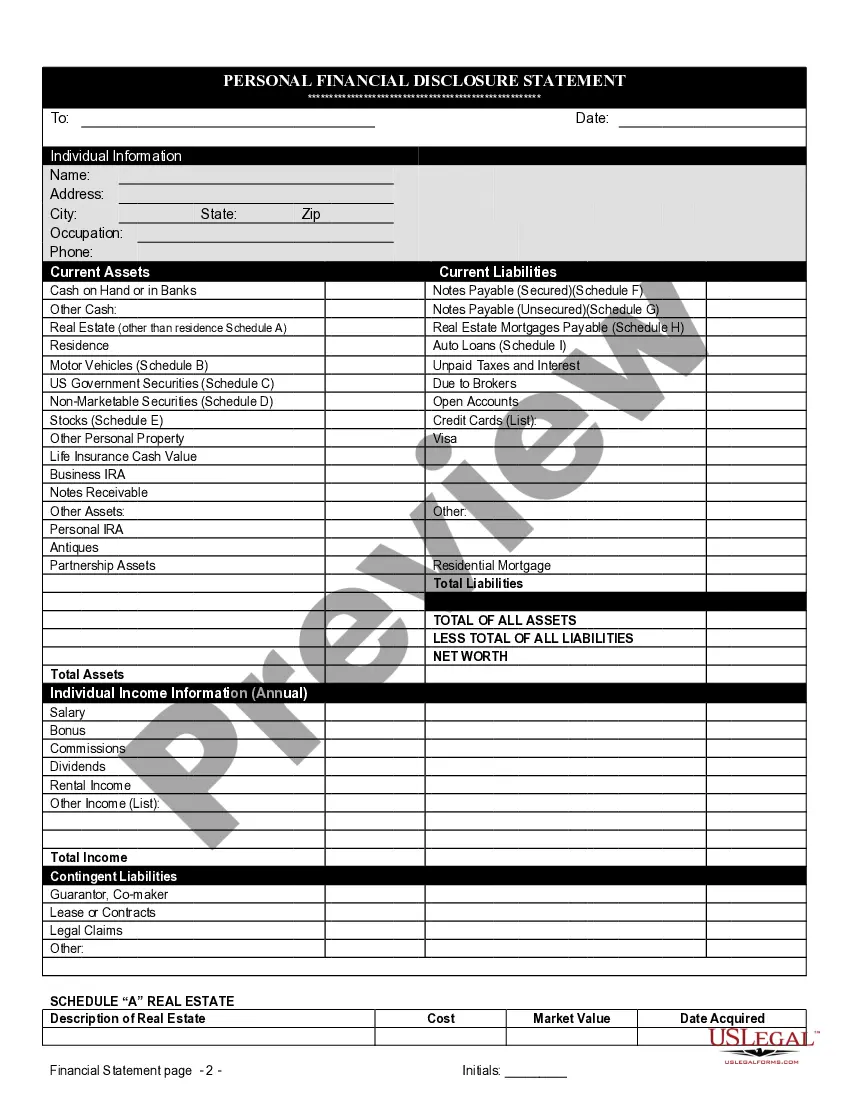

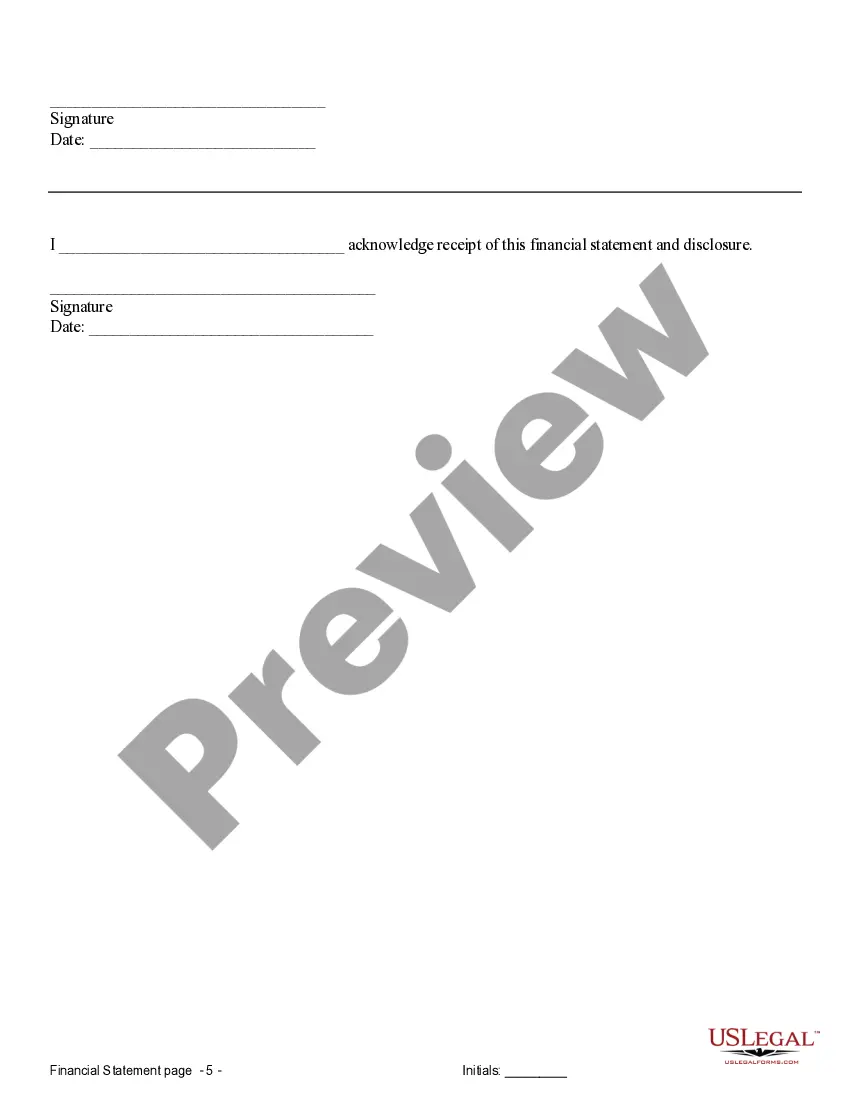

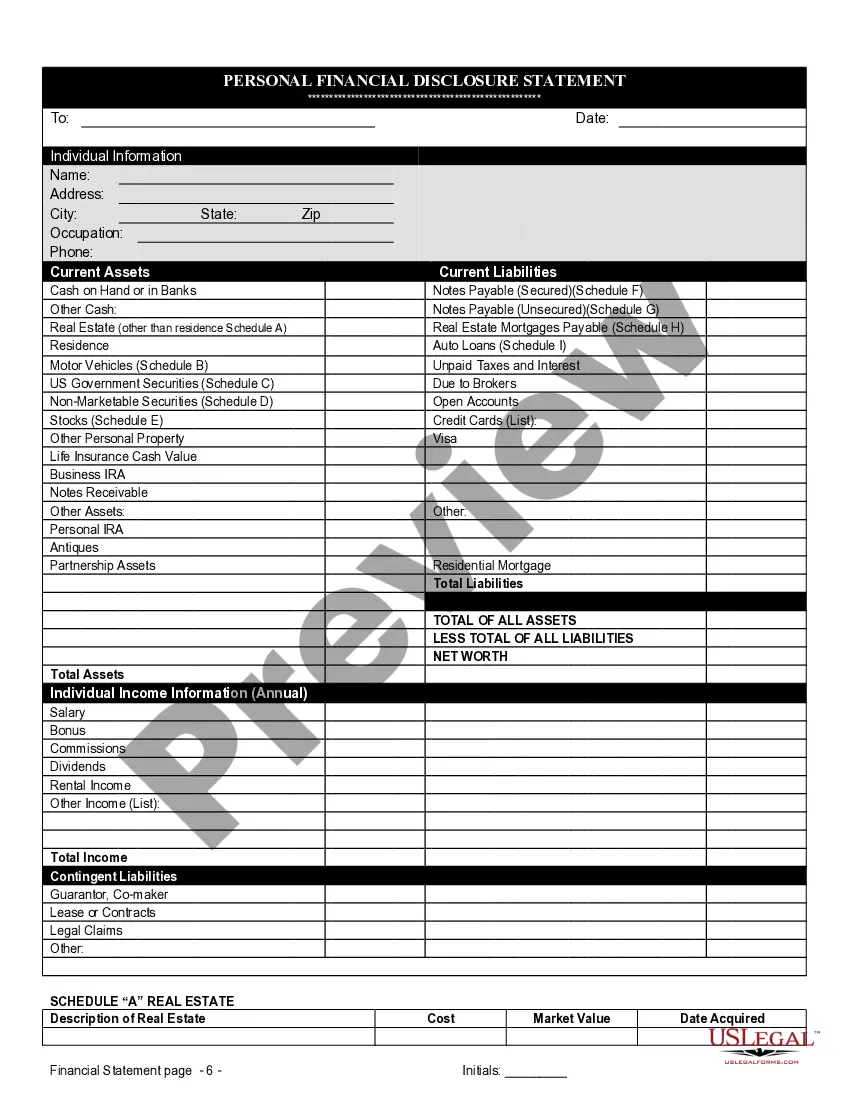

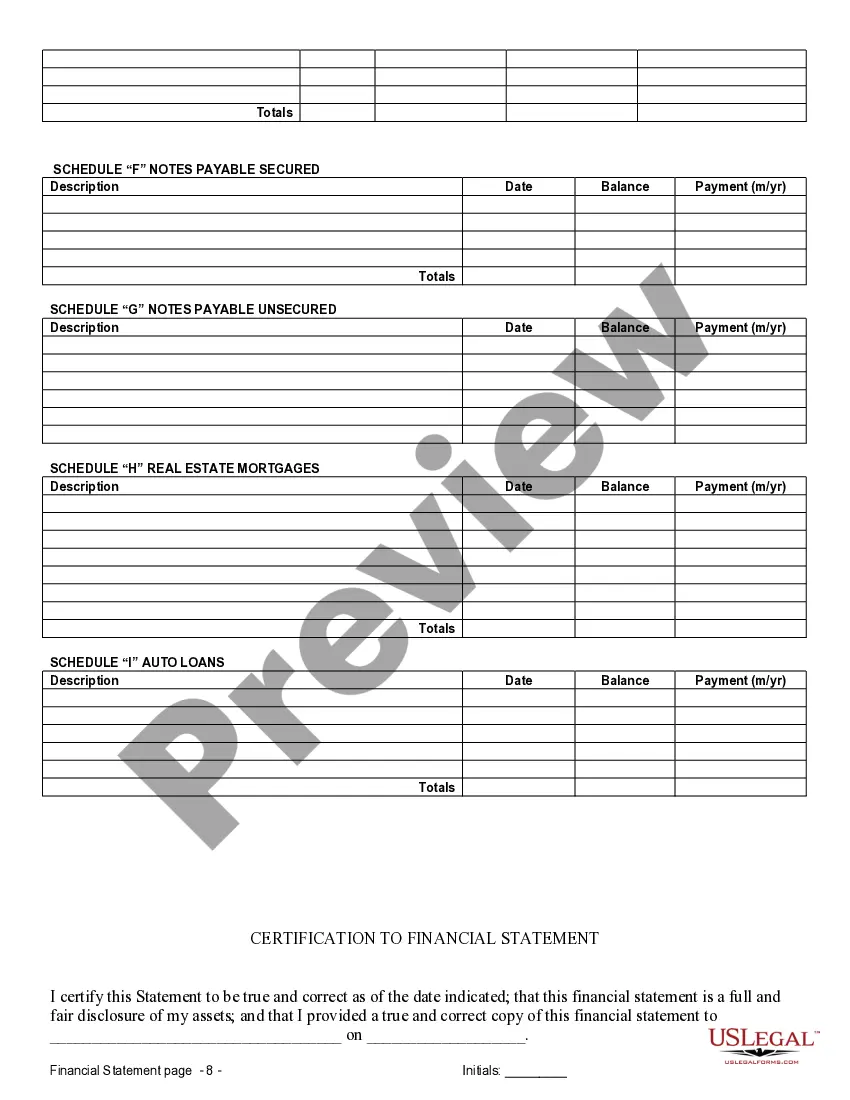

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

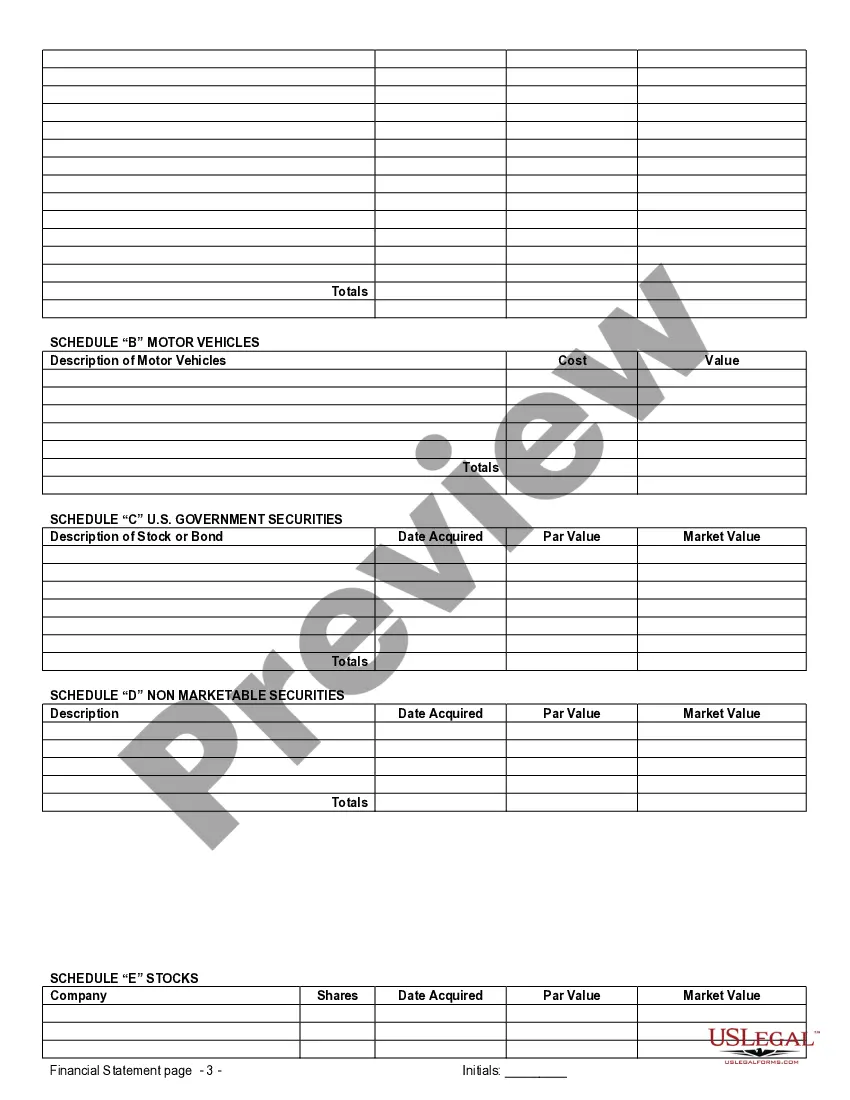

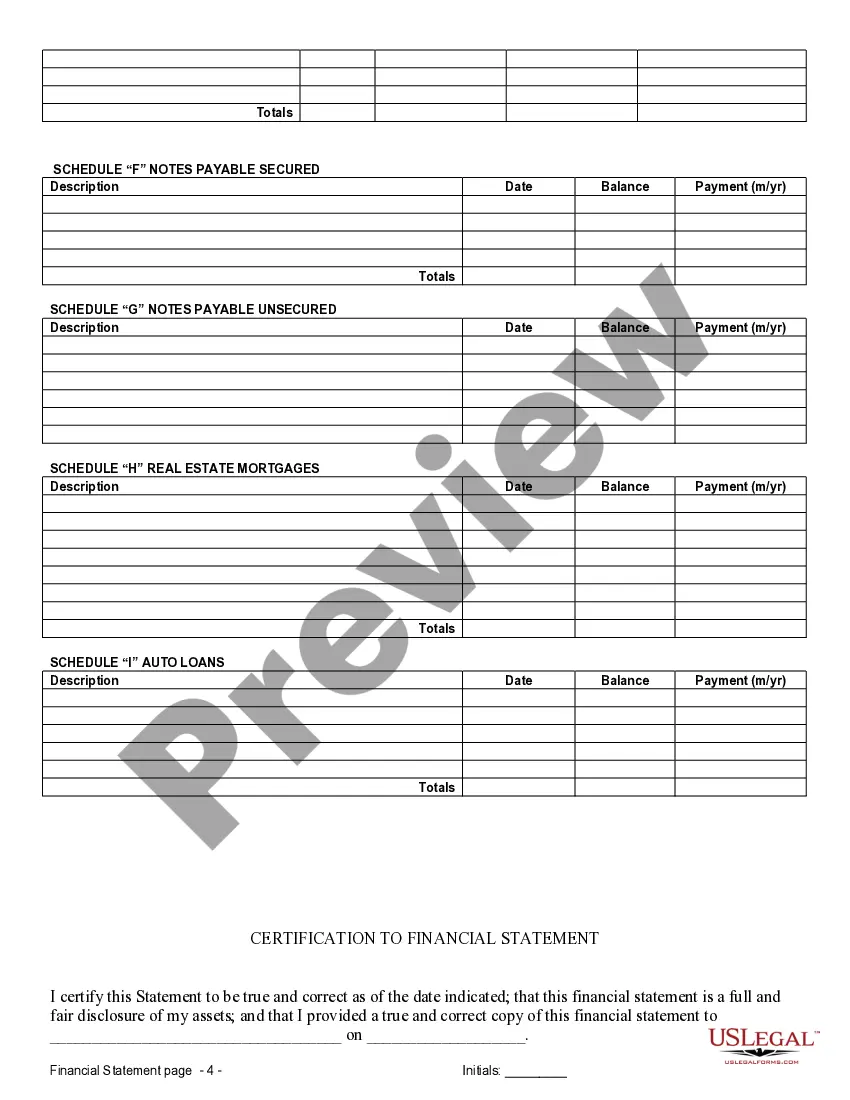

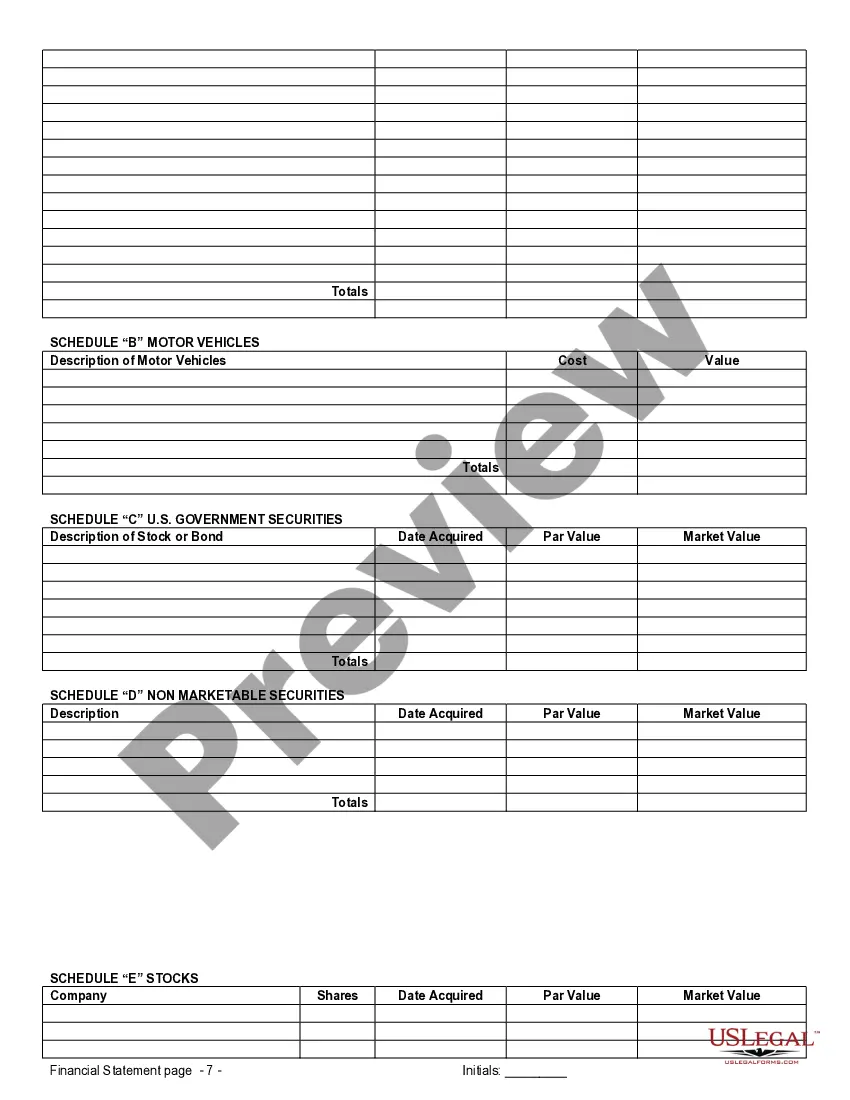

Miami Gardens Florida Financial Statements only in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in prenuptial (premarital) agreements in Miami Gardens, Florida. These statements provide a transparent overview of each party's financial status before entering into a marital contract. They offer a comprehensive record of assets, liabilities, and income, enabling both parties to make informed decisions about their future financial arrangements. Here are some types of financial statements commonly used in connection with prenuptial agreements: 1. Personal Balance Sheet: This statement outlines an individual's assets, including real estate properties, investment portfolios, bank accounts, vehicles, and valuable personal possessions such as jewelry or artwork. It also includes liabilities, such as outstanding loans, mortgages, or credit card debt. 2. Income Statement: Also known as a profit and loss statement, this document displays an individual's income and expenses over a specific period. It provides a detailed breakdown of earnings from employment, business ventures, rental properties, and investments, as well as all the regular expenses, such as rent/mortgage, utilities, insurance, and various discretionary costs. 3. Tax Returns: Tax returns provide a comprehensive overview of an individual or couple's income, deductions, and credits for a specific tax year. By reviewing tax returns, both parties can understand the other's financial history and make more informed decisions regarding any potential spousal support or liability implications. 4. Bank Statements: These documents show an individual's account balances, transactions, and history for a specific period. Bank statements help in establishing patterns of income, expenses, and financial conduct, giving both parties an accurate picture of their future spouse's financial habits. 5. Retirement Account Statements: Statements from retirement accounts, such as 401(k)s or IRAs, provide information on contributions, vested amounts, potential future growth, and beneficiaries. Including this information in the prenuptial agreement ensures transparency about retirement savings and plans, protecting both parties' financial interests. 6. Property Valuations: For individuals owning real estate, property valuations play a vital role. These evaluations determine the fair market value of properties, which can be crucial for dividing assets or establishing the value of a property in the event of a divorce or separation. It is essential for both parties to provide accurate and reliable financial statements to ensure a fair and valid prenuptial agreement. These statements must be prepared thoroughly and reviewed by financial advisors or legal professionals to avoid any discrepancies or misunderstandings. By utilizing the appropriate financial statements, couples in Miami Gardens, Florida, can protect their financial interests and build a strong foundation of trust and transparency within their prenuptial agreement.Miami Gardens Florida Financial Statements only in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in prenuptial (premarital) agreements in Miami Gardens, Florida. These statements provide a transparent overview of each party's financial status before entering into a marital contract. They offer a comprehensive record of assets, liabilities, and income, enabling both parties to make informed decisions about their future financial arrangements. Here are some types of financial statements commonly used in connection with prenuptial agreements: 1. Personal Balance Sheet: This statement outlines an individual's assets, including real estate properties, investment portfolios, bank accounts, vehicles, and valuable personal possessions such as jewelry or artwork. It also includes liabilities, such as outstanding loans, mortgages, or credit card debt. 2. Income Statement: Also known as a profit and loss statement, this document displays an individual's income and expenses over a specific period. It provides a detailed breakdown of earnings from employment, business ventures, rental properties, and investments, as well as all the regular expenses, such as rent/mortgage, utilities, insurance, and various discretionary costs. 3. Tax Returns: Tax returns provide a comprehensive overview of an individual or couple's income, deductions, and credits for a specific tax year. By reviewing tax returns, both parties can understand the other's financial history and make more informed decisions regarding any potential spousal support or liability implications. 4. Bank Statements: These documents show an individual's account balances, transactions, and history for a specific period. Bank statements help in establishing patterns of income, expenses, and financial conduct, giving both parties an accurate picture of their future spouse's financial habits. 5. Retirement Account Statements: Statements from retirement accounts, such as 401(k)s or IRAs, provide information on contributions, vested amounts, potential future growth, and beneficiaries. Including this information in the prenuptial agreement ensures transparency about retirement savings and plans, protecting both parties' financial interests. 6. Property Valuations: For individuals owning real estate, property valuations play a vital role. These evaluations determine the fair market value of properties, which can be crucial for dividing assets or establishing the value of a property in the event of a divorce or separation. It is essential for both parties to provide accurate and reliable financial statements to ensure a fair and valid prenuptial agreement. These statements must be prepared thoroughly and reviewed by financial advisors or legal professionals to avoid any discrepancies or misunderstandings. By utilizing the appropriate financial statements, couples in Miami Gardens, Florida, can protect their financial interests and build a strong foundation of trust and transparency within their prenuptial agreement.