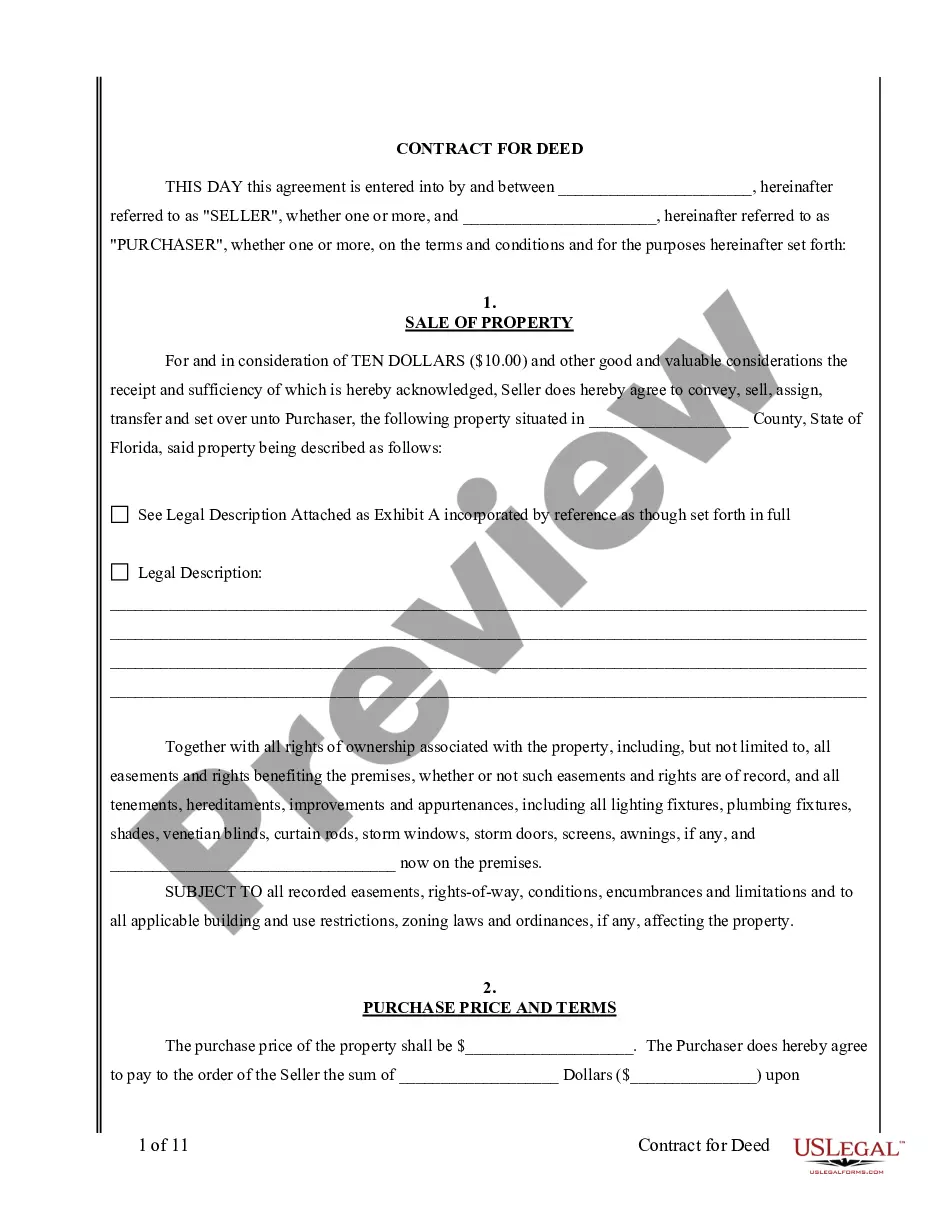

A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

- US Legal Forms

- Localized Forms

- Florida

- St. Petersburg

-

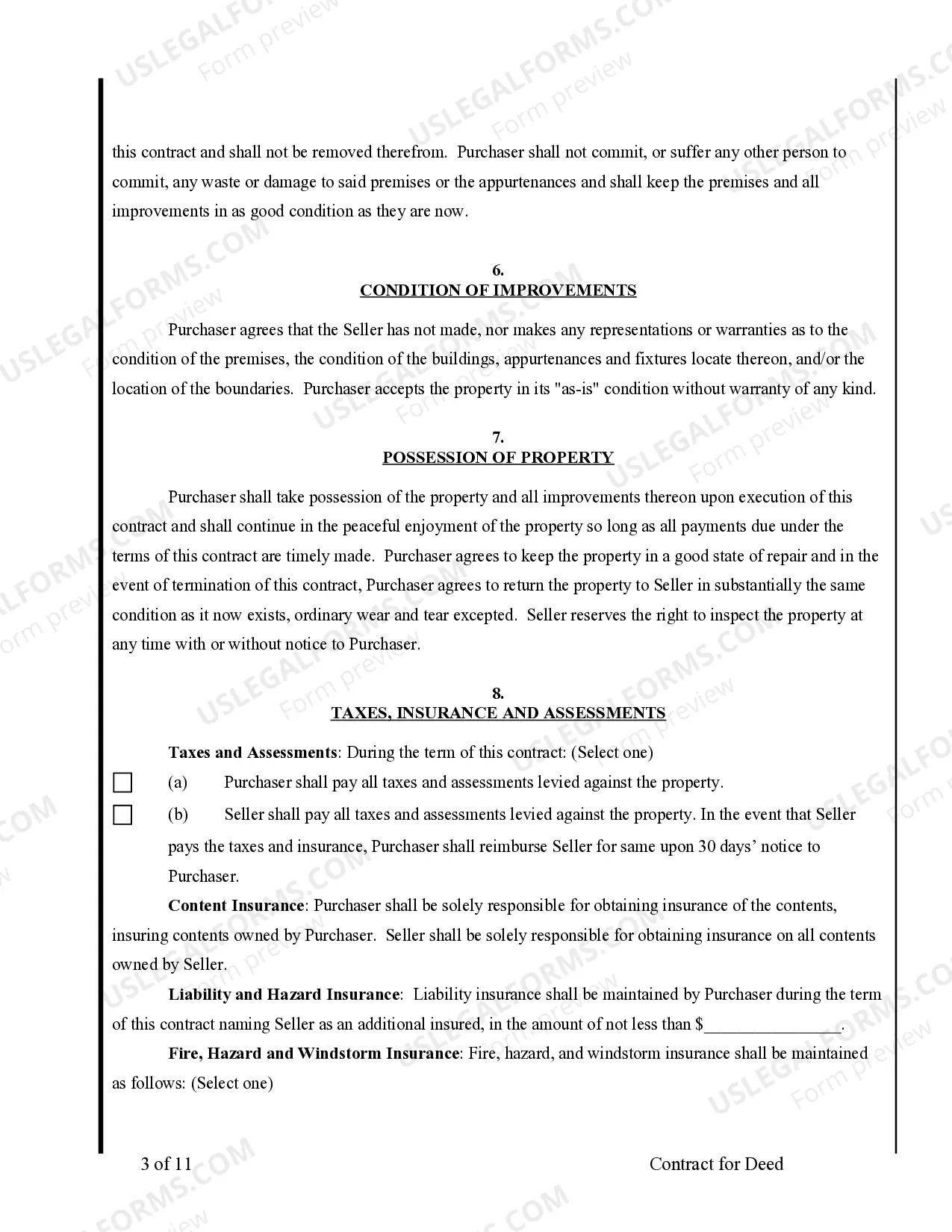

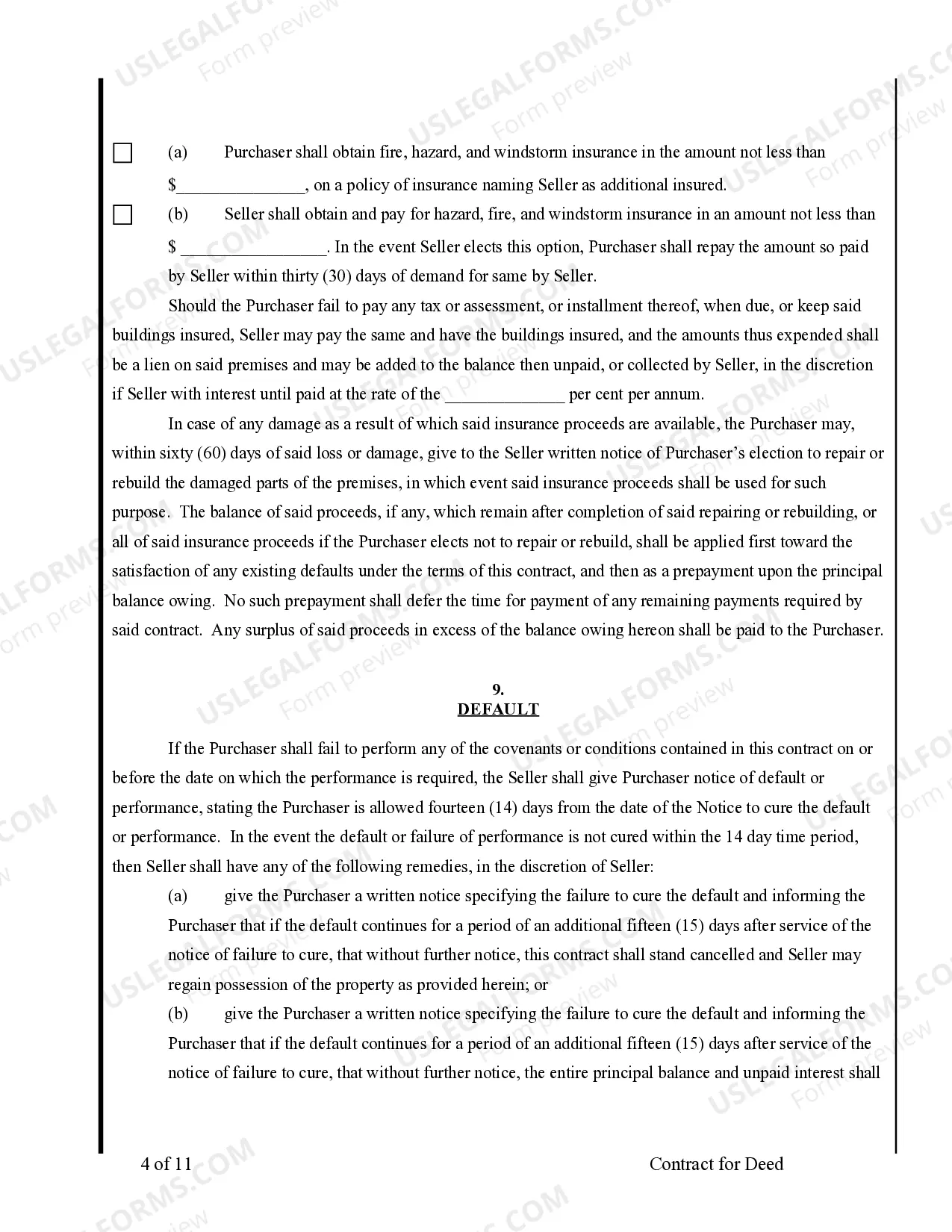

Florida Agreement or Contract for Deed for Sale and Purchase of Real...

St. Petersburg Florida Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Description

Related Forms

Buyer's Request for Accounting from Seller under Contract for Deed

Contract for Deed Seller's Annual Accounting Statement

Assignment of Contract for Deed by Seller

Notice of Assignment of Contract for Deed

Residential Real Estate Sales Disclosure Statement

Lead Based Paint Disclosure for Sales Transaction

View Bexar

View Bexar

View Bexar

Related legal definitions

Viewed forms

How to fill out St. Petersburg Florida Agreement Or Contract For Deed For Sale And Purchase Of Real Estate A/k/a Land Or Executory Contract?

If you are searching for a relevant form template, it’s extremely hard to find a more convenient place than the US Legal Forms website – one of the most considerable libraries on the web. With this library, you can get a large number of form samples for company and individual purposes by types and states, or key phrases. With our high-quality search option, getting the most recent St. Petersburg Florida Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract is as easy as 1-2-3. In addition, the relevance of every record is proved by a team of professional lawyers that regularly check the templates on our platform and update them based on the newest state and county laws.

If you already know about our system and have an account, all you should do to get the St. Petersburg Florida Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the sample you want. Read its information and use the Preview function (if available) to see its content. If it doesn’t meet your needs, use the Search option at the top of the screen to get the appropriate document.

- Confirm your decision. Choose the Buy now option. Following that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and save it to your system.

- Make adjustments. Fill out, modify, print, and sign the acquired St. Petersburg Florida Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract.

Each template you save in your account does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to have an additional version for editing or printing, you can return and download it once more whenever you want.

Take advantage of the US Legal Forms professional library to gain access to the St. Petersburg Florida Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract you were seeking and a large number of other professional and state-specific templates in a single place!

Form Rating

Form popularity

FAQ

A Florida Real Estate Contract must be in writing and contain the following, in order to be legally binding; The parties to the contract - Buyers and Sellers identification. Identification of the Real Property by means of a legal description and street address.

Offer, acceptance, awareness, consideration, and capacity are the five elements of an enforceable contract.

The ?AS IS? Heading It is in fact one of the most common standard contracts used in Florida. The ?AS IS? Contract simply places no repair obligations on the seller, while the Standard Contract has default terms requiring that the seller make certain types of repairs up to a certain dollar amount.

In Florida a contract for deed, or land contract, is a real property sale where the owner provides the financing for the purchase. The seller keeps the title for the property until the buyer makes the final payment on the agreed amount.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

In Florida the seller of a contract for deed can sell the rights to a property to a third party while the buyer is making payments. However, Florida land contract law requires the seller to provide the buyer with a signed and notarized notice stating the contract for deed has been assigned to another party.

Contracts may become invalid under the following circumstances: If the contract is against public policy. If the contract is illegal. If the offer/acceptance/consideration calls for action that violates the law ? such as gambling, robbery, etc.

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

While Florida law requires no particular form of contract for a real estate transaction, the FR/BAR Contract forms are the most utilized and well-recognized residential contract forms in Florida.

A Florida Real Estate Contract must be in writing and contain the following, in order to be legally binding; The parties to the contract - Buyers and Sellers identification. Identification of the Real Property by means of a legal description and street address.

Offer, acceptance, awareness, consideration, and capacity are the five elements of an enforceable contract.

The ?AS IS? Heading It is in fact one of the most common standard contracts used in Florida. The ?AS IS? Contract simply places no repair obligations on the seller, while the Standard Contract has default terms requiring that the seller make certain types of repairs up to a certain dollar amount.

In Florida a contract for deed, or land contract, is a real property sale where the owner provides the financing for the purchase. The seller keeps the title for the property until the buyer makes the final payment on the agreed amount.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

In Florida the seller of a contract for deed can sell the rights to a property to a third party while the buyer is making payments. However, Florida land contract law requires the seller to provide the buyer with a signed and notarized notice stating the contract for deed has been assigned to another party.

Contracts may become invalid under the following circumstances: If the contract is against public policy. If the contract is illegal. If the offer/acceptance/consideration calls for action that violates the law ? such as gambling, robbery, etc.

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

While Florida law requires no particular form of contract for a real estate transaction, the FR/BAR Contract forms are the most utilized and well-recognized residential contract forms in Florida.

A Florida Real Estate Contract must be in writing and contain the following, in order to be legally binding; The parties to the contract - Buyers and Sellers identification. Identification of the Real Property by means of a legal description and street address.

Offer, acceptance, awareness, consideration, and capacity are the five elements of an enforceable contract.

The ?AS IS? Heading It is in fact one of the most common standard contracts used in Florida. The ?AS IS? Contract simply places no repair obligations on the seller, while the Standard Contract has default terms requiring that the seller make certain types of repairs up to a certain dollar amount.

In Florida a contract for deed, or land contract, is a real property sale where the owner provides the financing for the purchase. The seller keeps the title for the property until the buyer makes the final payment on the agreed amount.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

In Florida the seller of a contract for deed can sell the rights to a property to a third party while the buyer is making payments. However, Florida land contract law requires the seller to provide the buyer with a signed and notarized notice stating the contract for deed has been assigned to another party.

Contracts may become invalid under the following circumstances: If the contract is against public policy. If the contract is illegal. If the offer/acceptance/consideration calls for action that violates the law ? such as gambling, robbery, etc.

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

While Florida law requires no particular form of contract for a real estate transaction, the FR/BAR Contract forms are the most utilized and well-recognized residential contract forms in Florida.

A Florida Real Estate Contract must be in writing and contain the following, in order to be legally binding; The parties to the contract - Buyers and Sellers identification. Identification of the Real Property by means of a legal description and street address.

Offer, acceptance, awareness, consideration, and capacity are the five elements of an enforceable contract.

The ?AS IS? Heading It is in fact one of the most common standard contracts used in Florida. The ?AS IS? Contract simply places no repair obligations on the seller, while the Standard Contract has default terms requiring that the seller make certain types of repairs up to a certain dollar amount.

In Florida a contract for deed, or land contract, is a real property sale where the owner provides the financing for the purchase. The seller keeps the title for the property until the buyer makes the final payment on the agreed amount.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

In Florida the seller of a contract for deed can sell the rights to a property to a third party while the buyer is making payments. However, Florida land contract law requires the seller to provide the buyer with a signed and notarized notice stating the contract for deed has been assigned to another party.

Contracts may become invalid under the following circumstances: If the contract is against public policy. If the contract is illegal. If the offer/acceptance/consideration calls for action that violates the law ? such as gambling, robbery, etc.

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

While Florida law requires no particular form of contract for a real estate transaction, the FR/BAR Contract forms are the most utilized and well-recognized residential contract forms in Florida.

St. Petersburg Florida Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract Related Searches

-

florida contract for deed form free

-

agreement for deed

-

agreement for deed florida form

-

florida land contract form

-

what is a deed

-

agreement for deed

-

florida land contract form

-

contract for deed florida

-

florida contract for deed form free

-

agreement for deed florida form

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Florida

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Florida Statutes

TITLE XIV TAXATION AND FINANCE

CHAPTER 197 TAX COLLECTIONS, SALES, AND LIENS

197.502 Application for obtaining tax deed by holder of tax sale certificate; fees.

(1) The holder of a tax certificate at any time after 2 years have elapsed since April 1 of the year of issuance of the tax certificate and before the cancellation of the certificate, may file the certificate and an application for a tax deed with the tax collector of the county where the property described in the certificate is located. The tax collector may charge a tax deed application fee of $75 and for reimbursement of the costs for providing online tax deed application services. If the tax collector charges a combined fee in excess of $75, applicants shall have the option of using the electronic tax deed application process or may file applications without using such service.(2) A certificateholder, other than the county, who makes application for a tax deed shall pay the tax collector at the time of application all amounts required for redemption or purchase of all other outstanding tax certificates, plus interest, any omitted taxes, plus interest, any delinquent taxes, plus interest, and current taxes, if due, covering the property. In addition, the certificateholder shall pay the costs of resale, if applicable, and failure to pay such costs within 30 days after notice from the clerk shall result in the clerk's entering the land on a list entitled lands available for taxes.

(3) The county in which the property described in the certificate is located shall apply for a tax deed on all county-held certificates on property valued at $5,000 or more on the property appraiser's most recent assessment roll, except deferred payment tax certificates, and may apply for tax deeds on certificates on property valued at less than $5,000 on the property appraiser's most recent assessment roll. The application shall be made 2 years after April 1 of the year of issuance of the certificates or as soon thereafter as is reasonable. Upon application, the county shall deposit with the tax collector all applicable costs and fees as provided in subsection (1), but may not deposit any money to cover the redemption of other outstanding certificates covering the property.

(4) The tax collector shall deliver to the clerk of the circuit court a statement that payment has been made for all outstanding certificates or, if the certificate is held by the county, that all appropriate fees have been deposited, and stating that the following persons are to be notified prior to the sale of the property:

(a) Any legal titleholder of record if the address of the owner appears on the record of conveyance of the property to the owner. However, if the legal titleholder of record is the same as the person to whom the property was assessed on the tax roll for the year in which the property was last assessed, the notice may be mailed to the address of the legal titleholder as it appears on the latest assessment roll.

(b) Any lienholder of record who has recorded a lien against the property described in the tax certificate if an address appears on the recorded lien.

(c) Any mortgagee of record if an address appears on the recorded mortgage.

(d) Any vendee of a recorded contract for deed if an address appears on the recorded contract or, if the contract is not recorded, any vendee who has applied to receive notice pursuant to s. 197.344(1)(c).

(e) Any other lienholder who has applied to the tax collector to receive notice if an address is supplied to the collector.

(f) Any person to whom the property was assessed on the tax roll for the year in which the property was last assessed.

(g) Any lienholder of record who has recorded a lien against a mobile home located on the property described in the tax certificate if an address appears on the recorded lien and if the lien is recorded with the clerk of the circuit court in the county where the mobile home is located.

(h) Any legal titleholder of record of property that is contiguous to the property described in the tax certificate, if the property described is submerged land or common elements of a subdivision and if the address of the titleholder of contiguous property appears on the record of conveyance of the property to the legal titleholder. However, if the legal titleholder of property contiguous to the property is the same as the person to whom the property described in the tax certificate was assessed on the tax roll for the year in which the property was last assessed, the notice may be mailed to the address of the legal titleholder as it appears on the latest assessment roll. As used in this chapter, the term contiguous means touching, meeting, or joining at the surface or border, other than at a corner or a single point, and not separated by submerged lands. Submerged lands lying below the ordinary high-water mark which are sovereignty lands are not part of the upland contiguous property for purposes of notification.

The statement must be signed by the tax collector or the tax collector's designee. The tax collector may purchase a reasonable bond for errors and omissions of his or her office in making such statement. The search of the official records must be made by a direct and inverse search. Direct means the index in straight and continuous alphabetic order by grantor, and inverse means the index in straight and continuous alphabetic order by grantee.

(5)(a) The tax collector may contract with a title company or an abstract company to provide the minimum information required in subsection (4), consistent with rules adopted by the department. If additional information is required, the tax collector must make a written request to the title or abstract company stating the additional requirements. The tax collector may select any title or abstract company, regardless of its location, as long as the fee is reasonable, the minimum information is submitted, and the title or abstract company is authorized to do business in this state. The tax collector may advertise and accept bids for the title or abstract company if he or she considers it appropriate to do so.

1. The ownership and encumbrance report must include the letterhead of the person, firm, or company that makes the search, and the signature of the individual who makes the search or of an officer of the firm. The tax collector is not liable for payment to the firm unless these requirements are met. The report may be submitted to the tax collector in an electronic format.

2. The tax collector may not accept or pay for any title search or abstract if financial responsibility is not assumed for the search. However, reasonable restrictions as to the liability or responsibility of the title or abstract company are acceptable. Notwithstanding s. 627.7843(3), the tax collector may contract for higher maximum liability limits.

3. In order to establish uniform prices for ownership and encumbrance reports within the county, the tax collector must ensure that the contract for ownership and encumbrance reports include all requests for title searches or abstracts for a given period of time.

(b) Any fee paid for a title search or abstract must be collected at the time of application under subsection (1), and the amount of the fee must be added to the opening bid.

(c) The clerk shall advertise and administer the sale and receive such fees for the issuance of the deed and sale of the property as provided in s. 28.24.

(6) The opening bid:

(a) On county-held certificates on nonhomestead property shall be the sum of the value of all outstanding certificates against the property, plus omitted years taxes, delinquent taxes, interest, and all costs and fees paid by the county.

(b) On an individual certificate must include, in addition to the amount of money paid to the tax collector by the certificateholder at the time of application, the amount required to redeem the applicant's tax certificate and all other costs and fees paid by the applicant, plus all tax certificates that were sold subsequent to the filing of the tax deed application and omitted taxes, if any.

(c) On property assessed on the latest tax roll as homestead property shall include, in addition to the amount of money required for an opening bid on nonhomestead property, an amount equal to one-half of the latest assessed value of the homestead.

(7) On county-held or individually held certificates for which there are no bidders at the public sale and for which the certificateholder fails to timely pay costs of resale or fails to pay the amounts due for issuance of a tax deed within 30 days after the sale, the clerk shall enter the land on a list entitled lands available for taxes” and shall immediately notify the county commission that the property is available. During the first 90 days after the property is placed on the list, the county may purchase the land for the opening bid or may waive its rights to purchase the property. Thereafter, any person, the county, or any other governmental unit may purchase the property from the clerk, without further notice or advertising, for the opening bid, except that if the county or other governmental unit is the purchaser for its own use, the board of county commissioners may cancel omitted years' taxes, as provided under s. 197.447. Interest on the opening bid continues to accrue through the month of sale as prescribed by s. 197.542.

(8) Taxes may not be extended against parcels listed as lands available for taxes, but in each year the taxes that would have been due shall be treated as omitted years and added to the required minimum bid. Three years after the day the land was offered for public sale, the land shall escheat to the county in which it is located, free and clear. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of no further legal force and effect, and the clerk shall execute an escheatment tax deed vesting title in the board of county commissioners of the county in which the land is located.

(a) When a property escheats to the county under this subsection, the county is not subject to any liability imposed by chapter 376 or chapter 403 for preexisting soil or groundwater contamination due solely to its ownership. However, this subsection does not affect the rights or liabilities of any past or future owners of the escheated property and does not affect the liability of any governmental entity for the results of its actions that create or exacerbate a pollution source.

(b) The county and the Department of Environmental Protection may enter into a written agreement for the performance, funding, and reimbursement of the investigative and remedial acts necessary for a property that escheats to the county.

(9) Consolidated applications on more than one tax certificate are allowed, but a separate statement shall be issued pursuant to subsection (4), and a separate tax deed shall be issued pursuant to s. 197.552, for each parcel of property shown on the tax certificate.

(10) Any fees collected pursuant to this section shall be refunded to the certificateholder in the event that the tax deed sale is canceled for any reason.

(11) For any property acquired under this section by the county for the express purpose of providing infill housing, the board of county commissioners may, in accordance with s. 197.447, cancel county-held tax certificates and omitted years' taxes on such properties. Furthermore, the county may not transfer a property acquired under this section specifically for infill housing back to a taxpayer who failed to pay the delinquent taxes or charges that led to the issuance of the tax certificate or lien. For purposes of this subsection only, the term taxpayer includes the taxpayer's family or any entity in which the taxpayer or taxpayer's family has any interest.

History. 187, ch. 85-342; s. 6, ch. 86-141; s. 27, ch. 86-152; s. 1, ch. 89-286; s. 7, ch. 92-312; s. 14, ch. 93-132; s. 1024, ch. 95-147; s. 1, ch. 96-181; s. 1, ch. 96-219; ss. 3, 4, 5, ch. 99-190; s. 3, ch. 2001-137; s. 9, ch. 2001-252; s. 1, ch. 2003-284; s. 8, ch. 2004-349; s. 1, ch. 2004-372; s. 49, ch. 2011-151; s. 1, ch. 2013-148; s. 6, ch. 2014-211.

TITLE XL REAL AND PERSONAL PROPERTY

CHAPTER 697 INSTRUMENTS DEEMED MORTGAGES AND THE NATURE OF A MORTGAGE

697.01 Instruments deemed mortgages.

(1) All conveyances, obligations conditioned or defeasible, bills of sale or other instruments of writing conveying or selling property, either real or personal, for the purpose or with the intention of securing the payment of money, whether such instrument be from the debtor to the creditor or from the debtor to some third person in trust for the creditor, shall be deemed and held mortgages, and shall be subject to the same rules of foreclosure and to the same regulations, restraints and forms as are prescribed in relation to mortgages.(2) Provided, however, that no such conveyance shall be deemed or held to be a mortgage, as against a bona fide purchaser or mortgagee, for value without notice, holding under the grantee.

History. 1, Jan. 30, 1838; s. 1, ch. 525, 1853; RS 1981; GS 2494; RGS 3836; CGL 5724; s. 12, ch. 20954, 1941.

Florida Case Law

Torcise v. Perez, 319 So.2d, 41 the issue is whether or not the purchaser or seller should maintain possession of the subject property. Held- the purchaser should maintain possession. This case shows that a contract for deed falls within 697.01.

Contracts for deed between the sellers and purchasers were intended to secure the payment of money, as provided in Fla. Stat. ch. 697.01(1), and would be deemed and held to be mortgages and subject to the same rules and regulations as mortgages; the sellers, who were in the position of mortgagees under the contracts for deed, had no right to the use or possession of the properties sold to the buyers and were enjoined from leasing the property to a third party. Torcise v. Perez, 319 So. 2d 41, 1975 Fla. App. LEXIS 15248 (Fla. Dist. Ct. App. 3d Dist. 1975).

A contract for deed wherein the seller agrees to convey title to land after the buyer pays all installments of the purchase price is merely a security device and is an alternative or substitute to an immediate conveyance of the title to the buyer with a purchase money mortgage back to the seller. Under equitable concepts, the buyer under the agreement for deed is in the same position as the purchaser-mortgagor and the seller is merely a lienor. Under the usual deed-mortgage sale arrangement, the buyer immediately receives and holds the legal title and the seller has a legal lien (mortgage) on the land; whereas under the land contract sale arrangement, the buyer immediately receives and holds the equitable title and the seller holds the bare legal title only as security for the unpaid purchase price. The form is different but the substance is the same for equitable purposes including the foreclosure procedure in the event the buyer defaults in payment of some portion of the purchase price. White v. Brousseau, 566 So.2d 832 (1990).

Florida Statutes

TITLE XIV TAXATION AND FINANCE

CHAPTER 197 TAX COLLECTIONS, SALES, AND LIENS

197.502 Application for obtaining tax deed by holder of tax sale certificate; fees.

(1) The holder of a tax certificate at any time after 2 years have elapsed since April 1 of the year of issuance of the tax certificate and before the cancellation of the certificate, may file the certificate and an application for a tax deed with the tax collector of the county where the property described in the certificate is located. The tax collector may charge a tax deed application fee of $75 and for reimbursement of the costs for providing online tax deed application services. If the tax collector charges a combined fee in excess of $75, applicants shall have the option of using the electronic tax deed application process or may file applications without using such service.(2) A certificateholder, other than the county, who makes application for a tax deed shall pay the tax collector at the time of application all amounts required for redemption or purchase of all other outstanding tax certificates, plus interest, any omitted taxes, plus interest, any delinquent taxes, plus interest, and current taxes, if due, covering the property. In addition, the certificateholder shall pay the costs of resale, if applicable, and failure to pay such costs within 30 days after notice from the clerk shall result in the clerk's entering the land on a list entitled lands available for taxes.

(3) The county in which the property described in the certificate is located shall apply for a tax deed on all county-held certificates on property valued at $5,000 or more on the property appraiser's most recent assessment roll, except deferred payment tax certificates, and may apply for tax deeds on certificates on property valued at less than $5,000 on the property appraiser's most recent assessment roll. The application shall be made 2 years after April 1 of the year of issuance of the certificates or as soon thereafter as is reasonable. Upon application, the county shall deposit with the tax collector all applicable costs and fees as provided in subsection (1), but may not deposit any money to cover the redemption of other outstanding certificates covering the property.

(4) The tax collector shall deliver to the clerk of the circuit court a statement that payment has been made for all outstanding certificates or, if the certificate is held by the county, that all appropriate fees have been deposited, and stating that the following persons are to be notified prior to the sale of the property:

(a) Any legal titleholder of record if the address of the owner appears on the record of conveyance of the property to the owner. However, if the legal titleholder of record is the same as the person to whom the property was assessed on the tax roll for the year in which the property was last assessed, the notice may be mailed to the address of the legal titleholder as it appears on the latest assessment roll.

(b) Any lienholder of record who has recorded a lien against the property described in the tax certificate if an address appears on the recorded lien.

(c) Any mortgagee of record if an address appears on the recorded mortgage.

(d) Any vendee of a recorded contract for deed if an address appears on the recorded contract or, if the contract is not recorded, any vendee who has applied to receive notice pursuant to s. 197.344(1)(c).

(e) Any other lienholder who has applied to the tax collector to receive notice if an address is supplied to the collector.

(f) Any person to whom the property was assessed on the tax roll for the year in which the property was last assessed.

(g) Any lienholder of record who has recorded a lien against a mobile home located on the property described in the tax certificate if an address appears on the recorded lien and if the lien is recorded with the clerk of the circuit court in the county where the mobile home is located.

(h) Any legal titleholder of record of property that is contiguous to the property described in the tax certificate, if the property described is submerged land or common elements of a subdivision and if the address of the titleholder of contiguous property appears on the record of conveyance of the property to the legal titleholder. However, if the legal titleholder of property contiguous to the property is the same as the person to whom the property described in the tax certificate was assessed on the tax roll for the year in which the property was last assessed, the notice may be mailed to the address of the legal titleholder as it appears on the latest assessment roll. As used in this chapter, the term contiguous means touching, meeting, or joining at the surface or border, other than at a corner or a single point, and not separated by submerged lands. Submerged lands lying below the ordinary high-water mark which are sovereignty lands are not part of the upland contiguous property for purposes of notification.

The statement must be signed by the tax collector or the tax collector's designee. The tax collector may purchase a reasonable bond for errors and omissions of his or her office in making such statement. The search of the official records must be made by a direct and inverse search. Direct means the index in straight and continuous alphabetic order by grantor, and inverse means the index in straight and continuous alphabetic order by grantee.

(5)(a) The tax collector may contract with a title company or an abstract company to provide the minimum information required in subsection (4), consistent with rules adopted by the department. If additional information is required, the tax collector must make a written request to the title or abstract company stating the additional requirements. The tax collector may select any title or abstract company, regardless of its location, as long as the fee is reasonable, the minimum information is submitted, and the title or abstract company is authorized to do business in this state. The tax collector may advertise and accept bids for the title or abstract company if he or she considers it appropriate to do so.

1. The ownership and encumbrance report must include the letterhead of the person, firm, or company that makes the search, and the signature of the individual who makes the search or of an officer of the firm. The tax collector is not liable for payment to the firm unless these requirements are met. The report may be submitted to the tax collector in an electronic format.

2. The tax collector may not accept or pay for any title search or abstract if financial responsibility is not assumed for the search. However, reasonable restrictions as to the liability or responsibility of the title or abstract company are acceptable. Notwithstanding s. 627.7843(3), the tax collector may contract for higher maximum liability limits.

3. In order to establish uniform prices for ownership and encumbrance reports within the county, the tax collector must ensure that the contract for ownership and encumbrance reports include all requests for title searches or abstracts for a given period of time.

(b) Any fee paid for a title search or abstract must be collected at the time of application under subsection (1), and the amount of the fee must be added to the opening bid.

(c) The clerk shall advertise and administer the sale and receive such fees for the issuance of the deed and sale of the property as provided in s. 28.24.

(6) The opening bid:

(a) On county-held certificates on nonhomestead property shall be the sum of the value of all outstanding certificates against the property, plus omitted years taxes, delinquent taxes, interest, and all costs and fees paid by the county.

(b) On an individual certificate must include, in addition to the amount of money paid to the tax collector by the certificateholder at the time of application, the amount required to redeem the applicant's tax certificate and all other costs and fees paid by the applicant, plus all tax certificates that were sold subsequent to the filing of the tax deed application and omitted taxes, if any.

(c) On property assessed on the latest tax roll as homestead property shall include, in addition to the amount of money required for an opening bid on nonhomestead property, an amount equal to one-half of the latest assessed value of the homestead.

(7) On county-held or individually held certificates for which there are no bidders at the public sale and for which the certificateholder fails to timely pay costs of resale or fails to pay the amounts due for issuance of a tax deed within 30 days after the sale, the clerk shall enter the land on a list entitled lands available for taxes” and shall immediately notify the county commission that the property is available. During the first 90 days after the property is placed on the list, the county may purchase the land for the opening bid or may waive its rights to purchase the property. Thereafter, any person, the county, or any other governmental unit may purchase the property from the clerk, without further notice or advertising, for the opening bid, except that if the county or other governmental unit is the purchaser for its own use, the board of county commissioners may cancel omitted years' taxes, as provided under s. 197.447. Interest on the opening bid continues to accrue through the month of sale as prescribed by s. 197.542.

(8) Taxes may not be extended against parcels listed as lands available for taxes, but in each year the taxes that would have been due shall be treated as omitted years and added to the required minimum bid. Three years after the day the land was offered for public sale, the land shall escheat to the county in which it is located, free and clear. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of no further legal force and effect, and the clerk shall execute an escheatment tax deed vesting title in the board of county commissioners of the county in which the land is located.

(a) When a property escheats to the county under this subsection, the county is not subject to any liability imposed by chapter 376 or chapter 403 for preexisting soil or groundwater contamination due solely to its ownership. However, this subsection does not affect the rights or liabilities of any past or future owners of the escheated property and does not affect the liability of any governmental entity for the results of its actions that create or exacerbate a pollution source.

(b) The county and the Department of Environmental Protection may enter into a written agreement for the performance, funding, and reimbursement of the investigative and remedial acts necessary for a property that escheats to the county.

(9) Consolidated applications on more than one tax certificate are allowed, but a separate statement shall be issued pursuant to subsection (4), and a separate tax deed shall be issued pursuant to s. 197.552, for each parcel of property shown on the tax certificate.

(10) Any fees collected pursuant to this section shall be refunded to the certificateholder in the event that the tax deed sale is canceled for any reason.

(11) For any property acquired under this section by the county for the express purpose of providing infill housing, the board of county commissioners may, in accordance with s. 197.447, cancel county-held tax certificates and omitted years' taxes on such properties. Furthermore, the county may not transfer a property acquired under this section specifically for infill housing back to a taxpayer who failed to pay the delinquent taxes or charges that led to the issuance of the tax certificate or lien. For purposes of this subsection only, the term taxpayer includes the taxpayer's family or any entity in which the taxpayer or taxpayer's family has any interest.

History. 187, ch. 85-342; s. 6, ch. 86-141; s. 27, ch. 86-152; s. 1, ch. 89-286; s. 7, ch. 92-312; s. 14, ch. 93-132; s. 1024, ch. 95-147; s. 1, ch. 96-181; s. 1, ch. 96-219; ss. 3, 4, 5, ch. 99-190; s. 3, ch. 2001-137; s. 9, ch. 2001-252; s. 1, ch. 2003-284; s. 8, ch. 2004-349; s. 1, ch. 2004-372; s. 49, ch. 2011-151; s. 1, ch. 2013-148; s. 6, ch. 2014-211.

TITLE XL REAL AND PERSONAL PROPERTY

CHAPTER 697 INSTRUMENTS DEEMED MORTGAGES AND THE NATURE OF A MORTGAGE

697.01 Instruments deemed mortgages.

(1) All conveyances, obligations conditioned or defeasible, bills of sale or other instruments of writing conveying or selling property, either real or personal, for the purpose or with the intention of securing the payment of money, whether such instrument be from the debtor to the creditor or from the debtor to some third person in trust for the creditor, shall be deemed and held mortgages, and shall be subject to the same rules of foreclosure and to the same regulations, restraints and forms as are prescribed in relation to mortgages.(2) Provided, however, that no such conveyance shall be deemed or held to be a mortgage, as against a bona fide purchaser or mortgagee, for value without notice, holding under the grantee.

History. 1, Jan. 30, 1838; s. 1, ch. 525, 1853; RS 1981; GS 2494; RGS 3836; CGL 5724; s. 12, ch. 20954, 1941.

Florida Case Law

Torcise v. Perez, 319 So.2d, 41 the issue is whether or not the purchaser or seller should maintain possession of the subject property. Held- the purchaser should maintain possession. This case shows that a contract for deed falls within 697.01.

Contracts for deed between the sellers and purchasers were intended to secure the payment of money, as provided in Fla. Stat. ch. 697.01(1), and would be deemed and held to be mortgages and subject to the same rules and regulations as mortgages; the sellers, who were in the position of mortgagees under the contracts for deed, had no right to the use or possession of the properties sold to the buyers and were enjoined from leasing the property to a third party. Torcise v. Perez, 319 So. 2d 41, 1975 Fla. App. LEXIS 15248 (Fla. Dist. Ct. App. 3d Dist. 1975).

A contract for deed wherein the seller agrees to convey title to land after the buyer pays all installments of the purchase price is merely a security device and is an alternative or substitute to an immediate conveyance of the title to the buyer with a purchase money mortgage back to the seller. Under equitable concepts, the buyer under the agreement for deed is in the same position as the purchaser-mortgagor and the seller is merely a lienor. Under the usual deed-mortgage sale arrangement, the buyer immediately receives and holds the legal title and the seller has a legal lien (mortgage) on the land; whereas under the land contract sale arrangement, the buyer immediately receives and holds the equitable title and the seller holds the bare legal title only as security for the unpaid purchase price. The form is different but the substance is the same for equitable purposes including the foreclosure procedure in the event the buyer defaults in payment of some portion of the purchase price. White v. Brousseau, 566 So.2d 832 (1990).