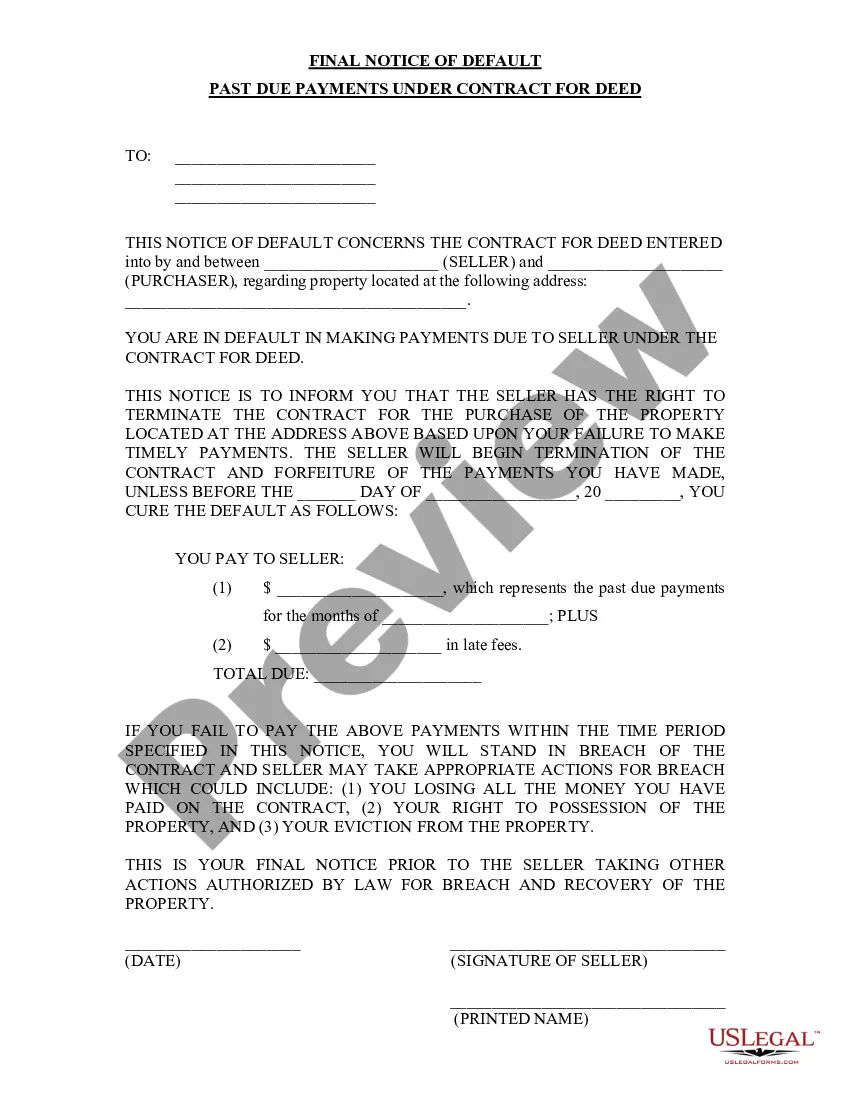

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Palm Beach Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: When it comes to Contract for Deeds in Palm Beach, Florida, it is crucial for both parties involved to understand the legal implications and consequences of defaulting on payment obligations. This article aims to provide a detailed description of the Palm Beach Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed, shedding light on its importance and possible variations. 1. Importance of a Final Notice of Default: A Final Notice of Default serves as an official communication sent by the seller or lender to the buyer or borrower to notify them of their overdue payments. This notice serves as a formal document to clearly indicate the impending consequences of non-payment and provides an opportunity for the buyer to address the situation. 2. Key Elements of a Palm Beach Florida Final Notice of Default: — Identification of the parties involved: The notice should clearly identify both the seller or lender and the buyer or borrower, including their legal names, addresses, and contact information. — Declaration of default: The notice should explicitly state that the buyer has defaulted on their payment obligations according to the terms of the Contract for Deed. — Description of terms and payment due: The notification must specify the amount past due, the due date of the unpaid installment, and highlight any additional fees or penalties incurred as a result of non-payment. — Timeframe for resolution: The notice should provide a reasonable period for the buyer to address the default, often referred to as a "cure period," during which they are required to bring the payments up to date. — Consequences of non-compliance: The notice must outline the potential consequences if the buyer fails to cure the default within the stipulated timeframe, which may include termination of the Contract for Deed, foreclosure proceedings, and potential legal actions. 3. Variations of Palm Beach Florida Final Notice of Default: — Preliminary Notice of Default: This notice is often sent as an initial warning to the buyer, informing them of their missed payments and the potential consequences if the default is not addressed promptly. It is intended to give the buyer an opportunity to remedy the situation before a Final Notice of Default is issued. — Notice of Acceleration: If the buyer fails to cure the default within the specified cure period, this notice may be sent, declaring that the entire remaining balance of the Contract for Deed is due immediately rather than the default payment plan. — Notice of Termination: When the buyer remains in default or fails to cure within the given timeframe even after receiving a Final Notice of Default, this notice confirms the termination of the Contract for Deed, potentially leading to foreclosure proceedings. Conclusion: In Palm Beach, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a critical step in the resolution process when a buyer fails to meet their payment obligations. It is essential for both parties to understand the implications, and possible variations such as Preliminary Notices of Default, Notices of Acceleration, and Notices of Termination. Seeking legal advice can be valuable in such circumstances to ensure compliance with the applicable laws and protect one's rights and interests.Title: Understanding Palm Beach Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: When it comes to Contract for Deeds in Palm Beach, Florida, it is crucial for both parties involved to understand the legal implications and consequences of defaulting on payment obligations. This article aims to provide a detailed description of the Palm Beach Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed, shedding light on its importance and possible variations. 1. Importance of a Final Notice of Default: A Final Notice of Default serves as an official communication sent by the seller or lender to the buyer or borrower to notify them of their overdue payments. This notice serves as a formal document to clearly indicate the impending consequences of non-payment and provides an opportunity for the buyer to address the situation. 2. Key Elements of a Palm Beach Florida Final Notice of Default: — Identification of the parties involved: The notice should clearly identify both the seller or lender and the buyer or borrower, including their legal names, addresses, and contact information. — Declaration of default: The notice should explicitly state that the buyer has defaulted on their payment obligations according to the terms of the Contract for Deed. — Description of terms and payment due: The notification must specify the amount past due, the due date of the unpaid installment, and highlight any additional fees or penalties incurred as a result of non-payment. — Timeframe for resolution: The notice should provide a reasonable period for the buyer to address the default, often referred to as a "cure period," during which they are required to bring the payments up to date. — Consequences of non-compliance: The notice must outline the potential consequences if the buyer fails to cure the default within the stipulated timeframe, which may include termination of the Contract for Deed, foreclosure proceedings, and potential legal actions. 3. Variations of Palm Beach Florida Final Notice of Default: — Preliminary Notice of Default: This notice is often sent as an initial warning to the buyer, informing them of their missed payments and the potential consequences if the default is not addressed promptly. It is intended to give the buyer an opportunity to remedy the situation before a Final Notice of Default is issued. — Notice of Acceleration: If the buyer fails to cure the default within the specified cure period, this notice may be sent, declaring that the entire remaining balance of the Contract for Deed is due immediately rather than the default payment plan. — Notice of Termination: When the buyer remains in default or fails to cure within the given timeframe even after receiving a Final Notice of Default, this notice confirms the termination of the Contract for Deed, potentially leading to foreclosure proceedings. Conclusion: In Palm Beach, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a critical step in the resolution process when a buyer fails to meet their payment obligations. It is essential for both parties to understand the implications, and possible variations such as Preliminary Notices of Default, Notices of Acceleration, and Notices of Termination. Seeking legal advice can be valuable in such circumstances to ensure compliance with the applicable laws and protect one's rights and interests.