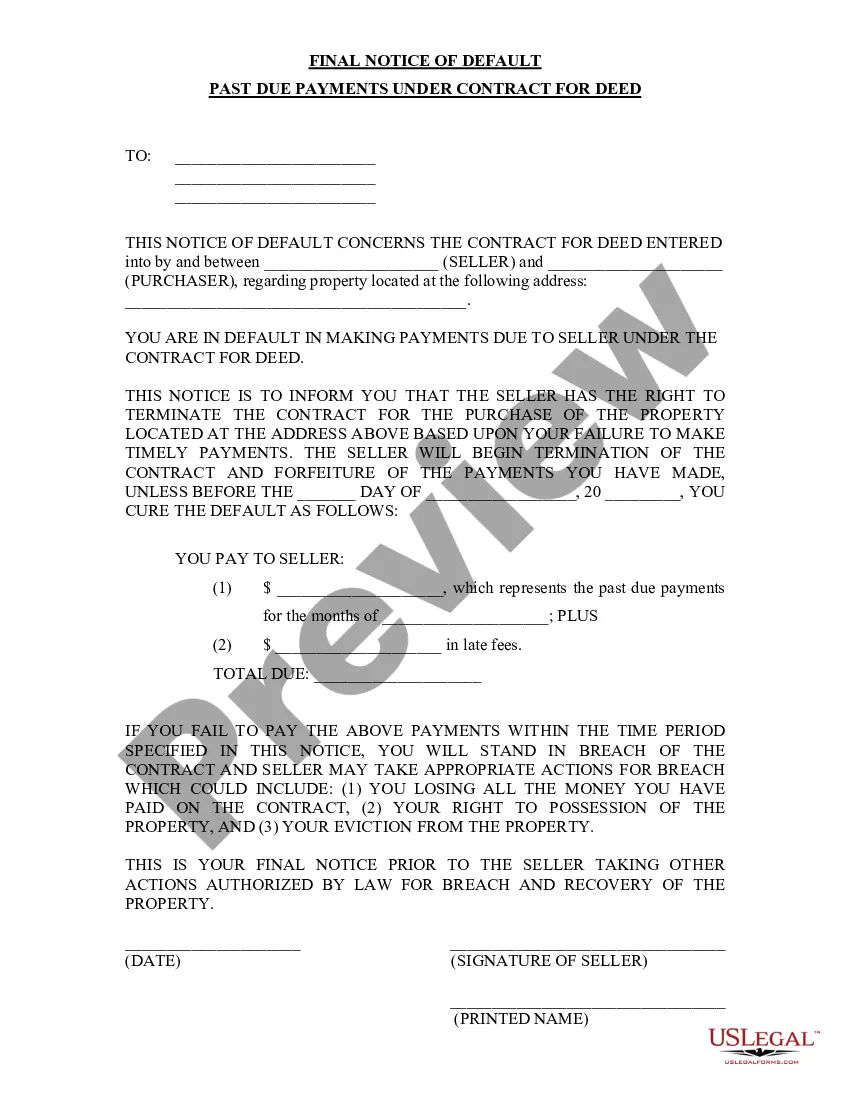

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Coral Springs Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Coral Springs, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an essential legal document that addresses overdue payments between a seller and a buyer. It establishes the consequences of non-payment and informs the buyer of the potential legal actions that may be taken by the seller. This article aims to provide a detailed description of the Final Notice of Default, including its purpose, legal implications, and potential consequences for non-compliance. 1. What is a Final Notice of Default for Past Due Payments? A Final Notice of Default serves as a formal communication from the seller to the buyer, indicating that the buyer has failed to make agreed-upon payments in connection with a Contract for Deed in Coral Springs, Florida. It serves as a warning that the buyer is in default and outlines the seller's intention to initiate further legal action if the missed payments are not rectified within a specified timeframe. 2. Purpose of the Final Notice of Default: The primary purpose of a Final Notice of Default is to notify the buyer about their non-compliance with payment terms mentioned in the Contract for Deed. It underscores the seriousness of the issue and prompts immediate action to bring payments up to date. Additionally, the notice aims to protect the seller's rights and provides an opportunity for the buyer to rectify the situation before more severe consequences occur. 3. Types of Coral Springs Florida Final Notice of Default for Past Due Payments: While there may not be specific variations of Final Notices of Default for Past Due Payments in Coral Springs, Florida, the language and content of the notice may vary depending on the terms specified in the Contract for Deed. Each contract may have unique clauses concerning notice periods, grace periods, penalties, and remedies available to the seller. Therefore, it is crucial to review the specific terms outlined in the Contract for Deed to understand the precise details of the notice. 4. Consequences for Non-Compliance: When a buyer receives a Final Notice of Default, it is critical to address the situation promptly to avoid escalating legal actions. The consequences for non-compliance may vary based on the terms of the Contract for Deed. They can include: 4.1 Legal Action: The seller may choose to initiate legal proceedings against the buyer to enforce payment or potentially facilitate the property's foreclosure. 4.2 Termination of Contract: Non-compliance with payment obligations specified in the Contract for Deed can result in contract termination, potentially leading to the buyer's eviction from the property. 4.3 Damage to Credit Score: Failure to resolve the outstanding payments may result in negative reporting to credit bureaus, which can harm the buyer's credit score and affect future borrowing capabilities. Conclusion: If you find yourself on the receiving end of a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Coral Springs, Florida, it is vital to address the issue promptly. Consult legal counsel, thoroughly review the terms of the Contract for Deed, and work towards resolving the outstanding payments to avoid further legal repercussions.Title: Understanding Coral Springs Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Coral Springs, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an essential legal document that addresses overdue payments between a seller and a buyer. It establishes the consequences of non-payment and informs the buyer of the potential legal actions that may be taken by the seller. This article aims to provide a detailed description of the Final Notice of Default, including its purpose, legal implications, and potential consequences for non-compliance. 1. What is a Final Notice of Default for Past Due Payments? A Final Notice of Default serves as a formal communication from the seller to the buyer, indicating that the buyer has failed to make agreed-upon payments in connection with a Contract for Deed in Coral Springs, Florida. It serves as a warning that the buyer is in default and outlines the seller's intention to initiate further legal action if the missed payments are not rectified within a specified timeframe. 2. Purpose of the Final Notice of Default: The primary purpose of a Final Notice of Default is to notify the buyer about their non-compliance with payment terms mentioned in the Contract for Deed. It underscores the seriousness of the issue and prompts immediate action to bring payments up to date. Additionally, the notice aims to protect the seller's rights and provides an opportunity for the buyer to rectify the situation before more severe consequences occur. 3. Types of Coral Springs Florida Final Notice of Default for Past Due Payments: While there may not be specific variations of Final Notices of Default for Past Due Payments in Coral Springs, Florida, the language and content of the notice may vary depending on the terms specified in the Contract for Deed. Each contract may have unique clauses concerning notice periods, grace periods, penalties, and remedies available to the seller. Therefore, it is crucial to review the specific terms outlined in the Contract for Deed to understand the precise details of the notice. 4. Consequences for Non-Compliance: When a buyer receives a Final Notice of Default, it is critical to address the situation promptly to avoid escalating legal actions. The consequences for non-compliance may vary based on the terms of the Contract for Deed. They can include: 4.1 Legal Action: The seller may choose to initiate legal proceedings against the buyer to enforce payment or potentially facilitate the property's foreclosure. 4.2 Termination of Contract: Non-compliance with payment obligations specified in the Contract for Deed can result in contract termination, potentially leading to the buyer's eviction from the property. 4.3 Damage to Credit Score: Failure to resolve the outstanding payments may result in negative reporting to credit bureaus, which can harm the buyer's credit score and affect future borrowing capabilities. Conclusion: If you find yourself on the receiving end of a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Coral Springs, Florida, it is vital to address the issue promptly. Consult legal counsel, thoroughly review the terms of the Contract for Deed, and work towards resolving the outstanding payments to avoid further legal repercussions.