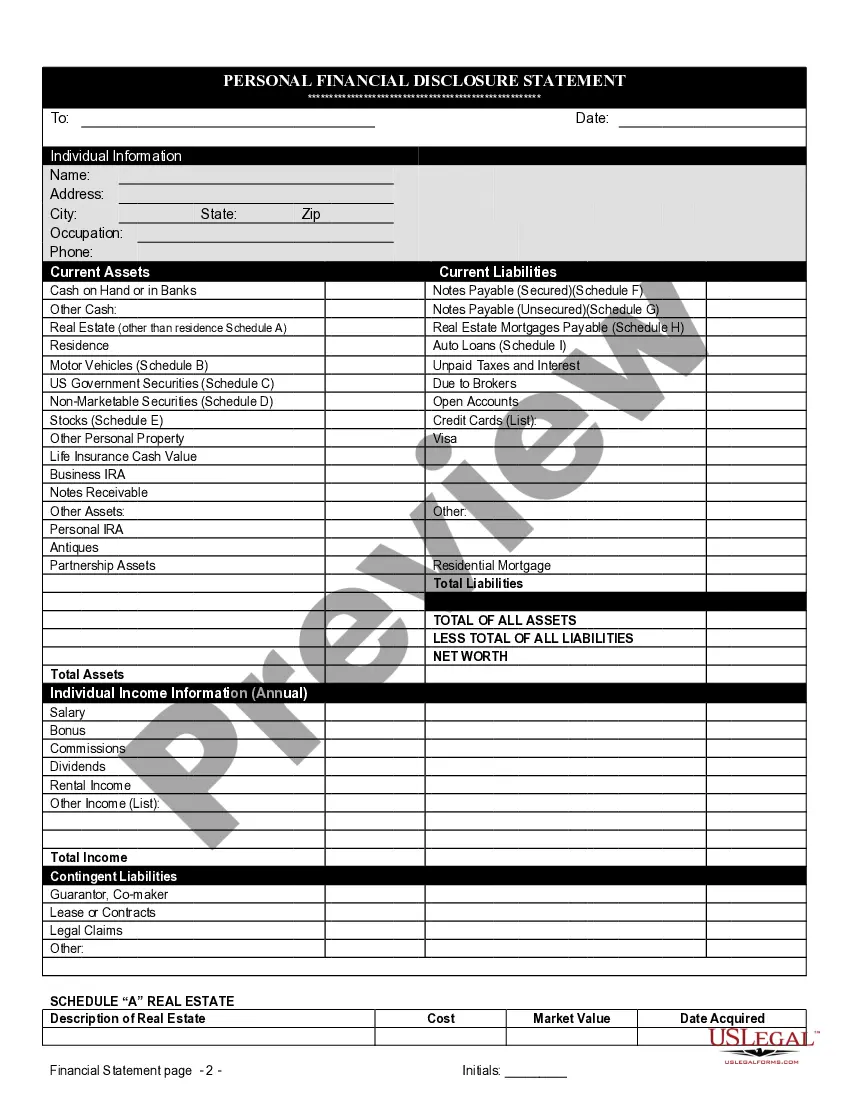

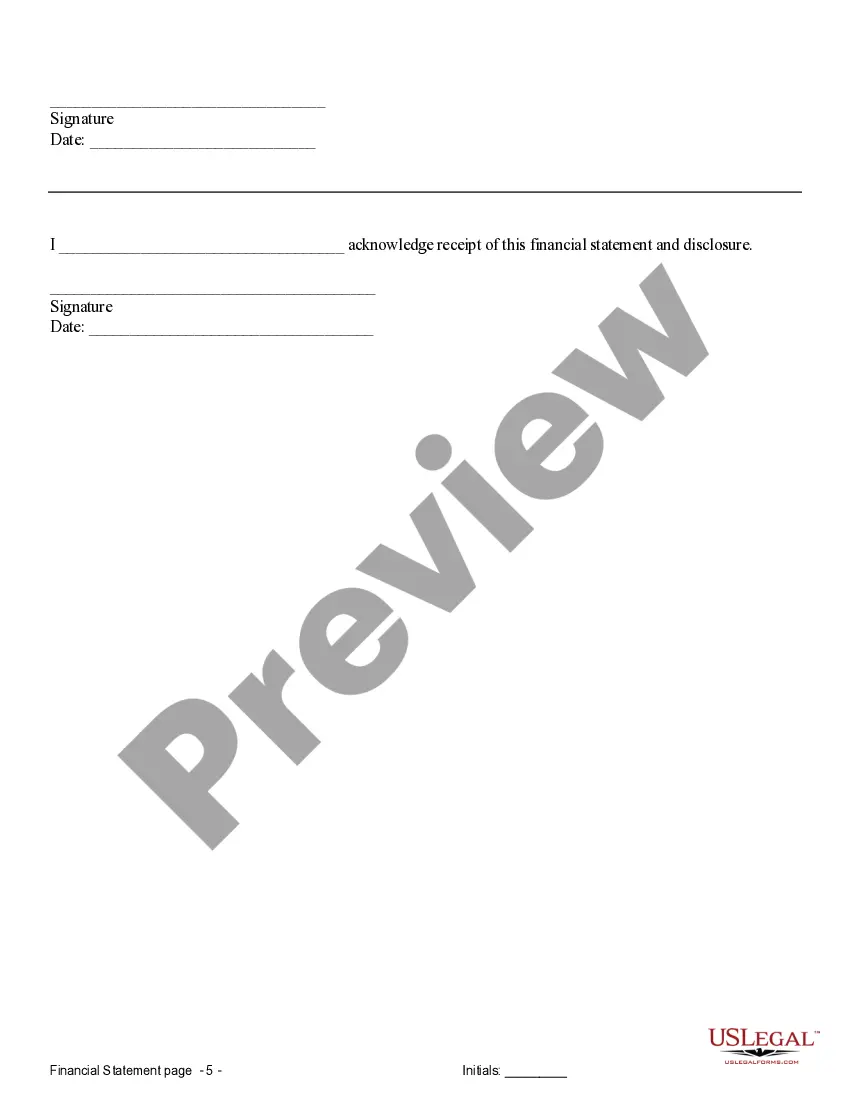

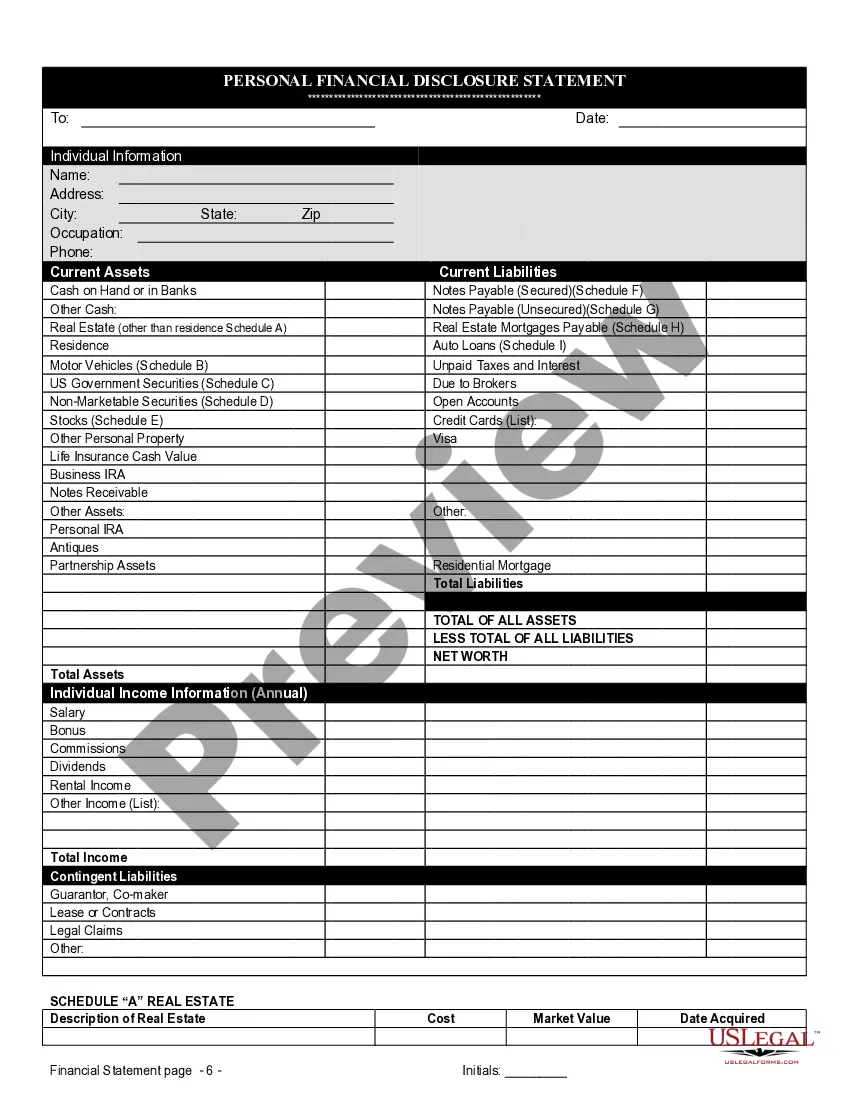

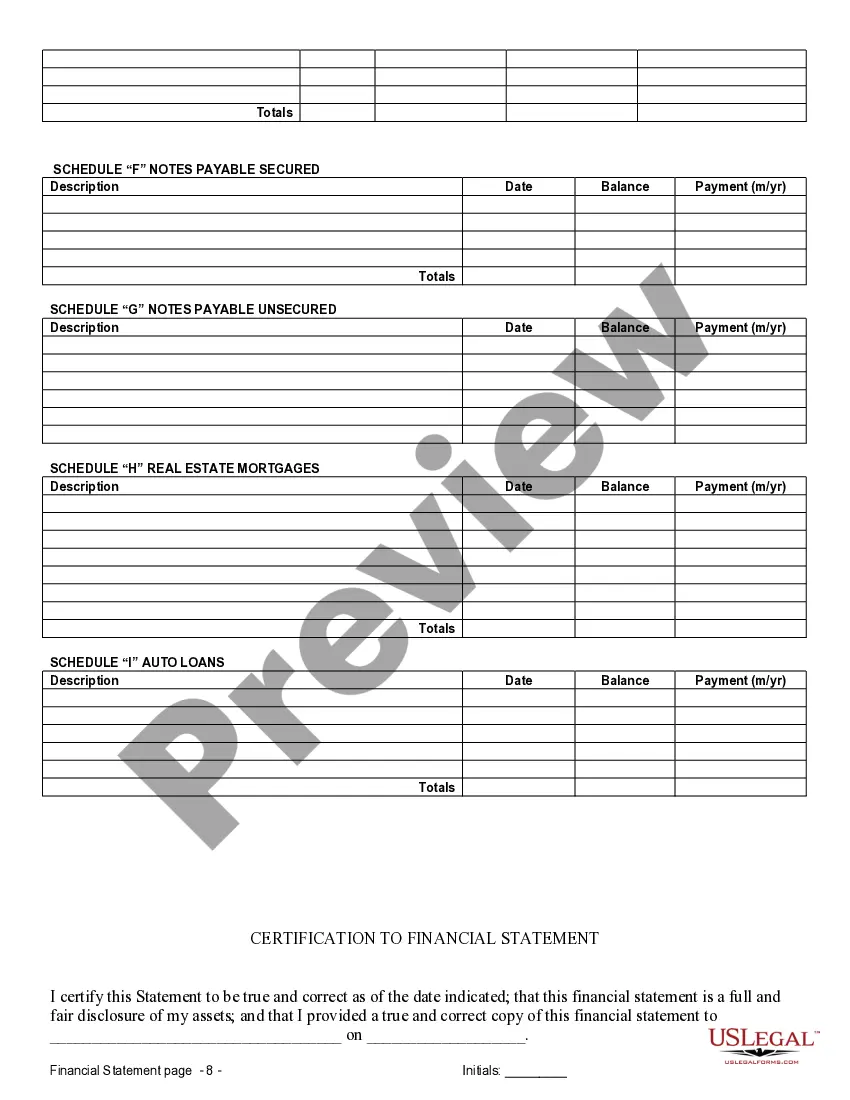

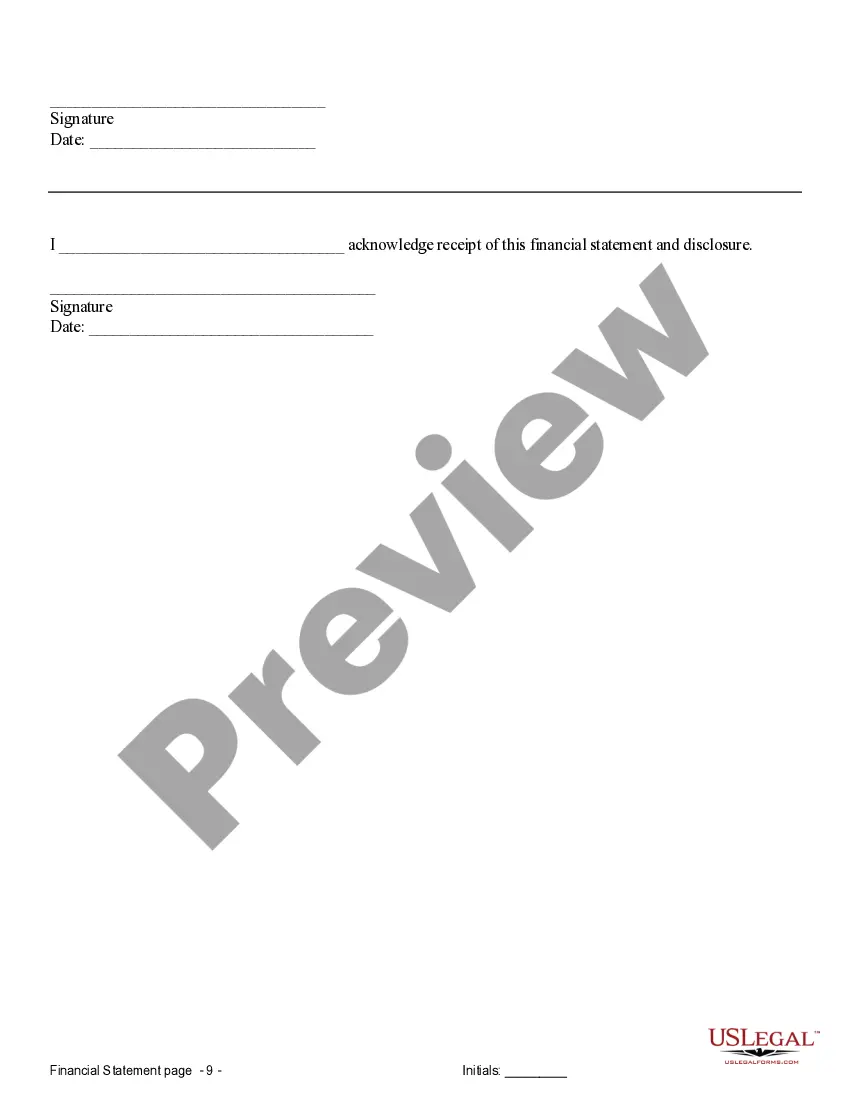

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

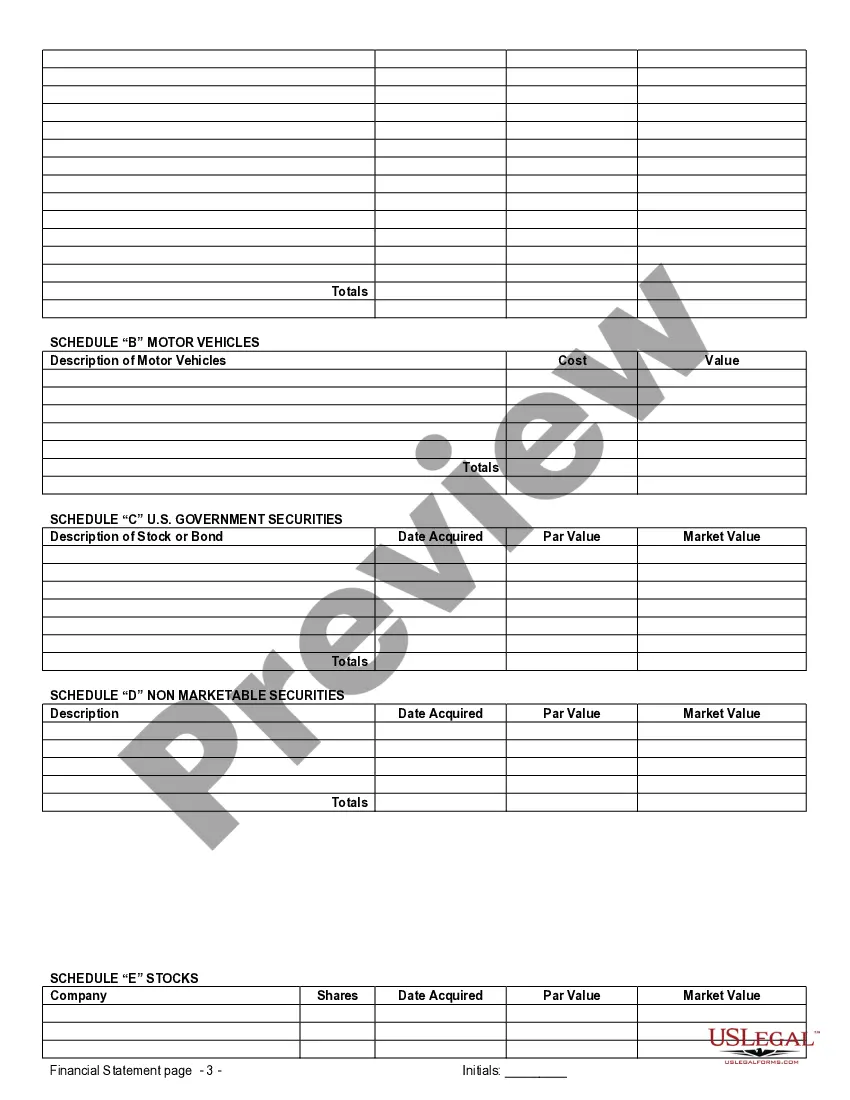

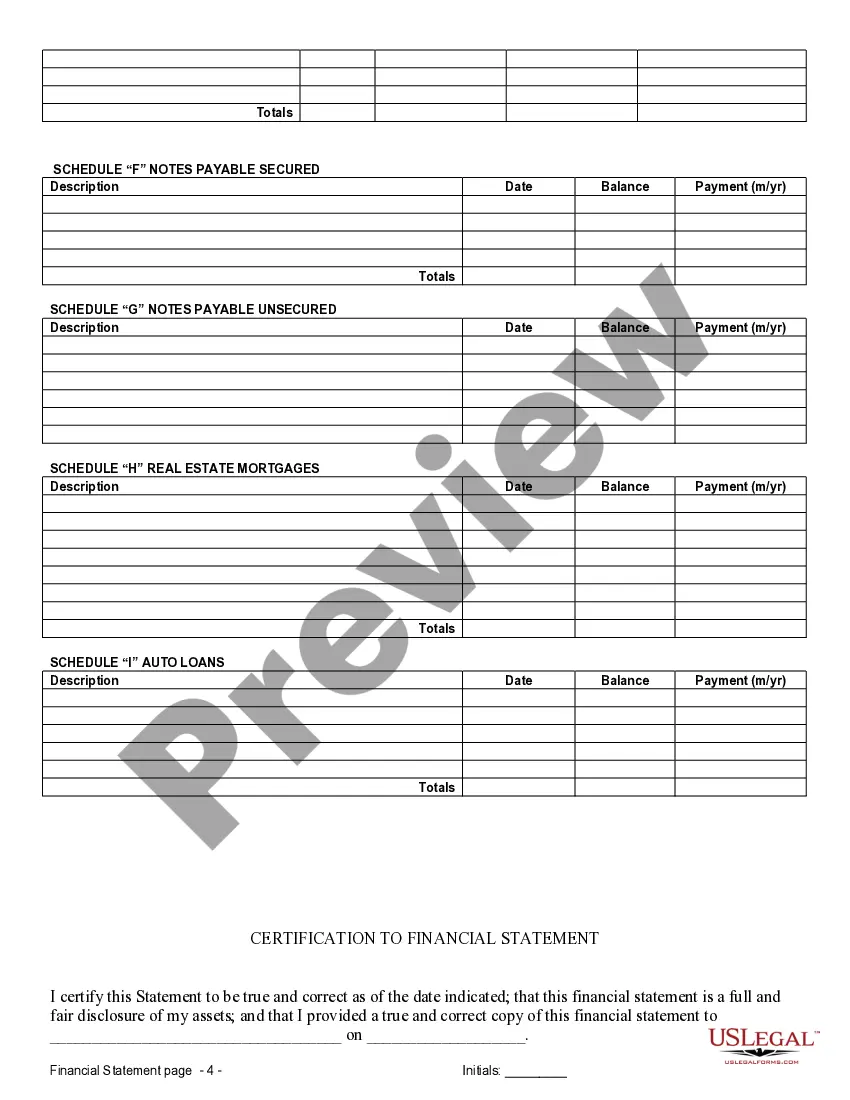

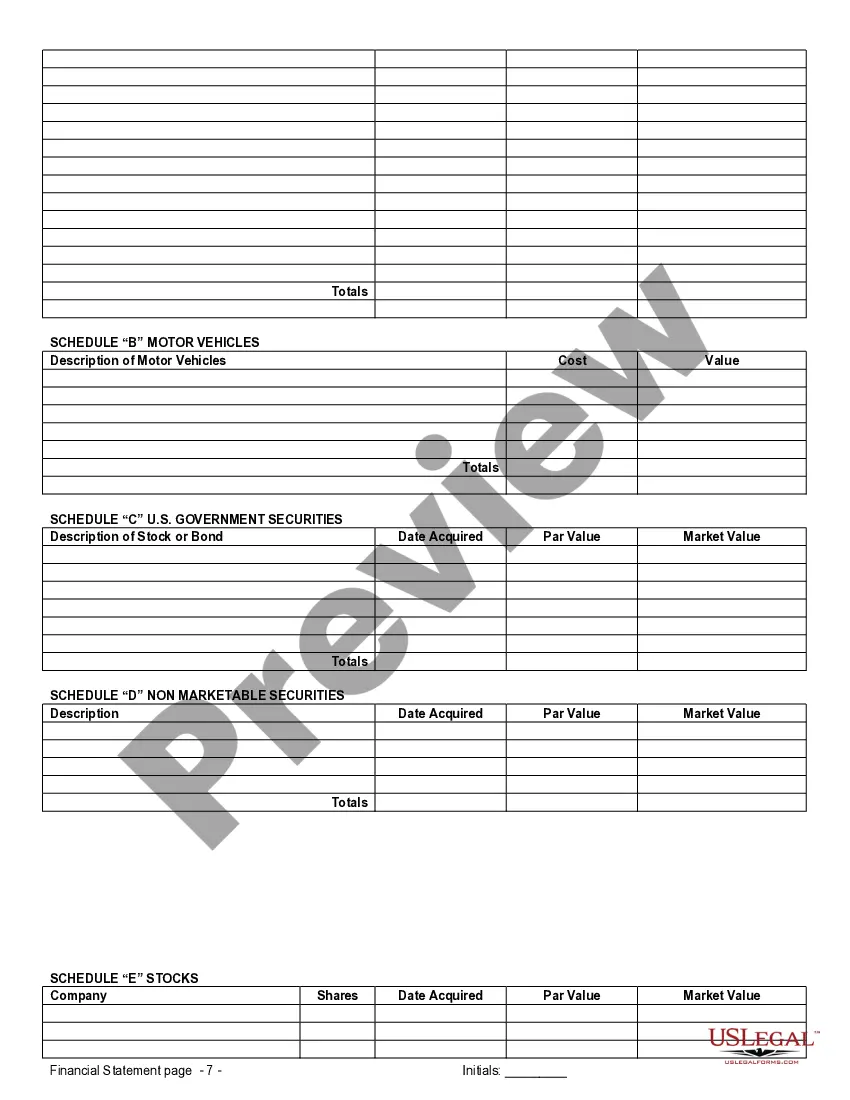

Detailed Description of Hialeah Florida Financial Statements only in Connection with Prenuptial Premarital Agreement: Hialeah, a vibrant city in Florida, requires specific financial statements when considering a prenuptial or premarital agreement. These financial statements are essential to protect the financial interest of both parties involved in the agreement. Hialeah Florida Financial Statements in connection with Prenuptial Premarital Agreement are designed to provide a clear picture of each party's financial situation before entering into the agreement, ensuring transparency and fairness. Here are the different types of Hialeah Florida Financial Statements only in Connection with Prenuptial Premarital Agreement: 1. Personal Financial Statements: These statements provide a comprehensive overview of an individual's financial assets, liabilities, income, and expenses. It includes details about bank accounts, investments, real estate properties, vehicles, credit card debts, loans, and other financial obligations. Personal financial statements help determine each party's individual net worth and financial health. 2. Business Financial Statements: If either party owns a business or has a significant interest in one, business financial statements become crucial. These statements offer an in-depth analysis of the business's financial condition, including its assets, liabilities, revenues, expenses, profitability, and future prospects. These documents help evaluate the financial impact of the business on the prenuptial or premarital agreement. 3. Tax Returns: Tax returns are paramount in understanding one's income, sources of income, deductions, and any potential tax liabilities. By analyzing the tax returns, both parties can gain insights into individual earning capacities, investments, and overall financial standings. This information is vital for establishing fair terms and conditions in the prenuptial or premarital agreement. 4. Retirement Account Statements: Retirement accounts, such as 401(k)s, IRAs, and pensions, play a significant role in asset division and support provisions in a prenuptial or premarital agreement. Providing retirement account statements ensures transparency, allowing both parties to understand their current savings, investments, and future retirement benefits. 5. Property Valuations: Determining the value of real estate properties, such as primary residences, vacation homes, or investment properties, is essential when drafting a prenuptial or premarital agreement. Property valuations enable fair distribution or protection of assets, ensuring that both parties agree on the property's worth and their respective shares. 6. Debt Statements: Understanding the existing debts, credit card balances, mortgages, and other financial liabilities is crucial in determining how these obligations will be handled during the agreement. Debt statements provide clarity on each party's financial responsibilities and help outline potential limitations or protections in the event of separation or divorce. Hialeah Florida Financial Statements only in Connection with Prenuptial Premarital Agreement are necessary tools to promote openness and fairness between parties entering into such agreements. These statements ensure both parties are well-informed about each other's financial positions, thus supporting proper decision-making and protecting individual interests.Detailed Description of Hialeah Florida Financial Statements only in Connection with Prenuptial Premarital Agreement: Hialeah, a vibrant city in Florida, requires specific financial statements when considering a prenuptial or premarital agreement. These financial statements are essential to protect the financial interest of both parties involved in the agreement. Hialeah Florida Financial Statements in connection with Prenuptial Premarital Agreement are designed to provide a clear picture of each party's financial situation before entering into the agreement, ensuring transparency and fairness. Here are the different types of Hialeah Florida Financial Statements only in Connection with Prenuptial Premarital Agreement: 1. Personal Financial Statements: These statements provide a comprehensive overview of an individual's financial assets, liabilities, income, and expenses. It includes details about bank accounts, investments, real estate properties, vehicles, credit card debts, loans, and other financial obligations. Personal financial statements help determine each party's individual net worth and financial health. 2. Business Financial Statements: If either party owns a business or has a significant interest in one, business financial statements become crucial. These statements offer an in-depth analysis of the business's financial condition, including its assets, liabilities, revenues, expenses, profitability, and future prospects. These documents help evaluate the financial impact of the business on the prenuptial or premarital agreement. 3. Tax Returns: Tax returns are paramount in understanding one's income, sources of income, deductions, and any potential tax liabilities. By analyzing the tax returns, both parties can gain insights into individual earning capacities, investments, and overall financial standings. This information is vital for establishing fair terms and conditions in the prenuptial or premarital agreement. 4. Retirement Account Statements: Retirement accounts, such as 401(k)s, IRAs, and pensions, play a significant role in asset division and support provisions in a prenuptial or premarital agreement. Providing retirement account statements ensures transparency, allowing both parties to understand their current savings, investments, and future retirement benefits. 5. Property Valuations: Determining the value of real estate properties, such as primary residences, vacation homes, or investment properties, is essential when drafting a prenuptial or premarital agreement. Property valuations enable fair distribution or protection of assets, ensuring that both parties agree on the property's worth and their respective shares. 6. Debt Statements: Understanding the existing debts, credit card balances, mortgages, and other financial liabilities is crucial in determining how these obligations will be handled during the agreement. Debt statements provide clarity on each party's financial responsibilities and help outline potential limitations or protections in the event of separation or divorce. Hialeah Florida Financial Statements only in Connection with Prenuptial Premarital Agreement are necessary tools to promote openness and fairness between parties entering into such agreements. These statements ensure both parties are well-informed about each other's financial positions, thus supporting proper decision-making and protecting individual interests.