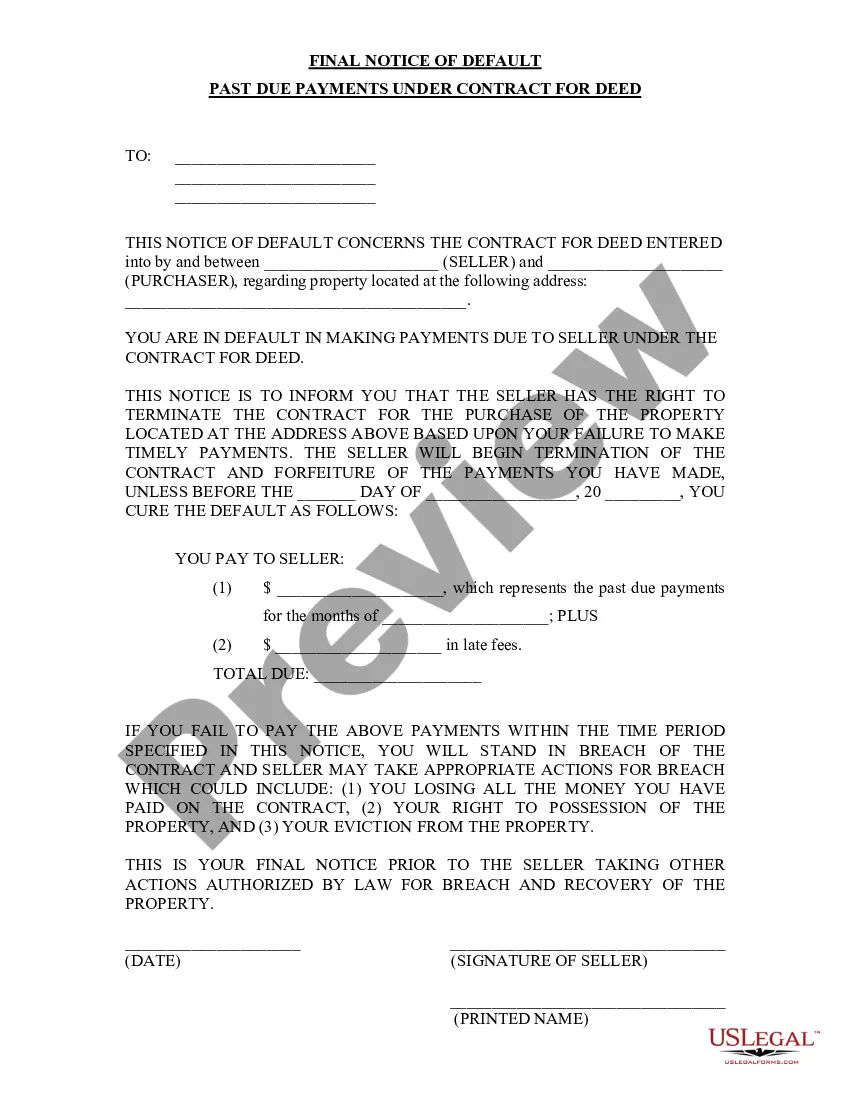

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

A Broward Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that is issued by the creditor to the debtor when the debtor fails to make timely payments in accordance with the terms of the Contract for Deed. This notice serves as a formal warning indicating that the debtor is in default and that further action may be taken if the overdue payments are not resolved promptly. In Broward County, Florida, there may be different types of Broward Florida Final Notices of Default for Past Due Payments, including: 1. Broward Florida Final Notice of Default for Past Due Mortgage Payments: This type of notice specifically relates to default in mortgage payments connected to a Contract for Deed. It is typically issued by the mortgage lender or financing institution. 2. Broward Florida Final Notice of Default for Past Due Land Contract Payments: This notice is specific to default in payments related to land contract agreements. It is usually issued by the land contract seller. 3. Broward Florida Final Notice of Default for Past Due Vendor Financing Payments: In cases where a vendor extends financing to the buyer through a Contract for Deed, this notice addresses the default in payments owed to the vendor or seller. 4. Broward Florida Final Notice of Default for Past Due Purchase Money Deed of Trust Payments: This type of notice applies when the buyer defaults on payments associated with a purchase money deed of trust, which is a type of financing arrangement commonly used in real estate transactions. When a Broward Florida Final Notice of Default for Past Due Payments is issued, it is important for the debtor to respond promptly. Failure to do so may result in further legal action, such as foreclosure or repossession, depending on the terms stated in the Contract for Deed. To avoid such consequences, it is advisable for the debtor to reach out to the creditor or their representatives immediately to discuss potential resolutions, propose a repayment plan, or negotiate alternatives to foreclosure, such as a loan modification or refinancing. Seeking professional legal or financial advice is also recommended to fully understand one's rights and options in dealing with the default situation.A Broward Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that is issued by the creditor to the debtor when the debtor fails to make timely payments in accordance with the terms of the Contract for Deed. This notice serves as a formal warning indicating that the debtor is in default and that further action may be taken if the overdue payments are not resolved promptly. In Broward County, Florida, there may be different types of Broward Florida Final Notices of Default for Past Due Payments, including: 1. Broward Florida Final Notice of Default for Past Due Mortgage Payments: This type of notice specifically relates to default in mortgage payments connected to a Contract for Deed. It is typically issued by the mortgage lender or financing institution. 2. Broward Florida Final Notice of Default for Past Due Land Contract Payments: This notice is specific to default in payments related to land contract agreements. It is usually issued by the land contract seller. 3. Broward Florida Final Notice of Default for Past Due Vendor Financing Payments: In cases where a vendor extends financing to the buyer through a Contract for Deed, this notice addresses the default in payments owed to the vendor or seller. 4. Broward Florida Final Notice of Default for Past Due Purchase Money Deed of Trust Payments: This type of notice applies when the buyer defaults on payments associated with a purchase money deed of trust, which is a type of financing arrangement commonly used in real estate transactions. When a Broward Florida Final Notice of Default for Past Due Payments is issued, it is important for the debtor to respond promptly. Failure to do so may result in further legal action, such as foreclosure or repossession, depending on the terms stated in the Contract for Deed. To avoid such consequences, it is advisable for the debtor to reach out to the creditor or their representatives immediately to discuss potential resolutions, propose a repayment plan, or negotiate alternatives to foreclosure, such as a loan modification or refinancing. Seeking professional legal or financial advice is also recommended to fully understand one's rights and options in dealing with the default situation.