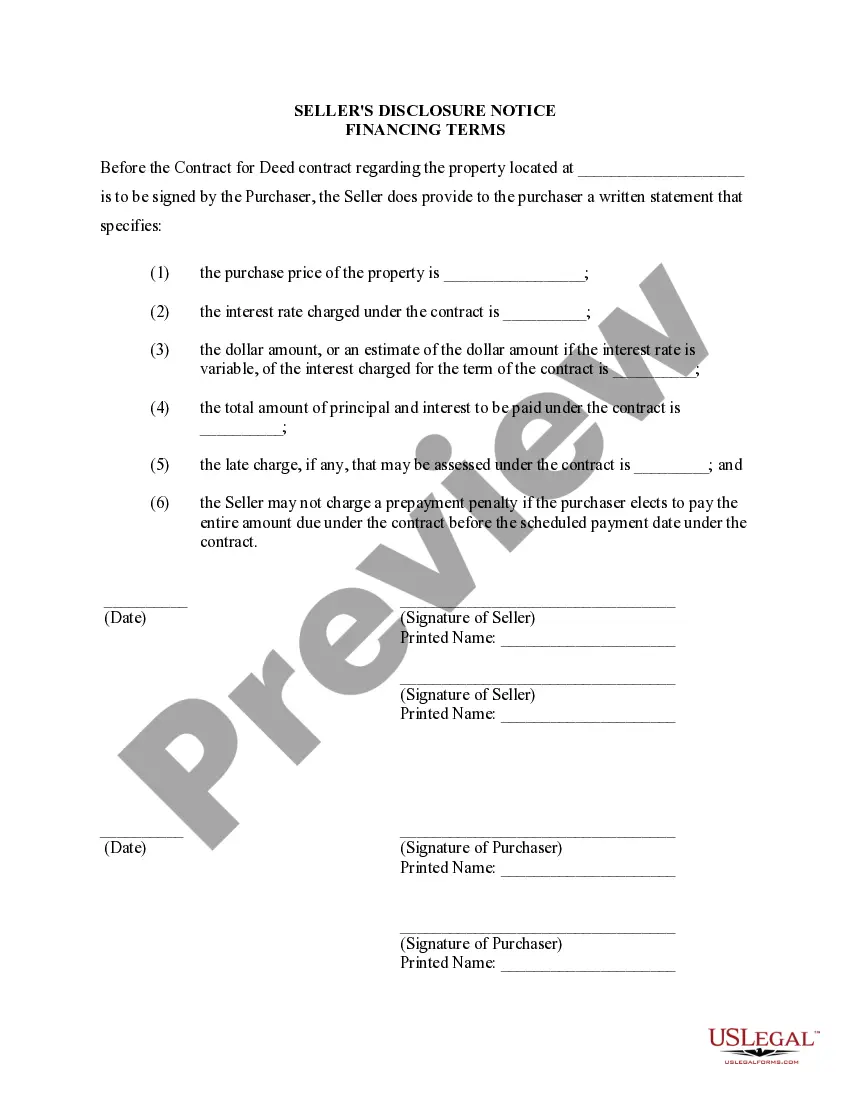

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Miramar Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Florida Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Utilize the US Legal Forms and gain instant access to any form template you desire.

Our beneficial website, featuring thousands of templates, streamlines the process of locating and acquiring nearly any document template you need.

You can download, complete, and validate the Miramar Florida Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed, also known as Land Contract, in just a few minutes instead of spending hours online searching for a suitable template.

Employing our collection is an excellent approach to enhance the security of your document submissions.

Initiate the saving process. Click Buy Now and select the payment plan that fits you best. Then, register for an account and complete your order using a credit card or PayPal.

Download the document. Select the format to acquire the Miramar Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also referred to as Land Contract, and edit, complete, or sign it for your requirements.

- Our skilled legal experts routinely review all documents to ensure that the templates are suitable for a specific state and adhere to current regulations and laws.

- To obtain the Miramar Florida Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed, known as Land Contract, if you already hold a subscription, simply Log In to your account.

- The Download button will show up on every document you view. Additionally, you can access all previously saved documents in the My documents section.

- If you don’t possess an account yet, follow the steps below.

- Access the page with the template you need. Ensure it is the correct template: confirm its name and description, and utilize the Preview option when available. Otherwise, use the Search bar to locate the suitable one.

Form popularity

FAQ

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Florida case law provides that, with some exceptions, a home seller must disclose any facts or conditions about the property that have a substantial impact on its value or desirability and that others cannot easily see for themselves. This originally came from the court case of Johnson v. Davis, 480 So.

Since an agreement for deed is an agreement that the seller makes to the buyer to transfer the property once a specified amount of money has been received, it is considered a mortgage under Florida Law.

?No contract, agreement, or other instrument purporting to contain an agreement to purchase or sell real estate shall be recorded in the public records of any county in the state, unless such contract, agreement or other instrument is acknowledged by the vendor in the manner provided by law for the acknowledgment of

A seller must disclose any facts or conditions they know about that materially affect the value of the property. This means that they have to tell a buyer about any issue that would reduce the value of the property or make the property less desirable. Problems with the title to the home or property.

In Florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the Property being sold which are not readily observable by a buyer.

Florida is a ?mortgage-only? state. Florida does not recognize deeds of trust in its state law.

Essentially, an Agreement for Deed is a purchase money mortgage from the seller to the buyer, allowing the buyer to take possession before the full purchase price is paid to the seller. The Florida Courts and Legislature view an Agreement for Deed as a mortgage, securing an obligation to pay.

Start Deed of Trust StateMortgage allowedDeed of trust allowedFloridaYGeorgiaYHawaiiYIdahoY47 more rows

Notice to Seller: Florida law1 requires a Seller of a home to disclose to the Buyer all known facts that materially affect the value of the property being sold and that are not readily observable or known by the Buyer. This disclosure form is designed to help you comply with the law.