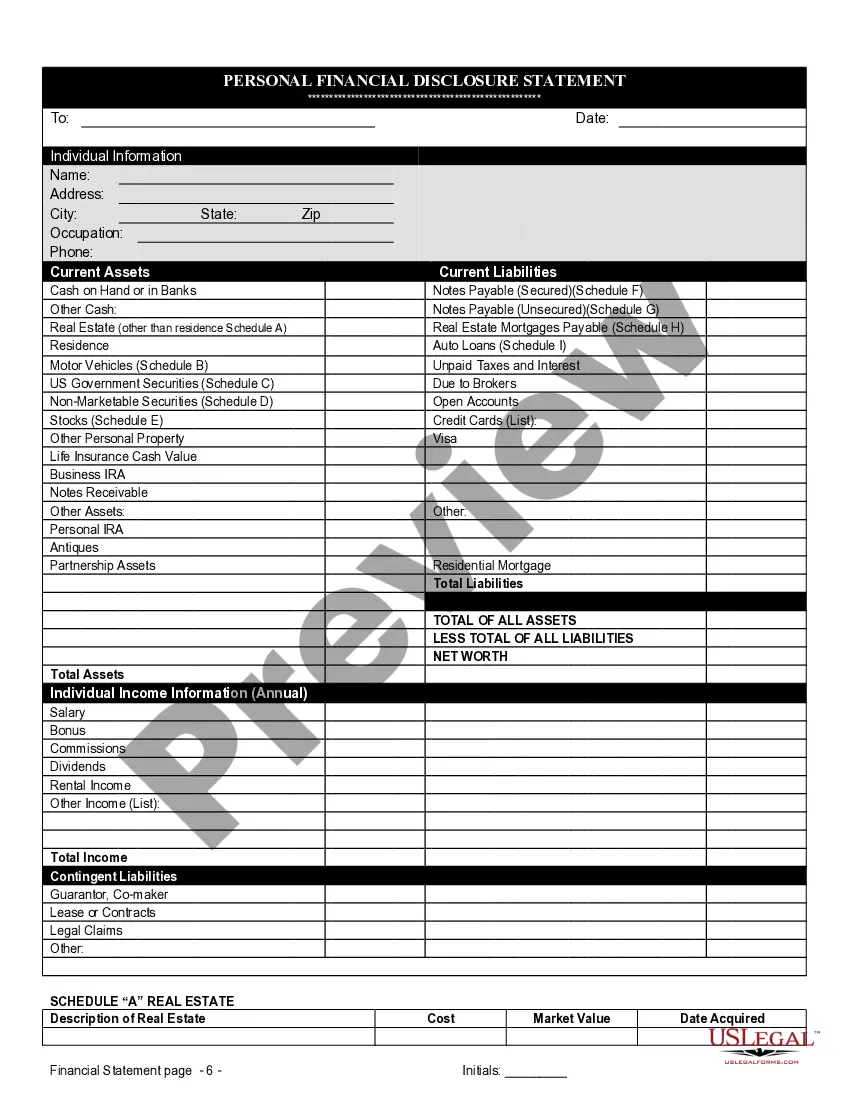

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

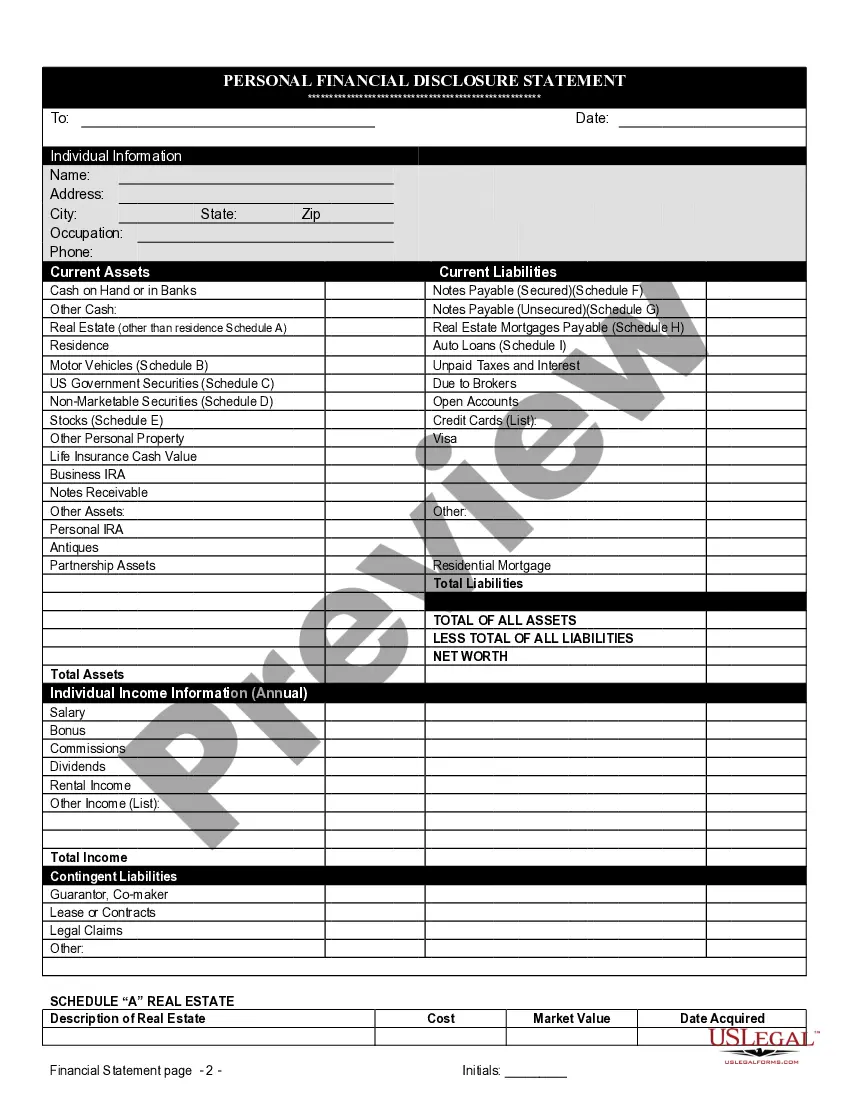

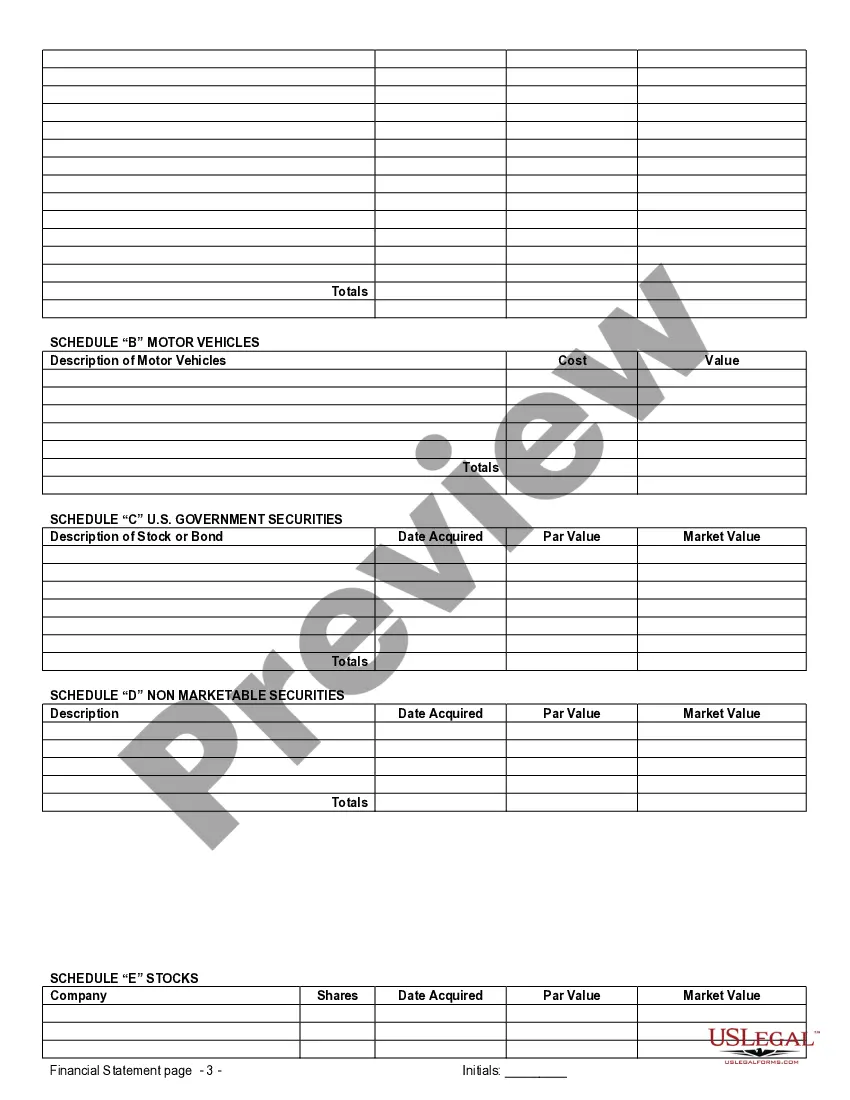

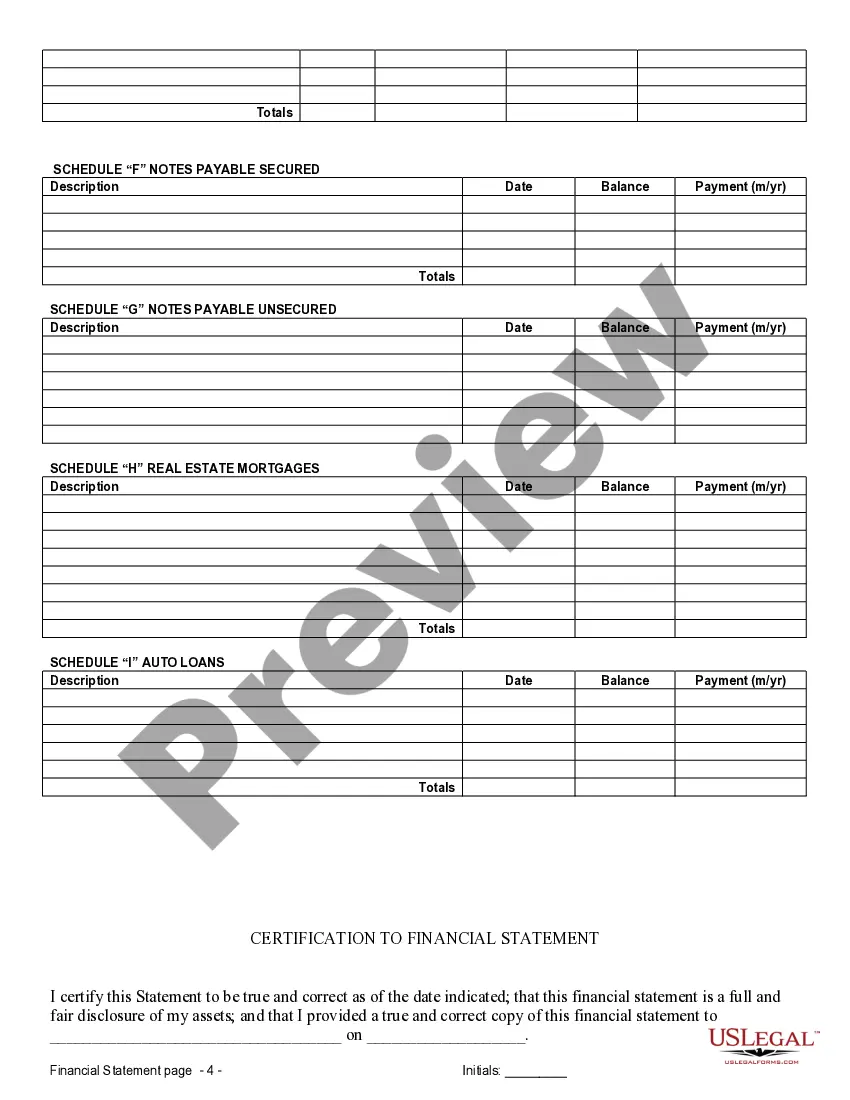

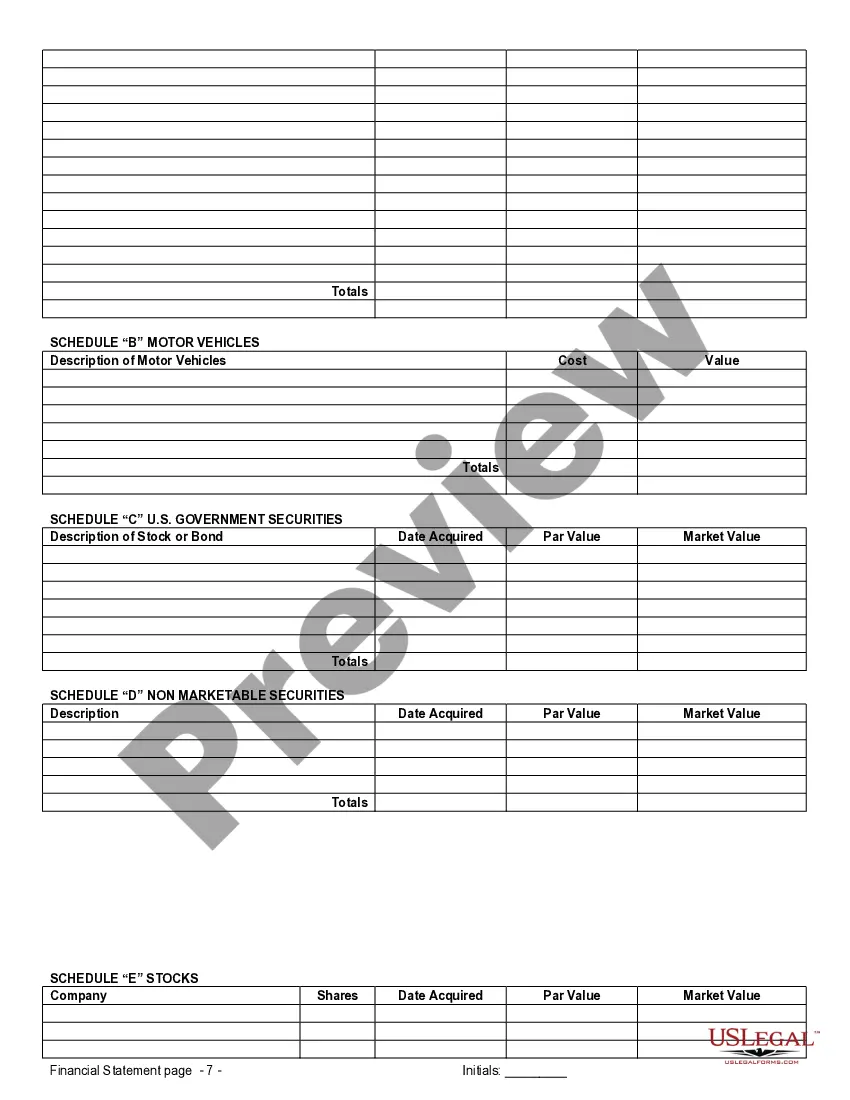

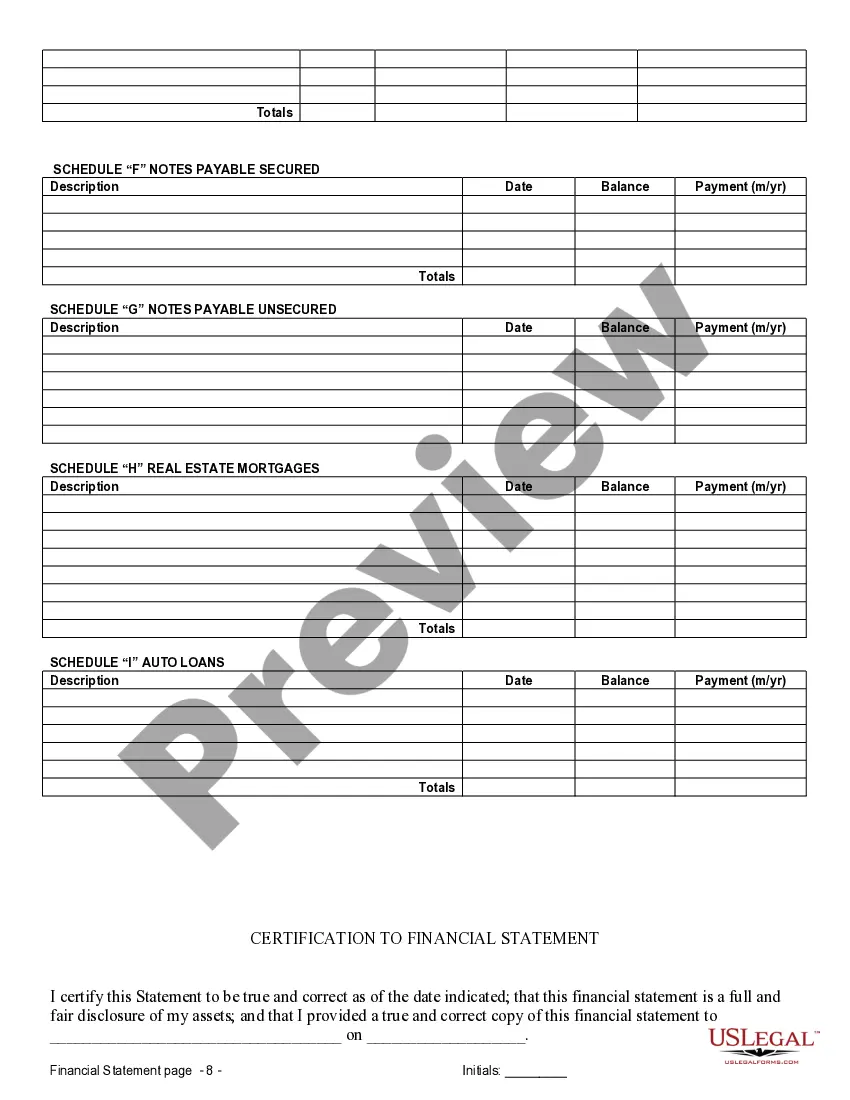

Broward Florida Financial Statements are important documents used in connection with prenuptial (premarital) agreements. These statements serve as a comprehensive record of an individual's financial status and are typically prepared during the legal process of drafting a prenuptial agreement in Broward County, Florida. These statements are vital in facilitating open and honest discussions about finances between the parties involved. They provide a detailed overview of each party's assets, liabilities, income, expenses, and financial history, helping establish a clear understanding of the financial situation. Different types of Broward Florida Financial Statements commonly associated with prenuptial agreements include: 1. Personal Financial Statement: This includes a thorough analysis of an individual's personal financial information, including bank accounts, investments, real estate holdings, retirement accounts, vehicles, and any outstanding debts or loans. 2. Income Statement: This statement focuses on an individual's income and earnings, including salary, bonuses, dividends, interest income, rental income, and any other sources of revenue. It may also include projected future income estimates. 3. Expense Statement: This statement outlines an individual's regular and recurring expenses, including living expenses, insurance premiums, loan payments, education costs, medical expenses, and other financial obligations. 4. Asset Statement: This document identifies and values all the assets owned by each party, such as cash, stocks, bonds, mutual funds, real estate properties, vehicles, valuable personal items, and any other investments. 5. Debt Statement: This statement lists all outstanding debts or liabilities, such as mortgages, loans, credit card debts, student loans, and any other financial obligations that the party may have. 6. Credit Report: Although not technically a financial statement, a credit report is often included as part of the overall financial picture. It provides an overview of an individual's credit history and current credit standing, including credit scores and any outstanding debts or collections. These financial statements play a crucial role in prenuptial agreements, as they help determine how assets and debts will be divided or protected in the event of a divorce or separation. By providing a comprehensive snapshot of each party's financial situation, these statements ensure transparency and help establish fairness and clarity in the agreement. It is important to consult with an experienced family law attorney in Broward County, Florida to ensure the accuracy and legality of these financial statements when drafting a prenuptial agreement. Legal guidance is instrumental in preparing and presenting these statements accurately, satisfying the necessary legal requirements, and protecting both parties' interests.Broward Florida Financial Statements are important documents used in connection with prenuptial (premarital) agreements. These statements serve as a comprehensive record of an individual's financial status and are typically prepared during the legal process of drafting a prenuptial agreement in Broward County, Florida. These statements are vital in facilitating open and honest discussions about finances between the parties involved. They provide a detailed overview of each party's assets, liabilities, income, expenses, and financial history, helping establish a clear understanding of the financial situation. Different types of Broward Florida Financial Statements commonly associated with prenuptial agreements include: 1. Personal Financial Statement: This includes a thorough analysis of an individual's personal financial information, including bank accounts, investments, real estate holdings, retirement accounts, vehicles, and any outstanding debts or loans. 2. Income Statement: This statement focuses on an individual's income and earnings, including salary, bonuses, dividends, interest income, rental income, and any other sources of revenue. It may also include projected future income estimates. 3. Expense Statement: This statement outlines an individual's regular and recurring expenses, including living expenses, insurance premiums, loan payments, education costs, medical expenses, and other financial obligations. 4. Asset Statement: This document identifies and values all the assets owned by each party, such as cash, stocks, bonds, mutual funds, real estate properties, vehicles, valuable personal items, and any other investments. 5. Debt Statement: This statement lists all outstanding debts or liabilities, such as mortgages, loans, credit card debts, student loans, and any other financial obligations that the party may have. 6. Credit Report: Although not technically a financial statement, a credit report is often included as part of the overall financial picture. It provides an overview of an individual's credit history and current credit standing, including credit scores and any outstanding debts or collections. These financial statements play a crucial role in prenuptial agreements, as they help determine how assets and debts will be divided or protected in the event of a divorce or separation. By providing a comprehensive snapshot of each party's financial situation, these statements ensure transparency and help establish fairness and clarity in the agreement. It is important to consult with an experienced family law attorney in Broward County, Florida to ensure the accuracy and legality of these financial statements when drafting a prenuptial agreement. Legal guidance is instrumental in preparing and presenting these statements accurately, satisfying the necessary legal requirements, and protecting both parties' interests.