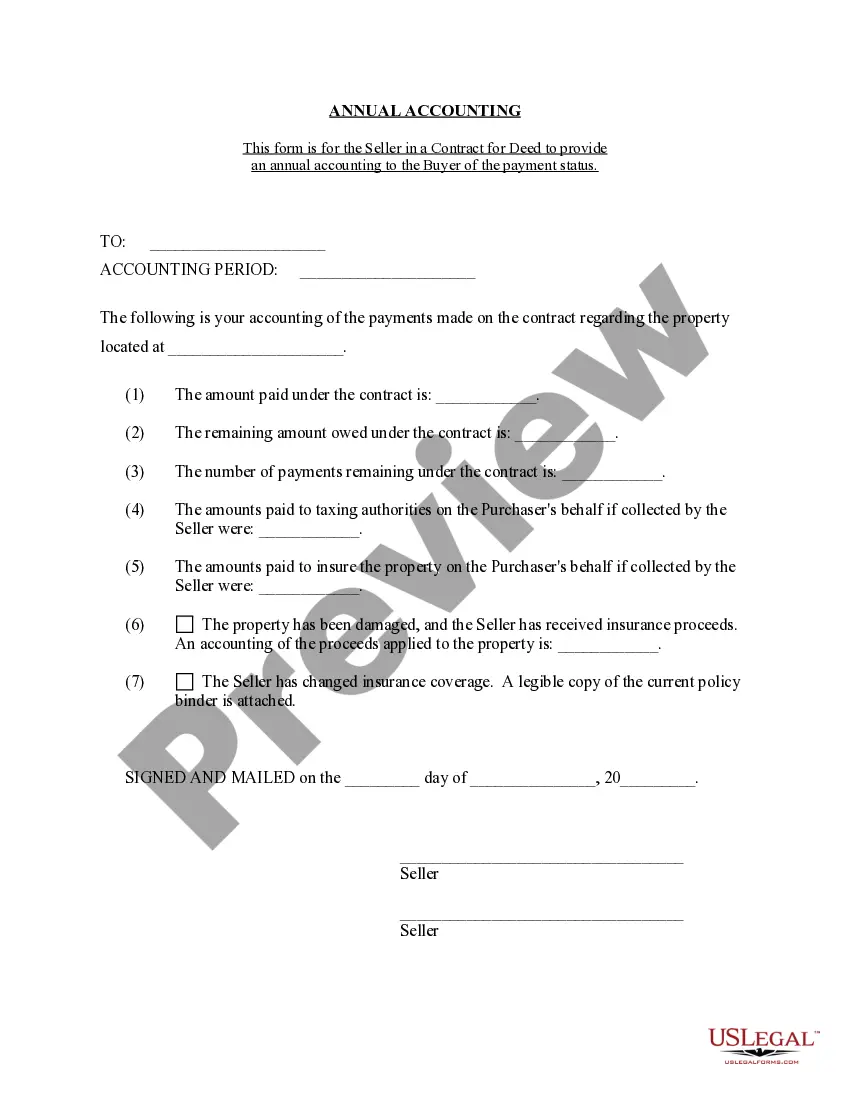

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

A Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and details of a seller's contract for deed arrangement in Fort Lauderdale, Florida. This statement serves as an important record for both the seller and buyer involved in the contract. Keywords: Fort Lauderdale, Florida, Contract for Deed, Seller's Annual Accounting Statement. A Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statement typically includes the following information: 1. Parties involved: This section provides the names and contact information of both the seller and the buyer involved in the contract for deed agreement. 2. Contract details: The statement should specify the terms and conditions outlined in the contract for deed, including the purchase price, down payment, interest rate, and any other pertinent details of the agreement. 3. Payment history: This section outlines the payment history of the buyer, including the dates, amounts, and method of payment. It highlights the principal amount, interest paid, and any additional fees or charges, if applicable. 4. Escrow account: If there is an escrow account established for property taxes, insurance, or any other specific purpose, the statement should detail the contributions made to the account as well as any disbursements made throughout the year. 5. Balance due: The seller's annual accounting statement should clearly indicate the remaining balance owed by the buyer. It should incorporate any principal payments made during the year and deduct them from the initial purchase price. 6. Additional charges and adjustments: This section may include any late fees, penalties, or charges for non-compliance with payment terms. It should also highlight any adjustments such as property tax assessments or insurance premium changes. 7. Dispute resolution: If there are any disputes or disagreements regarding the annual accounting statement, this section outlines the process to resolve them, such as mediation or arbitration. Different types of Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statements may exist based on variations in the contract terms or specific regulations. Some possible variations include: 1. Commercial Contract for Deed Seller's Annual Accounting Statement: This type of statement applies to commercial properties, outlining financial information related to a contract for deed agreement for non-residential real estate. 2. Residential Contract for Deed Seller's Annual Accounting Statement: This statement specifically relates to residential properties, including single-family homes, condos, townhouses, or multi-family units covered under a contract for deed. 3. Joint Seller's Annual Accounting Statement: In cases where more than one seller is involved in the contract for deed arrangement, a joint statement may be prepared, highlighting the collective financial information of all sellers. 4. Seller-Financed Contract for Deed Seller's Annual Accounting Statement: This statement is applicable when the seller is also providing financing for the buyer and details the payments received, interest accrued, and the balance remaining. In summary, a Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides an overview of payments, balances, and pertinent details related to a contract for deed agreement in Fort Lauderdale, Florida. This statement ensures transparency and helps both parties involved in the contract maintain a clear financial record.A Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and details of a seller's contract for deed arrangement in Fort Lauderdale, Florida. This statement serves as an important record for both the seller and buyer involved in the contract. Keywords: Fort Lauderdale, Florida, Contract for Deed, Seller's Annual Accounting Statement. A Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statement typically includes the following information: 1. Parties involved: This section provides the names and contact information of both the seller and the buyer involved in the contract for deed agreement. 2. Contract details: The statement should specify the terms and conditions outlined in the contract for deed, including the purchase price, down payment, interest rate, and any other pertinent details of the agreement. 3. Payment history: This section outlines the payment history of the buyer, including the dates, amounts, and method of payment. It highlights the principal amount, interest paid, and any additional fees or charges, if applicable. 4. Escrow account: If there is an escrow account established for property taxes, insurance, or any other specific purpose, the statement should detail the contributions made to the account as well as any disbursements made throughout the year. 5. Balance due: The seller's annual accounting statement should clearly indicate the remaining balance owed by the buyer. It should incorporate any principal payments made during the year and deduct them from the initial purchase price. 6. Additional charges and adjustments: This section may include any late fees, penalties, or charges for non-compliance with payment terms. It should also highlight any adjustments such as property tax assessments or insurance premium changes. 7. Dispute resolution: If there are any disputes or disagreements regarding the annual accounting statement, this section outlines the process to resolve them, such as mediation or arbitration. Different types of Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statements may exist based on variations in the contract terms or specific regulations. Some possible variations include: 1. Commercial Contract for Deed Seller's Annual Accounting Statement: This type of statement applies to commercial properties, outlining financial information related to a contract for deed agreement for non-residential real estate. 2. Residential Contract for Deed Seller's Annual Accounting Statement: This statement specifically relates to residential properties, including single-family homes, condos, townhouses, or multi-family units covered under a contract for deed. 3. Joint Seller's Annual Accounting Statement: In cases where more than one seller is involved in the contract for deed arrangement, a joint statement may be prepared, highlighting the collective financial information of all sellers. 4. Seller-Financed Contract for Deed Seller's Annual Accounting Statement: This statement is applicable when the seller is also providing financing for the buyer and details the payments received, interest accrued, and the balance remaining. In summary, a Fort Lauderdale Florida Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides an overview of payments, balances, and pertinent details related to a contract for deed agreement in Fort Lauderdale, Florida. This statement ensures transparency and helps both parties involved in the contract maintain a clear financial record.