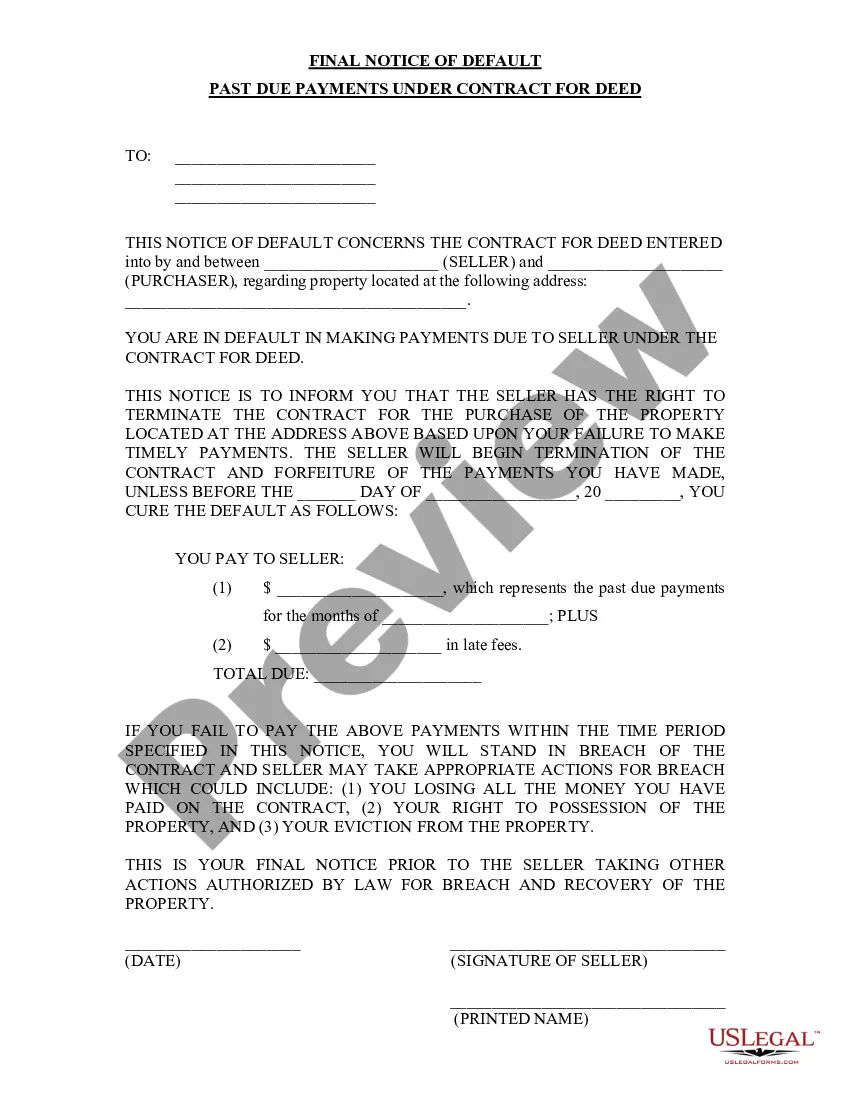

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Tampa, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: When a borrower fails to make timely payments on a Contract for Deed in Tampa, Florida, a Final Notice of Default is issued. This notice serves to alert the borrower about their past due payments, potential consequences, and provide information on the steps that can be taken to rectify the situation. In Tampa, there can be variations of Final Notices of Default for Past Due Payments with slight differences in circumstances or terminologies. This article aims to provide a detailed description of a Tampa, Florida Final Notice of Default for Past Due Payments, highlighting the potential types of notices that may be encountered. 1. Notice of Default for Late Payment: This type of notice is issued to a borrower when they fail to make their scheduled monthly payment on time. It serves as an initial warning to remind them of their overdue payment and the potential consequences if the situation is not rectified promptly. It may also include details of any penalties or fees associated with late payments. 2. Notice of Default for Multiple Late Payments: When a borrower continues to default on multiple monthly payments, a Notice of Default for Multiple Late Payments is issued. This notice emphasizes the borrower's persistent failure to meet their financial obligations under the Contract for Deed and may include additional information regarding the accumulation of late fees or interest on unpaid amounts. 3. Final Notice of Default: If a borrower has ignored previous notices and failed to address the overdue payments, a Final Notice of Default is sent. This notice signifies serious consequences, including potential foreclosure proceedings. It may provide a specific period (often referred to as a cure period) in which the borrower must bring their payments up to date to avoid further legal action. 4. Notice of Intent to Accelerate: Upon expiration of the cure period mentioned in the Final Notice of Default, the lender may send a Notice of Intent to Accelerate. This notice typically informs the borrower that the entire loan amount, including all unpaid principal, interest, and fees, will become due immediately unless the borrower takes necessary steps to remedy the default. 5. Notice of Foreclosure: If the borrower fails to pay the outstanding amount or resolve the default within the specified cure period mentioned in the previous notices, a Notice of Foreclosure may be issued. This legal document begins the formal process of foreclosure, where the lender seeks to take possession of the property securing the Contract for Deed. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Tampa, Florida can be a distressing situation for both borrowers and lenders. It is crucial for borrowers to acknowledge these notices promptly and take the necessary steps to address their default to avoid more severe consequences, such as foreclosure. Seek legal advice or contact the lender directly to understand the specific implications and options available in response to the notice received.Title: Tampa, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: When a borrower fails to make timely payments on a Contract for Deed in Tampa, Florida, a Final Notice of Default is issued. This notice serves to alert the borrower about their past due payments, potential consequences, and provide information on the steps that can be taken to rectify the situation. In Tampa, there can be variations of Final Notices of Default for Past Due Payments with slight differences in circumstances or terminologies. This article aims to provide a detailed description of a Tampa, Florida Final Notice of Default for Past Due Payments, highlighting the potential types of notices that may be encountered. 1. Notice of Default for Late Payment: This type of notice is issued to a borrower when they fail to make their scheduled monthly payment on time. It serves as an initial warning to remind them of their overdue payment and the potential consequences if the situation is not rectified promptly. It may also include details of any penalties or fees associated with late payments. 2. Notice of Default for Multiple Late Payments: When a borrower continues to default on multiple monthly payments, a Notice of Default for Multiple Late Payments is issued. This notice emphasizes the borrower's persistent failure to meet their financial obligations under the Contract for Deed and may include additional information regarding the accumulation of late fees or interest on unpaid amounts. 3. Final Notice of Default: If a borrower has ignored previous notices and failed to address the overdue payments, a Final Notice of Default is sent. This notice signifies serious consequences, including potential foreclosure proceedings. It may provide a specific period (often referred to as a cure period) in which the borrower must bring their payments up to date to avoid further legal action. 4. Notice of Intent to Accelerate: Upon expiration of the cure period mentioned in the Final Notice of Default, the lender may send a Notice of Intent to Accelerate. This notice typically informs the borrower that the entire loan amount, including all unpaid principal, interest, and fees, will become due immediately unless the borrower takes necessary steps to remedy the default. 5. Notice of Foreclosure: If the borrower fails to pay the outstanding amount or resolve the default within the specified cure period mentioned in the previous notices, a Notice of Foreclosure may be issued. This legal document begins the formal process of foreclosure, where the lender seeks to take possession of the property securing the Contract for Deed. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Tampa, Florida can be a distressing situation for both borrowers and lenders. It is crucial for borrowers to acknowledge these notices promptly and take the necessary steps to address their default to avoid more severe consequences, such as foreclosure. Seek legal advice or contact the lender directly to understand the specific implications and options available in response to the notice received.