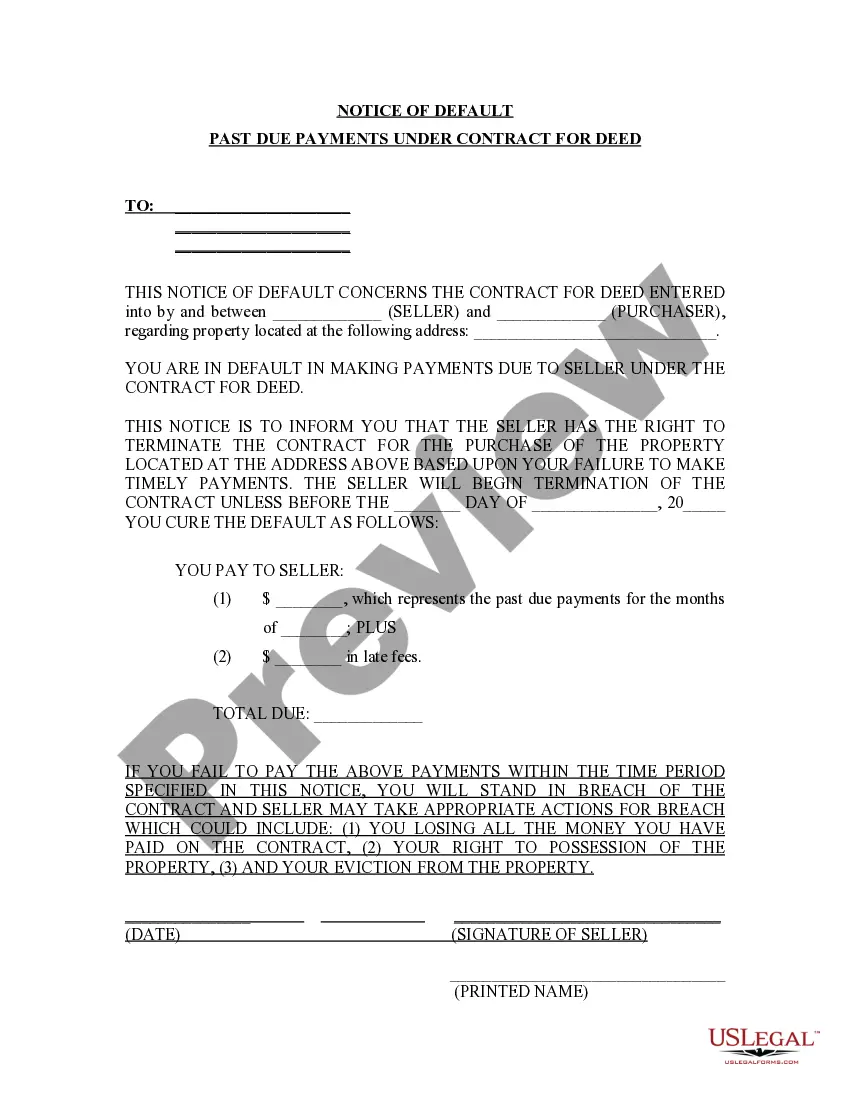

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed provides an official notification to a borrower that they have failed to make their payments as agreed upon in a Contract for Deed. This legal document outlines the specific terms of the contract that have been violated and serves as a warning to the borrower that legal action may be taken if the past due payments are not resolved promptly. Keywords: Miramar Florida, Notice of Default, Past Due Payments, Contract for Deed, legal document, borrower, terms, violated, warning, legal action, resolved promptly. There are different types of Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed, depending on the severity and stage of the delinquency. Here are a few examples: 1. Preliminary Notice of Default: This is the first formal notice sent to the borrower when they default on their payment obligations in connection with a Contract for Deed. It serves as a warning and provides an opportunity for the borrower to rectify the situation before further actions are taken. 2. Notice of Default: This notice is sent when the borrower has failed to bring their payments up to date despite receiving the preliminary notice. It typically includes a specific deadline by which the outstanding payments must be made, along with the consequences of non-compliance. 3. Notice of Intent to Accelerate: If the borrower fails to cure the default mentioned in the Notice of Default within the specified timeframe, the lender may issue a Notice of Intent to Accelerate. This notice notifies the borrower that the entire loan balance becomes due immediately if the past due payments are not resolved within a certain period. 4. Notice of Sale: If the borrower still fails to cure the default after receiving the Notice of Intent to Accelerate, the lender may proceed with foreclosure proceedings. The Notice of Sale is typically issued to inform the borrower of the date and time of the foreclosure sale, giving them one last chance to pay off the debt or seek alternatives such as short sale or loan modification. It is important to note that the specific content and terms of each notice may vary depending on the contractual agreement and applicable laws in Miramar, Florida.Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed provides an official notification to a borrower that they have failed to make their payments as agreed upon in a Contract for Deed. This legal document outlines the specific terms of the contract that have been violated and serves as a warning to the borrower that legal action may be taken if the past due payments are not resolved promptly. Keywords: Miramar Florida, Notice of Default, Past Due Payments, Contract for Deed, legal document, borrower, terms, violated, warning, legal action, resolved promptly. There are different types of Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed, depending on the severity and stage of the delinquency. Here are a few examples: 1. Preliminary Notice of Default: This is the first formal notice sent to the borrower when they default on their payment obligations in connection with a Contract for Deed. It serves as a warning and provides an opportunity for the borrower to rectify the situation before further actions are taken. 2. Notice of Default: This notice is sent when the borrower has failed to bring their payments up to date despite receiving the preliminary notice. It typically includes a specific deadline by which the outstanding payments must be made, along with the consequences of non-compliance. 3. Notice of Intent to Accelerate: If the borrower fails to cure the default mentioned in the Notice of Default within the specified timeframe, the lender may issue a Notice of Intent to Accelerate. This notice notifies the borrower that the entire loan balance becomes due immediately if the past due payments are not resolved within a certain period. 4. Notice of Sale: If the borrower still fails to cure the default after receiving the Notice of Intent to Accelerate, the lender may proceed with foreclosure proceedings. The Notice of Sale is typically issued to inform the borrower of the date and time of the foreclosure sale, giving them one last chance to pay off the debt or seek alternatives such as short sale or loan modification. It is important to note that the specific content and terms of each notice may vary depending on the contractual agreement and applicable laws in Miramar, Florida.