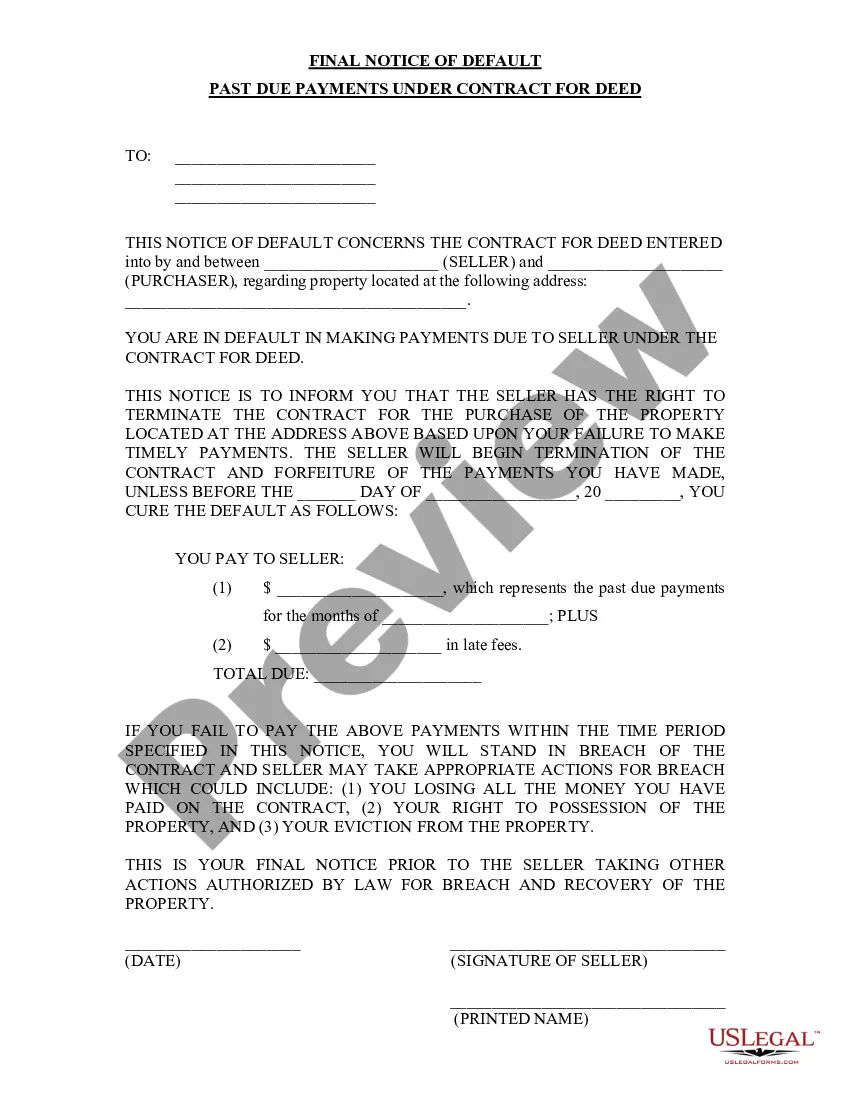

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding the Fort Lauderdale, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: When engaging in a real estate transaction through a Contract for Deed in Fort Lauderdale, Florida, both parties must adhere to the agreed-upon terms, including timely and complete payment of the purchase price. Failing to meet these obligations may result in a Final Notice of Default for Past Due Payments being issued. This article aims to provide a detailed description of this notice, its implications, and the potential consequences for individuals involved in such a situation in Fort Lauderdale, Florida. Keywords: Fort Lauderdale, Florida; Final Notice of Default; Past Due Payments; Contract for Deed; real estate transaction Types of Fort Lauderdale Final Notices of Default for Past Due Payments in Connection with Contract for Deed: 1. Fort Lauderdale Florida Final Notice of Default for Past Due Payments: This notice is issued when a buyer fails to make the agreed-upon payments under a Contract for Deed, causing them to fall behind in their financial obligations. The notice is typically sent by the seller or their representative to inform the buyer of their non-compliance and the consequences that may follow if the outstanding payments are not made promptly. 2. Fort Lauderdale Florida Notice of Default Cure Period: A Notice of Default Cure Period may follow the initial Final Notice of Default for Past Due Payments. It provides the delinquent buyer with a specified timeframe within which they can remedy the payment default, bringing their obligations up to date. This period allows the buyer an opportunity to rectify the default and prevent further legal action. 3. Fort Lauderdale Florida Notice of Intent to Foreclose: If the buyer fails to cure the default and bring their payments up to date within the given timeframe, a Notice of Intent to Foreclose may be issued. This notice formally informs the buyer that the seller intends to pursue foreclosure on the property, potentially leading to the loss of their ownership rights and eviction from the premises. Description of the Fort Lauderdale Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed: The Final Notice of Default for Past Due Payments is a crucial document in the Contract for Deed process when a buyer fails to meet their payment obligations. It is a written communication from the seller to the delinquent buyer, indicating that they have not fulfilled their financial responsibilities as outlined in the contract. This notice serves as a necessary step before further legal actions are taken and is typically sent by certified mail or personal delivery. The notice typically includes: 1. Title and Contact Details: The notice should clearly state "Final Notice of Default for Past Due Payments" and include the seller or their representative's contact information for any inquiries or discussions regarding the default. 2. Date of Delinquency: The notice will specify the date or period when the buyer became delinquent in their payments. This helps establish the basis for the default and gives the buyer an understanding of the duration of their non-compliance. 3. Outstanding Amount: The notice will specify the total amount due, including any interest, late fees, or penalties that have accrued due to the delinquency. A breakdown of the outstanding balance should be provided, including the principal amount and any additional charges that may have been incurred. 4. Cure Period: The notice may grant the buyer a specified period within which they must cure the default by making the overdue payments in full. The duration varies and depends on the specific terms outlined in the Contract for Deed, but it is typically 30 days. 5. Consequences of Non-Compliance: The notice should clearly state the consequences of failing to cure the default within the given timeframe. This may include further legal action, the potential loss of ownership rights, and the initiation of the foreclosure process. Conclusion: Receiving a Fort Lauderdale, Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a serious matter. It signifies that a buyer has fallen behind in their financial obligations, prompting potential legal actions and the risk of losing the property. Therefore, it is crucial for buyers to promptly address the default by either making the overdue payments or seeking alternative solutions that protect their interests while resolving the delinquency issue. Seeking legal advice and consulting the Contract for Deed terms are recommended courses of action in such circumstances.Title: Understanding the Fort Lauderdale, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: When engaging in a real estate transaction through a Contract for Deed in Fort Lauderdale, Florida, both parties must adhere to the agreed-upon terms, including timely and complete payment of the purchase price. Failing to meet these obligations may result in a Final Notice of Default for Past Due Payments being issued. This article aims to provide a detailed description of this notice, its implications, and the potential consequences for individuals involved in such a situation in Fort Lauderdale, Florida. Keywords: Fort Lauderdale, Florida; Final Notice of Default; Past Due Payments; Contract for Deed; real estate transaction Types of Fort Lauderdale Final Notices of Default for Past Due Payments in Connection with Contract for Deed: 1. Fort Lauderdale Florida Final Notice of Default for Past Due Payments: This notice is issued when a buyer fails to make the agreed-upon payments under a Contract for Deed, causing them to fall behind in their financial obligations. The notice is typically sent by the seller or their representative to inform the buyer of their non-compliance and the consequences that may follow if the outstanding payments are not made promptly. 2. Fort Lauderdale Florida Notice of Default Cure Period: A Notice of Default Cure Period may follow the initial Final Notice of Default for Past Due Payments. It provides the delinquent buyer with a specified timeframe within which they can remedy the payment default, bringing their obligations up to date. This period allows the buyer an opportunity to rectify the default and prevent further legal action. 3. Fort Lauderdale Florida Notice of Intent to Foreclose: If the buyer fails to cure the default and bring their payments up to date within the given timeframe, a Notice of Intent to Foreclose may be issued. This notice formally informs the buyer that the seller intends to pursue foreclosure on the property, potentially leading to the loss of their ownership rights and eviction from the premises. Description of the Fort Lauderdale Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed: The Final Notice of Default for Past Due Payments is a crucial document in the Contract for Deed process when a buyer fails to meet their payment obligations. It is a written communication from the seller to the delinquent buyer, indicating that they have not fulfilled their financial responsibilities as outlined in the contract. This notice serves as a necessary step before further legal actions are taken and is typically sent by certified mail or personal delivery. The notice typically includes: 1. Title and Contact Details: The notice should clearly state "Final Notice of Default for Past Due Payments" and include the seller or their representative's contact information for any inquiries or discussions regarding the default. 2. Date of Delinquency: The notice will specify the date or period when the buyer became delinquent in their payments. This helps establish the basis for the default and gives the buyer an understanding of the duration of their non-compliance. 3. Outstanding Amount: The notice will specify the total amount due, including any interest, late fees, or penalties that have accrued due to the delinquency. A breakdown of the outstanding balance should be provided, including the principal amount and any additional charges that may have been incurred. 4. Cure Period: The notice may grant the buyer a specified period within which they must cure the default by making the overdue payments in full. The duration varies and depends on the specific terms outlined in the Contract for Deed, but it is typically 30 days. 5. Consequences of Non-Compliance: The notice should clearly state the consequences of failing to cure the default within the given timeframe. This may include further legal action, the potential loss of ownership rights, and the initiation of the foreclosure process. Conclusion: Receiving a Fort Lauderdale, Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a serious matter. It signifies that a buyer has fallen behind in their financial obligations, prompting potential legal actions and the risk of losing the property. Therefore, it is crucial for buyers to promptly address the default by either making the overdue payments or seeking alternative solutions that protect their interests while resolving the delinquency issue. Seeking legal advice and consulting the Contract for Deed terms are recommended courses of action in such circumstances.