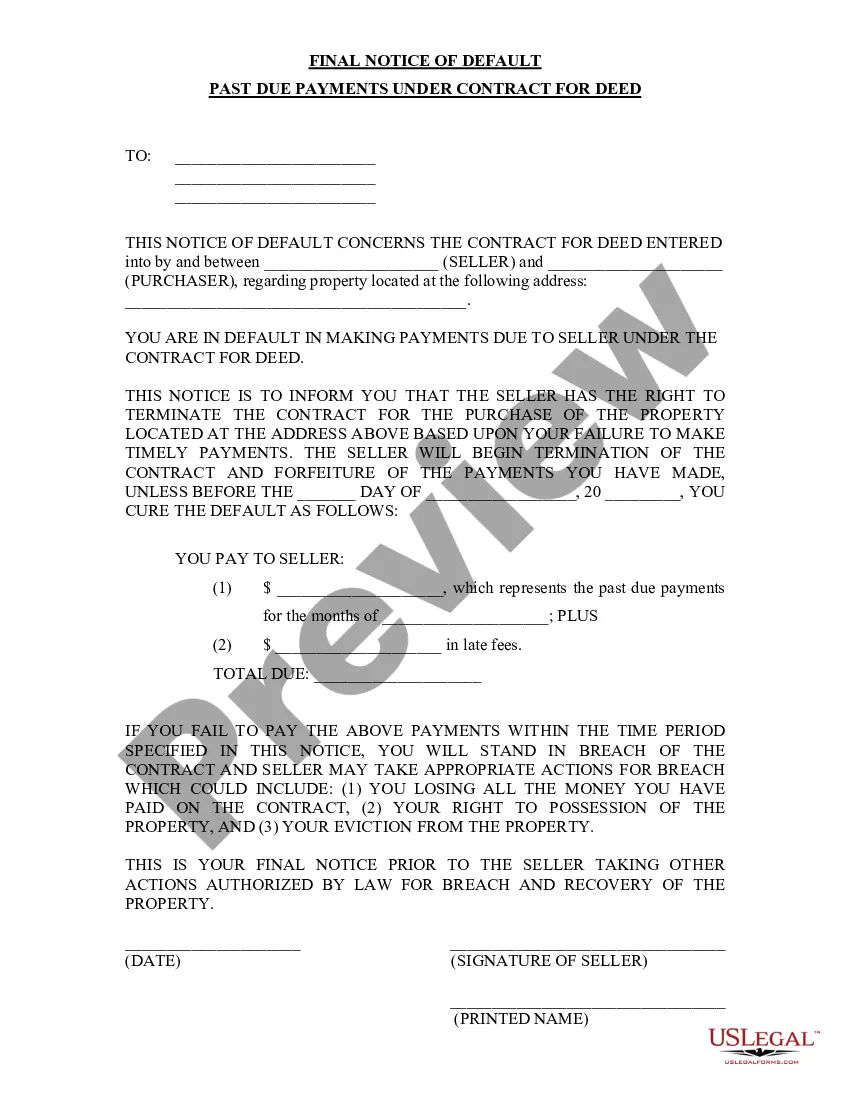

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Hillsborough Florida's Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Hillsborough Florida, Final Notice of Default, Past Due Payments, Contract for Deed Introduction: In Hillsborough, Florida, when a party fails to make timely payments as required under a Contract for Deed agreement, a Final Notice of Default may be issued by the seller or the lender. This notice serves as a legal notification to the buyer, informing them of their failure to meet payment obligations and the potential consequences involved. Let's delve deeper into the specifics of the Hillsborough Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed. Types of Hillsborough Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed: 1. Standard Final Notice of Default: This notice is typically issued when the buyer fails to make the required monthly payments for an extended period, resulting in significant outstanding payments under the terms of the Contract for Deed. The standard notice outlines the outstanding balance, late fees, and the number of days given to rectify the default. 2. Cure or Quit Notice: This type of notice informs the buyer that they must "cure" or fix the default within a specified timeframe, usually mentioned as per the terms of the original Contract for Deed agreement. If the buyer fails to do so, the seller may initiate legal proceedings to terminate the contract. 3. Acceleration Notice: An acceleration notice is issued when the buyer accumulates substantial overdue payments for an extended period, breaching the terms of the Contract for Deed. This type of notice typically demands full payment of the remaining balance owed, giving the buyer a certain timeframe to fulfill the payment or face foreclosure. 4. Intent to Foreclose Notice: When previous notices and attempts to resolve payment issues have failed, the seller or lender may issue an Intent to Foreclose Notice. This notice indicates the intention to initiate foreclosure proceedings, leading to the termination of the Contract for Deed agreement. Consequences of Default: The consequences of receiving a Final Notice of Default for Past Due Payments can be severe. If the buyer fails to adhere to the notice within the specified timeframe, the seller or lender may proceed with legal actions such as foreclosure. This could result in the buyer losing all rights to the property and potential financial damages based on the terms of the contract. Conclusion: Understanding the implications of a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for both buyers and sellers in Hillsborough, Florida. Buyers are advised to ensure timely payment obligations, while sellers must follow legal procedures when issuing these notices. It is essential to consult with legal professionals to fully grasp the intricacies of the Contract for Deed and the ramifications of defaulting on payment obligations.Title: Understanding Hillsborough Florida's Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Hillsborough Florida, Final Notice of Default, Past Due Payments, Contract for Deed Introduction: In Hillsborough, Florida, when a party fails to make timely payments as required under a Contract for Deed agreement, a Final Notice of Default may be issued by the seller or the lender. This notice serves as a legal notification to the buyer, informing them of their failure to meet payment obligations and the potential consequences involved. Let's delve deeper into the specifics of the Hillsborough Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed. Types of Hillsborough Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed: 1. Standard Final Notice of Default: This notice is typically issued when the buyer fails to make the required monthly payments for an extended period, resulting in significant outstanding payments under the terms of the Contract for Deed. The standard notice outlines the outstanding balance, late fees, and the number of days given to rectify the default. 2. Cure or Quit Notice: This type of notice informs the buyer that they must "cure" or fix the default within a specified timeframe, usually mentioned as per the terms of the original Contract for Deed agreement. If the buyer fails to do so, the seller may initiate legal proceedings to terminate the contract. 3. Acceleration Notice: An acceleration notice is issued when the buyer accumulates substantial overdue payments for an extended period, breaching the terms of the Contract for Deed. This type of notice typically demands full payment of the remaining balance owed, giving the buyer a certain timeframe to fulfill the payment or face foreclosure. 4. Intent to Foreclose Notice: When previous notices and attempts to resolve payment issues have failed, the seller or lender may issue an Intent to Foreclose Notice. This notice indicates the intention to initiate foreclosure proceedings, leading to the termination of the Contract for Deed agreement. Consequences of Default: The consequences of receiving a Final Notice of Default for Past Due Payments can be severe. If the buyer fails to adhere to the notice within the specified timeframe, the seller or lender may proceed with legal actions such as foreclosure. This could result in the buyer losing all rights to the property and potential financial damages based on the terms of the contract. Conclusion: Understanding the implications of a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for both buyers and sellers in Hillsborough, Florida. Buyers are advised to ensure timely payment obligations, while sellers must follow legal procedures when issuing these notices. It is essential to consult with legal professionals to fully grasp the intricacies of the Contract for Deed and the ramifications of defaulting on payment obligations.