedule, any interest charges, and the consequences of default or early termination. In conclusion, the Miami-Dade Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a comprehensive document that outlines the financing terms associated with the sale of residential property. Its purpose is to ensure transparency and protect the interests of both parties involved in the transaction. The specific terms contained within the disclosure may vary depending on the type of financing arrangement agreed upon.