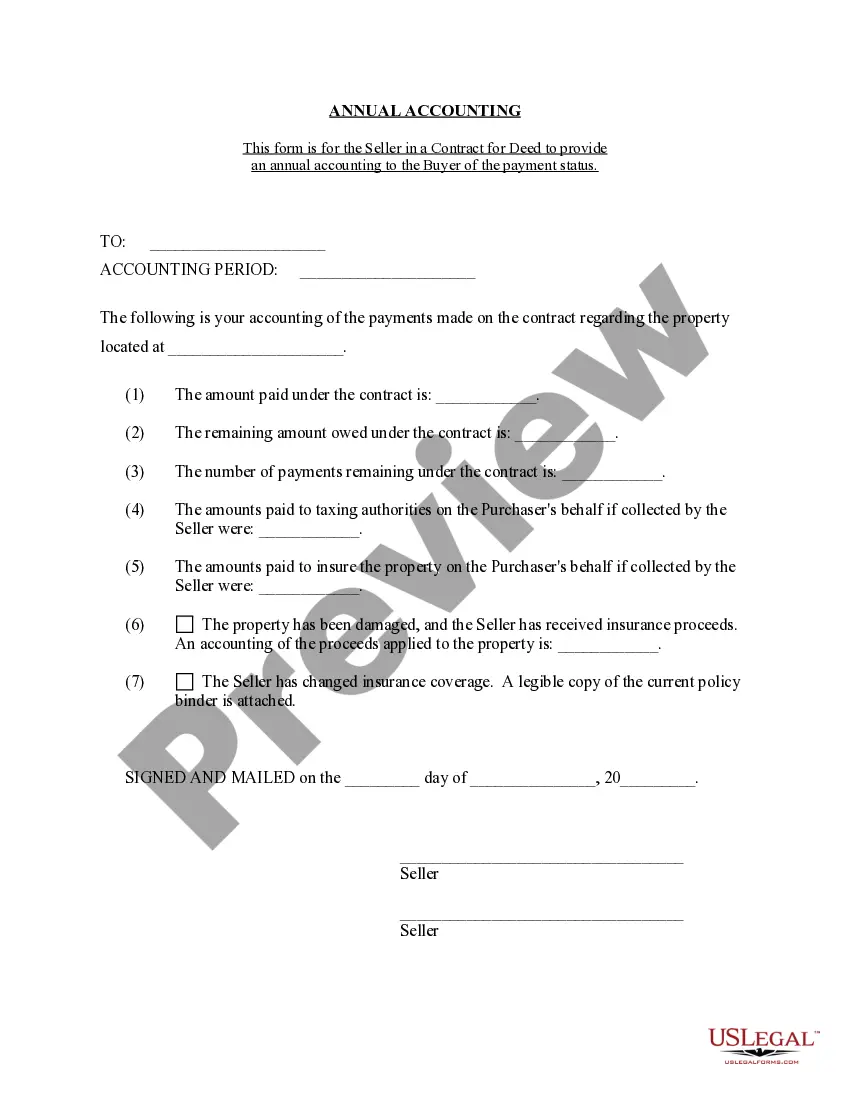

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Miramar Florida Contract for Deed Seller's Annual Accounting Statement is a financial document that provides a detailed summary of financial transactions between a seller and buyer involved in a contract for deed agreement in Miramar, Florida. This statement serves as an important tool in ensuring transparency, accountability, and accurate record-keeping throughout the contract for deed transaction. The Miramar Florida Contract for Deed Seller's Annual Accounting Statement includes various components to provide a comprehensive overview of the financial aspects, which may vary based on the specific terms of the agreement. Some key elements covered in this statement are: 1. Purchase Price: The statement includes the original purchase price agreed upon by the seller and the buyer, which is the total monetary consideration for the property involved in the contract. 2. Payment Schedule: It outlines the payment schedule for the buyer, including the frequency (monthly, quarterly, etc.) and the due dates for each installment. This helps keep track of when payments are expected throughout the year. 3. Principal and Interest Payments: The seller's annual accounting statement breaks down the principal and interest portion of each payment made by the buyer. This information helps calculate the outstanding balance and the reduction of the principal amount over time. 4. Escrow Account Details: If an escrow account was established as part of the contract for deed agreement, the statement will include a detailed breakdown of any funds held in escrow for insurance, taxes, or other purposes. 5. Additional Charges: Any additional charges, such as late fees or penalties, are mentioned in the statement. This ensures both parties are aware of any outstanding obligations or fees that need to be settled. 6. Taxes and Insurance: The seller's annual accounting statement highlights the payment of property taxes and homeowner's insurance if the seller agrees to handle these responsibilities on behalf of the buyer. This section helps understand the allocation and management of these expenses. 7. Repairs and Maintenance: In some cases, the seller may be responsible for repairs and maintenance expenses. The statement will outline these costs and any reimbursements made by the buyer. Miramar Florida Contract for Deed Seller's Annual Accounting Statement may have variations based on specific contractual agreements. For example, there could be statements that focus solely on the principal and interest payments, while others may include additional information such as late fees, repairs, or escrow account details. In conclusion, the Miramar Florida Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that ensures transparency and accurate reporting of financial transactions between a seller and buyer under a contract for deed agreement. It provides essential information regarding payment schedules, principal and interest payments, escrow account details, additional charges, taxes and insurance payments, and repairs and maintenance expenses, among others.