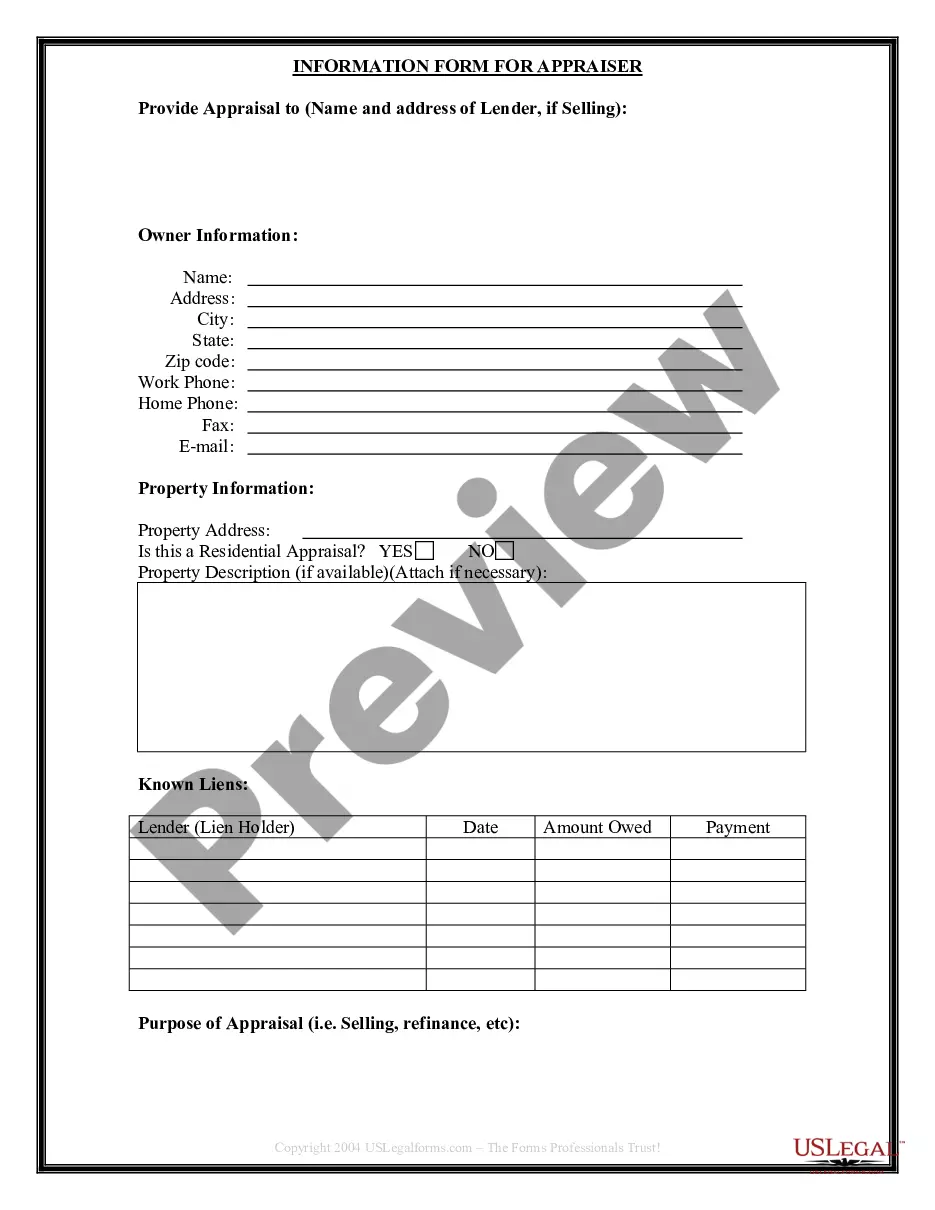

This Seller's Information for Appraiser provided to Buyer form is used by the Buyer in Florida to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Miami-Dade Florida Seller's Information for Appraiser is a comprehensive document used during a real estate transaction to provide crucial details about the property being sold. This information serves as a valuable resource for appraisers who assess the fair market value of the property, allowing them to make informed judgments and accurate appraisals. Below are some essential types of Miami-Dade Florida Seller's Information for Appraiser that are typically provided to the buyer: 1. Property Description: This section includes detailed information about the property, such as its address, legal description, lot size, and zoning. It provides appraisers with essential information to identify and locate the property accurately. 2. Property History: This segment outlines the historical background of the property, including its previous owners, sales history, and any past renovations or upgrades. It provides the appraiser with a historical perspective on the property's value and potential appreciation. 3. Disclosures: This section discloses any known issues or defects with the property that may impact its value. It includes information about structural problems, pest infestations, water damage, lead-based paint, asbestos, or any other environmental hazards. These disclosures allow the appraiser to consider potential issues while evaluating the property's worth. 4. Comparable Sales: This part presents recent comparable sales in the neighborhood or surrounding area. It includes information such as the sale price, square footage, number of bedrooms and bathrooms, and other relevant details. By comparing the subject property with similar properties, appraisers can determine an accurate market value. 5. Neighborhood Information: This segment provides details about the local community, highlighting amenities, schools, parks, transportation, and accessibility to public services. The neighborhood's characteristics significantly impact property values, and this information helps appraisers assess the property within its broader community context. 6. Additional Documentation: Depending on the property's specifics, additional documentation may be required. This can include surveys, floor plans, building permits, HOA/condo association documents, property tax records, title reports, or any other relevant paperwork. These documents offer substantial support to the appraiser in validating the property's value. By providing Miami-Dade Florida Seller's Information for Appraiser to the buyer, the seller enables the appraiser to conduct a thorough and accurate assessment. This information equips the appraiser with the necessary data and context to evaluate the property's fair market value, ensuring a reliable appraisal that benefits both the buyer and seller.Miami-Dade Florida Seller's Information for Appraiser is a comprehensive document used during a real estate transaction to provide crucial details about the property being sold. This information serves as a valuable resource for appraisers who assess the fair market value of the property, allowing them to make informed judgments and accurate appraisals. Below are some essential types of Miami-Dade Florida Seller's Information for Appraiser that are typically provided to the buyer: 1. Property Description: This section includes detailed information about the property, such as its address, legal description, lot size, and zoning. It provides appraisers with essential information to identify and locate the property accurately. 2. Property History: This segment outlines the historical background of the property, including its previous owners, sales history, and any past renovations or upgrades. It provides the appraiser with a historical perspective on the property's value and potential appreciation. 3. Disclosures: This section discloses any known issues or defects with the property that may impact its value. It includes information about structural problems, pest infestations, water damage, lead-based paint, asbestos, or any other environmental hazards. These disclosures allow the appraiser to consider potential issues while evaluating the property's worth. 4. Comparable Sales: This part presents recent comparable sales in the neighborhood or surrounding area. It includes information such as the sale price, square footage, number of bedrooms and bathrooms, and other relevant details. By comparing the subject property with similar properties, appraisers can determine an accurate market value. 5. Neighborhood Information: This segment provides details about the local community, highlighting amenities, schools, parks, transportation, and accessibility to public services. The neighborhood's characteristics significantly impact property values, and this information helps appraisers assess the property within its broader community context. 6. Additional Documentation: Depending on the property's specifics, additional documentation may be required. This can include surveys, floor plans, building permits, HOA/condo association documents, property tax records, title reports, or any other relevant paperwork. These documents offer substantial support to the appraiser in validating the property's value. By providing Miami-Dade Florida Seller's Information for Appraiser to the buyer, the seller enables the appraiser to conduct a thorough and accurate assessment. This information equips the appraiser with the necessary data and context to evaluate the property's fair market value, ensuring a reliable appraisal that benefits both the buyer and seller.