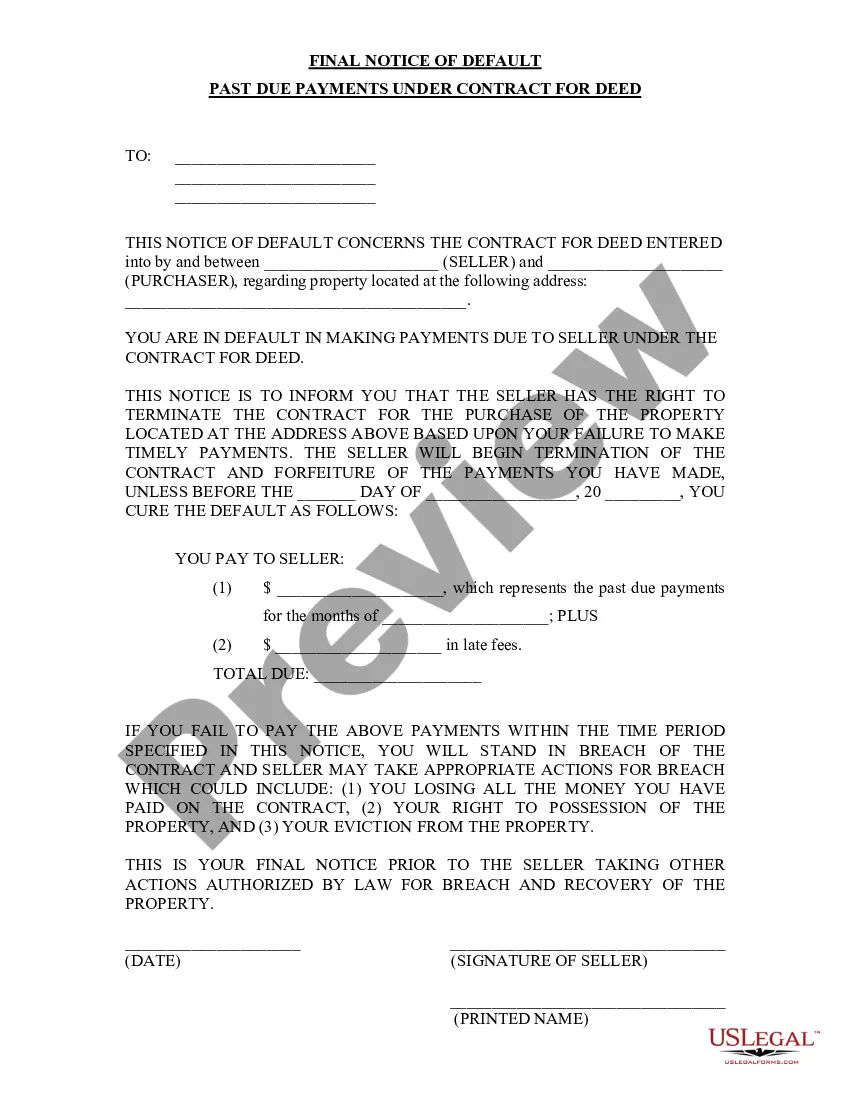

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Lakeland Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: In the city of Lakeland, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legally binding document that notifies the buyer or borrower that they have failed to make timely or complete payments as agreed upon in the contract. A Contract for Deed is a type of financing arrangement where the seller finances the purchase of the property instead of a traditional mortgage lender. The Final Notice of Default serves as a formal communication to inform the buyer that they are in default of their contractual obligations. It is typically sent by the seller or their representative, such as a property management company or attorney, to the buyer's last known address. The notice outlines the specific payment amounts, dates, and the total amount overdue. Failure to resolve the past due payments within a specified period mentioned in the notice could lead to serious consequences, including potential legal action, foreclosure, and forfeiture of the property. Different types of Lakeland Florida Final Notices of Default for Past Due Payments in connection with Contract for Deed may include: 1. Initial Notice of Default: This is the first notice sent to the buyer when a payment is missed or delayed. It serves as a warning and typically provides a grace period to rectify the situation before more severe actions are taken. 2. Second Notice of Default: If the buyer does not rectify the default within the grace period provided in the initial notice, a second notice is sent as a reminder. This notice may include additional penalties or fees associated with the default. 3. Final Notice of Default: This notice represents the last opportunity for the buyer to settle the defaulted payments before legal action. It usually includes a specific deadline by which the buyer must bring the account current or face further consequences. It is crucial for buyers who receive a Lakeland Florida Final Notice of Default for Past Due Payments to promptly review the notice, contact the seller's representative, and explore remedies to resolve the default. Seeking legal advice or negotiating new payment arrangements might be potential options to prevent any further complications. In conclusion, the Lakeland Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed is a critical document that emphasizes the consequences of failing to meet payment obligations. It serves as a catalyst to encourage the buyer to take immediate action to resolve the default and avoid potential legal ramifications.Lakeland Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: In the city of Lakeland, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legally binding document that notifies the buyer or borrower that they have failed to make timely or complete payments as agreed upon in the contract. A Contract for Deed is a type of financing arrangement where the seller finances the purchase of the property instead of a traditional mortgage lender. The Final Notice of Default serves as a formal communication to inform the buyer that they are in default of their contractual obligations. It is typically sent by the seller or their representative, such as a property management company or attorney, to the buyer's last known address. The notice outlines the specific payment amounts, dates, and the total amount overdue. Failure to resolve the past due payments within a specified period mentioned in the notice could lead to serious consequences, including potential legal action, foreclosure, and forfeiture of the property. Different types of Lakeland Florida Final Notices of Default for Past Due Payments in connection with Contract for Deed may include: 1. Initial Notice of Default: This is the first notice sent to the buyer when a payment is missed or delayed. It serves as a warning and typically provides a grace period to rectify the situation before more severe actions are taken. 2. Second Notice of Default: If the buyer does not rectify the default within the grace period provided in the initial notice, a second notice is sent as a reminder. This notice may include additional penalties or fees associated with the default. 3. Final Notice of Default: This notice represents the last opportunity for the buyer to settle the defaulted payments before legal action. It usually includes a specific deadline by which the buyer must bring the account current or face further consequences. It is crucial for buyers who receive a Lakeland Florida Final Notice of Default for Past Due Payments to promptly review the notice, contact the seller's representative, and explore remedies to resolve the default. Seeking legal advice or negotiating new payment arrangements might be potential options to prevent any further complications. In conclusion, the Lakeland Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed is a critical document that emphasizes the consequences of failing to meet payment obligations. It serves as a catalyst to encourage the buyer to take immediate action to resolve the default and avoid potential legal ramifications.