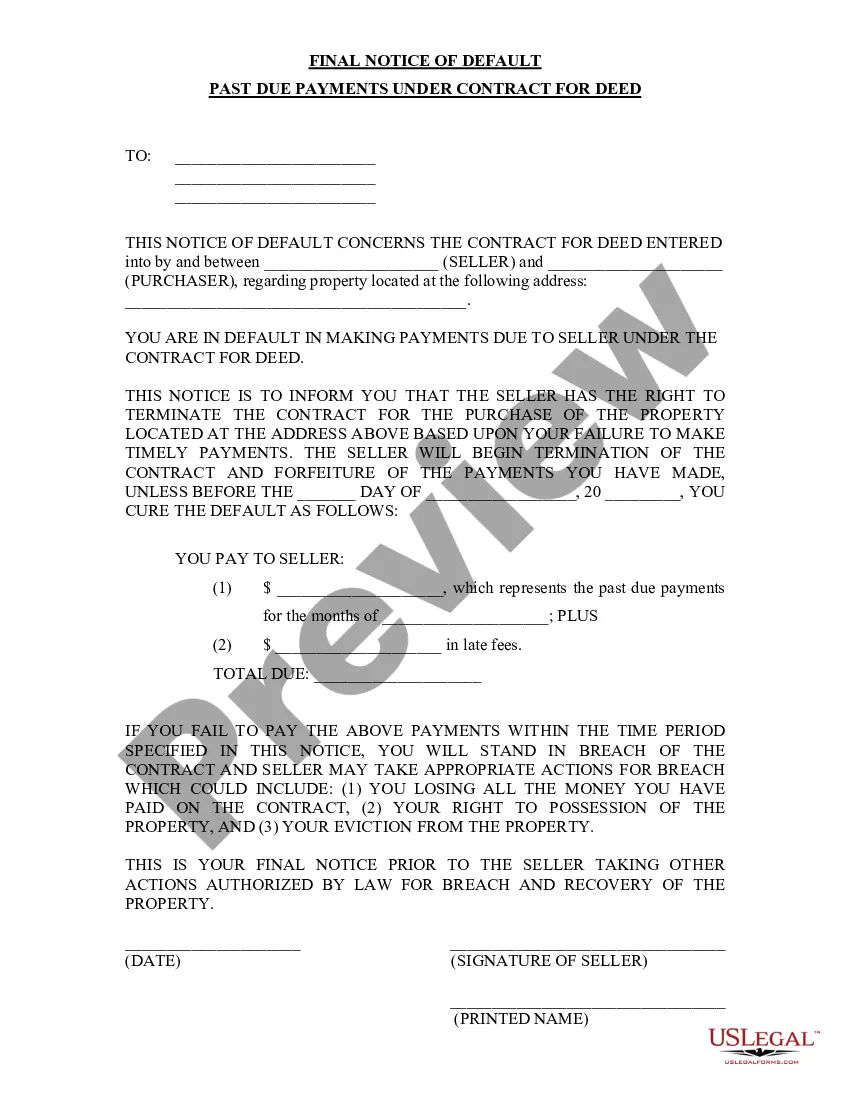

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Hollywood, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document issued to a party in Hollywood, Florida, who has failed to meet their financial obligations as per the terms of a Contract for Deed agreement. This notice serves as a last warning before initiating legal actions to recover the outstanding payments. Abiding by the terms of the Contract for Deed is crucial to maintain a good financial standing and avoid potential legal consequences. This article will outline the process, consequences, and potential solutions related to different types of Final Notices of Default in Hollywood, Florida. 1. Late Payment Default: In the case of a "Late Payment Default," the Contract for Deed recipient has failed to make their monthly payments by the agreed-upon due date. The issuer of the notice will specify the specific late payments and the total overdue amount outstanding. It is essential for the recipient to respond promptly to rectify this default and prevent further legal actions. 2. Non-Payment Default: The "Non-Payment Default" occurs when the recipient fails to make any payments as stated in the Contract for Deed within the grace period or on the agreed due date. This notice clearly outlines the missed payments, including all late fees and penalties. To avoid severe consequences, immediate action must be taken to remedy the non-payment default situation. 3. Breach of Contract Default: When a recipient violates the terms and conditions mentioned in the Contract for Deed agreement, it is considered a "Breach of Contract Default." This type of default notice highlights the specific provisions that have been breached, such as property maintenance, insurance, or unauthorized alterations. Addressing these issues promptly and rectifying the breach is crucial to avoid further legal proceedings. Consequences of Defaulting: — Legal Action: If the recipient fails to respond or remedy the default within the specified timeframe mentioned in the Final Notice of Default, the issuer may pursue legal actions to reclaim the property or seek financial compensation through foreclosure or a lawsuit. — Adverse Credit Impact: Defaulting on payments can severely impact the recipient's credit score, making it difficult to secure loans or future real estate opportunities. — Loss of Equity: Failure to rectify the default may result in the loss of any equity earned through previous payments and investments in the property. Resolving the Default: To rectify a Final Notice of Default for Past Due Payments in connection with a Contract for Deed, the recipient should consider the following actions: 1. Contact the Issuer: Communicate with the issuer to discuss the current financial situation, propose a repayment plan, or negotiate alternative solutions. 2. Seek Legal Advice: Consult an attorney well-versed in real estate and contract law to understand your rights, obligations, and potential options for resolving the default. 3. Repayment Plan: If feasible, propose a repayment plan to the issuer, ensuring future payments are made on time and addressing the overdue amount incrementally. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Hollywood, Florida is a serious matter. It is vital to act swiftly, communicate effectively, and seek appropriate legal counsel when faced with such a notice. Resolving the default promptly will help protect your financial standing, property ownership rights, and avoid the potential legal consequences associated with non-compliance.Title: Hollywood, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document issued to a party in Hollywood, Florida, who has failed to meet their financial obligations as per the terms of a Contract for Deed agreement. This notice serves as a last warning before initiating legal actions to recover the outstanding payments. Abiding by the terms of the Contract for Deed is crucial to maintain a good financial standing and avoid potential legal consequences. This article will outline the process, consequences, and potential solutions related to different types of Final Notices of Default in Hollywood, Florida. 1. Late Payment Default: In the case of a "Late Payment Default," the Contract for Deed recipient has failed to make their monthly payments by the agreed-upon due date. The issuer of the notice will specify the specific late payments and the total overdue amount outstanding. It is essential for the recipient to respond promptly to rectify this default and prevent further legal actions. 2. Non-Payment Default: The "Non-Payment Default" occurs when the recipient fails to make any payments as stated in the Contract for Deed within the grace period or on the agreed due date. This notice clearly outlines the missed payments, including all late fees and penalties. To avoid severe consequences, immediate action must be taken to remedy the non-payment default situation. 3. Breach of Contract Default: When a recipient violates the terms and conditions mentioned in the Contract for Deed agreement, it is considered a "Breach of Contract Default." This type of default notice highlights the specific provisions that have been breached, such as property maintenance, insurance, or unauthorized alterations. Addressing these issues promptly and rectifying the breach is crucial to avoid further legal proceedings. Consequences of Defaulting: — Legal Action: If the recipient fails to respond or remedy the default within the specified timeframe mentioned in the Final Notice of Default, the issuer may pursue legal actions to reclaim the property or seek financial compensation through foreclosure or a lawsuit. — Adverse Credit Impact: Defaulting on payments can severely impact the recipient's credit score, making it difficult to secure loans or future real estate opportunities. — Loss of Equity: Failure to rectify the default may result in the loss of any equity earned through previous payments and investments in the property. Resolving the Default: To rectify a Final Notice of Default for Past Due Payments in connection with a Contract for Deed, the recipient should consider the following actions: 1. Contact the Issuer: Communicate with the issuer to discuss the current financial situation, propose a repayment plan, or negotiate alternative solutions. 2. Seek Legal Advice: Consult an attorney well-versed in real estate and contract law to understand your rights, obligations, and potential options for resolving the default. 3. Repayment Plan: If feasible, propose a repayment plan to the issuer, ensuring future payments are made on time and addressing the overdue amount incrementally. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Hollywood, Florida is a serious matter. It is vital to act swiftly, communicate effectively, and seek appropriate legal counsel when faced with such a notice. Resolving the default promptly will help protect your financial standing, property ownership rights, and avoid the potential legal consequences associated with non-compliance.