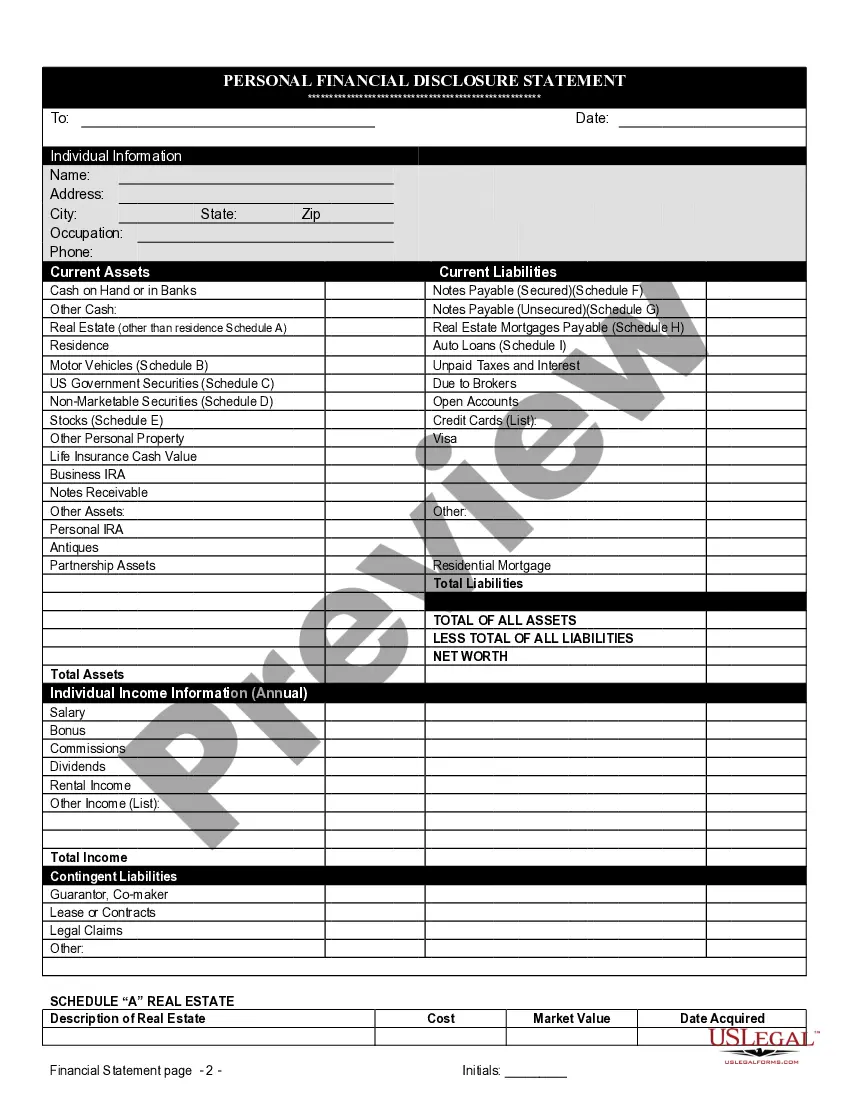

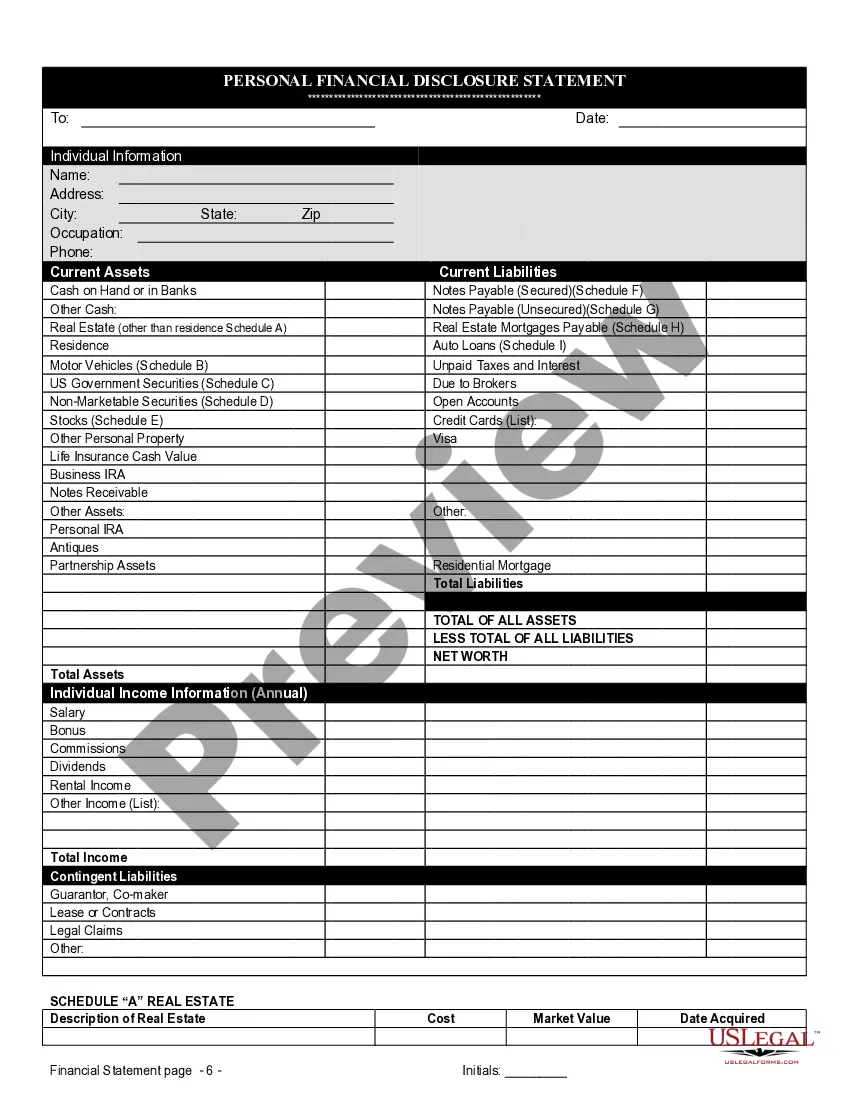

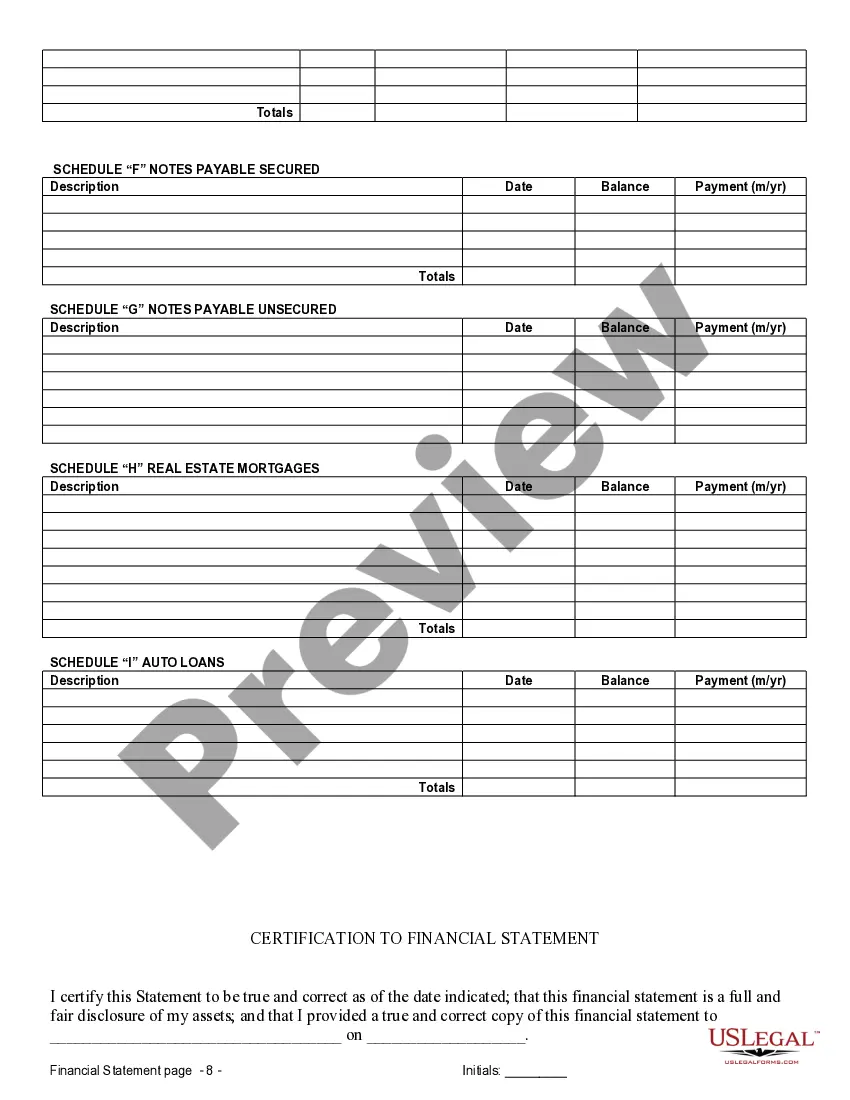

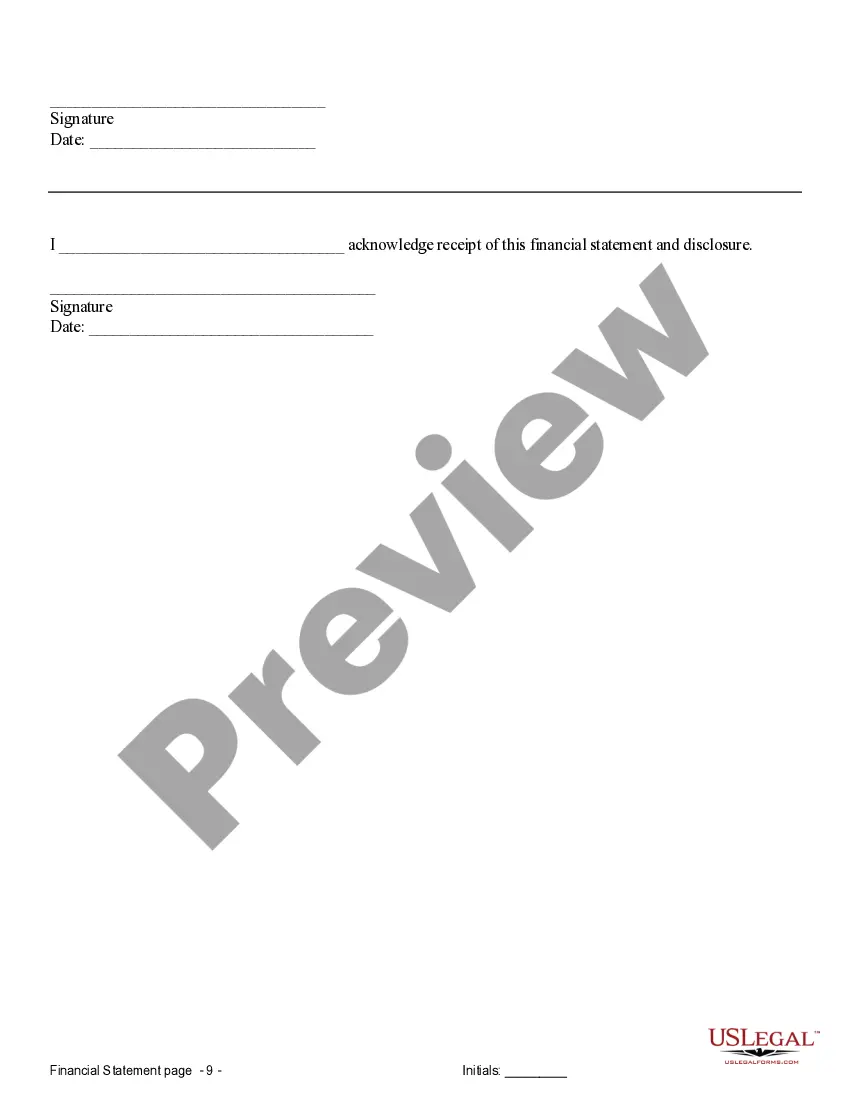

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

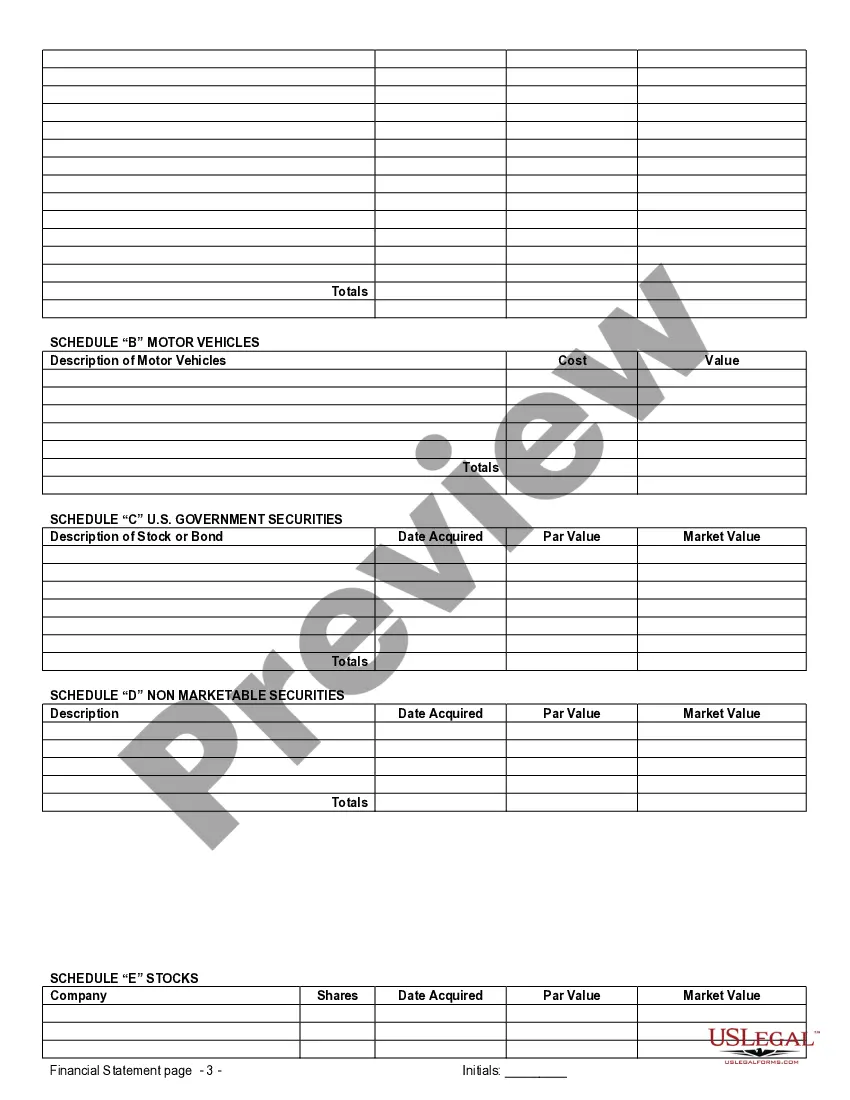

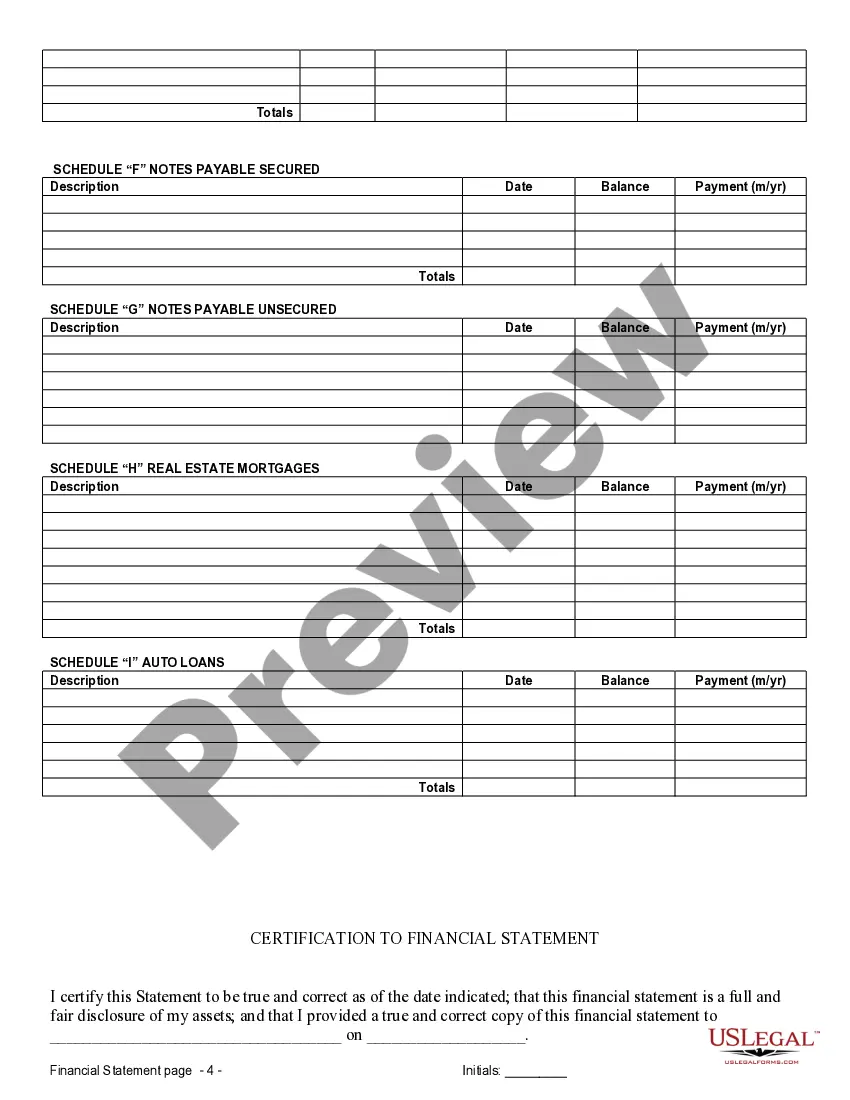

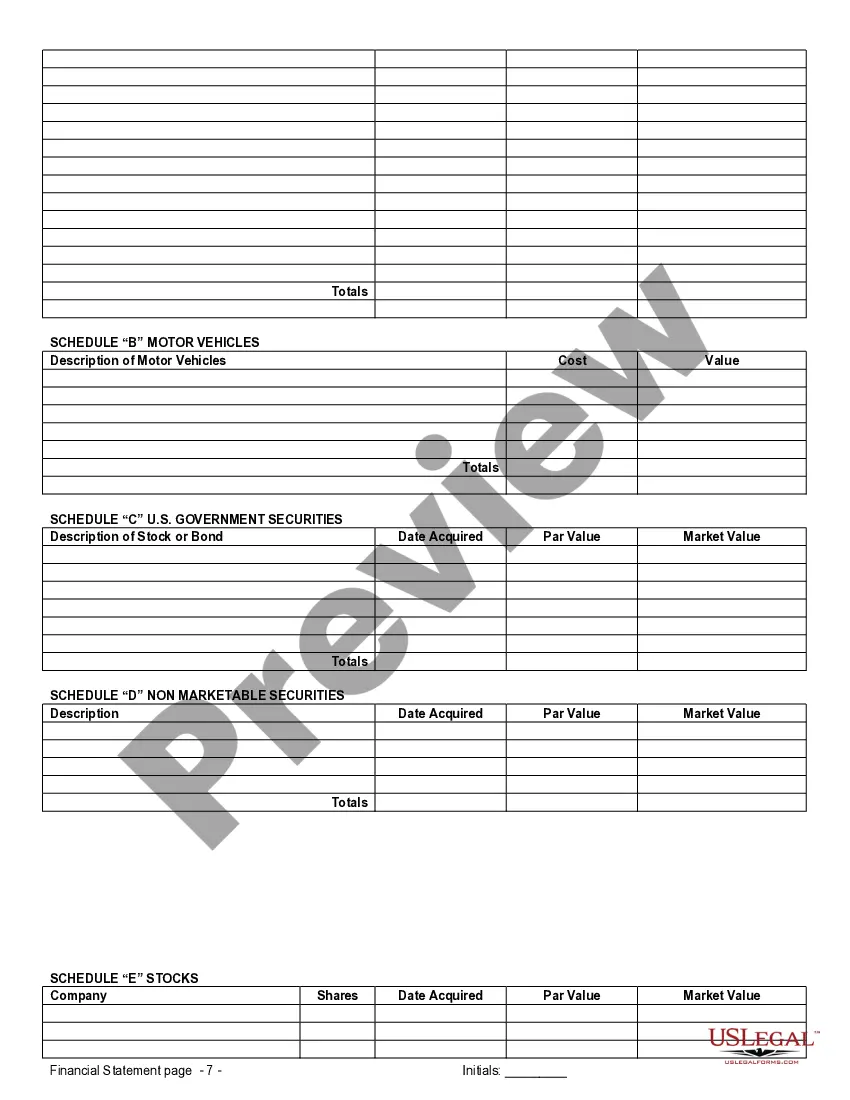

Orange Florida Financial Statements only in connection with Prenuptial Premarital Agreement are documents that provide a detailed overview of an individual or couple's financial situation. These statements are essential for individuals entering into a prenuptial or premarital agreement in Orange, Florida. There are different types of Orange Florida Financial Statements that can be used in connection with a Prenuptial Premarital Agreement, including: 1. Personal Financial Statements: This type of statement encompasses an individual's personal assets, liabilities, income, and expenses. It includes details of bank accounts, investments, real estate holdings, and any outstanding debts. 2. Business Financial Statements: If one or both parties own a business or have a significant interest in one, a business financial statement may be required. This statement outlines the financial position of the business, including assets, liabilities, revenues, and expenses. It provides a clear understanding of the business's value and potential impact on the prenuptial agreement. 3. Real Estate Financial Statements: If the couple owns real estate properties, a separate statement specifically highlighting their real estate holdings should be included. This statement includes details about the properties, such as location, market value, and any mortgages or loans against them. 4. Investment Portfolio Statements: If the individuals have investment portfolios, such as stocks, bonds, mutual funds, or retirement accounts, this statement provides an overview of the portfolio's holdings, their value, and any income generated from them. 5. Retirement Account Statements: This type of statement focuses solely on the retirement accounts owned by the individuals. It includes details about the account balances, contributions, withdrawals, and any associated penalties or tax implications. 6. Tax Return Statements: Providing copies of recent tax returns can give a comprehensive picture of the individuals' income, deductions, and overall financial situation. Tax returns can reveal additional assets, liabilities, and even hidden income sources. When preparing these financial statements, it is crucial to accurately disclose all relevant financial information to ensure transparency and fairness in the prenuptial or premarital agreement process. Professional assistance from financial advisors, accountants, or lawyers experienced in prenuptial agreements is highly recommended ensuring compliance with Orange, Florida's legal requirements and provide the necessary financial insight for a successful agreement.Orange Florida Financial Statements only in connection with Prenuptial Premarital Agreement are documents that provide a detailed overview of an individual or couple's financial situation. These statements are essential for individuals entering into a prenuptial or premarital agreement in Orange, Florida. There are different types of Orange Florida Financial Statements that can be used in connection with a Prenuptial Premarital Agreement, including: 1. Personal Financial Statements: This type of statement encompasses an individual's personal assets, liabilities, income, and expenses. It includes details of bank accounts, investments, real estate holdings, and any outstanding debts. 2. Business Financial Statements: If one or both parties own a business or have a significant interest in one, a business financial statement may be required. This statement outlines the financial position of the business, including assets, liabilities, revenues, and expenses. It provides a clear understanding of the business's value and potential impact on the prenuptial agreement. 3. Real Estate Financial Statements: If the couple owns real estate properties, a separate statement specifically highlighting their real estate holdings should be included. This statement includes details about the properties, such as location, market value, and any mortgages or loans against them. 4. Investment Portfolio Statements: If the individuals have investment portfolios, such as stocks, bonds, mutual funds, or retirement accounts, this statement provides an overview of the portfolio's holdings, their value, and any income generated from them. 5. Retirement Account Statements: This type of statement focuses solely on the retirement accounts owned by the individuals. It includes details about the account balances, contributions, withdrawals, and any associated penalties or tax implications. 6. Tax Return Statements: Providing copies of recent tax returns can give a comprehensive picture of the individuals' income, deductions, and overall financial situation. Tax returns can reveal additional assets, liabilities, and even hidden income sources. When preparing these financial statements, it is crucial to accurately disclose all relevant financial information to ensure transparency and fairness in the prenuptial or premarital agreement process. Professional assistance from financial advisors, accountants, or lawyers experienced in prenuptial agreements is highly recommended ensuring compliance with Orange, Florida's legal requirements and provide the necessary financial insight for a successful agreement.