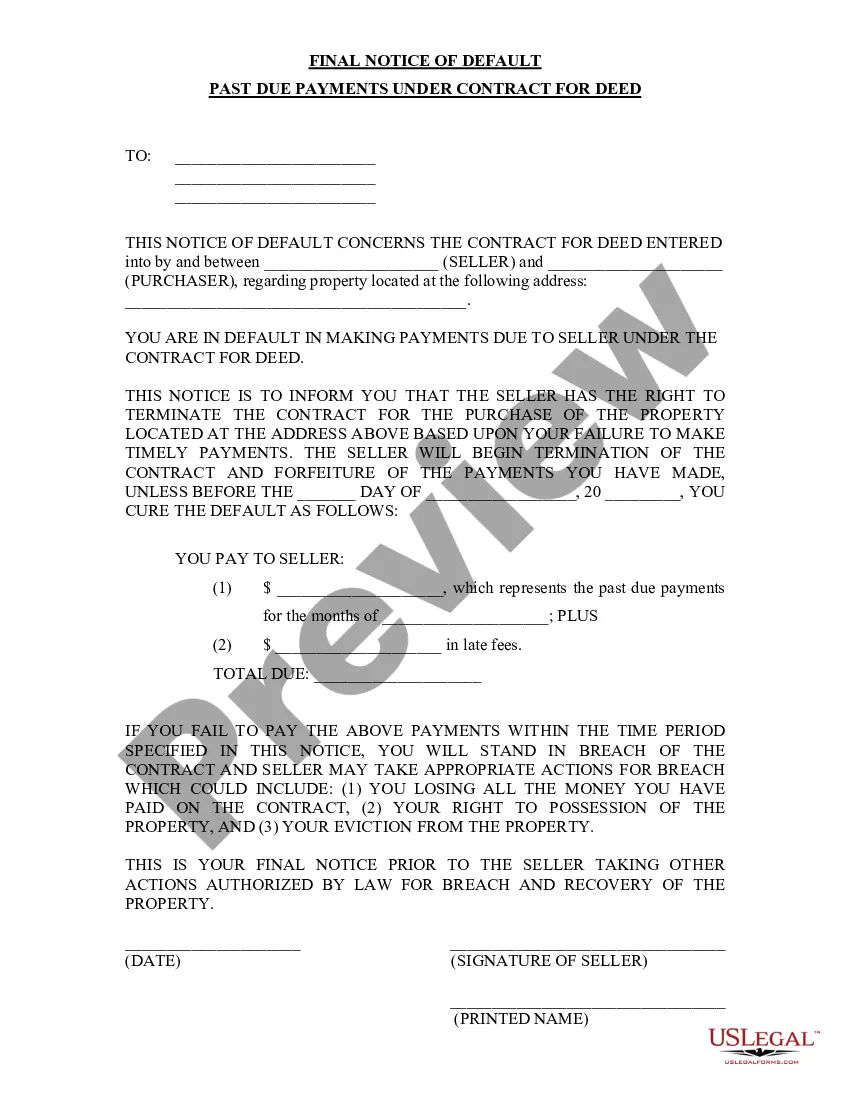

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Miami Gardens Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an official notification sent by a lender or seller to a buyer in Miami Gardens, Florida. This notice highlights payment delinquencies and serves as a last opportunity for the buyer to rectify the situation to avoid serious consequences. In Miami Gardens, there may be various types of Final Notices of Default for Past Due Payments, each with their own specific implications. Types of Miami Gardens Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Monetary Default Notice: This type of notice is typically issued when a buyer fails to make the required monthly payments according to the terms of the Contract for Deed. The lender or seller will specify the amount owed, the due date, and the number of missed payments. It acts as an initial warning to inform the buyer about their financial obligations and the potential consequences if the default persists. 2. Notice of Intention to Accelerate: If the buyer fails to address the monetary default within a specified timeframe after receiving the initial notice, the lender or seller may send a Notice of Intention to Accelerate. This notice signifies the lender's intent to demand full and immediate payment of the outstanding balance, typically representing the entire remaining purchase price of the property. It includes a deadline by which the buyer must pay the entire outstanding amount to avoid further action. 3. Notice of Foreclosure: If the buyer does not resolve the default and fails to make the full payment within the given timeframe mentioned in the Notice of Intention to Accelerate, the lender or seller may initiate foreclosure proceedings. A Notice of Foreclosure is a legal notice that informs the buyer of the intention to sell the property to recover the amount owed. It provides a final opportunity for the buyer to settle the outstanding payments and avoid the property's loss. Key Considerations for Buyers: a. Timely Communication: Buyers who receive any type of notice related to default must promptly communicate with the lender or seller to discuss their financial situation and explore potential solutions before the situation escalates. b. Seek Legal Advice: It is vital for buyers facing a Final Notice of Default to seek legal advice to understand their rights and options. An attorney experienced in real estate law can provide appropriate guidance, negotiate on the buyer's behalf, or explore alternatives to avoid foreclosure. c. Review Contract for Deed: Buyers should carefully review the terms and conditions outlined in their Contract for Deed to understand their obligations, grace periods, penalties, and potential remedies available to them in case of default. Conclusion: Receiving a Final Notice of Default for Past Due Payments can be a serious matter for buyers in Miami Gardens, Florida, as it may lead to foreclosure and the loss of the property. It is crucial for buyers to take immediate action upon receiving a notice, effectively communicate with the lender or seller, seek legal advice, and explore possible solutions to resolve the outstanding payments to safeguard their interests and preserve homeownership.Title: Understanding Miami Gardens Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an official notification sent by a lender or seller to a buyer in Miami Gardens, Florida. This notice highlights payment delinquencies and serves as a last opportunity for the buyer to rectify the situation to avoid serious consequences. In Miami Gardens, there may be various types of Final Notices of Default for Past Due Payments, each with their own specific implications. Types of Miami Gardens Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Monetary Default Notice: This type of notice is typically issued when a buyer fails to make the required monthly payments according to the terms of the Contract for Deed. The lender or seller will specify the amount owed, the due date, and the number of missed payments. It acts as an initial warning to inform the buyer about their financial obligations and the potential consequences if the default persists. 2. Notice of Intention to Accelerate: If the buyer fails to address the monetary default within a specified timeframe after receiving the initial notice, the lender or seller may send a Notice of Intention to Accelerate. This notice signifies the lender's intent to demand full and immediate payment of the outstanding balance, typically representing the entire remaining purchase price of the property. It includes a deadline by which the buyer must pay the entire outstanding amount to avoid further action. 3. Notice of Foreclosure: If the buyer does not resolve the default and fails to make the full payment within the given timeframe mentioned in the Notice of Intention to Accelerate, the lender or seller may initiate foreclosure proceedings. A Notice of Foreclosure is a legal notice that informs the buyer of the intention to sell the property to recover the amount owed. It provides a final opportunity for the buyer to settle the outstanding payments and avoid the property's loss. Key Considerations for Buyers: a. Timely Communication: Buyers who receive any type of notice related to default must promptly communicate with the lender or seller to discuss their financial situation and explore potential solutions before the situation escalates. b. Seek Legal Advice: It is vital for buyers facing a Final Notice of Default to seek legal advice to understand their rights and options. An attorney experienced in real estate law can provide appropriate guidance, negotiate on the buyer's behalf, or explore alternatives to avoid foreclosure. c. Review Contract for Deed: Buyers should carefully review the terms and conditions outlined in their Contract for Deed to understand their obligations, grace periods, penalties, and potential remedies available to them in case of default. Conclusion: Receiving a Final Notice of Default for Past Due Payments can be a serious matter for buyers in Miami Gardens, Florida, as it may lead to foreclosure and the loss of the property. It is crucial for buyers to take immediate action upon receiving a notice, effectively communicate with the lender or seller, seek legal advice, and explore possible solutions to resolve the outstanding payments to safeguard their interests and preserve homeownership.