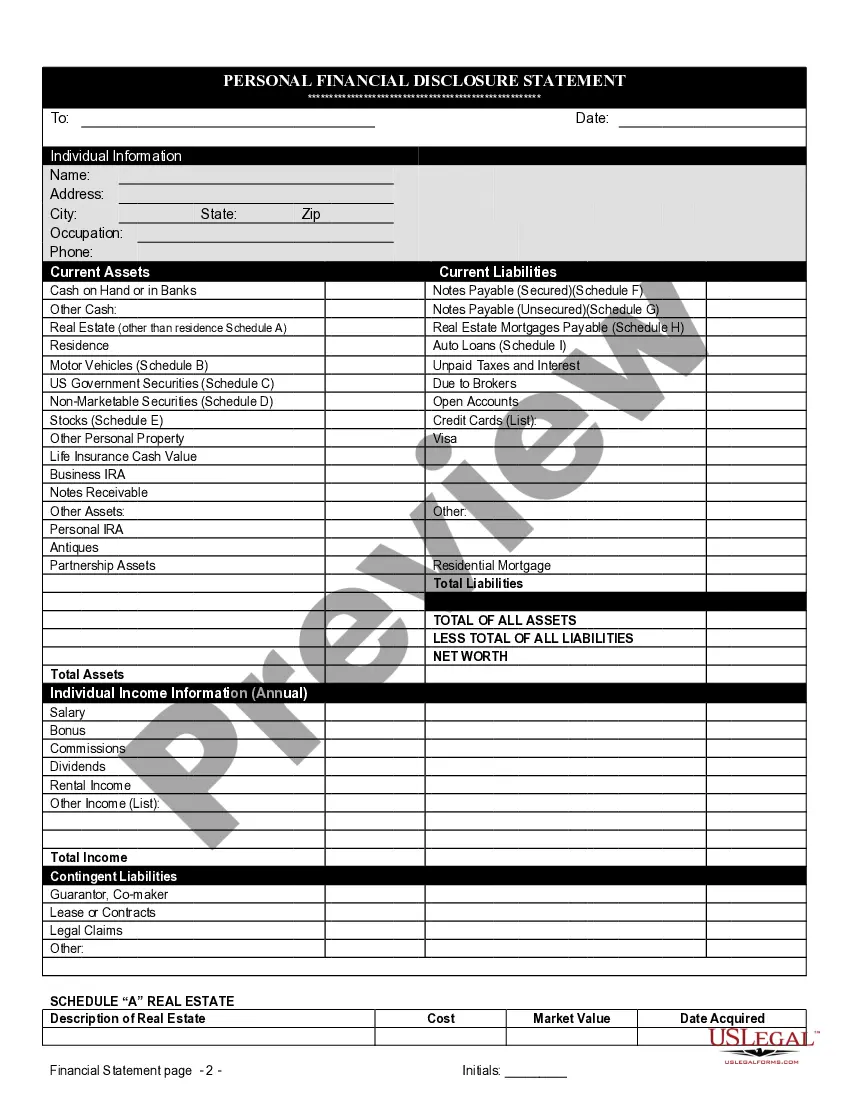

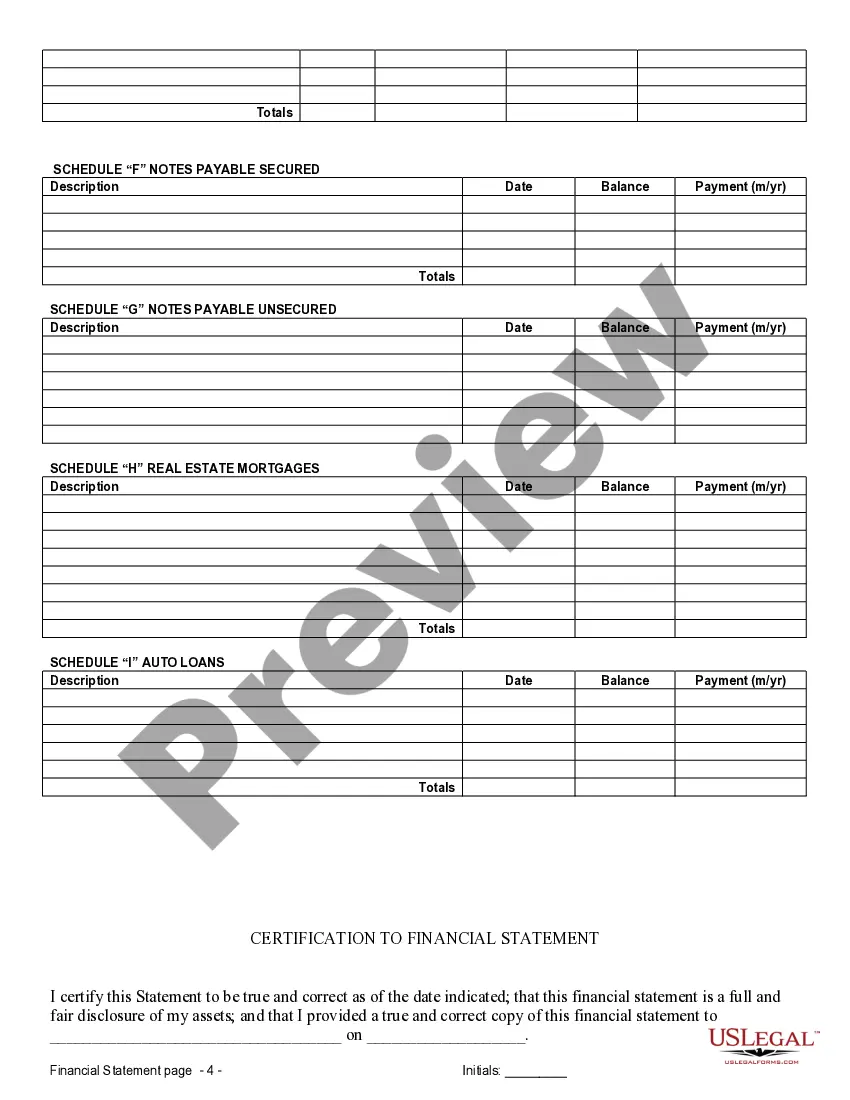

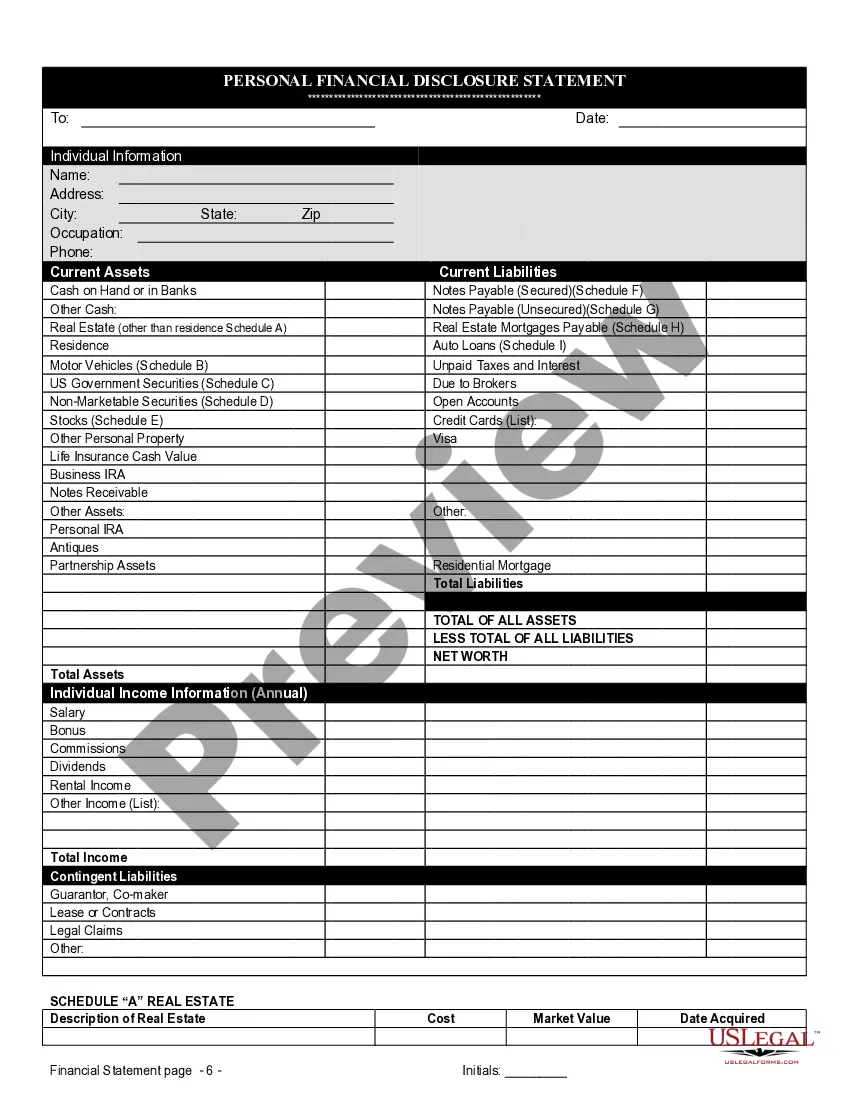

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

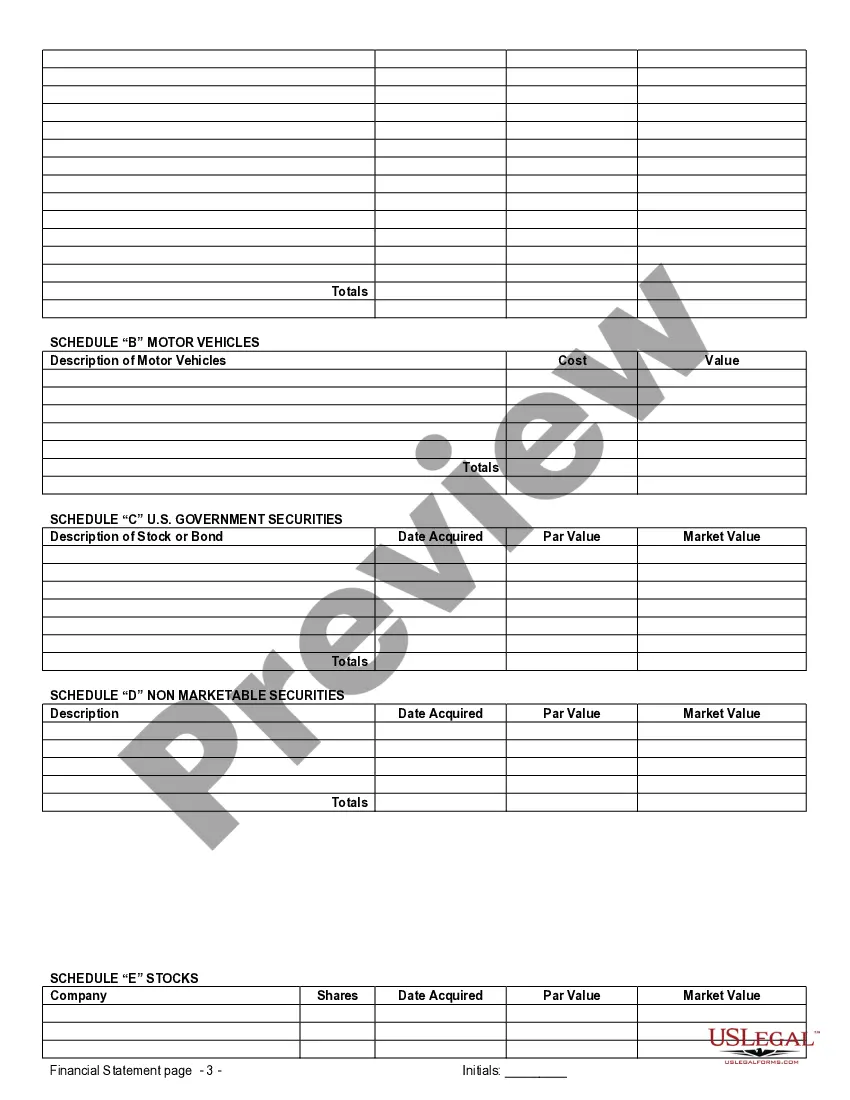

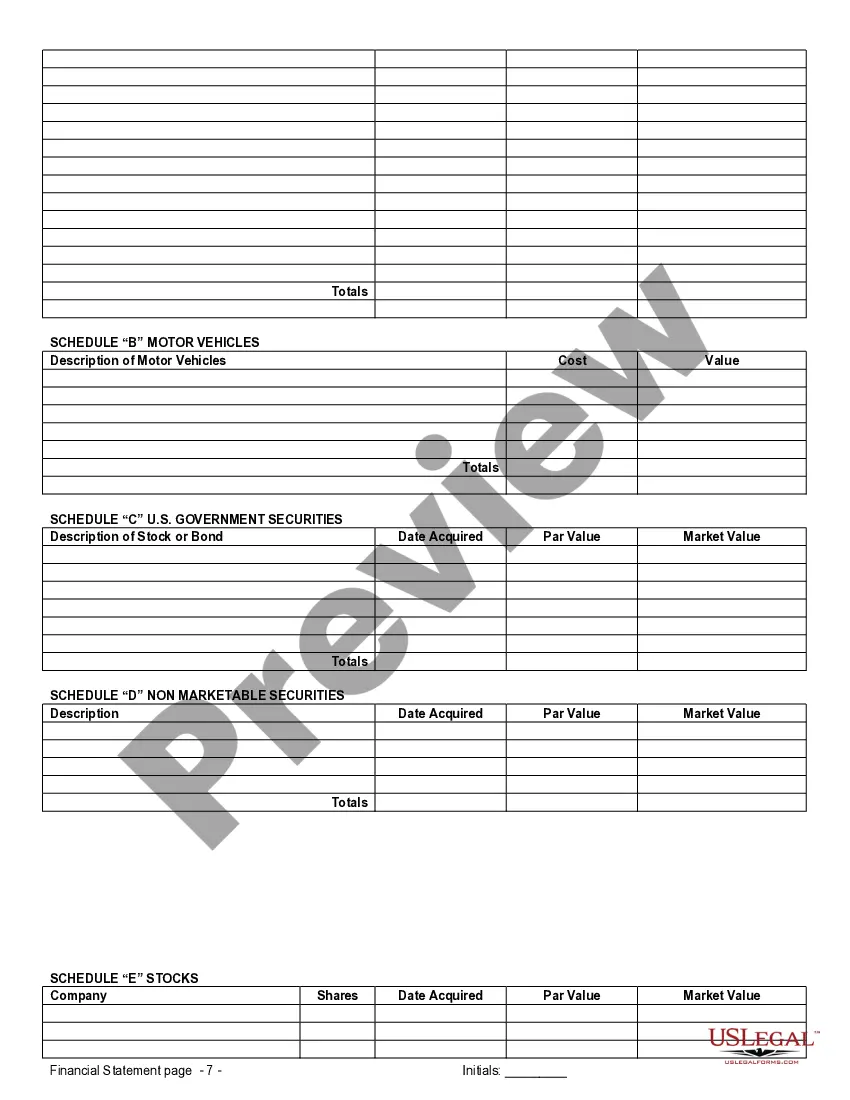

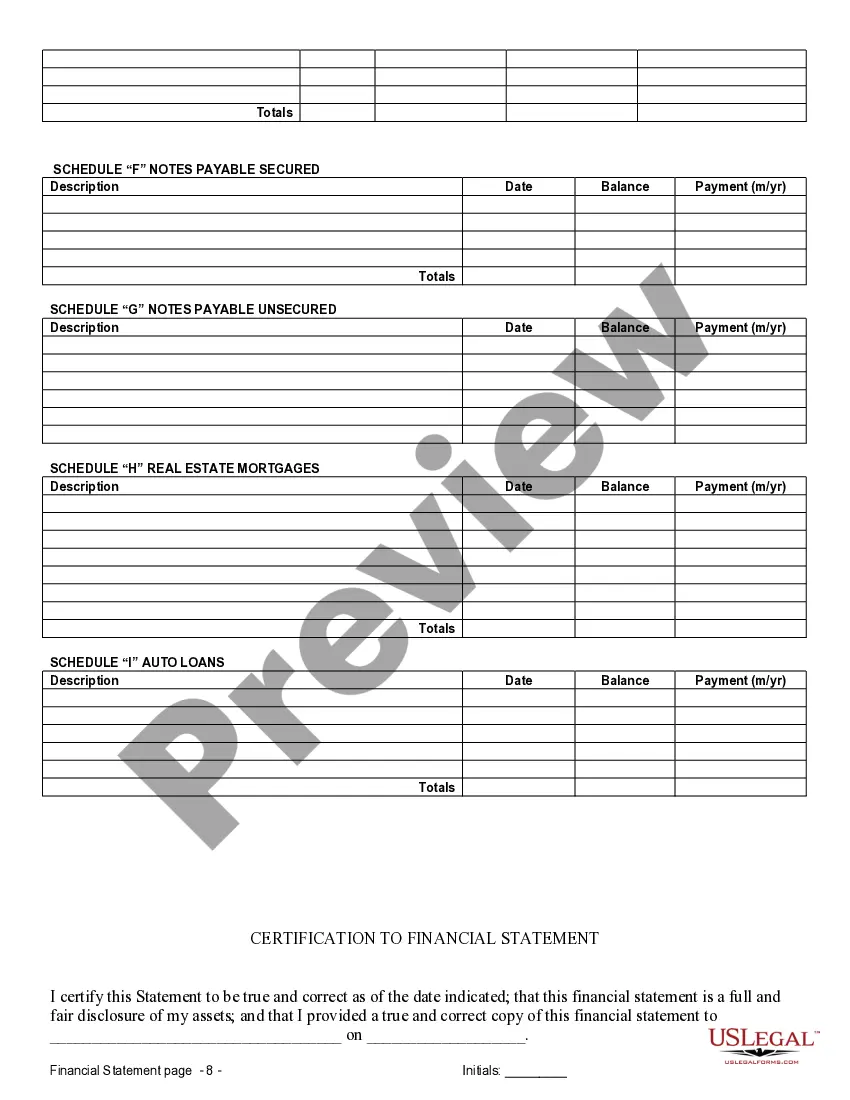

Fort Lauderdale Florida Financial Statements Only in Connection with Prenuptial Premarital Agreement In Fort Lauderdale, Florida, financial statements play a vital role in prenuptial or premarital agreements. These documents provide a comprehensive overview of an individual's financial circumstances, ensuring transparency and fairness when it comes to division of assets, debts, and other financial matters in the event of a divorce. Fort Lauderdale financial statements in connection with prenuptial or premarital agreements encompass various types, each serving a specific purpose. These include: 1. Personal Financial Statements: These documents outline an individual's personal income, expenses, assets, and liabilities. They provide a detailed snapshot of one's financial position before entering into a marriage or civil union. 2. Business Financial Statements: If either party owns a business, accurate and up-to-date financial statements related to the business may be required. This includes balance sheets, income statements, cash flow statements, and any accompanying schedules that shed light on the company's financial health. 3. Real Estate Financial Statements: This category encompasses financial information regarding properties, including residential homes, commercial buildings, or investment properties. These statements outline ownership details, property values, mortgages, rental income, and any other relevant financial aspects. 4. Investment Account Statements: In cases where individuals hold investment accounts, such as stocks, bonds, mutual funds, or retirement accounts, these statements provide a comprehensive overview of the holdings, balances, and performance of these investments. 5. Retirement Account Statements: Financial statements related to retirement accounts, including individual retirement accounts (IRAs), 401(k)s, or pensions, illustrate the value and status of these accounts, which may be subject to specific provisions agreed upon within the prenuptial agreement. When creating a prenuptial or premarital agreement in Fort Lauderdale, it is crucial to ensure financial statements are accurate, complete, and verify the information provided. These statements offer transparency and help to safeguard each party's financial rights and interests, ensuring a fair and equitable resolution should a divorce occur. In conclusion, Fort Lauderdale, Florida financial statements only in connection with prenuptial or premarital agreements encompass personal financial statements, business financial statements, real estate financial statements, investment account statements, and retirement account statements. These documents serve to provide a comprehensive overview of an individual's financial situation, ensuring transparency and fairness in the event of a divorce.