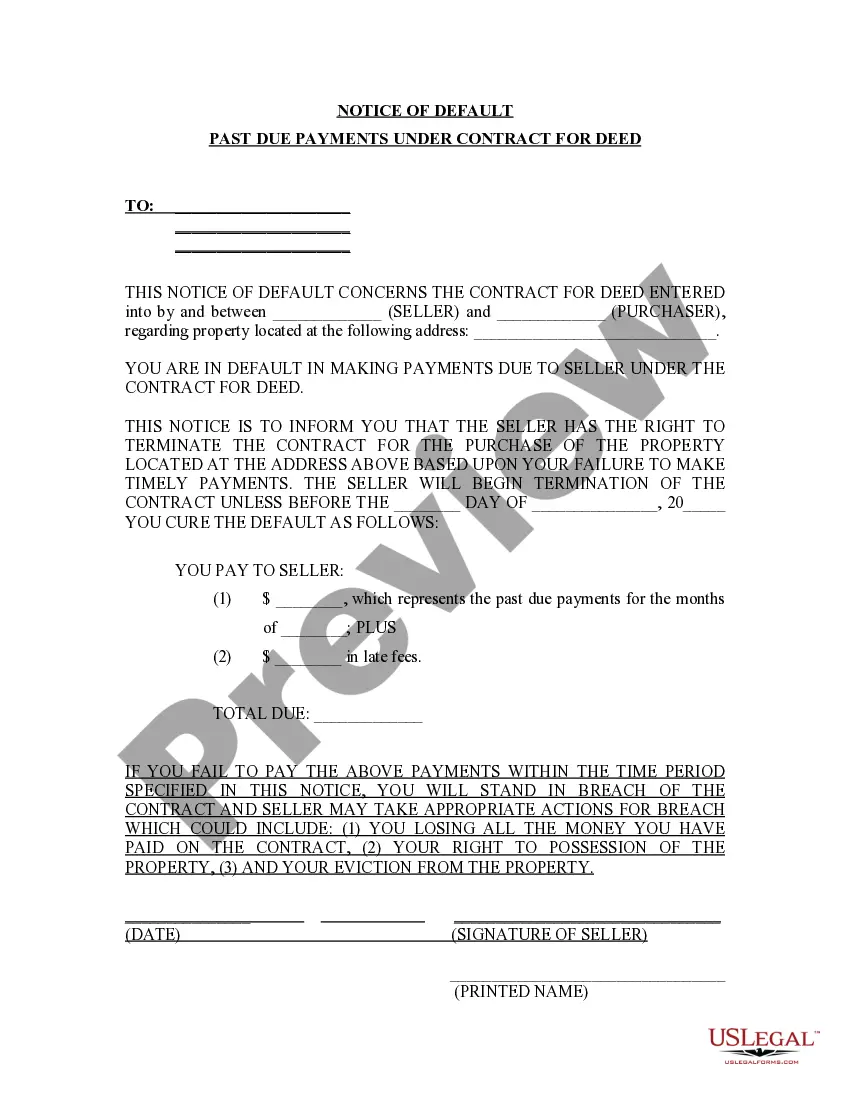

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

A Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that serves as a formal notice to a borrower who has failed to make the required payments under a Contract for Deed agreement. This notice signals the beginning of the foreclosure process and notifies the borrower of their default status. Keywords: Palm Beach Florida, Notice of Default, Past Due Payments, Contract for Deed, foreclosure process, borrower There are various types of Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed based on the specific circumstances of the default and the requirements of the lender. Some common types include: 1. Initial Notice of Default: This type of notice is typically sent to the borrower when they miss their first payment or fail to make a payment within the grace period specified in the Contract for Deed. It serves as a wake-up call to the borrower, reminding them of their obligations. 2. Cure or Quit Notice: If the borrower does not address the default within a specified period after receiving the initial notice, a cure or quit notice is sent. This notice demands that the borrower either pay the past due amounts or face termination of the Contract for Deed. 3. Intent to Accelerate Notice: If the borrower continues to default on payments even after receiving the cure or quit notice, the lender may send an intent to accelerate notice. This notice declares the lender's intention to accelerate the remaining balance of the contract and demand the full payment within a specified timeframe. 4. Final Notice of Default: If the borrower fails to cure the default or pay the full amount within the specified timeframe, the lender will issue a final notice of default. This notice formally initiates the foreclosure process and provides the borrower with a final opportunity to resolve the default before legal action is taken. 5. Foreclosure Sale Notice: Following the final notice of default, if the borrower fails to rectify the default, the lender may proceed with a foreclosure sale. In Palm Beach County, Florida, a foreclosure sale notice is typically published in a local newspaper and posted on the property. This notice informs the borrower and potential buyers of the upcoming sale of the property. It is essential for borrowers to understand their rights and obligations under a Contract for Deed to avoid default and the potential foreclosure process. Seeking legal advice or negotiating with the lender may provide options to resolve the default and reinstate the contract, thereby preventing the loss of the property.A Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that serves as a formal notice to a borrower who has failed to make the required payments under a Contract for Deed agreement. This notice signals the beginning of the foreclosure process and notifies the borrower of their default status. Keywords: Palm Beach Florida, Notice of Default, Past Due Payments, Contract for Deed, foreclosure process, borrower There are various types of Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed based on the specific circumstances of the default and the requirements of the lender. Some common types include: 1. Initial Notice of Default: This type of notice is typically sent to the borrower when they miss their first payment or fail to make a payment within the grace period specified in the Contract for Deed. It serves as a wake-up call to the borrower, reminding them of their obligations. 2. Cure or Quit Notice: If the borrower does not address the default within a specified period after receiving the initial notice, a cure or quit notice is sent. This notice demands that the borrower either pay the past due amounts or face termination of the Contract for Deed. 3. Intent to Accelerate Notice: If the borrower continues to default on payments even after receiving the cure or quit notice, the lender may send an intent to accelerate notice. This notice declares the lender's intention to accelerate the remaining balance of the contract and demand the full payment within a specified timeframe. 4. Final Notice of Default: If the borrower fails to cure the default or pay the full amount within the specified timeframe, the lender will issue a final notice of default. This notice formally initiates the foreclosure process and provides the borrower with a final opportunity to resolve the default before legal action is taken. 5. Foreclosure Sale Notice: Following the final notice of default, if the borrower fails to rectify the default, the lender may proceed with a foreclosure sale. In Palm Beach County, Florida, a foreclosure sale notice is typically published in a local newspaper and posted on the property. This notice informs the borrower and potential buyers of the upcoming sale of the property. It is essential for borrowers to understand their rights and obligations under a Contract for Deed to avoid default and the potential foreclosure process. Seeking legal advice or negotiating with the lender may provide options to resolve the default and reinstate the contract, thereby preventing the loss of the property.