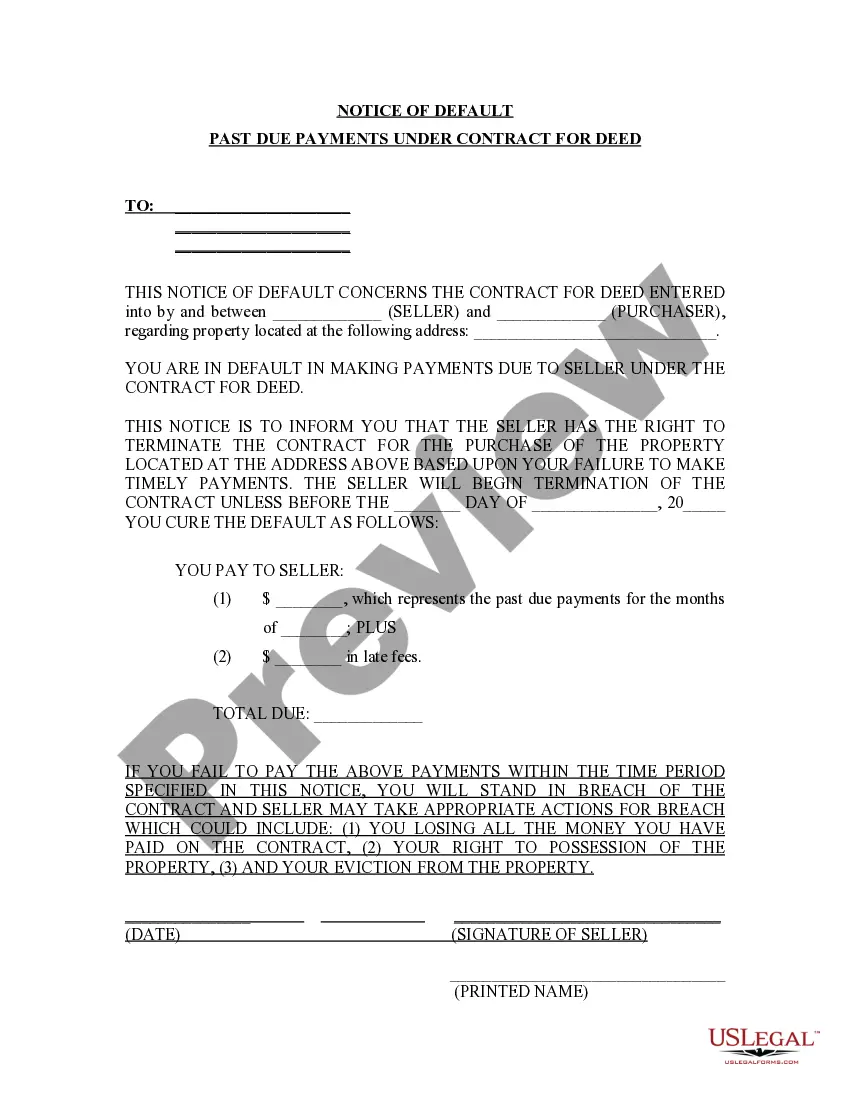

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Title: Understanding Lakeland Florida's Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Lakeland Florida, Notice of Default, Past Due Payments, Contract for Deed Introduction: The Lakeland Florida Notice of Default for Past Due Payments in connection with Contract for Deed refers to a legal document issued when a buyer fails to fulfill their payment obligations outlined in a Contract for Deed agreement. This notice serves as a formal notification to the buyer, providing them with an opportunity to rectify the payment arrears and avoid potential legal consequences. This article aims to provide a detailed description of the process and different types of Notice of Default associated with Contract for Deed transactions in Lakeland, Florida. 1. Standard Notice of Default: When a buyer under a Contract for Deed fails to make timely payments according to the agreed terms and conditions, the seller or their authorized representative issues a Standard Notice of Default. The notice specifies the overdue amount, payment due date, and provides a grace period for the buyer to settle the amount owed. This type of notice is generally sent as a preliminary step before considering further legal action. 2. Cure or Quit Notice: If the buyer fails to comply with the requirements of the Standard Notice of Default within the provided grace period, the seller issues a Cure or Quit Notice. This notice demands the buyer to either "cure" the overdue payment or "quit" the property. The buyer is usually given a specific timeframe, typically 15-30 days, to resolve the default or face the possibility of termination of the Contract for Deed. 3. Intent to Accelerate Notice: When the Cure or Quit Notice remains unresolved, the seller may decide to take more severe measures. The Intent to Accelerate Notice is issued, informing the buyer of the seller's intention to accelerate the entire remaining balance of the Contract for Deed. This notice often includes information about the total amount due, the foreclosure process, and the buyer's rights to contest the acceleration. 4. Li's Pendent Notice: If the buyer fails to comply with the Intent to Accelerate Notice, the seller may officially initiate a foreclosure action. As part of this process, the seller files a Li's Pendent Notice with the county clerk's office, providing public notice of the pending foreclosure lawsuit. This notice indicates that the property title may be potentially affected, making it challenging for the buyer to sell or refinance the property until the foreclosure matter is resolved. Conclusion: Understanding the different types of Lakeland Florida Notice of Default for Past Due Payments in connection with Contract for Deed is crucial for both buyers and sellers involved in such transactions. It is essential for buyers to be aware of their payment obligations and take timely action to prevent default, while sellers must follow the necessary legal steps to enforce the terms of the Contract for Deed. Acting promptly and seeking legal advice when faced with default notices can help mitigate the potential consequences associated with breach of payment obligations.Title: Understanding Lakeland Florida's Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Lakeland Florida, Notice of Default, Past Due Payments, Contract for Deed Introduction: The Lakeland Florida Notice of Default for Past Due Payments in connection with Contract for Deed refers to a legal document issued when a buyer fails to fulfill their payment obligations outlined in a Contract for Deed agreement. This notice serves as a formal notification to the buyer, providing them with an opportunity to rectify the payment arrears and avoid potential legal consequences. This article aims to provide a detailed description of the process and different types of Notice of Default associated with Contract for Deed transactions in Lakeland, Florida. 1. Standard Notice of Default: When a buyer under a Contract for Deed fails to make timely payments according to the agreed terms and conditions, the seller or their authorized representative issues a Standard Notice of Default. The notice specifies the overdue amount, payment due date, and provides a grace period for the buyer to settle the amount owed. This type of notice is generally sent as a preliminary step before considering further legal action. 2. Cure or Quit Notice: If the buyer fails to comply with the requirements of the Standard Notice of Default within the provided grace period, the seller issues a Cure or Quit Notice. This notice demands the buyer to either "cure" the overdue payment or "quit" the property. The buyer is usually given a specific timeframe, typically 15-30 days, to resolve the default or face the possibility of termination of the Contract for Deed. 3. Intent to Accelerate Notice: When the Cure or Quit Notice remains unresolved, the seller may decide to take more severe measures. The Intent to Accelerate Notice is issued, informing the buyer of the seller's intention to accelerate the entire remaining balance of the Contract for Deed. This notice often includes information about the total amount due, the foreclosure process, and the buyer's rights to contest the acceleration. 4. Li's Pendent Notice: If the buyer fails to comply with the Intent to Accelerate Notice, the seller may officially initiate a foreclosure action. As part of this process, the seller files a Li's Pendent Notice with the county clerk's office, providing public notice of the pending foreclosure lawsuit. This notice indicates that the property title may be potentially affected, making it challenging for the buyer to sell or refinance the property until the foreclosure matter is resolved. Conclusion: Understanding the different types of Lakeland Florida Notice of Default for Past Due Payments in connection with Contract for Deed is crucial for both buyers and sellers involved in such transactions. It is essential for buyers to be aware of their payment obligations and take timely action to prevent default, while sellers must follow the necessary legal steps to enforce the terms of the Contract for Deed. Acting promptly and seeking legal advice when faced with default notices can help mitigate the potential consequences associated with breach of payment obligations.