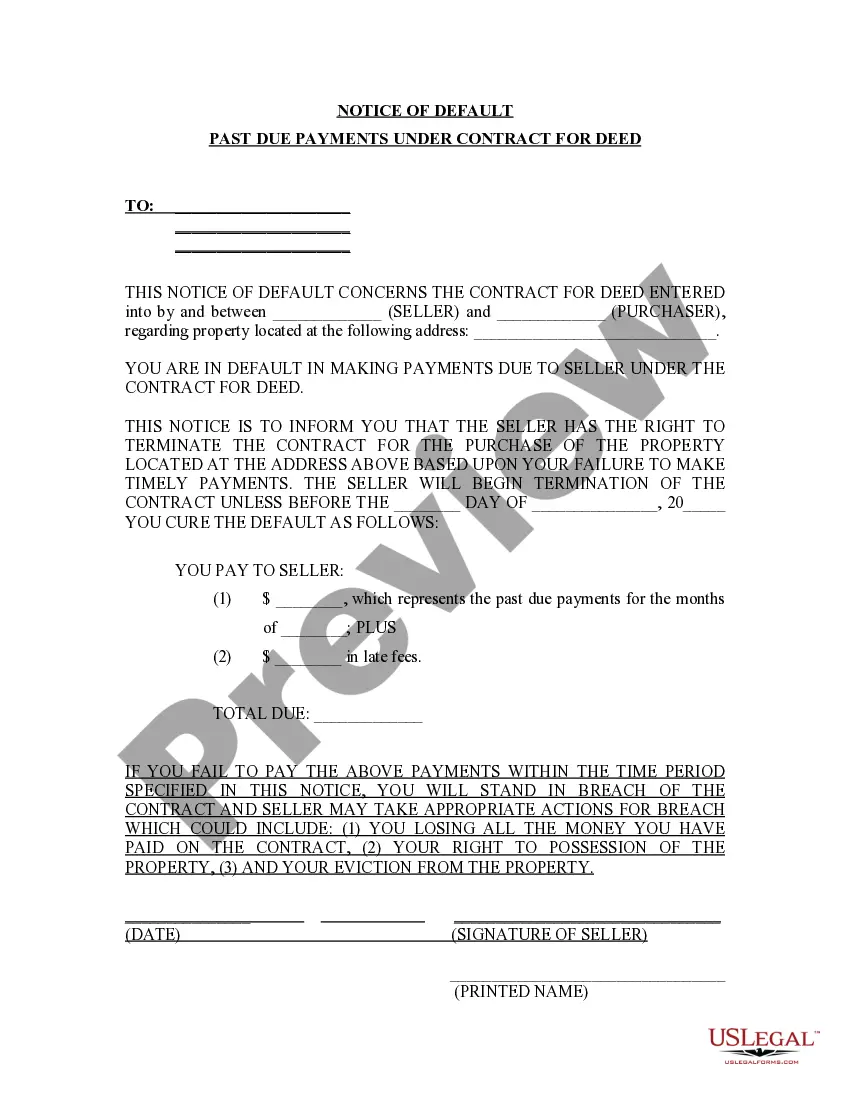

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

A West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is an official document that notifies the party involved in a Contract for Deed agreement that they have failed to make timely payments as stipulated in the contract. This notice is often issued by the seller or the lender and serves as a formal warning that immediate action needs to be taken to rectify the payment default. Keywords: West Palm Beach, Florida, Notice of Default, Past Due Payments, Contract for Deed. There can be different types of West Palm Beach Florida Notices of Default for Past Due Payments in connection with Contract for Deed, based on the specific circumstances of the default. Here are a few common types: 1. Initial Notice of Default: This is the first notice sent to the party who has defaulted on the Contract for Deed. It highlights the missed payments and provides a grace period during which the defaulting party is given a chance to catch up on their payments. 2. Second Notice of Default: If the defaulting party fails to rectify the payment default within the grace period provided in the initial notice, a second notice may be issued. This notice emphasizes the seriousness of the situation and may include additional penalties or legal consequences if the default continues. 3. Notice of Intent to Accelerate: If the default remains unresolved, the seller or lender may send a notice of intent to accelerate the outstanding balance of the Contract for Deed. This notice notifies the defaulting party that the entire balance is due immediately, rather than spreading out the payments over the agreed-upon period. 4. Notice of Foreclosure: In extreme cases of non-payment or prolonged default, a notice of foreclosure may be issued. This notice informs the defaulting party that legal action will be taken to reclaim the property, potentially resulting in eviction and loss of ownership rights. It is crucial for both parties involved in a Contract for Deed to understand the implications of a West Palm Beach Florida Notice of Default for Past Due Payments. It is recommended to seek legal advice and explore alternatives to resolve the default, such as payment plans, loan modifications, or negotiating a new agreement. Failure to address the notice promptly and adequately can lead to significant financial and legal consequences.A West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is an official document that notifies the party involved in a Contract for Deed agreement that they have failed to make timely payments as stipulated in the contract. This notice is often issued by the seller or the lender and serves as a formal warning that immediate action needs to be taken to rectify the payment default. Keywords: West Palm Beach, Florida, Notice of Default, Past Due Payments, Contract for Deed. There can be different types of West Palm Beach Florida Notices of Default for Past Due Payments in connection with Contract for Deed, based on the specific circumstances of the default. Here are a few common types: 1. Initial Notice of Default: This is the first notice sent to the party who has defaulted on the Contract for Deed. It highlights the missed payments and provides a grace period during which the defaulting party is given a chance to catch up on their payments. 2. Second Notice of Default: If the defaulting party fails to rectify the payment default within the grace period provided in the initial notice, a second notice may be issued. This notice emphasizes the seriousness of the situation and may include additional penalties or legal consequences if the default continues. 3. Notice of Intent to Accelerate: If the default remains unresolved, the seller or lender may send a notice of intent to accelerate the outstanding balance of the Contract for Deed. This notice notifies the defaulting party that the entire balance is due immediately, rather than spreading out the payments over the agreed-upon period. 4. Notice of Foreclosure: In extreme cases of non-payment or prolonged default, a notice of foreclosure may be issued. This notice informs the defaulting party that legal action will be taken to reclaim the property, potentially resulting in eviction and loss of ownership rights. It is crucial for both parties involved in a Contract for Deed to understand the implications of a West Palm Beach Florida Notice of Default for Past Due Payments. It is recommended to seek legal advice and explore alternatives to resolve the default, such as payment plans, loan modifications, or negotiating a new agreement. Failure to address the notice promptly and adequately can lead to significant financial and legal consequences.