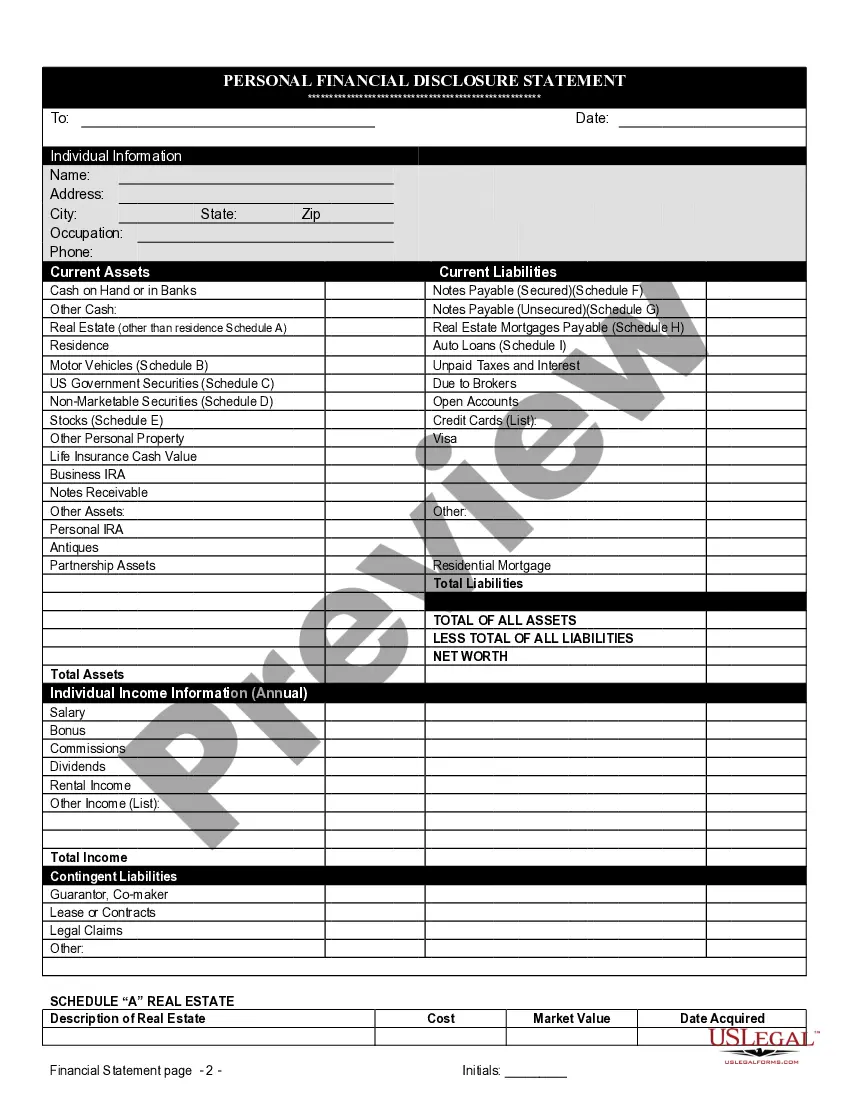

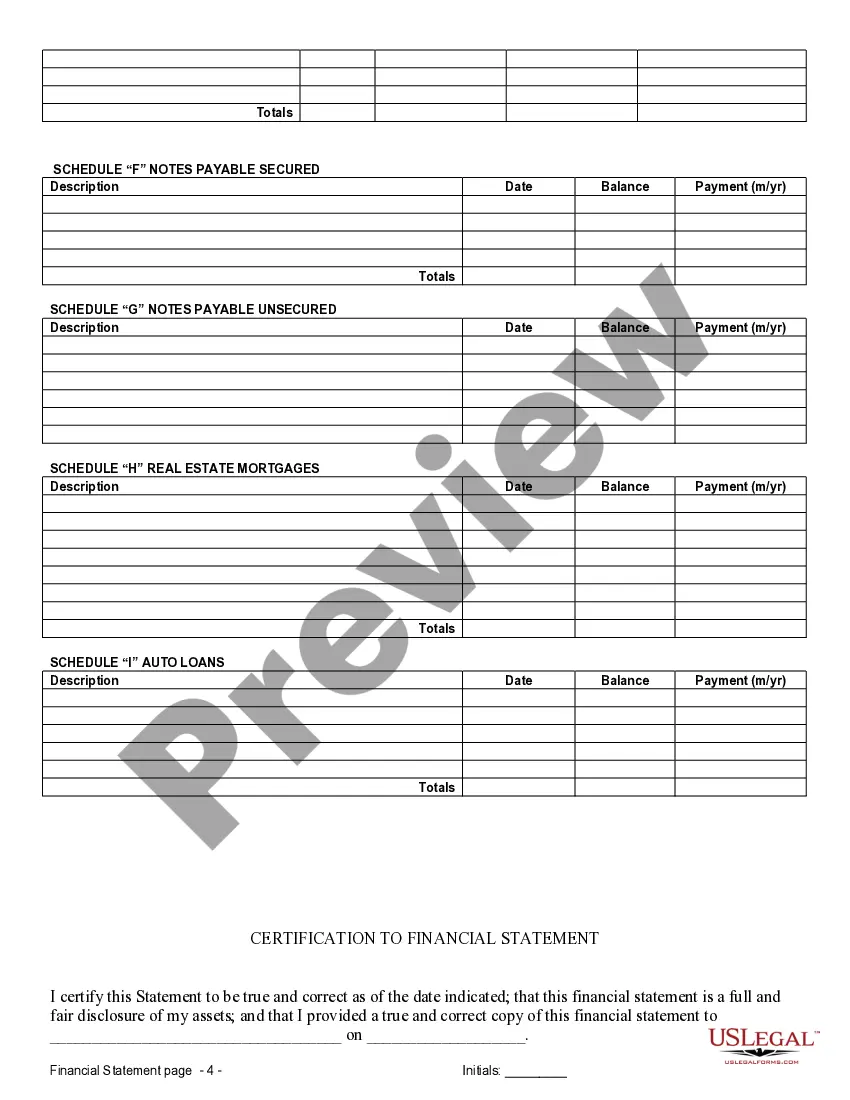

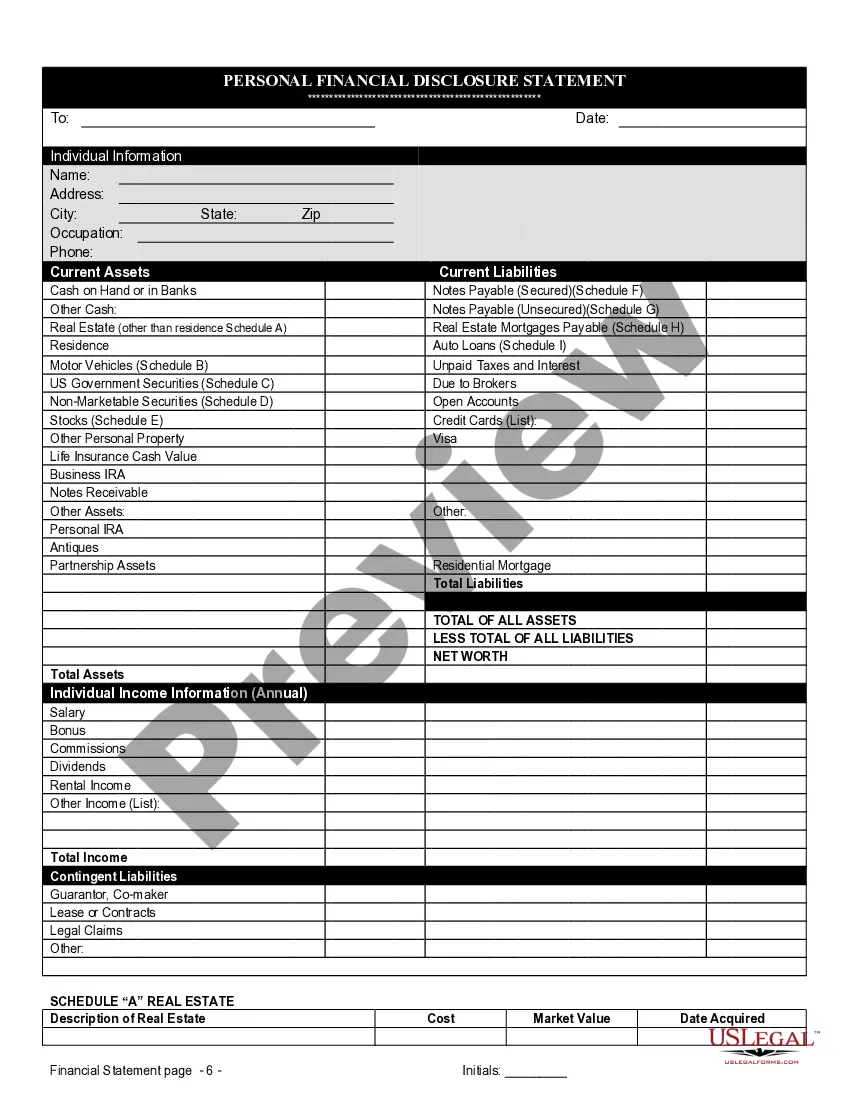

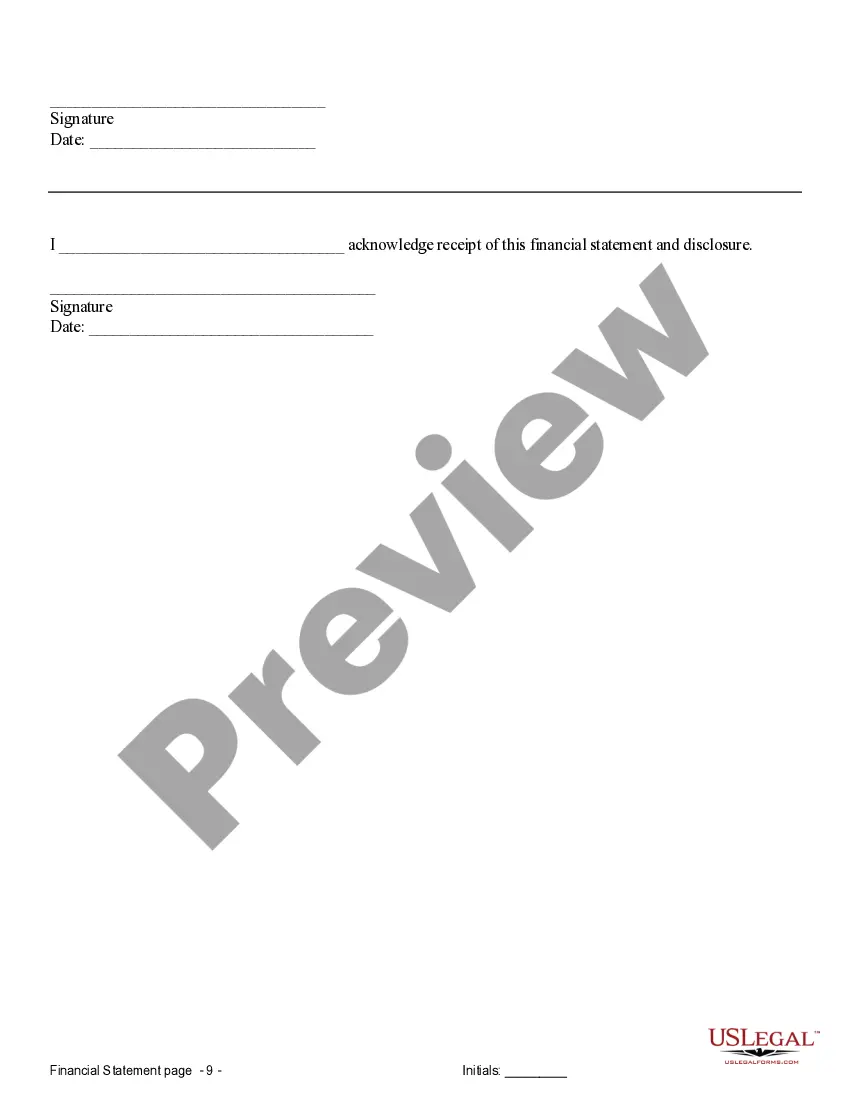

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

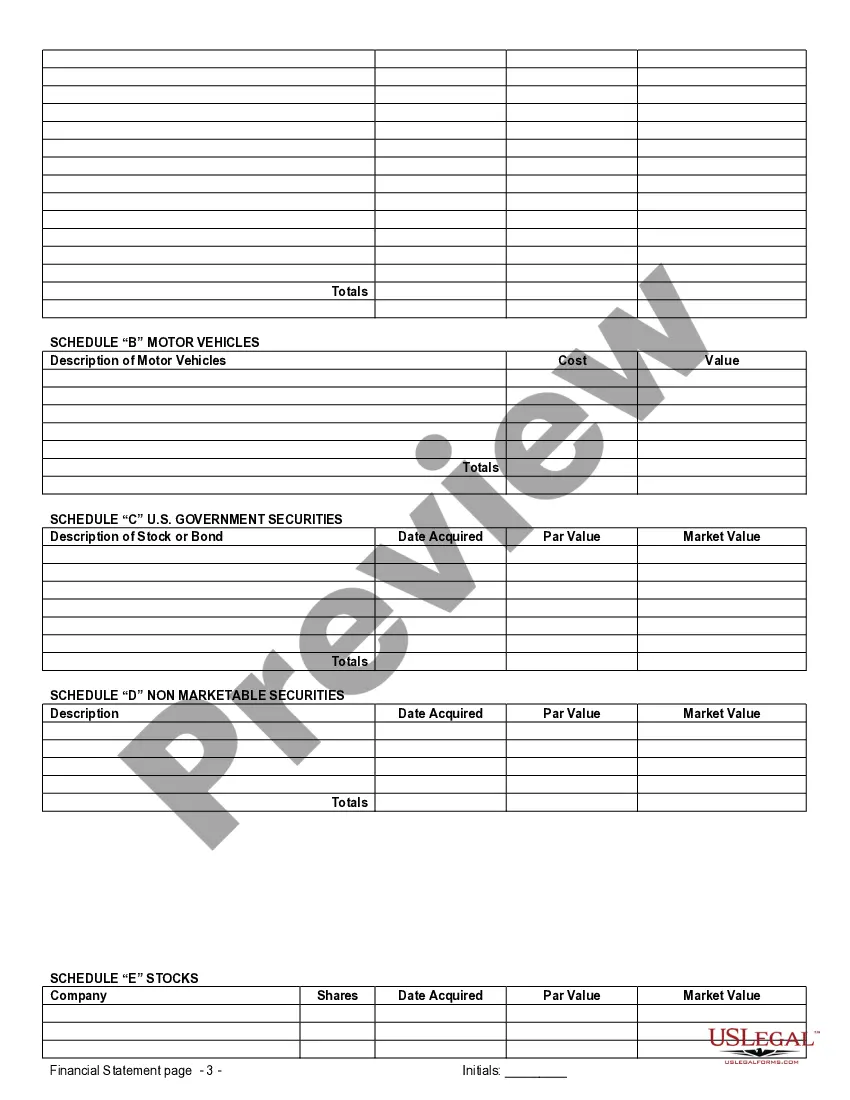

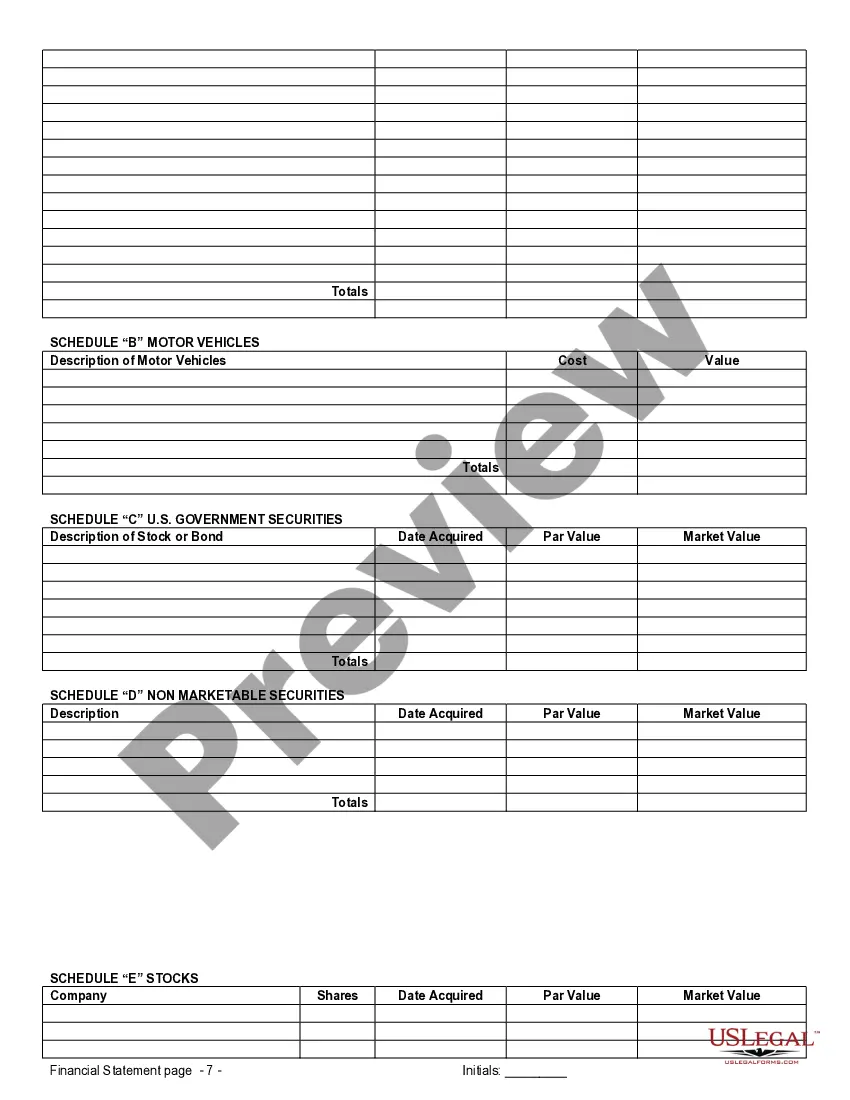

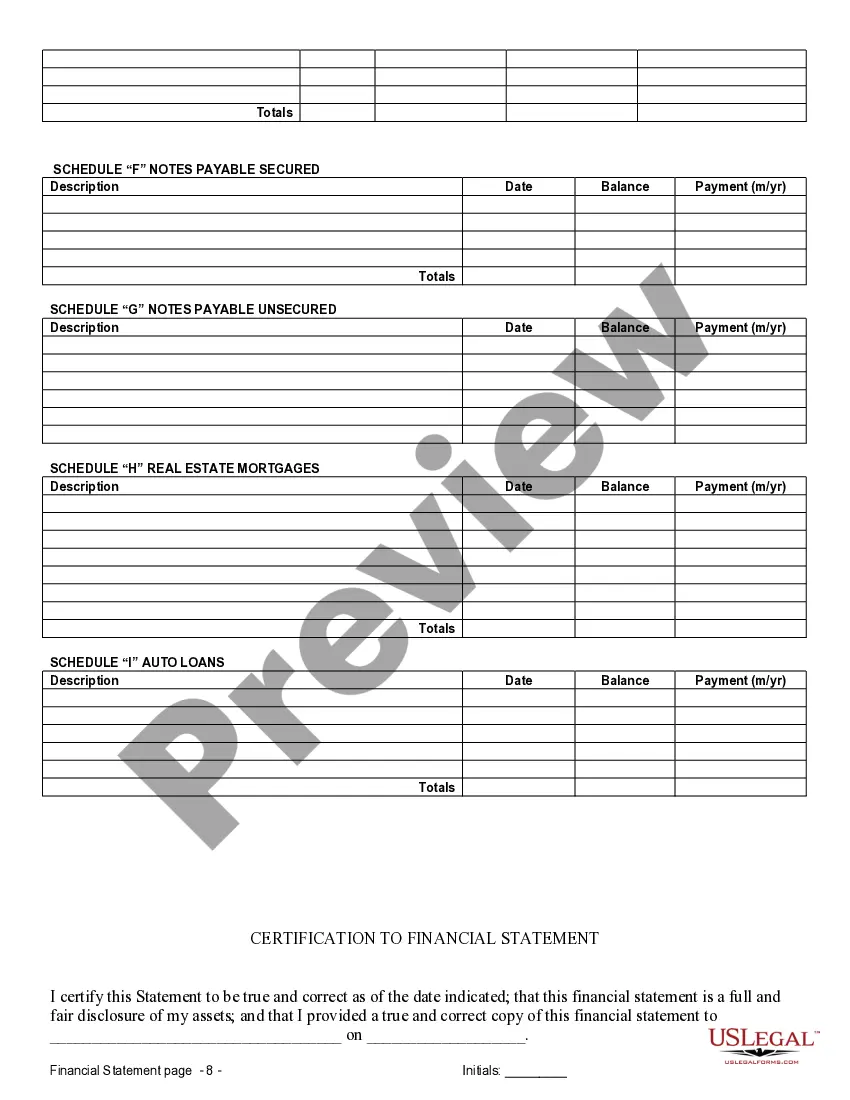

Cape Coral, Florida Financial Statements: A Crucial Component of Prenuptial Premarital Agreements In the beautiful coastal city of Cape Coral, Florida, financial statements play a vital role in prenuptial/premarital agreements. These documents provide a comprehensive overview of an individual's financial situation, assets, liabilities, and income, ensuring transparency and safeguarding the interests of both parties before entering into marriage. The financial statements involved in a Cape Coral prenuptial/premarital agreement vary depending on the specific circumstances of each couple. However, some common types of financial statements that might be included are: 1. Personal Financial Statement: The personal financial statement is a comprehensive document that outlines an individual's assets, liabilities, income, and expenses. It includes details such as bank account balances, investments, real estate, debts, and any other financial interests or obligations. This statement provides a comprehensive snapshot of an individual's financial health, forming a foundation for the prenuptial agreement. 2. Business Financial Statement: If one or both parties own a business, a business financial statement may be required. This document presents detailed information about the company's assets, financial performance, and liabilities. It helps assess the business's value and potential impact on the marriage, influencing the terms of the prenuptial agreement related to business ownership or division. 3. Property and Real Estate Statement: In Cape Coral, Florida, a city known for its sprawling waterfront properties, a property and real estate statement is often necessary. This statement outlines the details of any real estate owned by either party involved in the prenuptial agreement. It includes information such as property values, mortgages, liens, and any other relevant property-related financial considerations for equitable division in case of a marital dissolution. 4. Retirement Account Statements: If one or both individuals have retirement accounts, such as 401(k)s or IRAs, their statements become crucial. These documents offer insights into the value, contributions, and beneficiary designations of retirement savings. They ensure transparency and facilitate discussions on how these assets should be divided or protected in the event of divorce or separation. 5. Debt Statement: Debt statements disclose any liabilities an individual may have, such as student loans, credit card debts, personal loans, or outstanding obligations. These statements help determine how debts should be allocated in the prenuptial agreement and provide a comprehensive understanding of each party's total financial picture. In conclusion, Cape Coral, Florida financial statements are a vital component in prenuptial/premarital agreements. These statements, which can include personal financial statements, business financial statements, property and real estate statements, retirement account statements, and debt statements, help safeguard the interests of both parties involved and ensure transparency regarding financial matters. By providing a detailed overview of each individual's financial situation, these statements help pave the way for an equitable and informed prenuptial agreement.Cape Coral, Florida Financial Statements: A Crucial Component of Prenuptial Premarital Agreements In the beautiful coastal city of Cape Coral, Florida, financial statements play a vital role in prenuptial/premarital agreements. These documents provide a comprehensive overview of an individual's financial situation, assets, liabilities, and income, ensuring transparency and safeguarding the interests of both parties before entering into marriage. The financial statements involved in a Cape Coral prenuptial/premarital agreement vary depending on the specific circumstances of each couple. However, some common types of financial statements that might be included are: 1. Personal Financial Statement: The personal financial statement is a comprehensive document that outlines an individual's assets, liabilities, income, and expenses. It includes details such as bank account balances, investments, real estate, debts, and any other financial interests or obligations. This statement provides a comprehensive snapshot of an individual's financial health, forming a foundation for the prenuptial agreement. 2. Business Financial Statement: If one or both parties own a business, a business financial statement may be required. This document presents detailed information about the company's assets, financial performance, and liabilities. It helps assess the business's value and potential impact on the marriage, influencing the terms of the prenuptial agreement related to business ownership or division. 3. Property and Real Estate Statement: In Cape Coral, Florida, a city known for its sprawling waterfront properties, a property and real estate statement is often necessary. This statement outlines the details of any real estate owned by either party involved in the prenuptial agreement. It includes information such as property values, mortgages, liens, and any other relevant property-related financial considerations for equitable division in case of a marital dissolution. 4. Retirement Account Statements: If one or both individuals have retirement accounts, such as 401(k)s or IRAs, their statements become crucial. These documents offer insights into the value, contributions, and beneficiary designations of retirement savings. They ensure transparency and facilitate discussions on how these assets should be divided or protected in the event of divorce or separation. 5. Debt Statement: Debt statements disclose any liabilities an individual may have, such as student loans, credit card debts, personal loans, or outstanding obligations. These statements help determine how debts should be allocated in the prenuptial agreement and provide a comprehensive understanding of each party's total financial picture. In conclusion, Cape Coral, Florida financial statements are a vital component in prenuptial/premarital agreements. These statements, which can include personal financial statements, business financial statements, property and real estate statements, retirement account statements, and debt statements, help safeguard the interests of both parties involved and ensure transparency regarding financial matters. By providing a detailed overview of each individual's financial situation, these statements help pave the way for an equitable and informed prenuptial agreement.