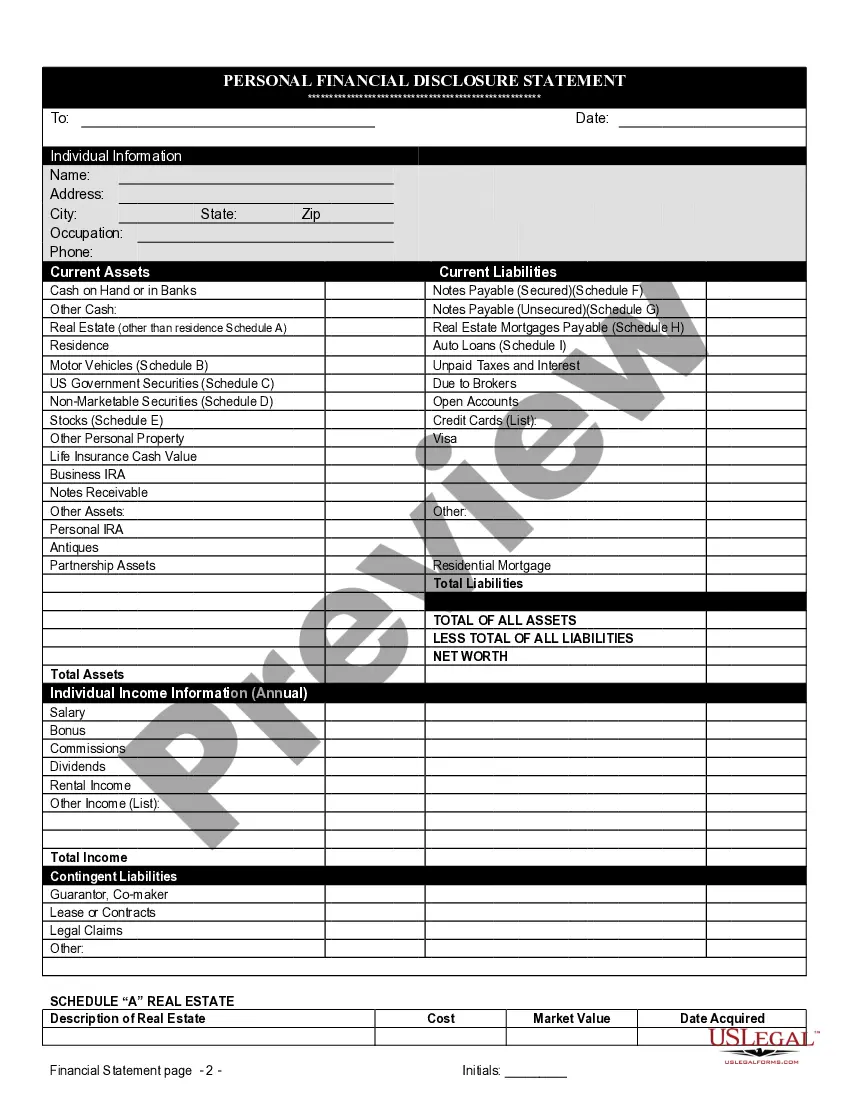

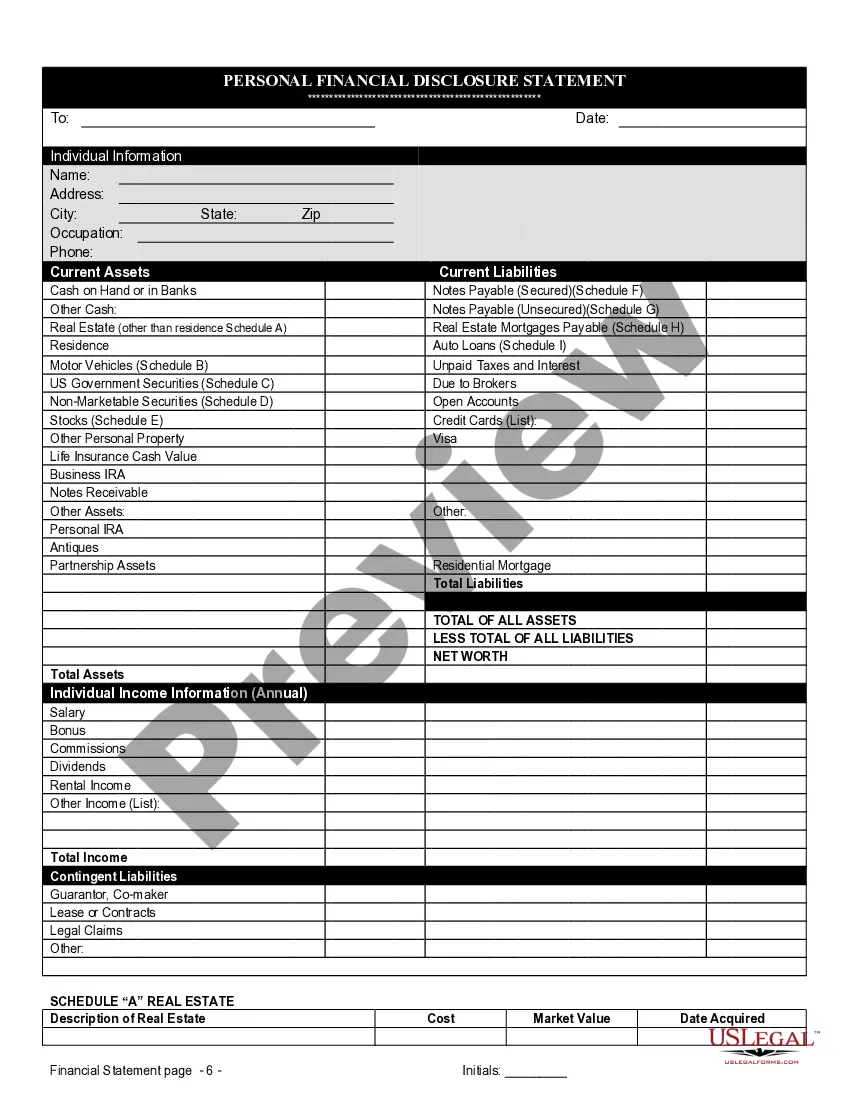

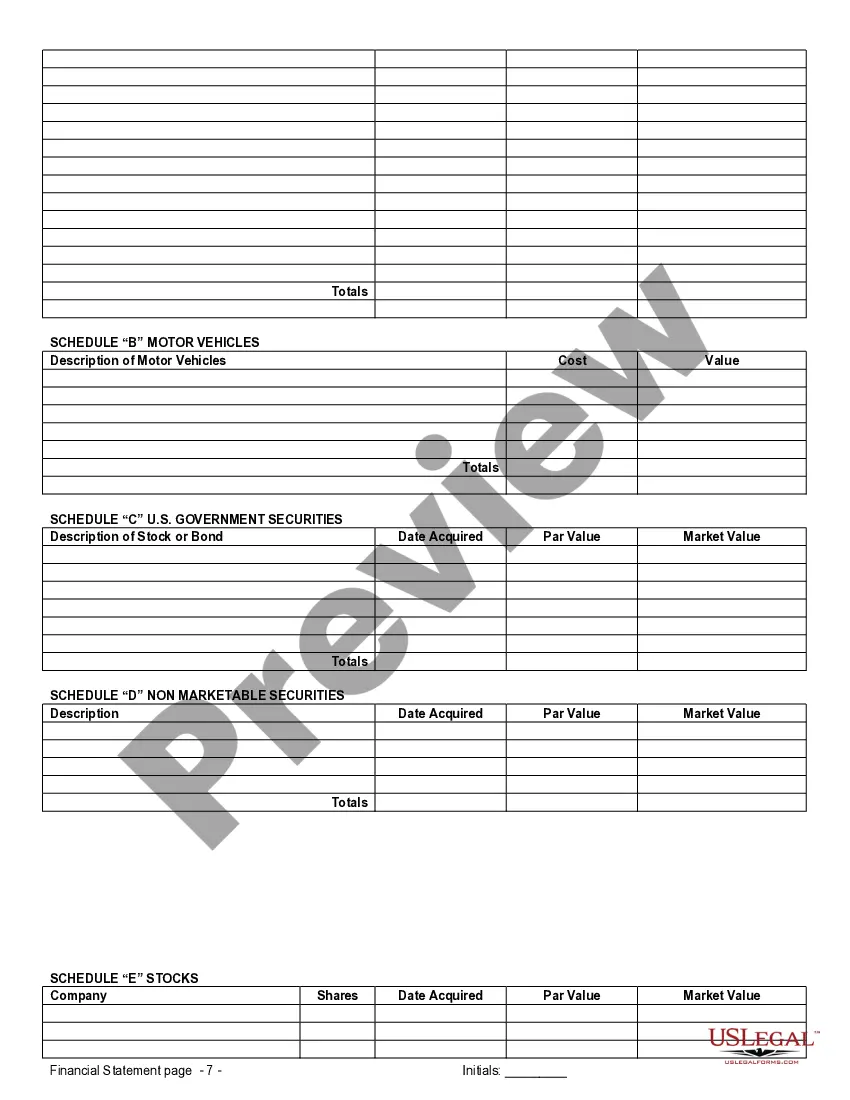

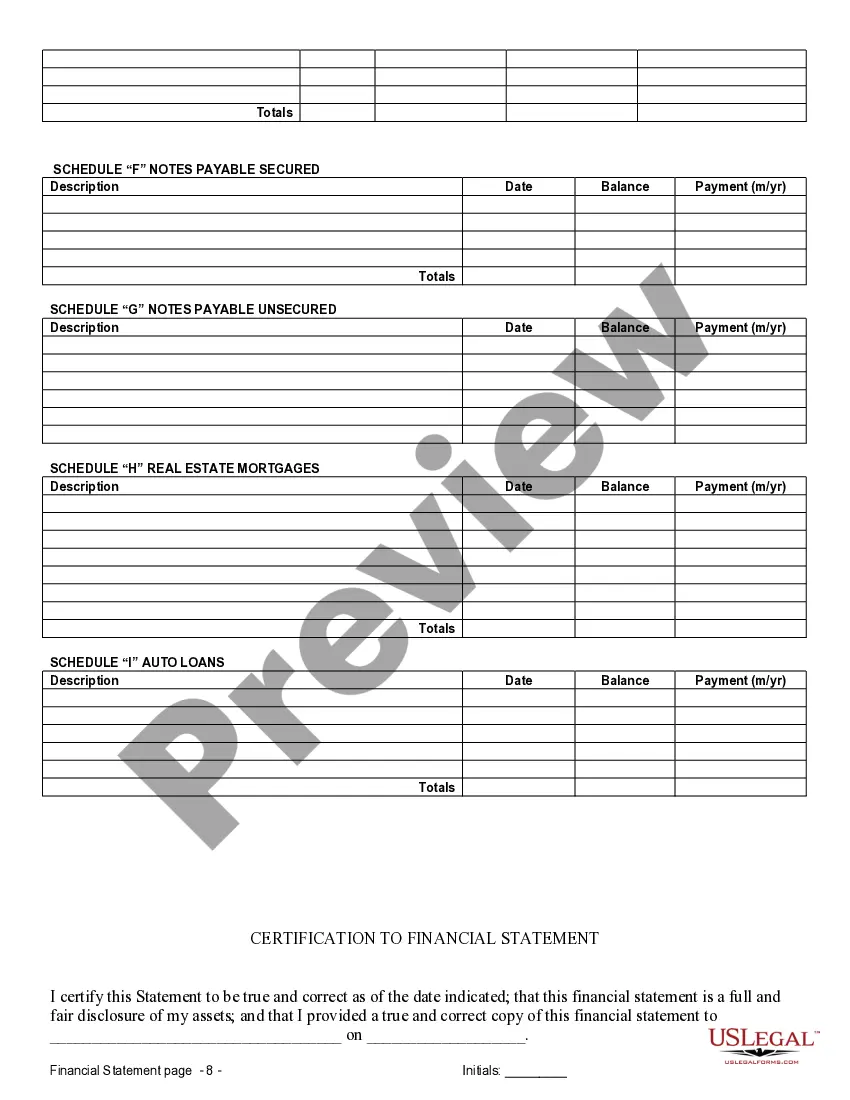

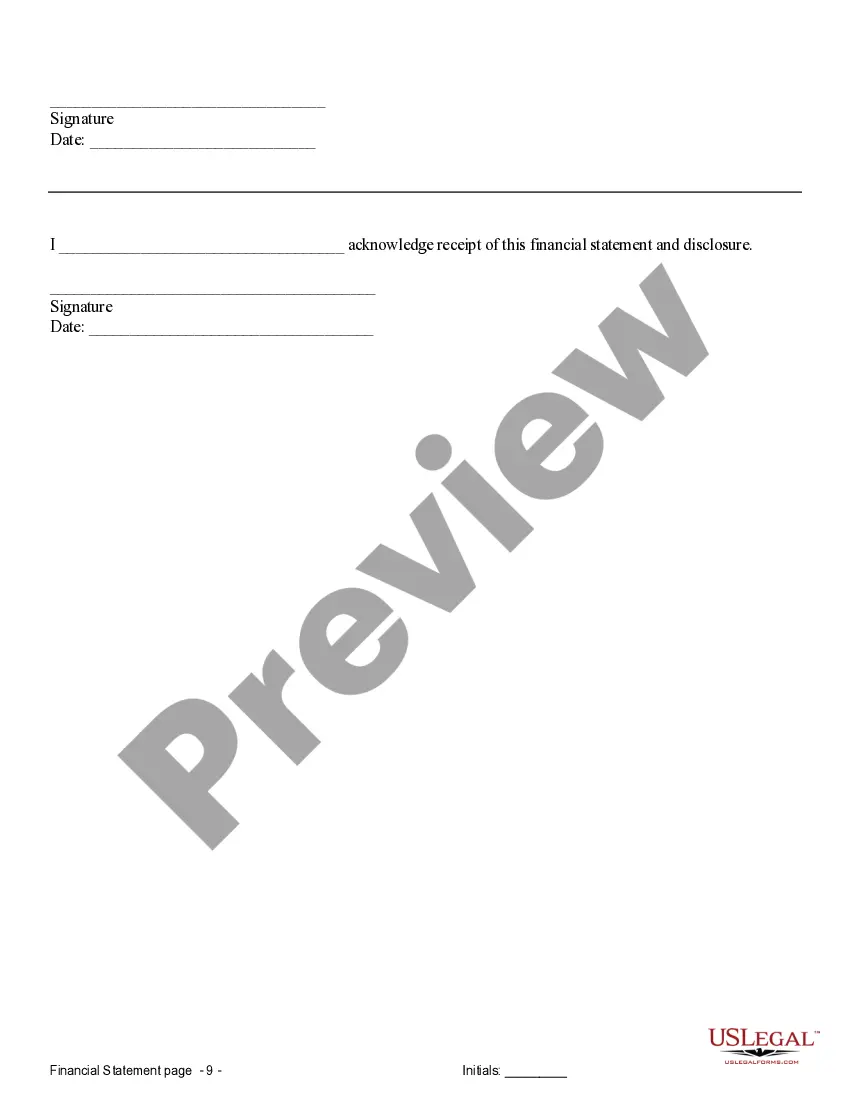

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Coral Springs Florida Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Florida Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you are looking for a pertinent form template, it’s exceptionally challenging to locate a superior platform than the US Legal Forms website – one of the largest repositories on the internet.

Here you can acquire thousands of form samples for organizational and personal use categorized by types and regions, or keywords.

With the excellent search function, finding the most recent Coral Springs Florida Financial Statements solely in connection with Prenuptial Premarital Agreement is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the document. Choose the file format and download it onto your device. Edit. Fill in, amend, print, and sign the obtained Coral Springs Florida Financial Statements solely in connection with Prenuptial Premarital Agreement.

- In addition, the validity of each document is validated by a team of experienced attorneys who consistently review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Coral Springs Florida Financial Statements only in relation to Prenuptial Premarital Agreement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions listed below.

- Ensure you have accessed the form you require. Review its description and utilize the Preview feature to inspect its content. If it does not meet your requirements, employ the Search bar at the top of the page to locate the desired document.

- Verify your selection. Click the Buy now button. Subsequently, choose your preferred subscription plan and provide the necessary details to register for an account.

Form popularity

FAQ

Primarily, a prenuptial premarital agreement focuses on assets acquired before marriage. However, it can also address how assets obtained during the marriage will be handled. This flexibility allows couples to delineate their financial responsibilities and rights clearly. Using Coral Springs Florida Financial Statements only in Connection with Prenuptial Premarital Agreement aids in identifying and managing those assets effectively.

Yes, when preparing a prenuptial premarital agreement, it is essential to disclose all assets. This transparency helps ensure that both parties understand each other's financial situations. It is important for creating a fair agreement and can prevent future conflicts. Utilizing Coral Springs Florida Financial Statements only in Connection with Prenuptial Premarital Agreement can provide a clear view of each person's financial landscape.

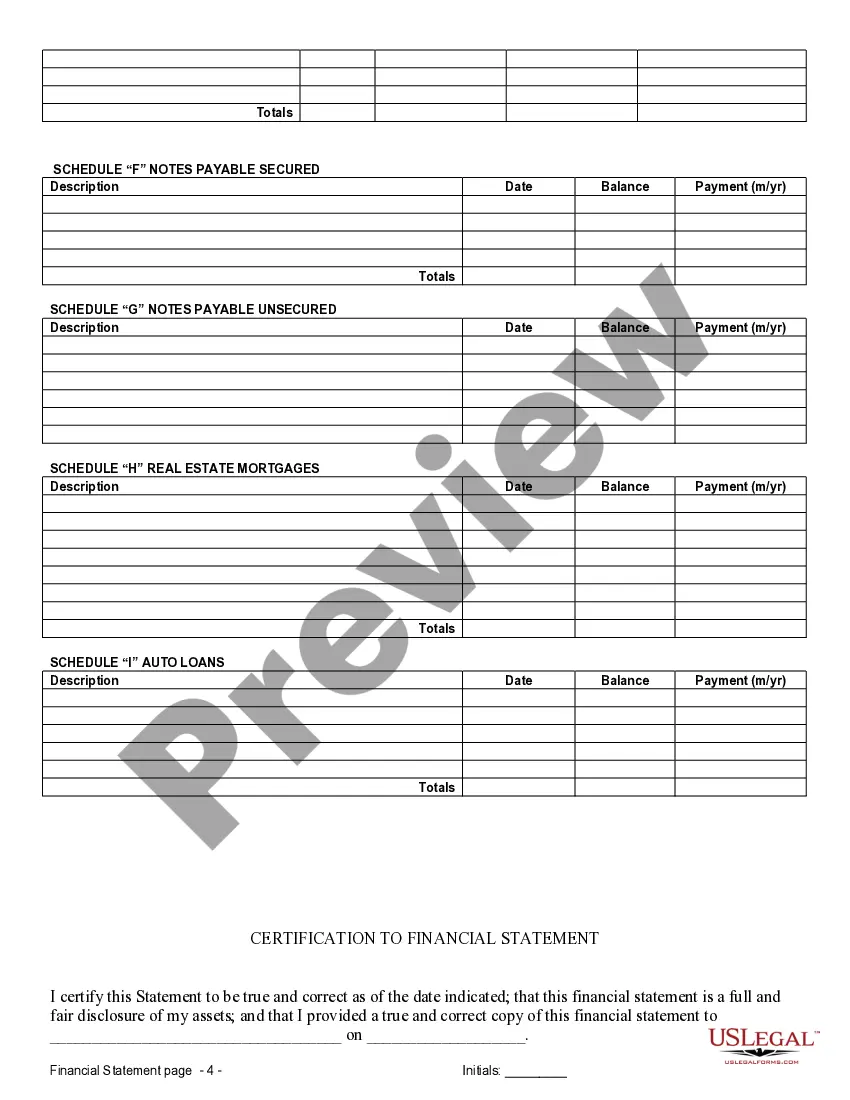

One potential loophole in a prenuptial agreement may arise if one party did not fully disclose their financial situation. If a court finds that financial statements did not provide accurate or complete information, it may invalidate certain clauses of the prenup. Therefore, it is essential to be transparent with Coral Springs, Florida, financial statements only in connection with a prenuptial premarital agreement, ensuring that both partners are protected and the agreement holds up legally.

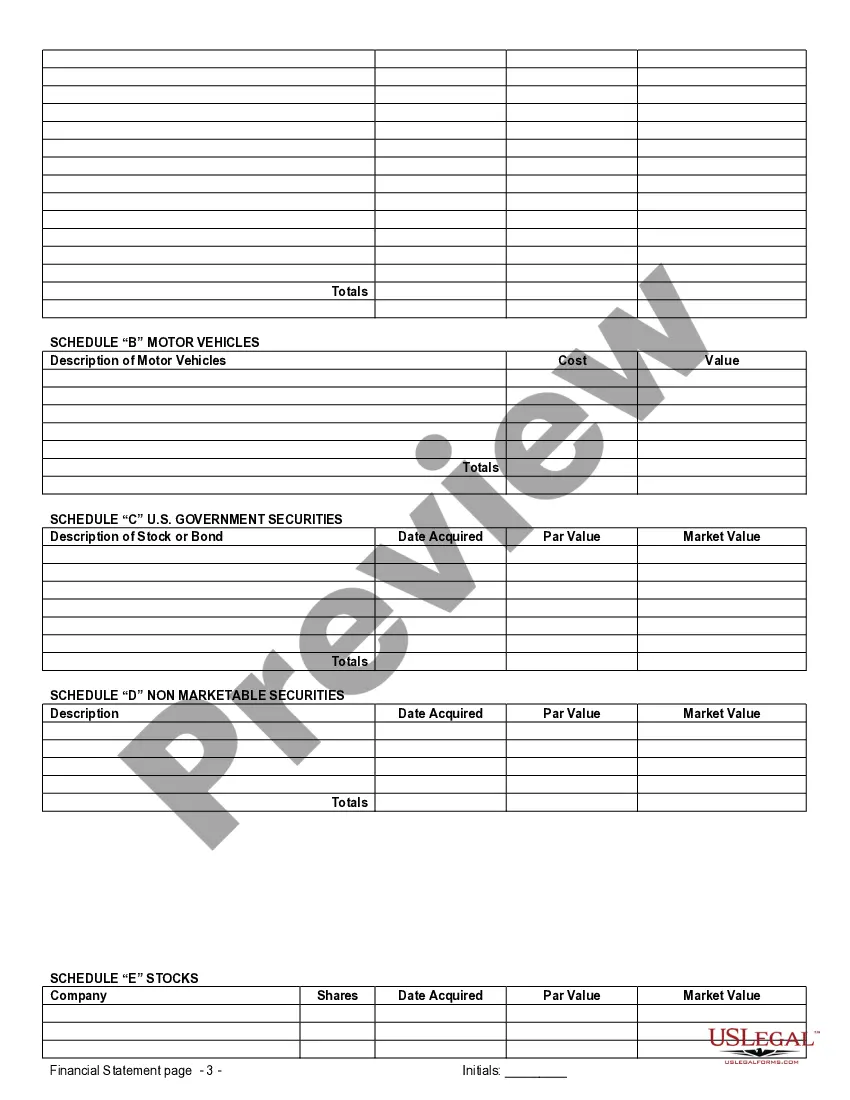

A financial statement for a prenuptial agreement provides a detailed overview of each party's financial situation. This document typically includes information about income, assets, liabilities, and any relevant financial obligations. In Coral Springs, Florida, financial statements only in connection with a prenuptial premarital agreement are necessary for transparency and help to establish trust between partners as they prepare for their future together.

Without a prenuptial agreement, premarital assets may not be fully protected in the event of a divorce. State laws vary, but in many cases, assets acquired before marriage can be subject to division during a divorce. Utilizing Coral Springs, Florida, financial statements only in connection with a prenuptial premarital agreement can help safeguard these assets by clearly outlining ownership and intentions, making it essential for those looking to protect their financial interests.

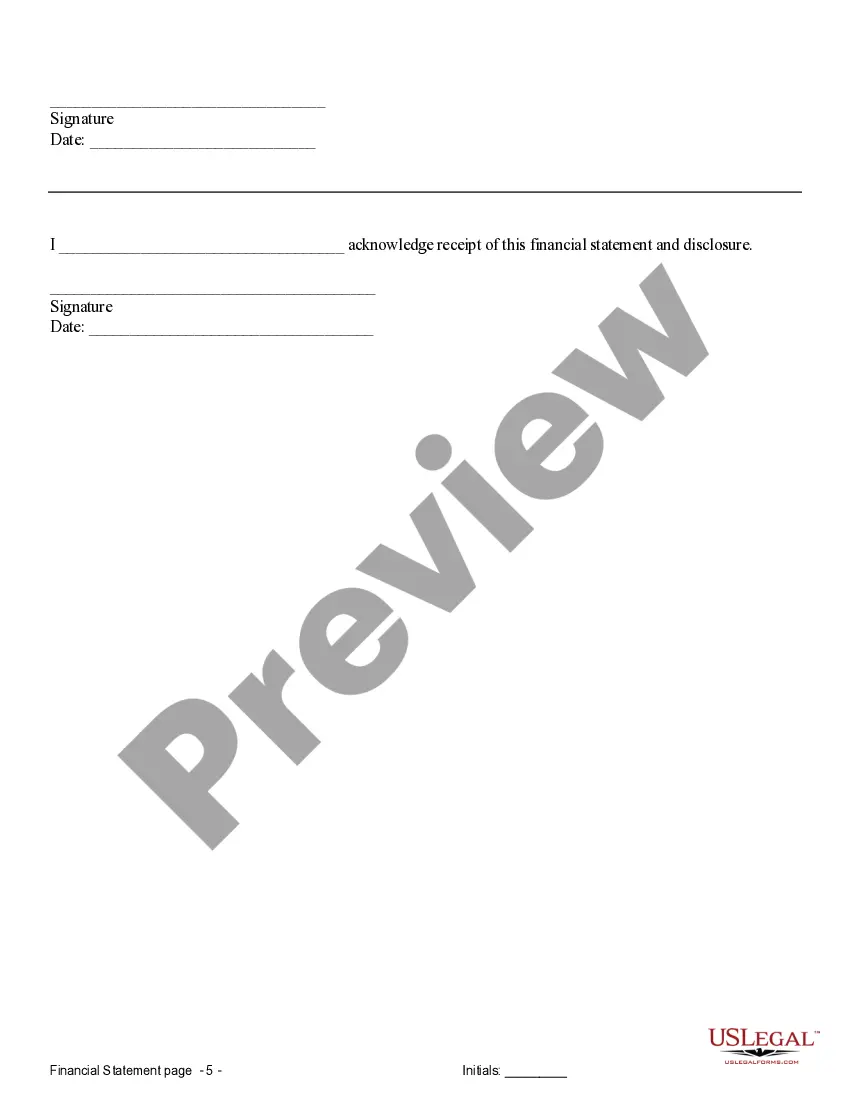

Yes, financial disclosure is a crucial part of creating a legally binding prenuptial agreement. Both parties must fully disclose their financial situation, including assets, debts, and income. In Coral Springs, Florida, financial statements only in connection with a prenuptial premarital agreement play a vital role in this process, ensuring that both partners are making informed decisions based on complete financial transparency.

A prenuptial agreement holds significant value as it sets clear expectations for both parties regarding asset division and financial responsibilities in the event of a separation. In Coral Springs, Florida, financial statements only in connection with a prenuptial premarital agreement provide essential insights into each partner's financial situation, helping to minimize disputes later. This proactive approach not only protects individual assets but also fosters open communication about finances, which is crucial for a healthy relationship.

Several factors can void a prenup, including lack of proper disclosure, coercion, or significant changes in circumstances. In Coral Springs, Florida, financial statements only in connection with prenuptial premarital agreements are essential in maintaining transparency; any omission can threaten the agreement's validity. Furthermore, if either party did not understand the terms when signing, the prenup might become unenforceable. It is critical to seek legal guidance to ensure that your agreement remains intact and effective.

For a prenup to be valid, certain elements must be present, including full disclosure of financial information from both parties. In Coral Springs, Florida, financial statements only in connection with prenuptial premarital agreements should accurately reflect each party's financial health. Additionally, both parties must willingly accept the terms and have the capacity to enter into a contract. Ensuring these factors are met increases the likelihood that your prenup will hold up in court.

A prenup typically requires detailed information about both parties, including income, assets, and debts. In Coral Springs, Florida, financial statements only in connection with prenuptial premarital agreements are essential for accurately portraying each individual's financial landscape. This transparency fosters trust and helps facilitate a fair agreement. Gathering this information upfront allows couples to create a solid and equitable foundation for their future.