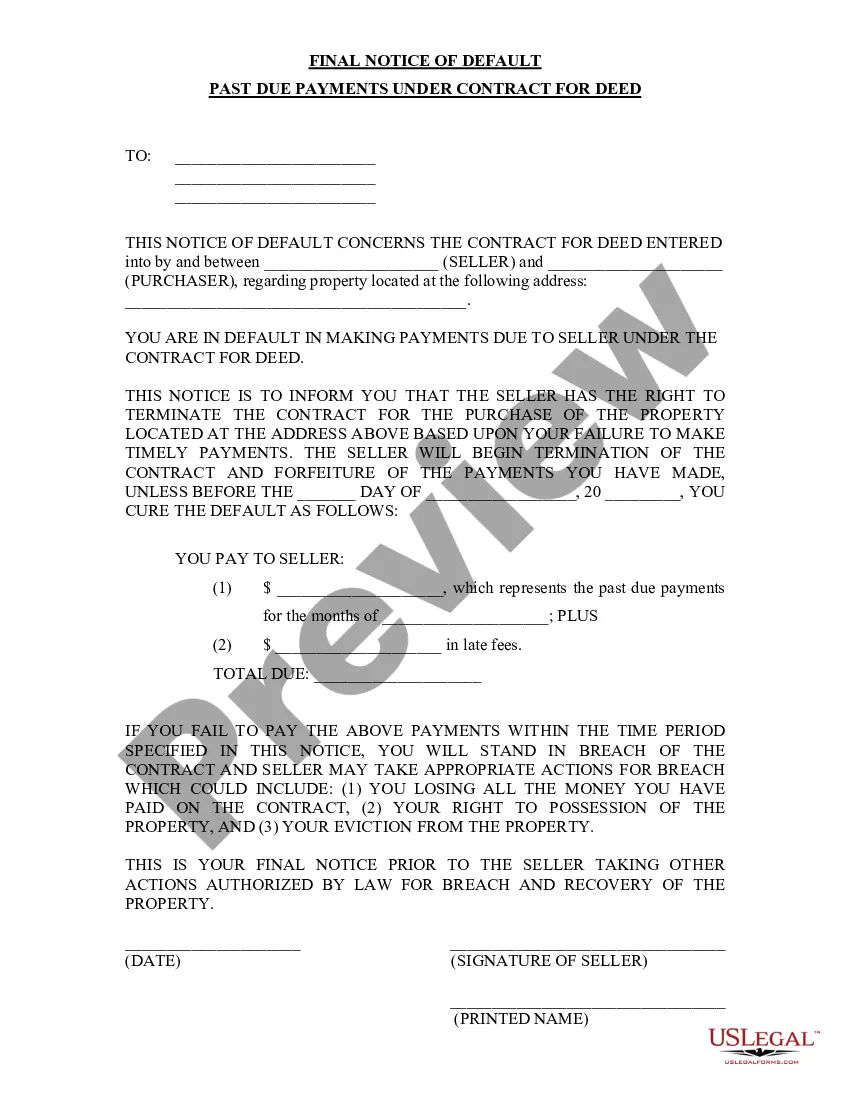

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Pompano Beach Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: Understanding the Process and Consequences In Pompano Beach, Florida, if a contract for deed, also known as an installment land contract or a land contract, has been agreed upon between a buyer and seller, it is important to understand the potential implications of defaulting on the payments. This notice serves as a warning for individuals who have fallen behind on the agreed-upon payments on their contract for deed, informing them of the imminent consequences if they fail to address their delinquency promptly. Types of Pompano Beach Florida Final Notice of Default: 1. Pompano Beach Florida Final Notice of Default for Past Due Payments (Standard): This notice is issued to purchasers who have missed one or more payments specified in their contract for deed. It highlights the seriousness of the situation and urges the recipient to take immediate action to resolve the overdue payments. 2. Pompano Beach Florida Final Notice of Default for Chronic Late Payment: This variant of the notice is sent to individuals who have consistently failed to make timely payments according to the contract terms. It signifies a repetitive pattern of late payments and may indicate potential financial instability. 3. Pompano Beach Florida Final Notice of Default for Non-Payment Non-Compliance: In cases where the buyer has not made any payment towards the contract for deed, this notice is issued. It marks a severe breach of the agreement, possibly resulting from financial hardship or other circumstances preventing the buyer from fulfilling their obligations. Key elements of a Pompano Beach Florida Final Notice of Default for Past Due Payments: 1. Contact Information: The notice typically includes the name, address, and contact details of the issuing party (often the seller or their representative), ensuring the recipient can reach out for further discussion or clarification. 2. Introduction and Identification: The notice should explicitly address the recipient and mention the contract for deed in question, mentioning any specific details such as property address, legal description, or account number to avoid confusion. 3. Statement of Default: The notice outlines the specific payment(s) that are currently past due, including any late fees or penalties incurred. It usually emphasizes the total amount owed and the due date for immediate payment. 4. Consequences of Default: This section explains the potential repercussions of continued non-compliance with the contract terms. It may detail possible legal actions, such as foreclosure proceedings, and the impact on the buyer's credit rating. 5. Remedial Actions: The notice should provide options for the recipient to rectify the default, such as making immediate payment of the outstanding balance, contacting the seller to negotiate a repayment plan, or seeking professional advice to discuss alternative solutions. 6. Response Deadline: To ensure a swift resolution, the notice specifies a clear deadline by which the recipient must respond or take appropriate action to address the default. This helps to establish a time frame for a mutually agreeable solution. 7. Document Retention: A clause reminding the recipient to retain a copy of the notice for their records reinforces the importance of the communication and helps to maintain transparency in the process. Remember, the specifics of the Pompano Beach Florida Final Notice of Default for Past Due Payments may vary depending on the terms outlined within the contract for deed and local regulations. It is advisable for both buyers and sellers to seek legal advice to understand their rights and obligations fully.Pompano Beach Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: Understanding the Process and Consequences In Pompano Beach, Florida, if a contract for deed, also known as an installment land contract or a land contract, has been agreed upon between a buyer and seller, it is important to understand the potential implications of defaulting on the payments. This notice serves as a warning for individuals who have fallen behind on the agreed-upon payments on their contract for deed, informing them of the imminent consequences if they fail to address their delinquency promptly. Types of Pompano Beach Florida Final Notice of Default: 1. Pompano Beach Florida Final Notice of Default for Past Due Payments (Standard): This notice is issued to purchasers who have missed one or more payments specified in their contract for deed. It highlights the seriousness of the situation and urges the recipient to take immediate action to resolve the overdue payments. 2. Pompano Beach Florida Final Notice of Default for Chronic Late Payment: This variant of the notice is sent to individuals who have consistently failed to make timely payments according to the contract terms. It signifies a repetitive pattern of late payments and may indicate potential financial instability. 3. Pompano Beach Florida Final Notice of Default for Non-Payment Non-Compliance: In cases where the buyer has not made any payment towards the contract for deed, this notice is issued. It marks a severe breach of the agreement, possibly resulting from financial hardship or other circumstances preventing the buyer from fulfilling their obligations. Key elements of a Pompano Beach Florida Final Notice of Default for Past Due Payments: 1. Contact Information: The notice typically includes the name, address, and contact details of the issuing party (often the seller or their representative), ensuring the recipient can reach out for further discussion or clarification. 2. Introduction and Identification: The notice should explicitly address the recipient and mention the contract for deed in question, mentioning any specific details such as property address, legal description, or account number to avoid confusion. 3. Statement of Default: The notice outlines the specific payment(s) that are currently past due, including any late fees or penalties incurred. It usually emphasizes the total amount owed and the due date for immediate payment. 4. Consequences of Default: This section explains the potential repercussions of continued non-compliance with the contract terms. It may detail possible legal actions, such as foreclosure proceedings, and the impact on the buyer's credit rating. 5. Remedial Actions: The notice should provide options for the recipient to rectify the default, such as making immediate payment of the outstanding balance, contacting the seller to negotiate a repayment plan, or seeking professional advice to discuss alternative solutions. 6. Response Deadline: To ensure a swift resolution, the notice specifies a clear deadline by which the recipient must respond or take appropriate action to address the default. This helps to establish a time frame for a mutually agreeable solution. 7. Document Retention: A clause reminding the recipient to retain a copy of the notice for their records reinforces the importance of the communication and helps to maintain transparency in the process. Remember, the specifics of the Pompano Beach Florida Final Notice of Default for Past Due Payments may vary depending on the terms outlined within the contract for deed and local regulations. It is advisable for both buyers and sellers to seek legal advice to understand their rights and obligations fully.