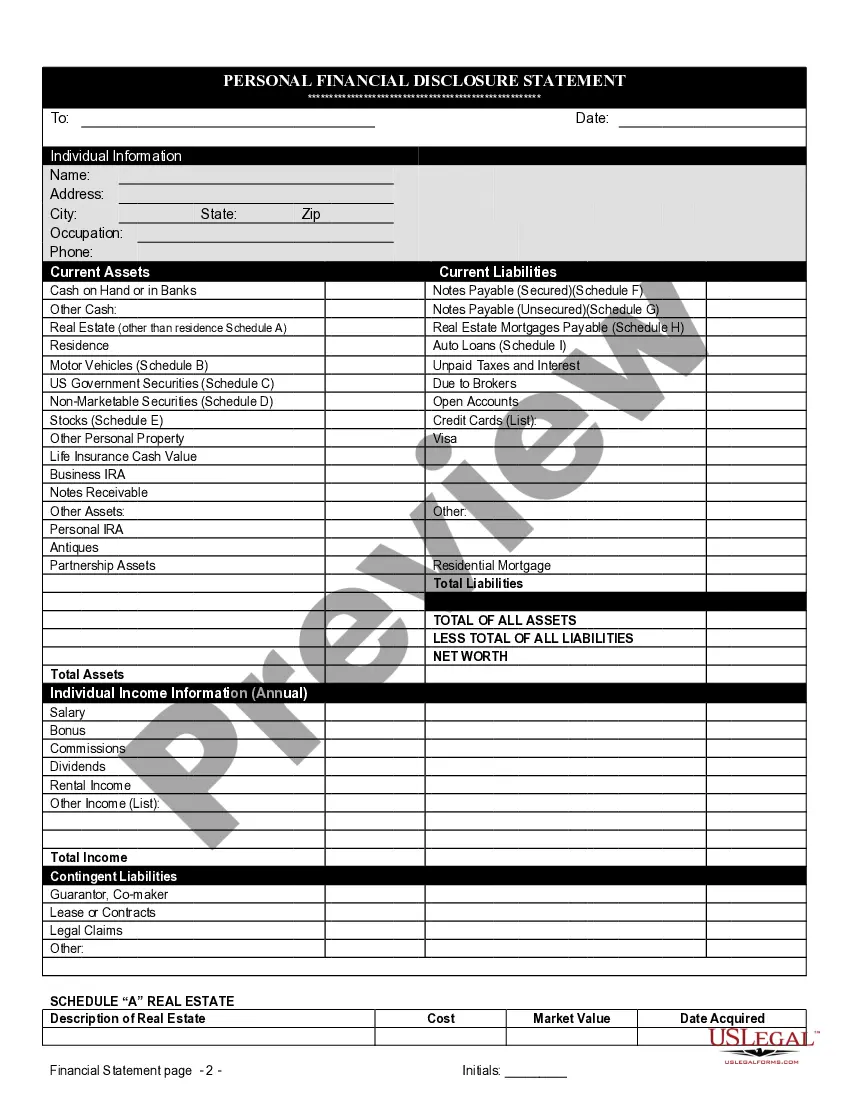

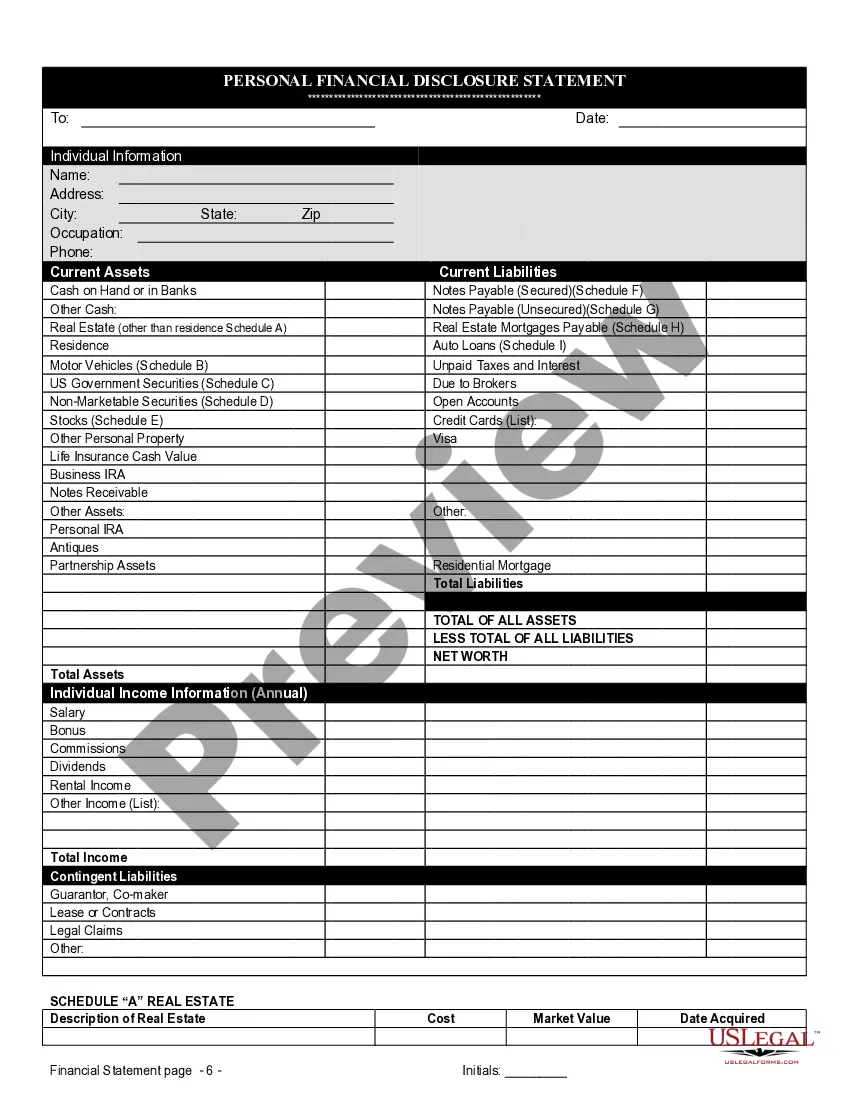

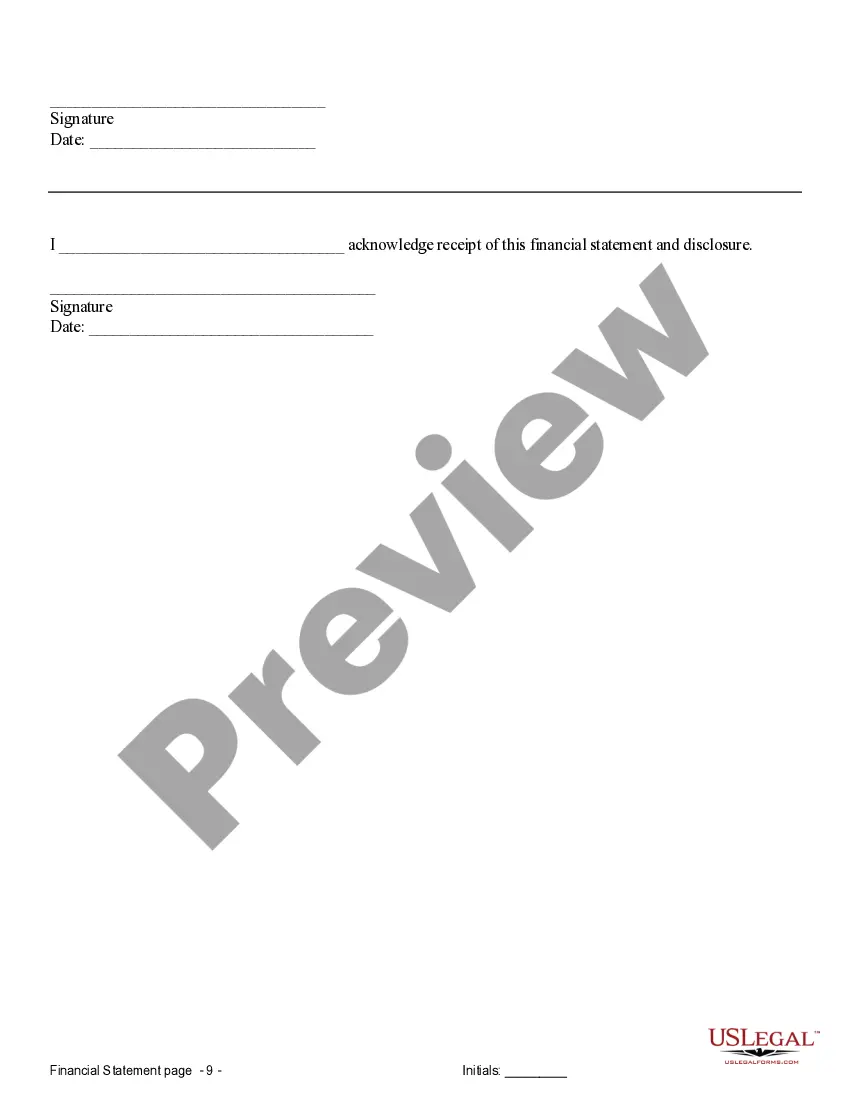

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Florida Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you have previously utilized our service, Log In to your account and retrieve the Lakeland Florida Financial Statements exclusively related to Prenuptial Premarital Agreement onto your device by pressing the Download button. Ensure that your subscription is active. If not, renew it following your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You consistently have access to every document you have purchased: you can locate it in your profile within the My documents menu whenever you need to reuse it. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Browse through the description and utilize the Preview feature, if available, to determine if it suits your requirements. If it doesn’t suit you, employ the Search tab above to find the correct one.

- Purchase the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to complete the transaction.

- Obtain your Lakeland Florida Financial Statements solely related to Prenuptial Premarital Agreement. Select the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

While prenuptial agreements primarily address premarital assets, they can also cover various financial matters, including debt responsibilities and income distribution. This flexibility means you can tailor your agreement to your specific needs. Including Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement helps clarify financial matters, making the prenup more comprehensive and protective.

Prenuptial agreements are not typically recorded in public records in Florida. Instead, they are retained as private contracts between the parties. By incorporating Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement, you provide a clearer financial picture that may assist in any future disputes, all while keeping your agreement confidential.

Prenuptial agreements are generally not considered public knowledge in Florida. They remain private documents unless one of the parties decides to disclose them. Utilizing Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement allows for transparency between partners while keeping the details confidential.

Yes, Florida legally recognizes prenuptial agreements. These agreements require both parties to enter into them voluntarily and with a full understanding of their rights. In Lakeland, Florida, having well-prepared financial statements included in the agreement strengthens its validity, ensuring it aligns with legal standards.

Prenuptial agreements do not automatically become void after 10 years in Florida. However, the enforceability of a prenuptial agreement can depend on various factors, including changes in circumstances or the financial situation of the parties involved. It is essential to keep Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement up-to-date to ensure its relevance and enforceability over time.

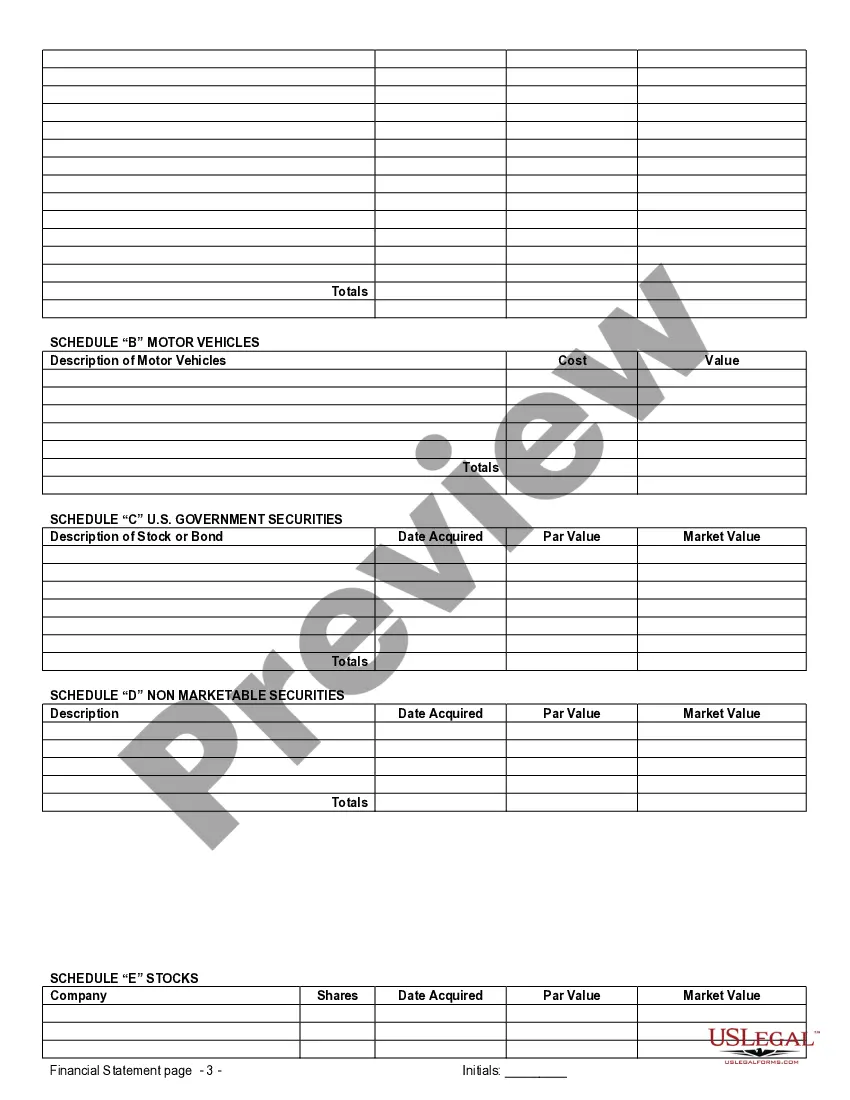

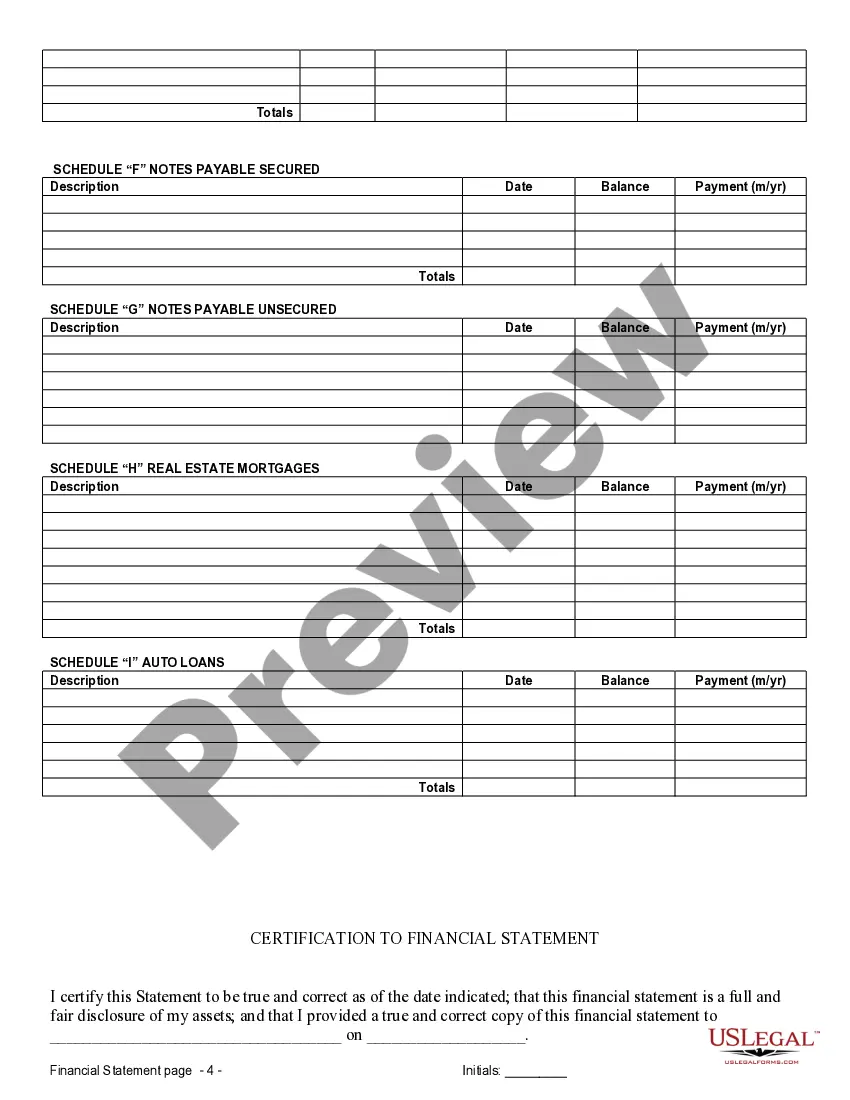

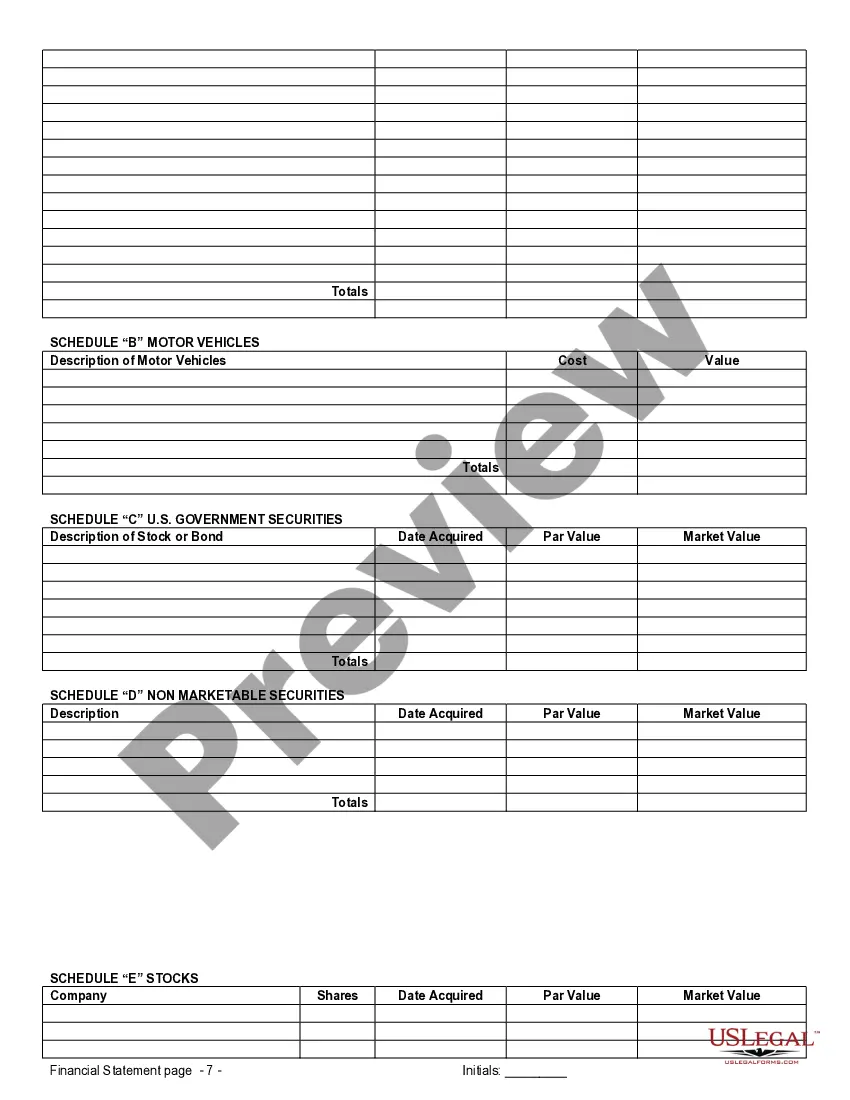

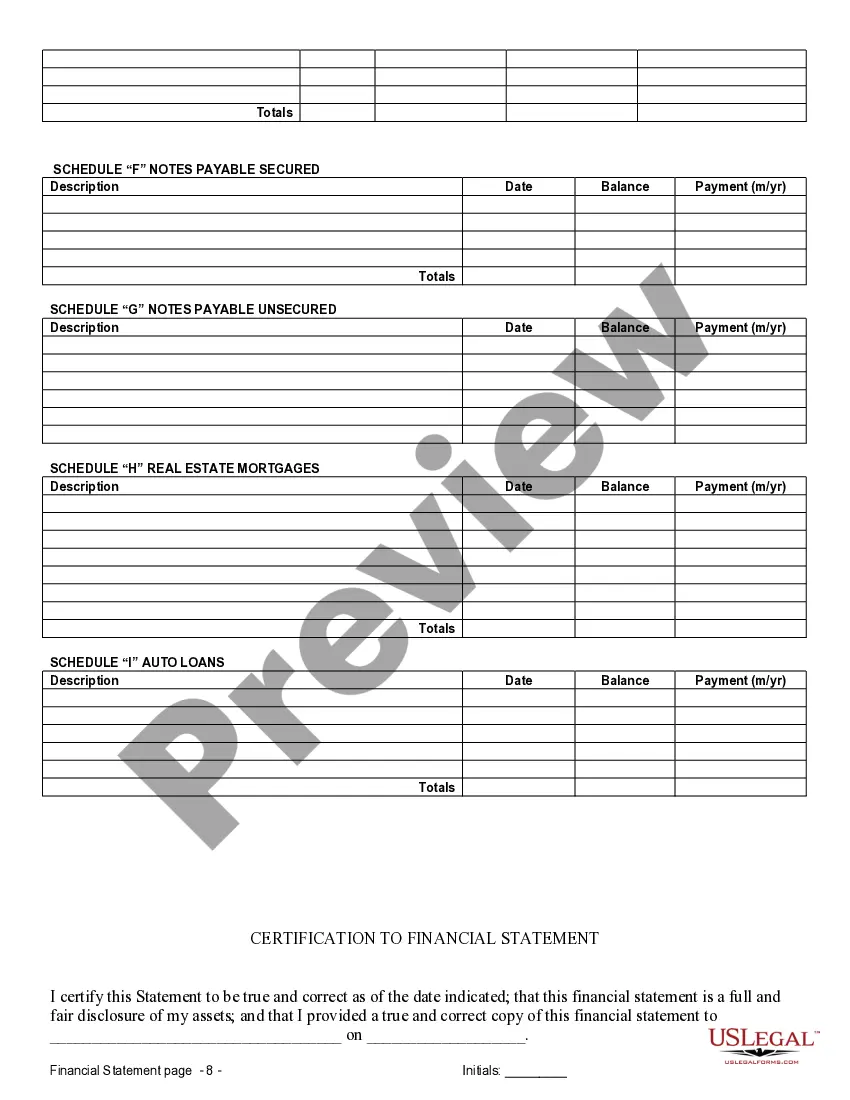

The financial schedule of a prenuptial agreement is a detailed outline of your financial assets and liabilities. It serves as a reference for both parties, providing clear insight into each spouse's financial standing. When discussing Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement, having a well-structured financial schedule can facilitate smoother discussions and negotiations. With uslegalforms, you can draft an agreement that includes this essential component.

Yes, a prenup can effectively keep finances separate. By specifying which assets belong to each spouse, it can prevent disputes in the future. This is especially relevant when dealing with complex situations involving Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement. Utilizing uslegalforms can simplify the process of creating a customized agreement that meets your unique financial needs.

A prenuptial agreement provides clarity and security for both parties entering a marriage. It allows couples to outline financial responsibilities and rights, ensuring transparency regarding assets. This can be particularly beneficial when considering Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement. With uslegalforms, you can easily create a prenuptial agreement tailored to your needs.

The 7 day rule for prenups means that each party should have at least seven days to review the agreement before signing it. This period ensures that both individuals fully understand the terms of the prenup, including the Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement. It's essential to allow this time to promote transparency and fairness, helping to prevent later challenges to the agreement.

The financial statement of a prenuptial agreement details the financial information of both parties involved. This includes a breakdown of assets, liabilities, income, and other financial interests. Comprehensive Lakeland Florida Financial Statements only in Connection with Prenuptial Premarital Agreement facilitate clear communication between partners, addressing potential financial disputes head-on.