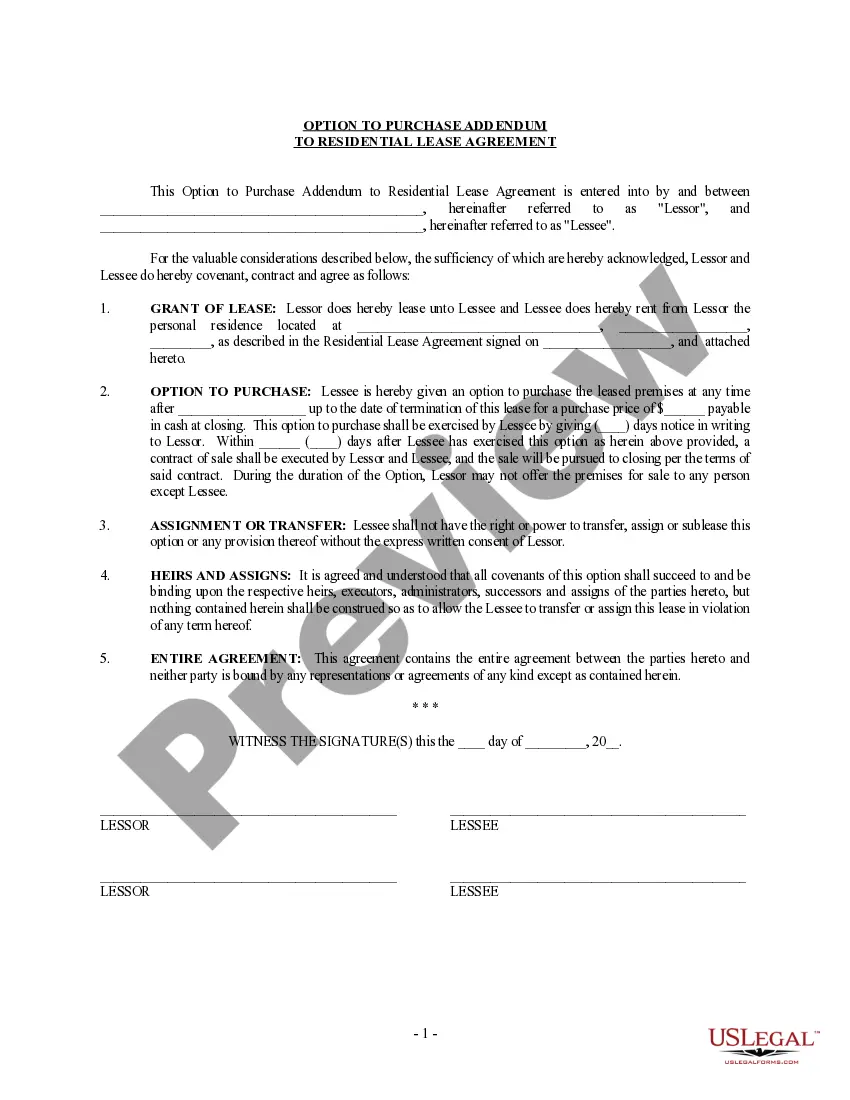

This Option to Purchase Addendum to Residential and Lease Agreement is entered into by and between the lessor and the lessee. The lessor agrees not to offer the residence for sale to anyone during the term of the lease, and to give the lessee (tenant) the option to purchase the residence at any time prior to the expiration of the lease, provided the lessee gives notice of intent to purchase in accordance with the provisions of the Addendum. At that point, a separate contract of sale will be executed and the sale will proceed as any sale would.

Please note: This Addendum form is NOT a lease agreement. You will need a separate Residential Lease Agreement. The Addendum would be attached to that Agreement

The Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legal document that provides tenants with the opportunity to potentially purchase the property they are currently leasing within a specified period. This addendum acts as an agreement between the landlord and the tenant, offering flexibility and an alternative pathway to homeownership. The Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is particularly beneficial for individuals who may not qualify for a traditional mortgage at the moment but wish to work towards homeownership in the future. It allows tenants to set aside a portion of their monthly rent to be used as a potential down payment or to build up their creditworthiness for obtaining a mortgage later. There are different types of Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, depending on various factors such as the agreed-upon purchase price, the length of the option period, and the terms and conditions regarding the option fee or rent credit. Some variations of this addendum might include: 1. Fixed Purchase Price Option Addendum: This type of addendum specifies a fixed purchase price for the property, which remains unchanged during the option period. This enables tenants to have a clear idea of the amount they need to save or secure for mortgage approval. 2. Rent Credit Option Addendum: In this type, a portion of the monthly rent paid by the tenant is credited towards the purchase price if the tenant decides to exercise the option to buy. This arrangement incentivizes tenants to stay in the property and accumulate equity through their rental payments, potentially reducing the overall purchase price. 3. Adjustable Purchase Price Option Addendum: With this addendum, the purchase price is determined at the end of the option period based on market conditions or an agreed-upon formula. This flexibility allows tenants to benefit from any property value appreciation during the lease term. 4. Short-term Option Addendum: This variation offers a relatively short option period, usually ranging from six months to two years. It may suit tenants who anticipate changes in their financial situation or want to evaluate the property and their readiness for homeownership within a shorter time frame. Ultimately, the Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own provides tenants in Orange County, Florida, with an opportunity to rent a property while exploring the possibility of purchasing it in the future. This addendum presents a mutually beneficial arrangement for landlords and tenants, offering increased flexibility and potential pathways to homeownership.The Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legal document that provides tenants with the opportunity to potentially purchase the property they are currently leasing within a specified period. This addendum acts as an agreement between the landlord and the tenant, offering flexibility and an alternative pathway to homeownership. The Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is particularly beneficial for individuals who may not qualify for a traditional mortgage at the moment but wish to work towards homeownership in the future. It allows tenants to set aside a portion of their monthly rent to be used as a potential down payment or to build up their creditworthiness for obtaining a mortgage later. There are different types of Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, depending on various factors such as the agreed-upon purchase price, the length of the option period, and the terms and conditions regarding the option fee or rent credit. Some variations of this addendum might include: 1. Fixed Purchase Price Option Addendum: This type of addendum specifies a fixed purchase price for the property, which remains unchanged during the option period. This enables tenants to have a clear idea of the amount they need to save or secure for mortgage approval. 2. Rent Credit Option Addendum: In this type, a portion of the monthly rent paid by the tenant is credited towards the purchase price if the tenant decides to exercise the option to buy. This arrangement incentivizes tenants to stay in the property and accumulate equity through their rental payments, potentially reducing the overall purchase price. 3. Adjustable Purchase Price Option Addendum: With this addendum, the purchase price is determined at the end of the option period based on market conditions or an agreed-upon formula. This flexibility allows tenants to benefit from any property value appreciation during the lease term. 4. Short-term Option Addendum: This variation offers a relatively short option period, usually ranging from six months to two years. It may suit tenants who anticipate changes in their financial situation or want to evaluate the property and their readiness for homeownership within a shorter time frame. Ultimately, the Orange Florida Option to Purchase Addendum to Residential Lease — Lease or Rent to Own provides tenants in Orange County, Florida, with an opportunity to rent a property while exploring the possibility of purchasing it in the future. This addendum presents a mutually beneficial arrangement for landlords and tenants, offering increased flexibility and potential pathways to homeownership.