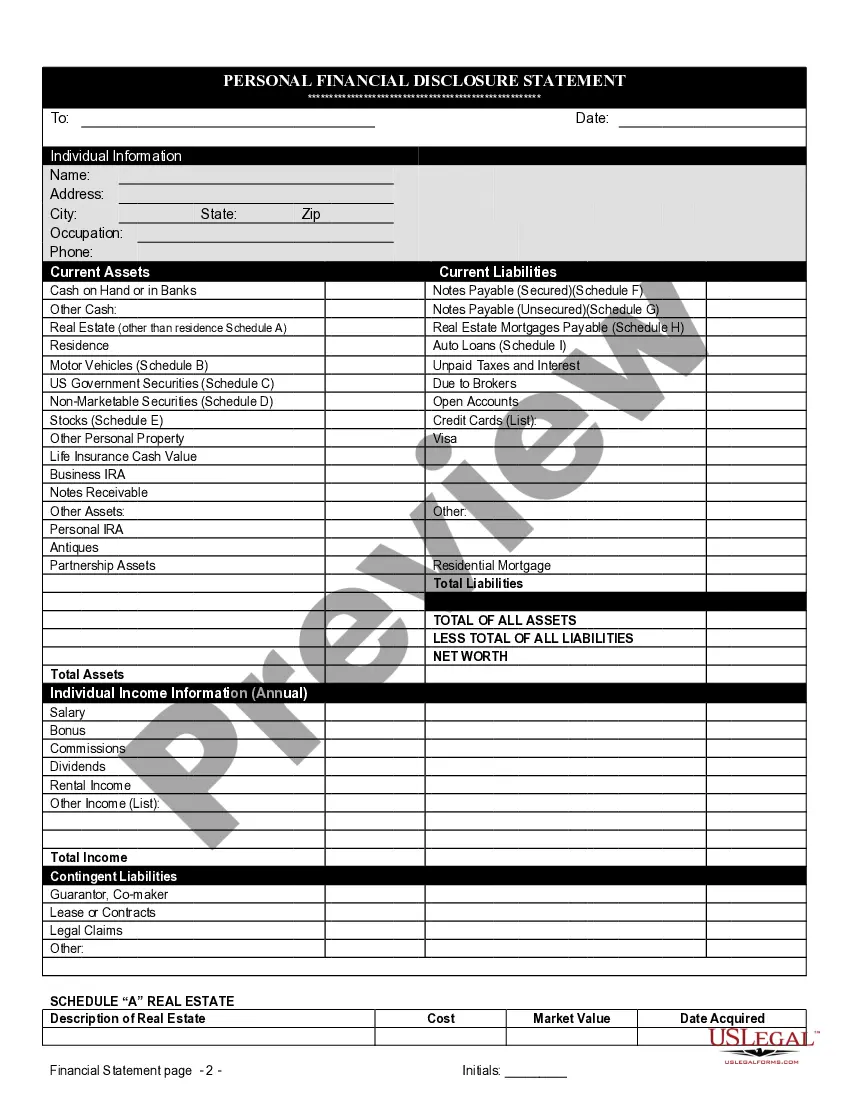

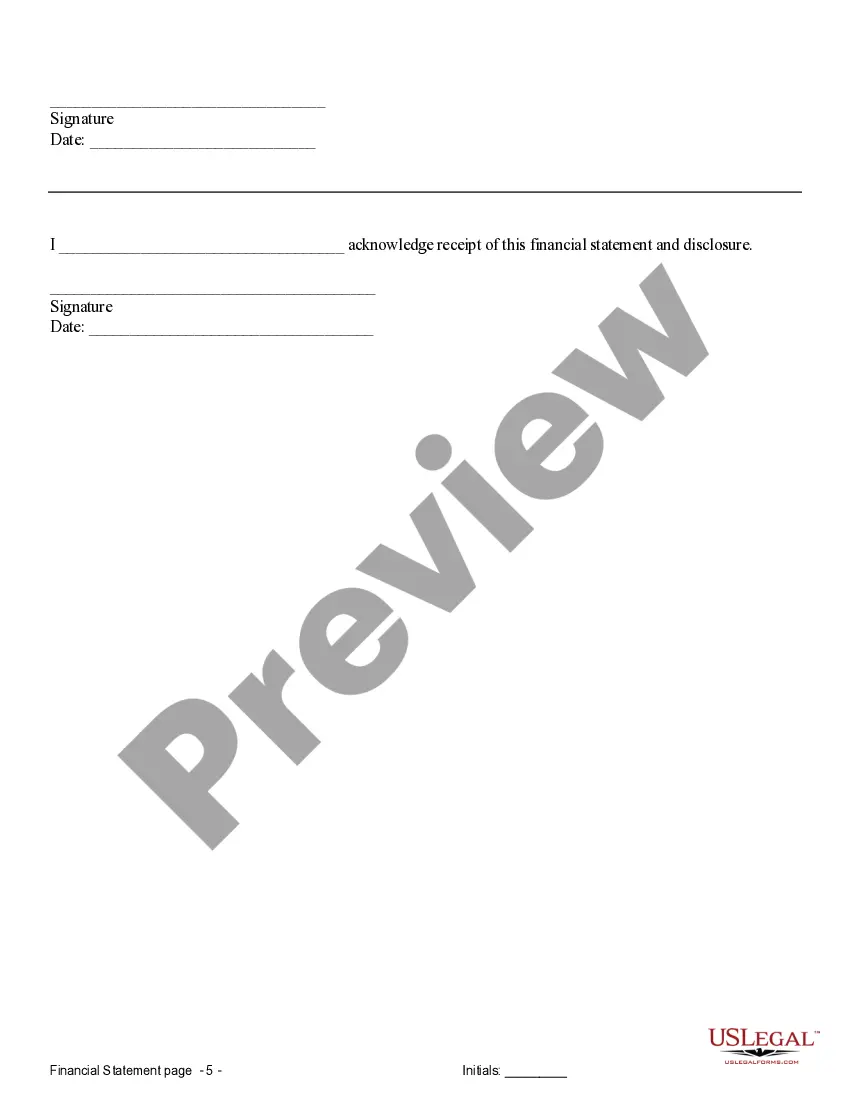

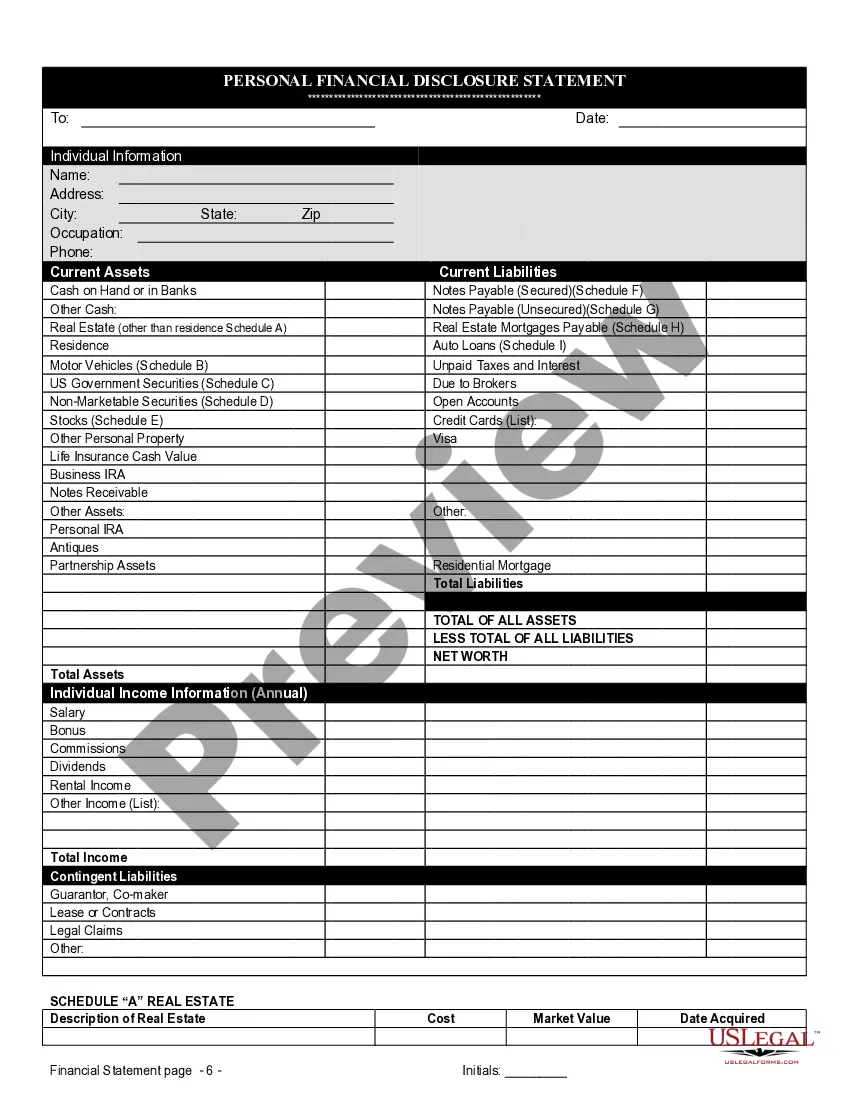

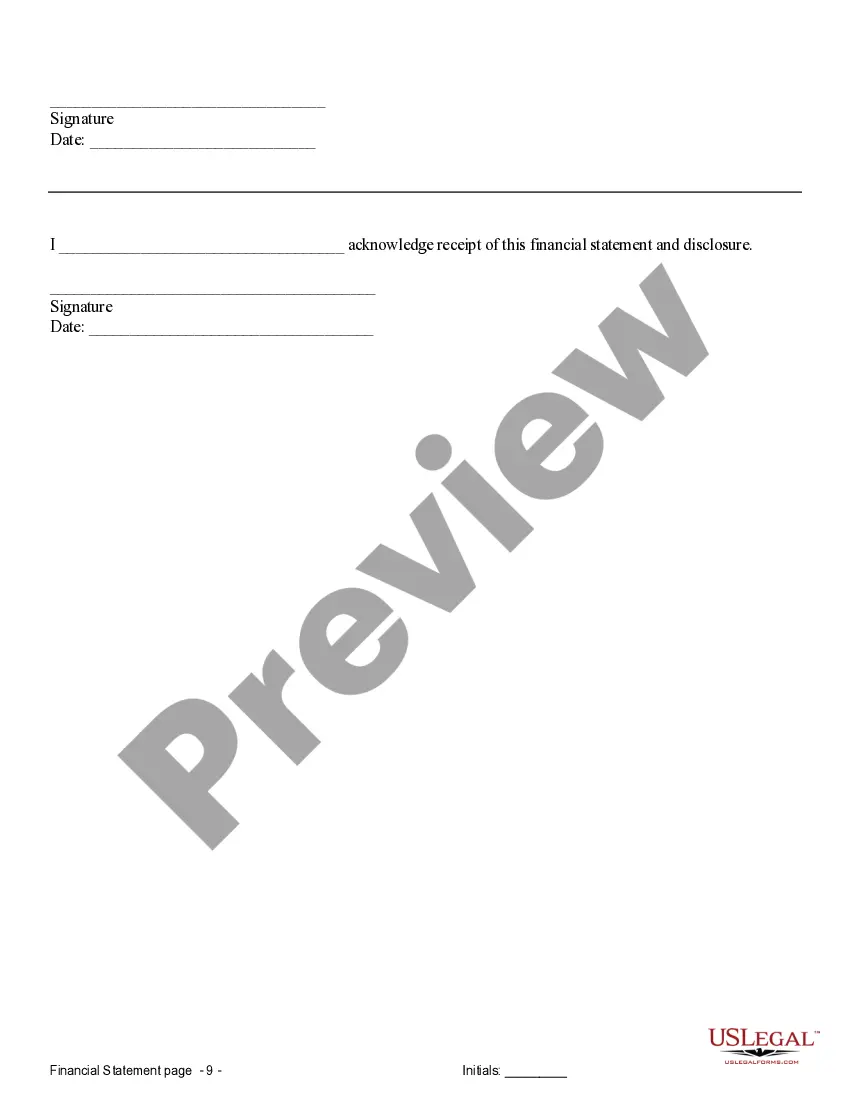

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

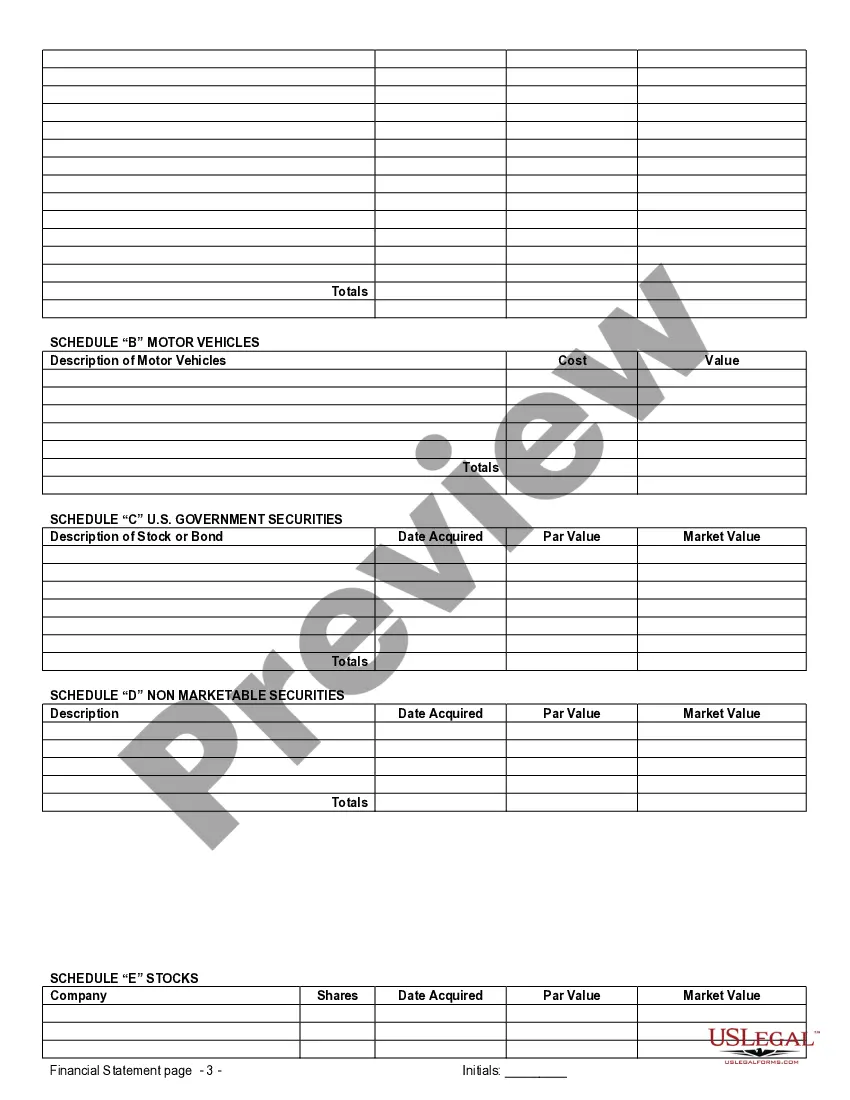

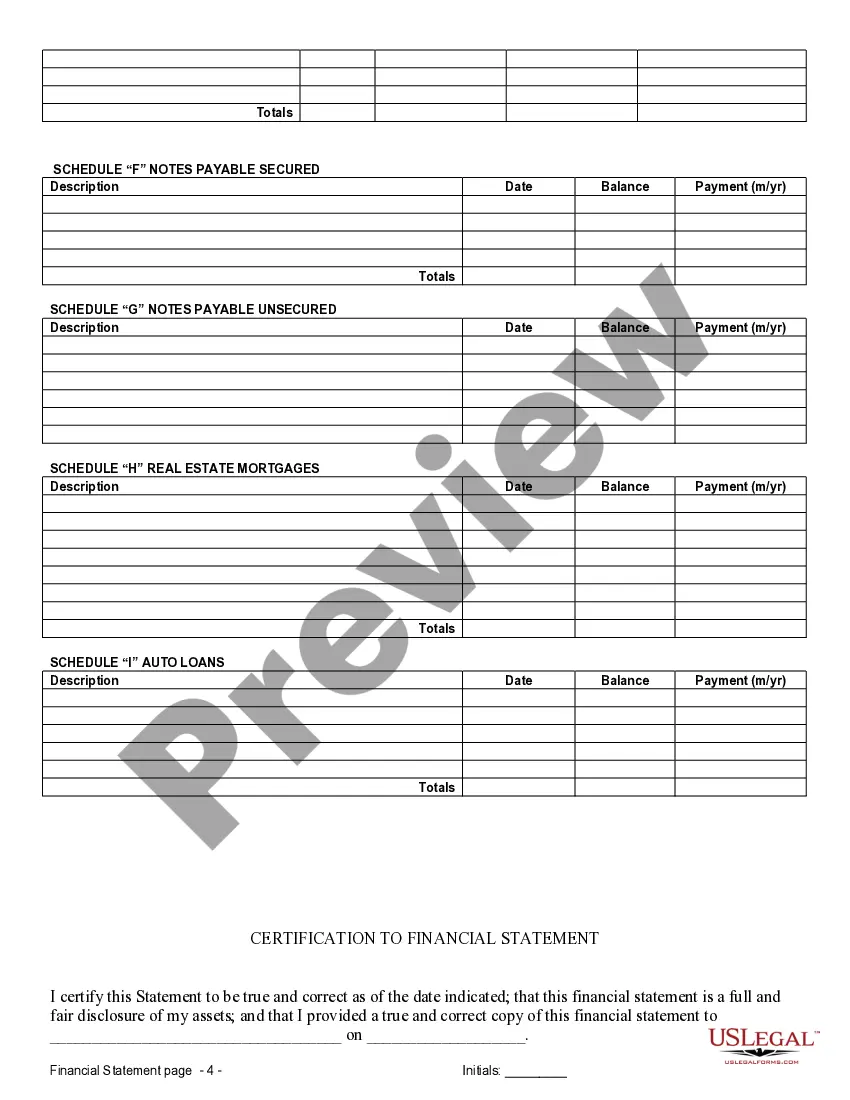

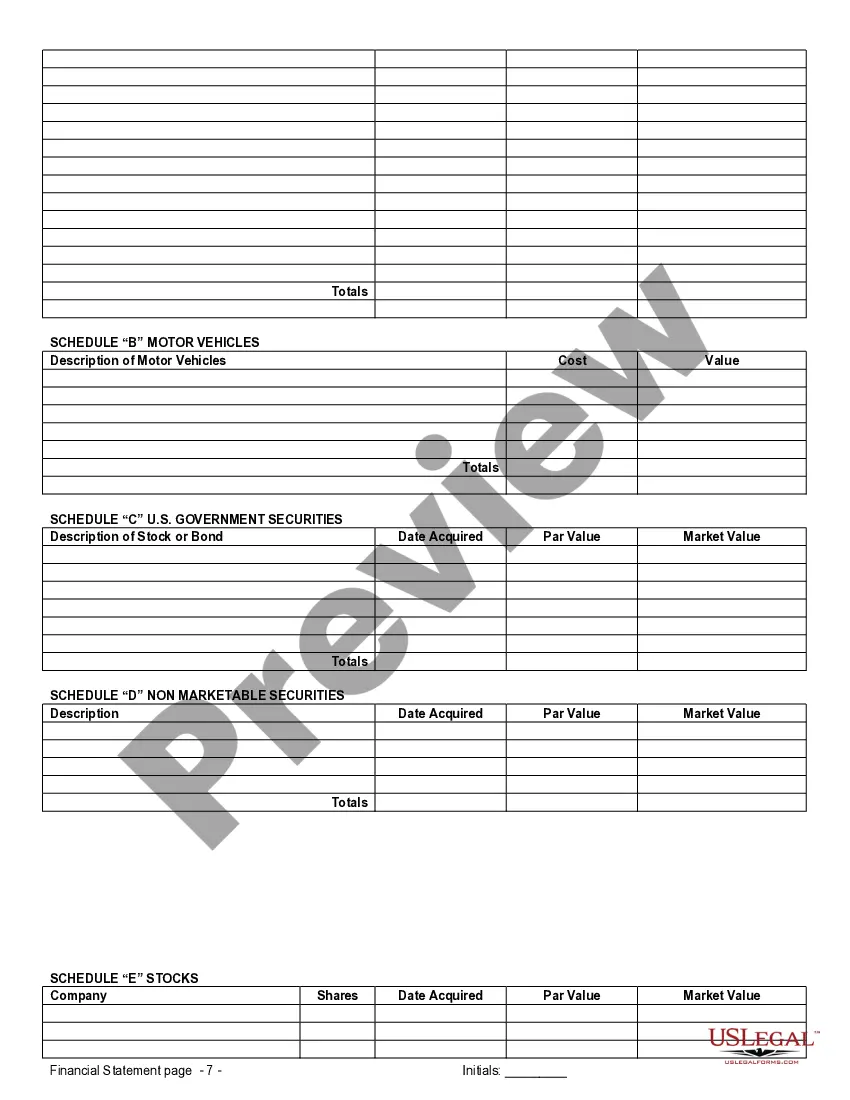

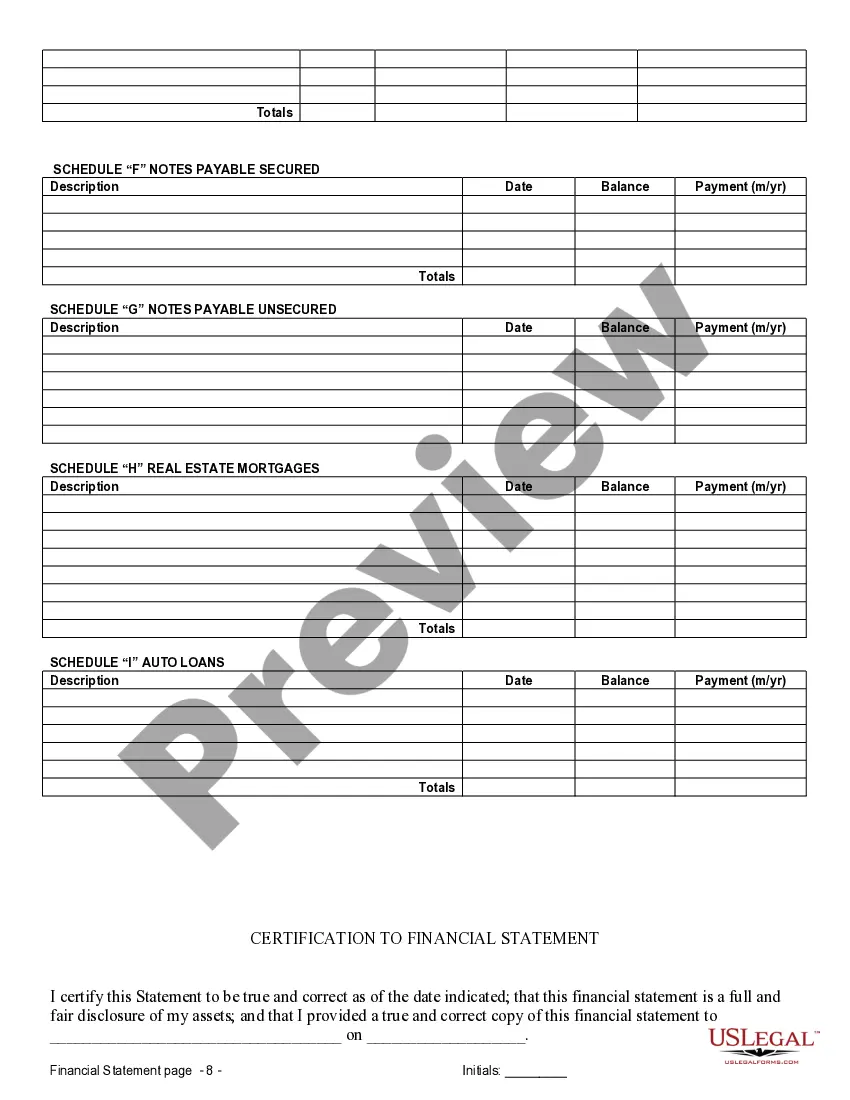

Gainesville Florida Financial Statements in Connection with Prenuptial Premarital Agreement: An Essential Guide for Couples When it comes to entering into a prenuptial or premarital agreement in Gainesville, Florida, it is crucial to understand the significance of including accurate financial statements. Financial statements serve as a comprehensive overview of an individual's or couple's financial standing, providing important information that ensures transparency and fairness within the agreement. In this detailed description, we will explore the different types of financial statements used in connection with a prenuptial or premarital agreement in Gainesville, Florida. 1. Personal Financial Statement: Also known as an individual financial statement, this document outlines an individual's personal assets, liabilities, and income. It includes details about bank accounts, investments, real estate, vehicles, debts, and any other financial obligations. 2. Business Financial Statement: If one or both parties own a business in Gainesville, a separate business financial statement may be required. This statement provides a comprehensive picture of the business's assets, liabilities, income, expenses, and other relevant financial information. 3. Real Estate Financial Statement: In cases where individuals or couples own real estate properties, a separate real estate financial statement is necessary. This document includes details about the properties' value, ownership, mortgages, rental income, and any other pertinent information related to real estate investments. 4. Investment Financial Statement: When individuals or couples have investment portfolios, an investment financial statement is essential. It outlines the value of investments, such as stocks, bonds, mutual funds, retirement accounts, and any other investment vehicles. Additionally, it may provide information about dividends, interest income, capital gains, or losses. 5. Retirement Account Financial Statement: Retirement accounts, including 401(k)s, IRAs, pensions, and other retirement savings, require specific attention in a prenuptial or premarital agreement. This financial statement details the value of retirement accounts, contributions made, and any rollovers or withdrawals that have occurred. 6. Debt Financial Statement: In some cases, individuals or couples may need to disclose any outstanding debts or liabilities they have. This statement includes details about credit card debt, student loans, personal loans, mortgages, and other financial obligations. Understanding the importance of these various financial statements is crucial to ensure fair and equitable agreements between both parties. Accurate and comprehensive financial documentation helps ensure that assets, debts, and other considerations are properly addressed, reducing the potential for disputes or misunderstandings in the future. In conclusion, Gainesville Florida Financial Statements in connection with a prenuptial or premarital agreement play a pivotal role in establishing fairness and transparency. By including personal financial statements, business financial statements, real estate financial statements, investment financial statements, retirement account financial statements, and debt financial statements, couples can ensure that all significant financial aspects are properly addressed. Consulting with an experienced family law attorney in Gainesville is highly recommended navigating the complex legal requirements and ensure compliance with the relevant laws.Gainesville Florida Financial Statements in Connection with Prenuptial Premarital Agreement: An Essential Guide for Couples When it comes to entering into a prenuptial or premarital agreement in Gainesville, Florida, it is crucial to understand the significance of including accurate financial statements. Financial statements serve as a comprehensive overview of an individual's or couple's financial standing, providing important information that ensures transparency and fairness within the agreement. In this detailed description, we will explore the different types of financial statements used in connection with a prenuptial or premarital agreement in Gainesville, Florida. 1. Personal Financial Statement: Also known as an individual financial statement, this document outlines an individual's personal assets, liabilities, and income. It includes details about bank accounts, investments, real estate, vehicles, debts, and any other financial obligations. 2. Business Financial Statement: If one or both parties own a business in Gainesville, a separate business financial statement may be required. This statement provides a comprehensive picture of the business's assets, liabilities, income, expenses, and other relevant financial information. 3. Real Estate Financial Statement: In cases where individuals or couples own real estate properties, a separate real estate financial statement is necessary. This document includes details about the properties' value, ownership, mortgages, rental income, and any other pertinent information related to real estate investments. 4. Investment Financial Statement: When individuals or couples have investment portfolios, an investment financial statement is essential. It outlines the value of investments, such as stocks, bonds, mutual funds, retirement accounts, and any other investment vehicles. Additionally, it may provide information about dividends, interest income, capital gains, or losses. 5. Retirement Account Financial Statement: Retirement accounts, including 401(k)s, IRAs, pensions, and other retirement savings, require specific attention in a prenuptial or premarital agreement. This financial statement details the value of retirement accounts, contributions made, and any rollovers or withdrawals that have occurred. 6. Debt Financial Statement: In some cases, individuals or couples may need to disclose any outstanding debts or liabilities they have. This statement includes details about credit card debt, student loans, personal loans, mortgages, and other financial obligations. Understanding the importance of these various financial statements is crucial to ensure fair and equitable agreements between both parties. Accurate and comprehensive financial documentation helps ensure that assets, debts, and other considerations are properly addressed, reducing the potential for disputes or misunderstandings in the future. In conclusion, Gainesville Florida Financial Statements in connection with a prenuptial or premarital agreement play a pivotal role in establishing fairness and transparency. By including personal financial statements, business financial statements, real estate financial statements, investment financial statements, retirement account financial statements, and debt financial statements, couples can ensure that all significant financial aspects are properly addressed. Consulting with an experienced family law attorney in Gainesville is highly recommended navigating the complex legal requirements and ensure compliance with the relevant laws.