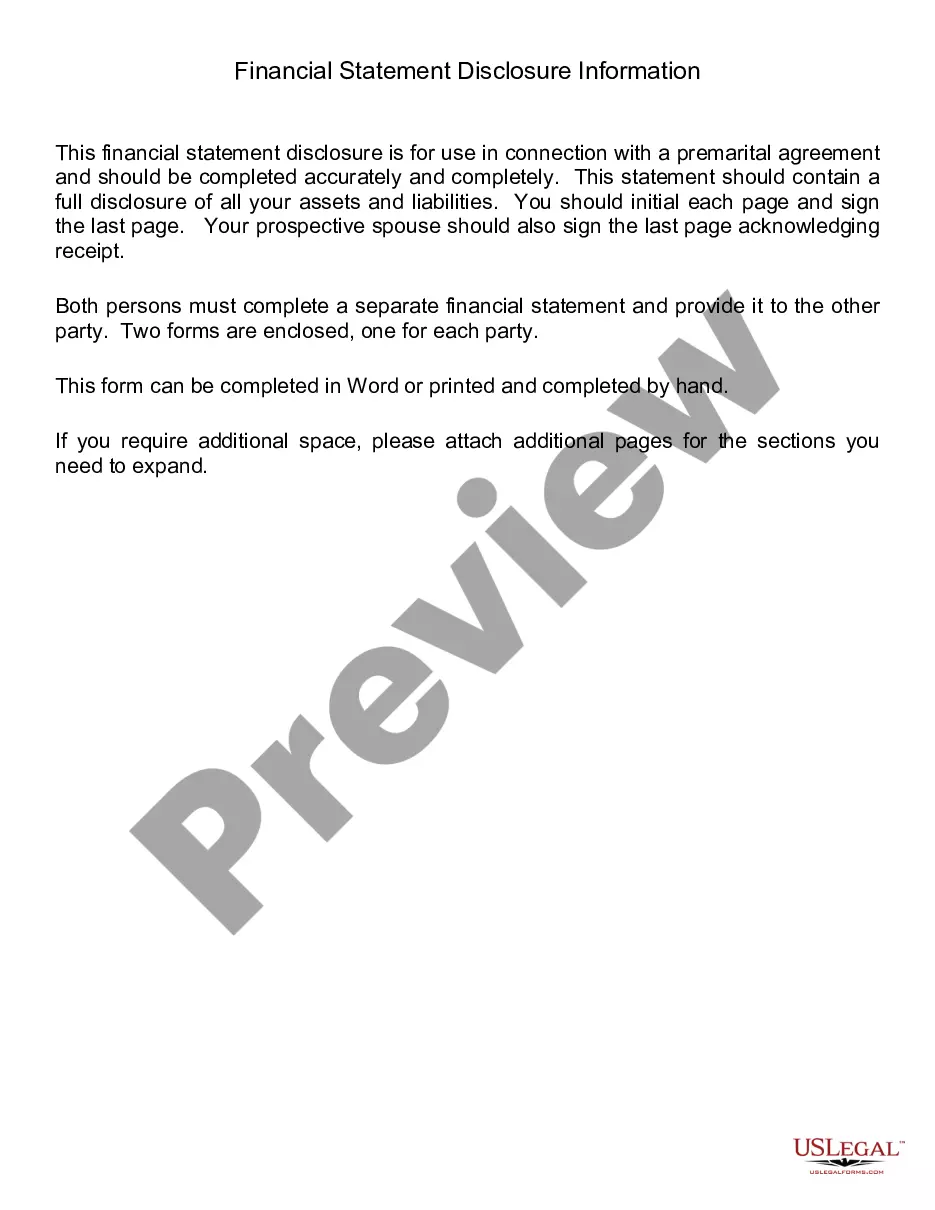

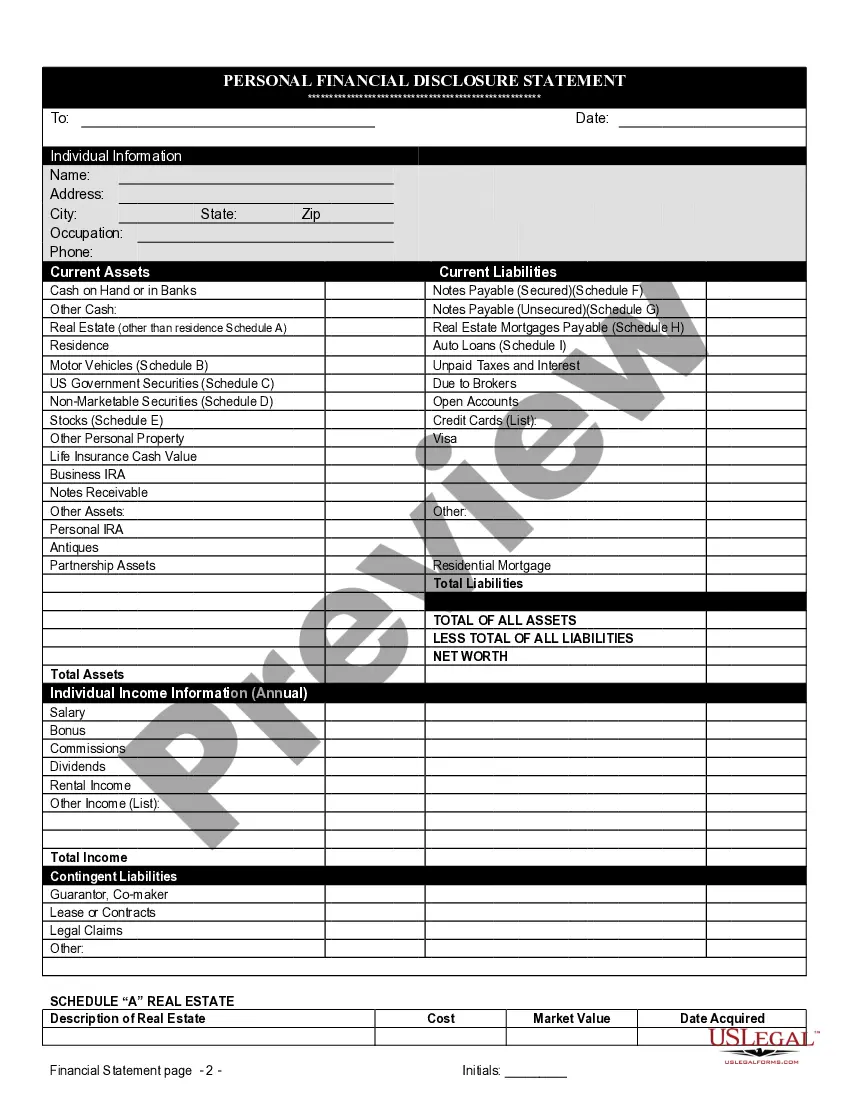

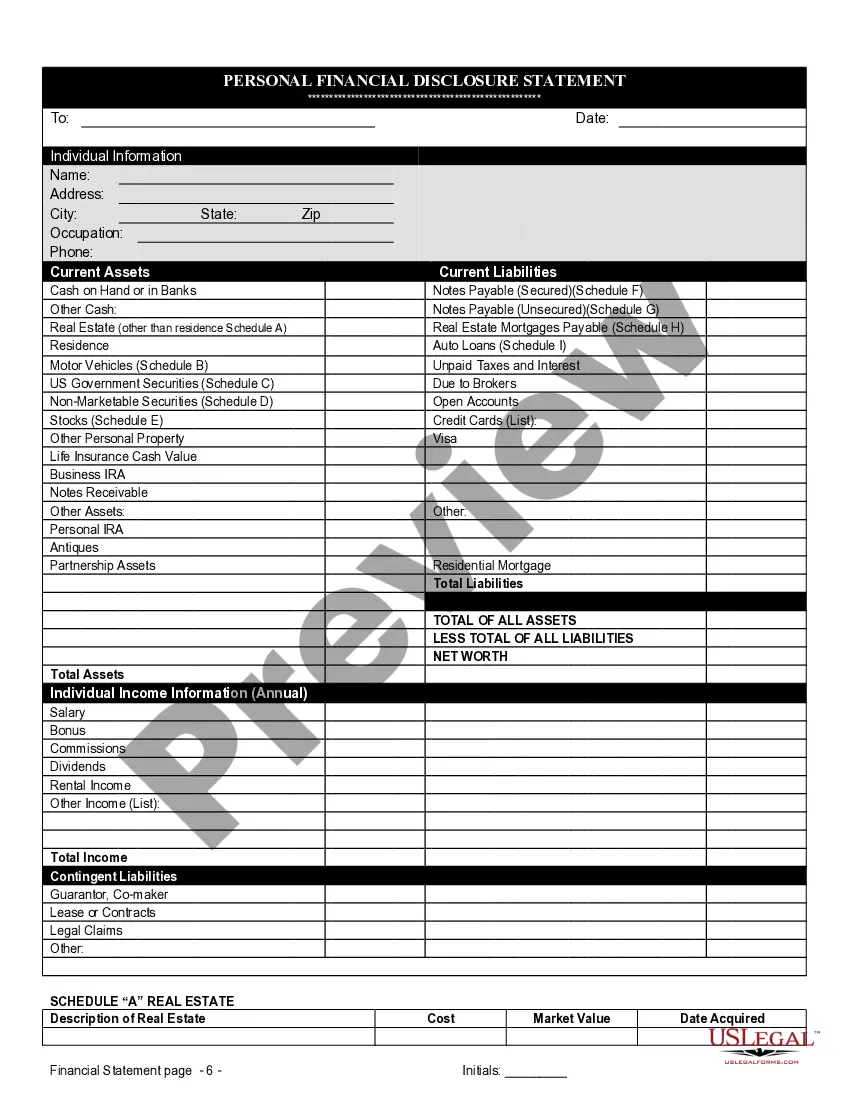

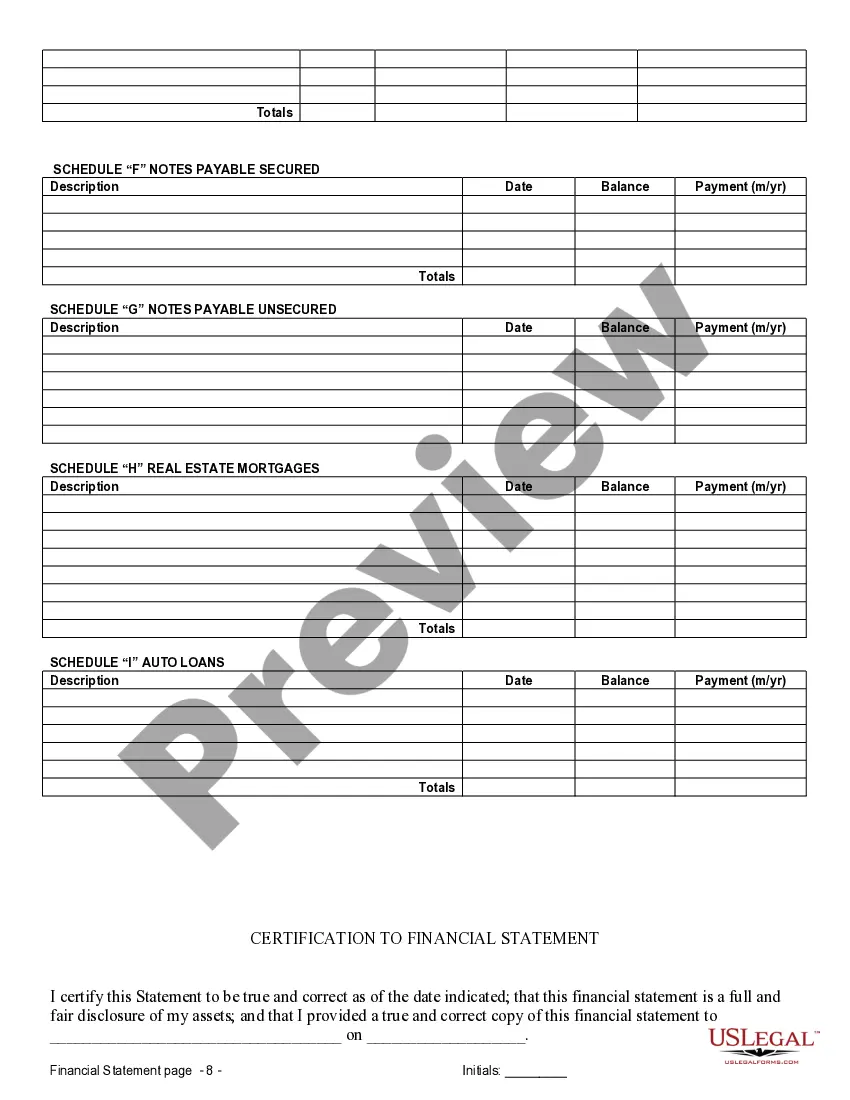

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

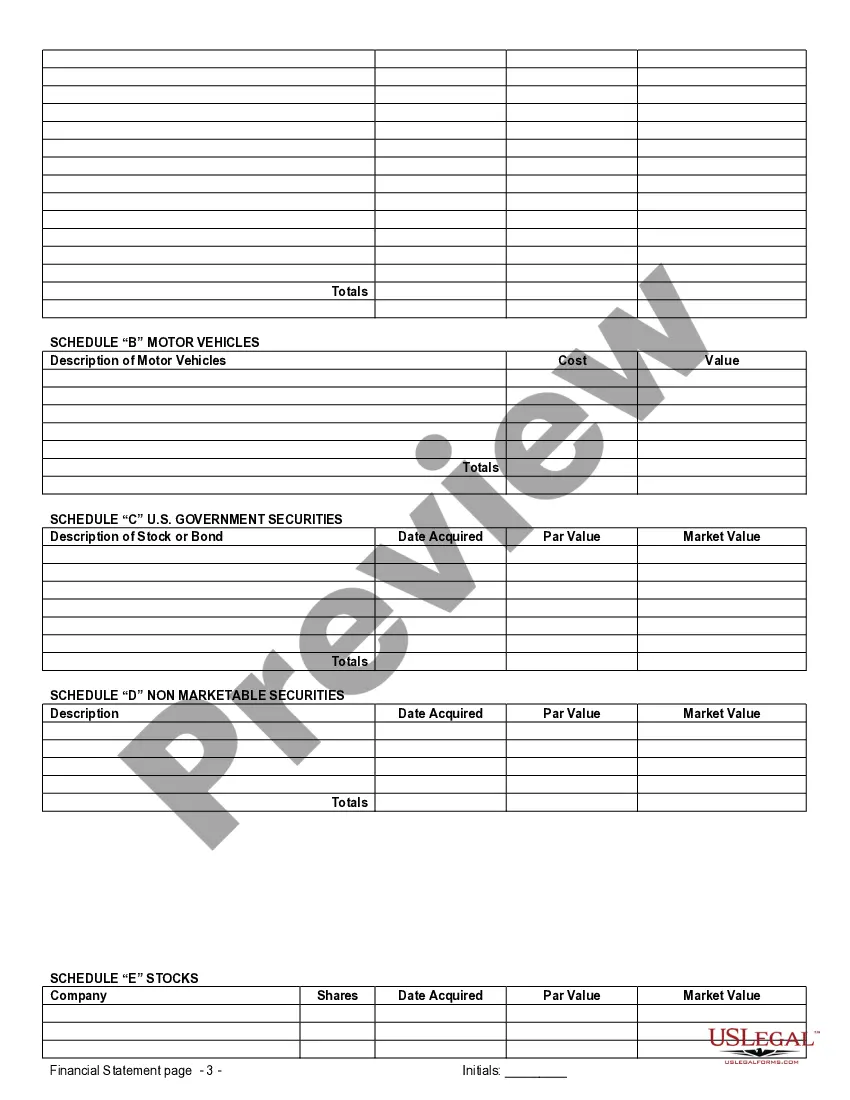

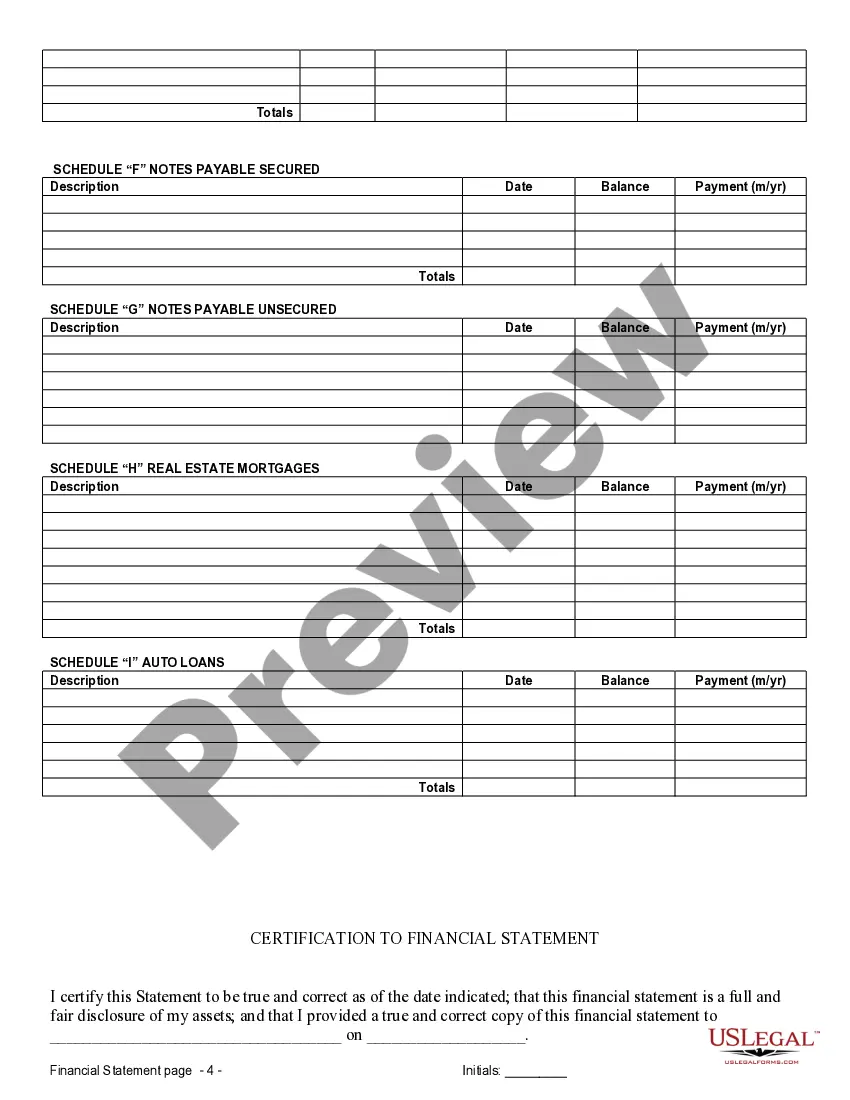

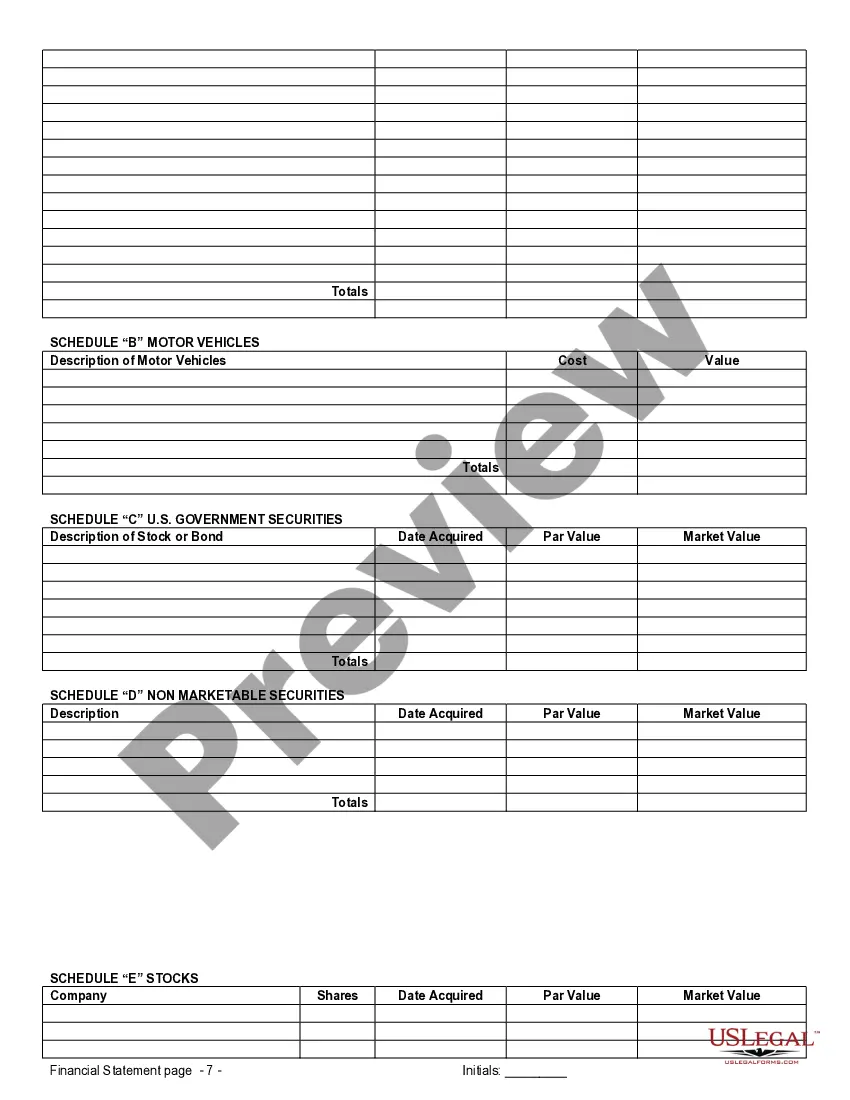

Miami-Dade Florida financial statements in connection with prenuptial premarital agreements are legal documents that provide a comprehensive overview of the financial status of individuals entering into a marriage or domestic partnership in Miami-Dade County, Florida. These statements play a crucial role in establishing transparency, trust, and fairness in the event of divorce or separation. The main purpose of Miami-Dade financial statements in connection with prenuptial premarital agreements is to disclose assets, liabilities, income, and expenses of each party involved. By including these statements in a prenuptial agreement, both parties can clearly understand each other's financial positions before entering into a legally binding commitment. This helps in determining the division of assets and debts in the case of divorce or dissolution of the marriage. There are different types of Miami-Dade Florida financial statements that can be included in a prenuptial premarital agreement. These include: 1. Personal Financial Statements: Individuals disclose their personal financial information such as bank accounts, savings, investments, real estate properties, vehicles, and retirement accounts. This statement provides a comprehensive view of their assets and identifies any potential disputes over ownership. 2. Business Financial Statements: If either party owns a business or has a stake in one, additional financial statements must be provided. These statements involve disclosing business income, expenses, assets, liabilities, and valuation. They are essential when determining the division of business assets in divorce cases. 3. Tax Returns: Including copies of recent tax returns provides important information about each party's income, deductions, and potential tax liabilities. Tax returns are particularly useful in evaluating the earning capacity, financial stability, and overall financial health of a party. 4. Investment Statements: Individuals may include investment statements, such as brokerage or investment account statements, to disclose holdings, realized and unrealized gains or losses, and other related financial information. These statements provide insights into the individuals' investment portfolios and help assess their financial obligations and resources. 5. Debt Statements: Disclosing debts, including mortgages, loans, credit cards, and other financial obligations, is crucial. Outstanding debts can significantly impact the division of assets and financial responsibilities in the event of a divorce or separation. Debt statements ensure transparency and prevent any hidden obligations from surfacing later. In conclusion, Miami-Dade Florida financial statements in connection with prenuptial premarital agreements are vital for establishing financial transparency and division of assets. Including various types of financial statements helps ensure all parties entering into a marriage or domestic partnership have a clear understanding of each other's financial situations. By providing this information, individuals can protect their rights and ensure a fair resolution in case of a future separation.Miami-Dade Florida financial statements in connection with prenuptial premarital agreements are legal documents that provide a comprehensive overview of the financial status of individuals entering into a marriage or domestic partnership in Miami-Dade County, Florida. These statements play a crucial role in establishing transparency, trust, and fairness in the event of divorce or separation. The main purpose of Miami-Dade financial statements in connection with prenuptial premarital agreements is to disclose assets, liabilities, income, and expenses of each party involved. By including these statements in a prenuptial agreement, both parties can clearly understand each other's financial positions before entering into a legally binding commitment. This helps in determining the division of assets and debts in the case of divorce or dissolution of the marriage. There are different types of Miami-Dade Florida financial statements that can be included in a prenuptial premarital agreement. These include: 1. Personal Financial Statements: Individuals disclose their personal financial information such as bank accounts, savings, investments, real estate properties, vehicles, and retirement accounts. This statement provides a comprehensive view of their assets and identifies any potential disputes over ownership. 2. Business Financial Statements: If either party owns a business or has a stake in one, additional financial statements must be provided. These statements involve disclosing business income, expenses, assets, liabilities, and valuation. They are essential when determining the division of business assets in divorce cases. 3. Tax Returns: Including copies of recent tax returns provides important information about each party's income, deductions, and potential tax liabilities. Tax returns are particularly useful in evaluating the earning capacity, financial stability, and overall financial health of a party. 4. Investment Statements: Individuals may include investment statements, such as brokerage or investment account statements, to disclose holdings, realized and unrealized gains or losses, and other related financial information. These statements provide insights into the individuals' investment portfolios and help assess their financial obligations and resources. 5. Debt Statements: Disclosing debts, including mortgages, loans, credit cards, and other financial obligations, is crucial. Outstanding debts can significantly impact the division of assets and financial responsibilities in the event of a divorce or separation. Debt statements ensure transparency and prevent any hidden obligations from surfacing later. In conclusion, Miami-Dade Florida financial statements in connection with prenuptial premarital agreements are vital for establishing financial transparency and division of assets. Including various types of financial statements helps ensure all parties entering into a marriage or domestic partnership have a clear understanding of each other's financial situations. By providing this information, individuals can protect their rights and ensure a fair resolution in case of a future separation.