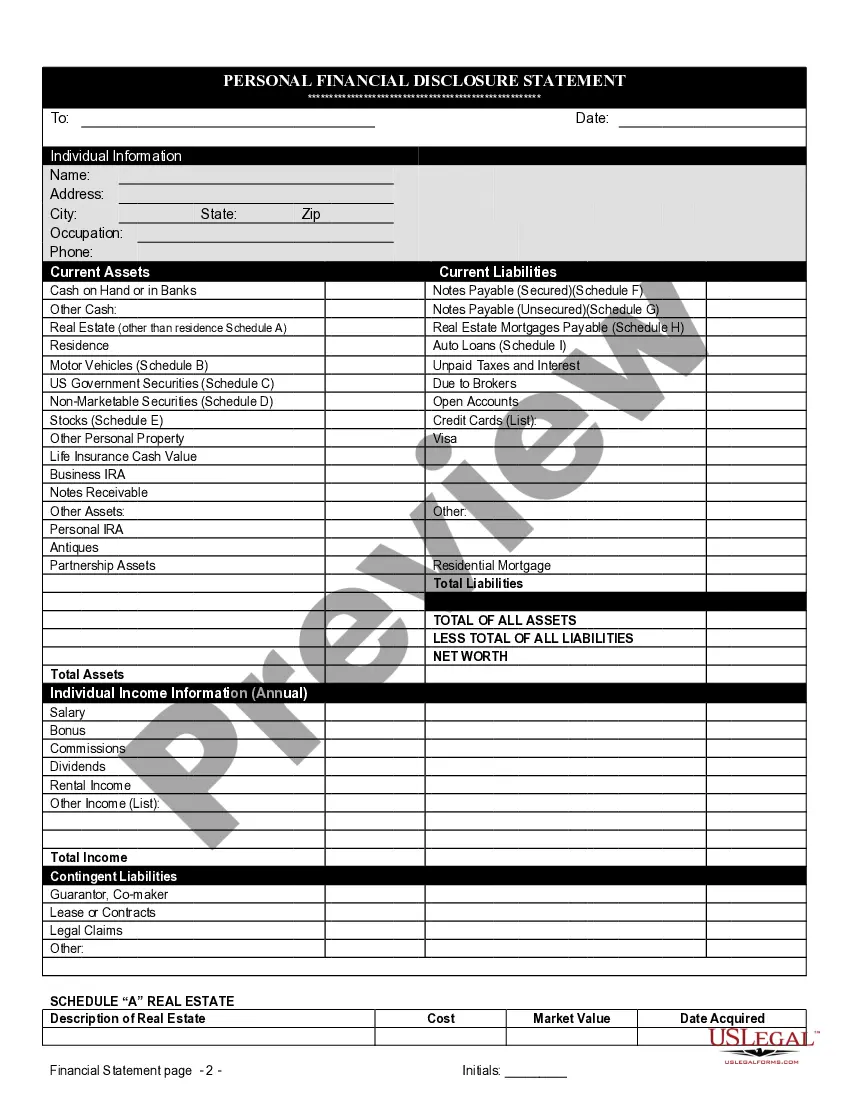

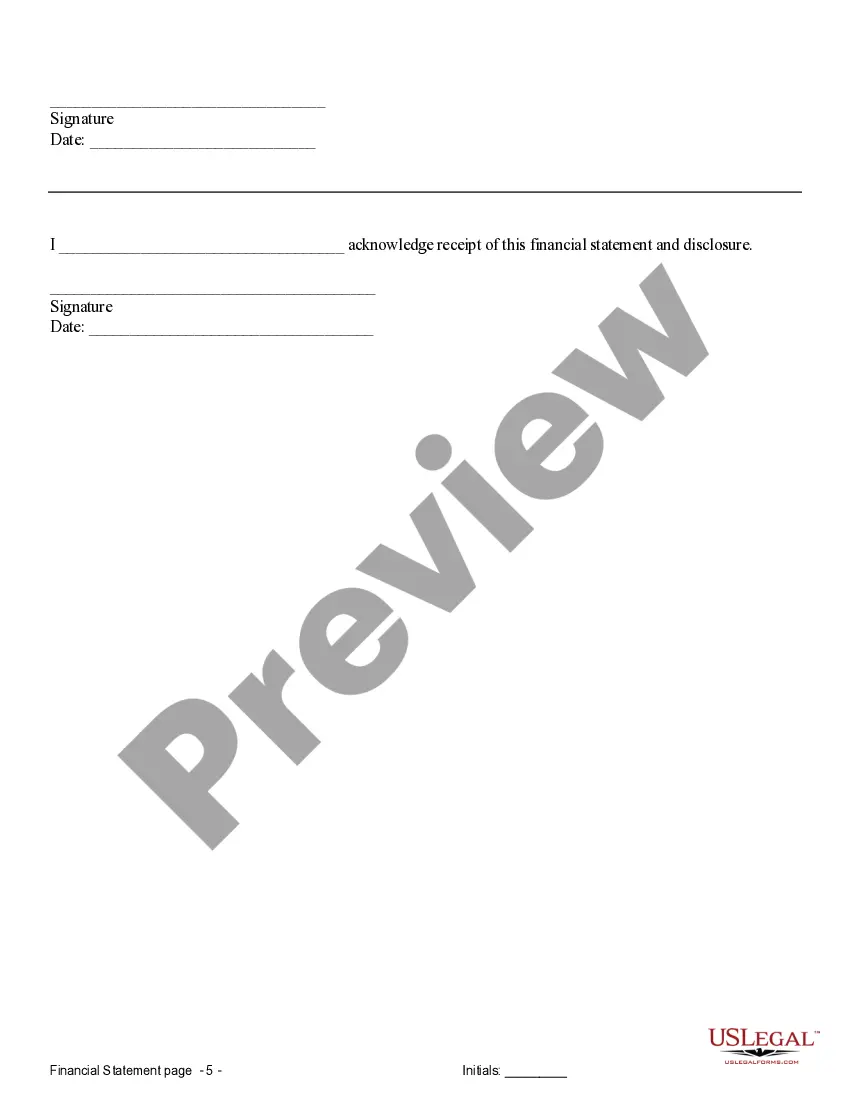

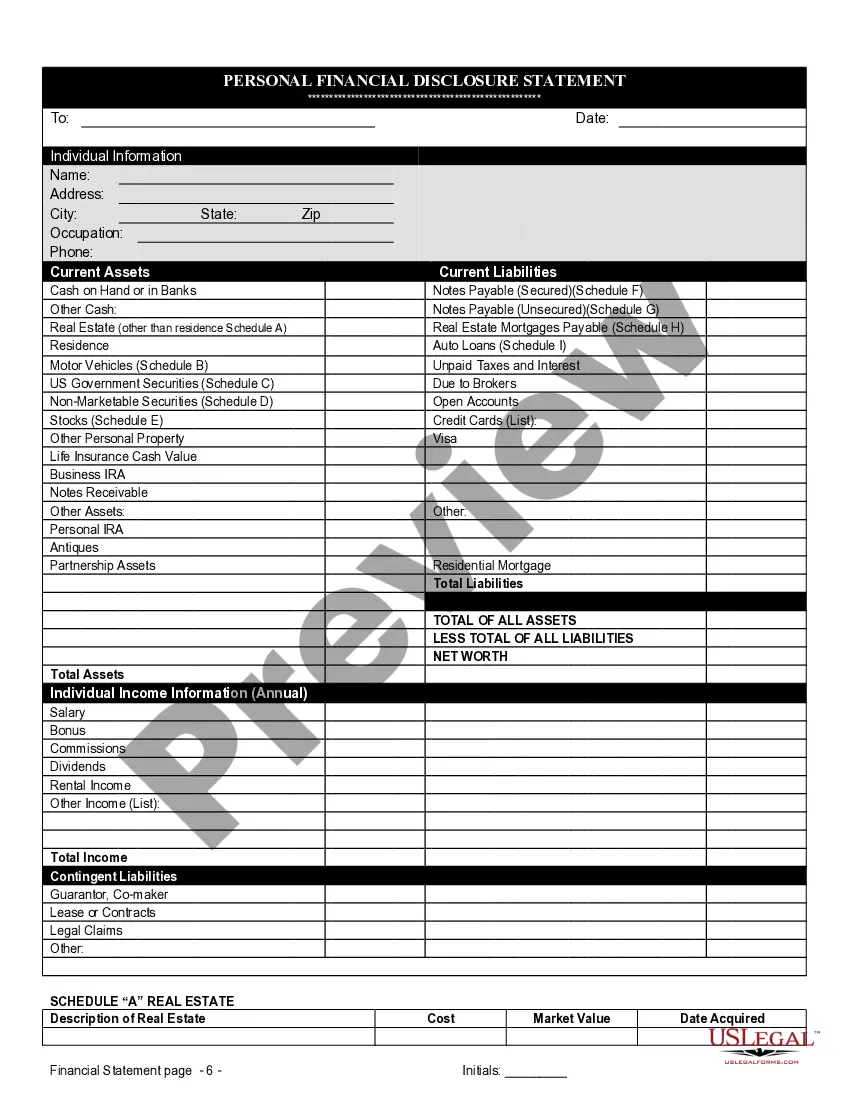

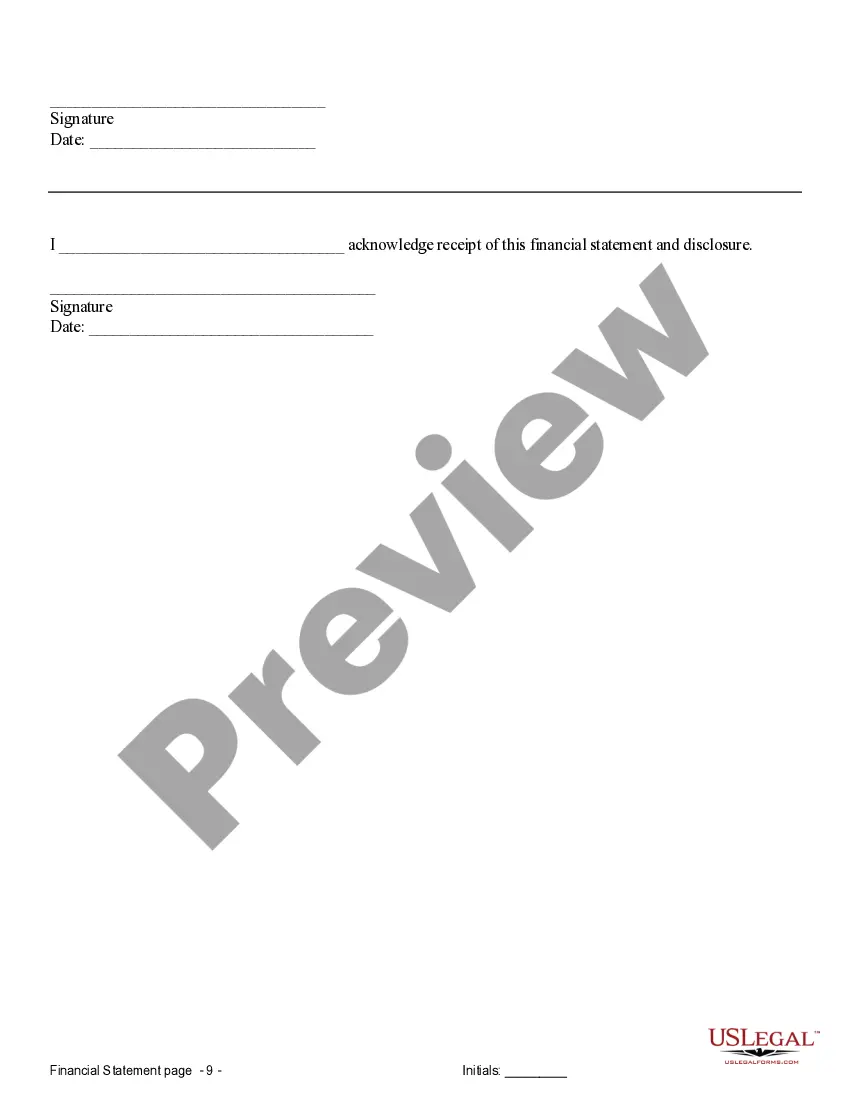

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

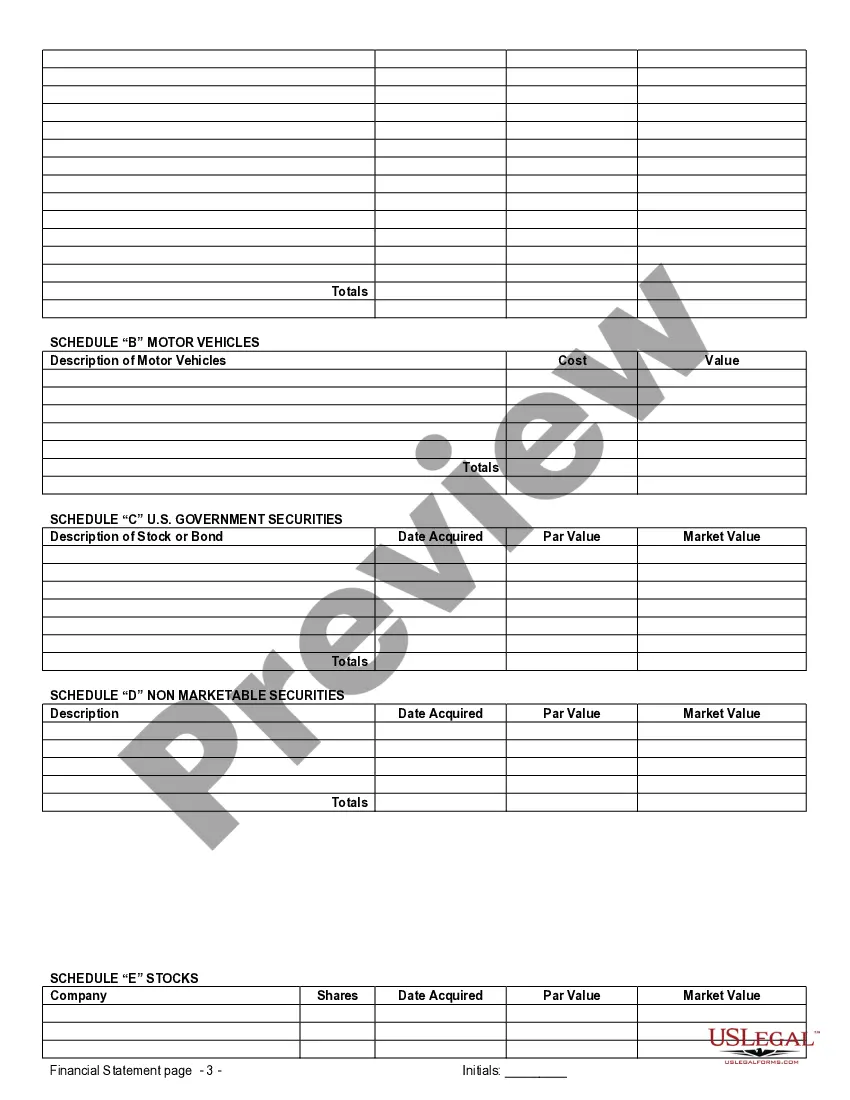

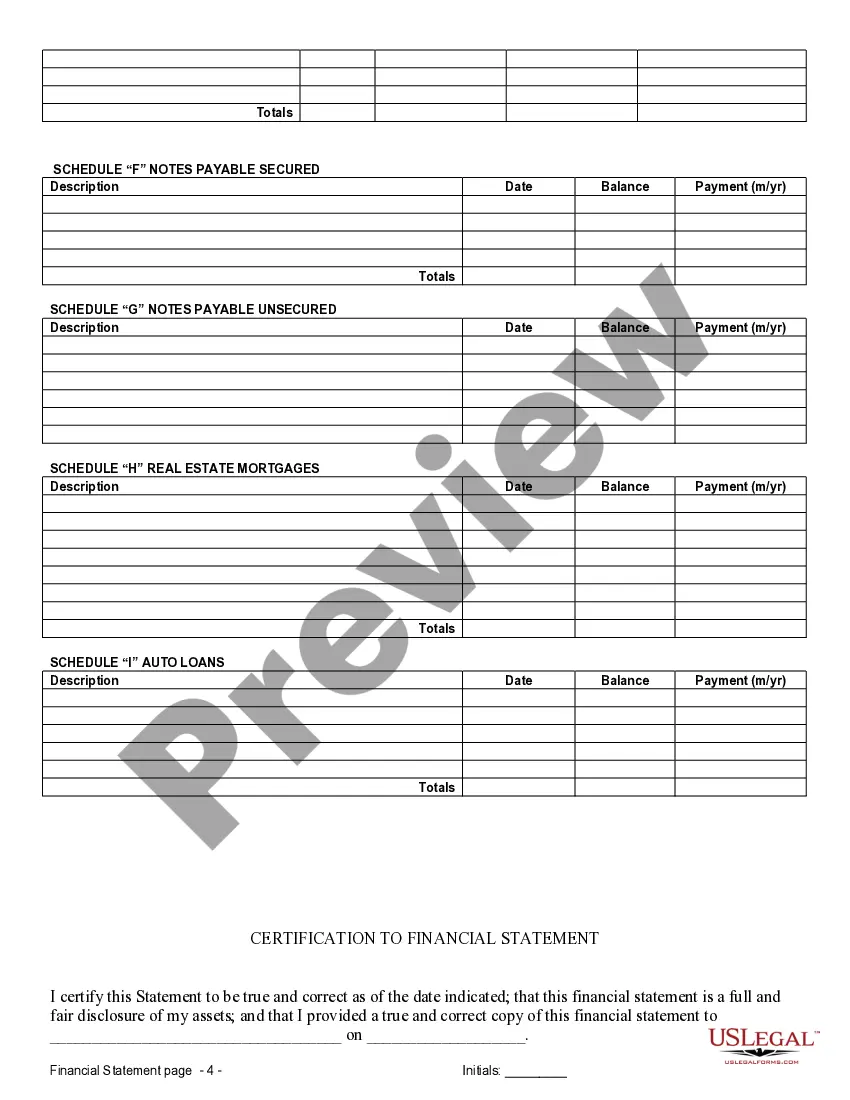

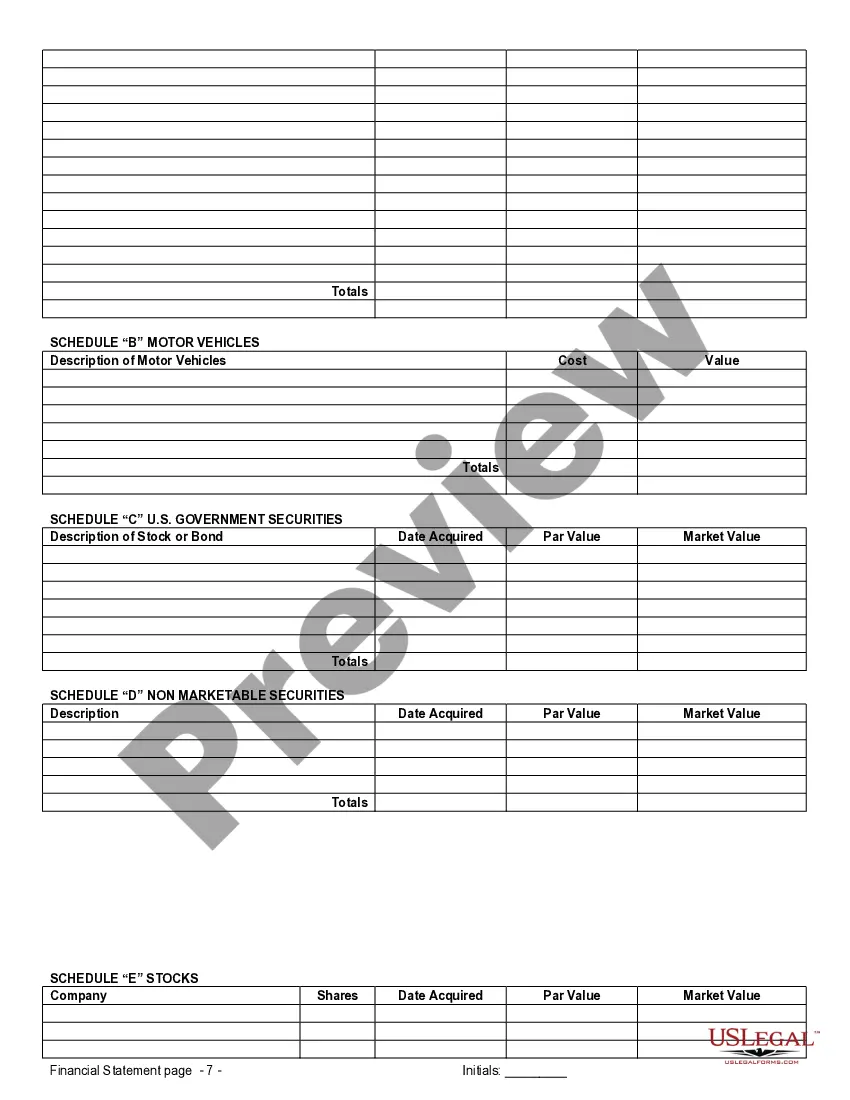

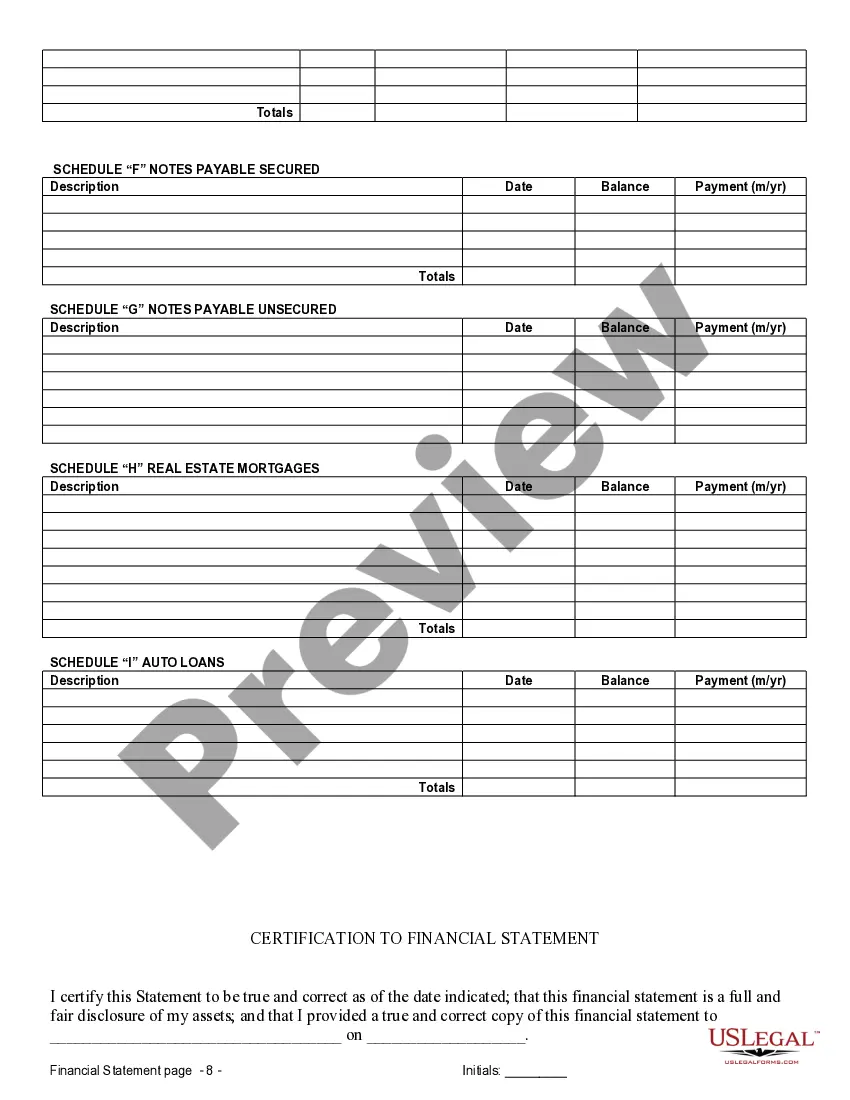

In Hollywood, Florida, financial statements are an essential component when considering a prenuptial or premarital agreement. These statements provide a comprehensive overview of the financial status, assets, and liabilities of both individuals involved in the agreement. Financial statements in connection with a prenuptial or premarital agreement are crucial in ensuring transparency, fairness, and protection for the parties involved. These statements help determine the division of assets, liabilities, and financial obligations, should the marriage come to an end. There are several types of financial statements commonly used in Hollywood, Florida, specifically for prenuptial or premarital agreements: 1. Personal Balance Sheet: A personal balance sheet provides an overview of an individual's assets, such as real estate properties, bank accounts, investments, and personal belongings. It also includes liabilities, like mortgages, loans, and credit card debts. This statement helps determine each spouse's net worth and their potential financial contributions to the marriage. 2. Income Statement: An income statement outlines an individual's income sources, including salaries, business profits, dividends, and rental income. This statement helps understand each spouse's earning potential, which can be relevant when deciding on spousal support or alimony provisions in the prenuptial or premarital agreement. 3. Tax Returns: Tax returns provide a comprehensive financial overview, including income, deductions, credits, and tax liabilities. These documents can be crucial in understanding the financial standing of both individuals, and they help ensure accurate reporting of income for the agreement's negotiation. 4. Bank Statements: Bank statements detail an individual's financial transactions, including deposits, withdrawals, and account balances. These statements provide evidence of income, spending habits, and financial commitment. They help shed light on each spouse's financial management skills and financial obligations. 5. Investment and Retirement Account Statements: These statements showcase a spouse's investment portfolio, including stocks, bonds, mutual funds, and retirement accounts (such as IRAs or 401(k)s). They give insights into the long-term financial goals, financial stability, and anticipated future income of both spouses. 6. Real Estate Documentation: This type of documentation includes property deeds, mortgage statements, and rental agreements. Real estate documents help identify the parties' property ownership and any associated financial obligations related to mortgages or leases. 7. Business Financial Statements: If either spouse owns a business, business financial statements become relevant. These statements include income statements, balance sheets, and cash flow statements, providing an understanding of the business's financial health and potential financial support it may require. When drafting a prenuptial or premarital agreement in Hollywood, Florida, it is crucial to gather and present these financial statements to ensure transparency, fairness, and legal compliance. By documenting accurate and comprehensive financial information, both parties can approach the agreement negotiation with clarity, ensuring the protection and interest of all involved.