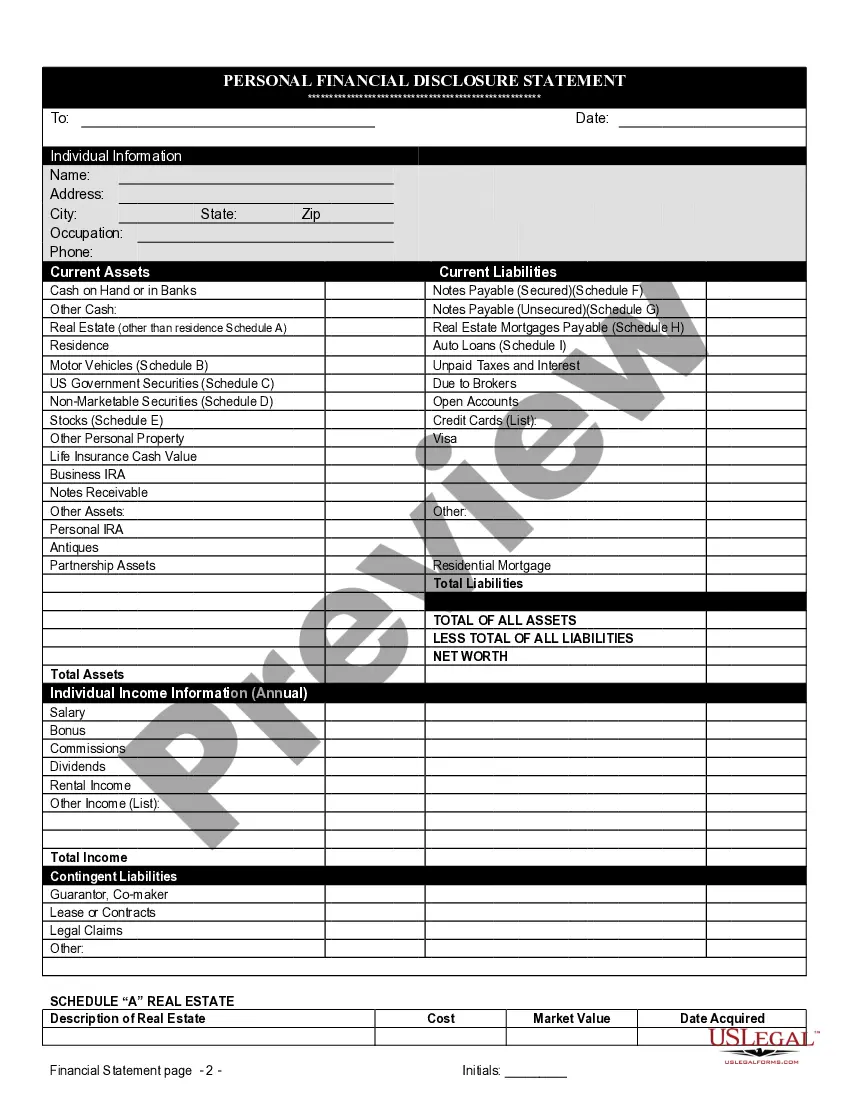

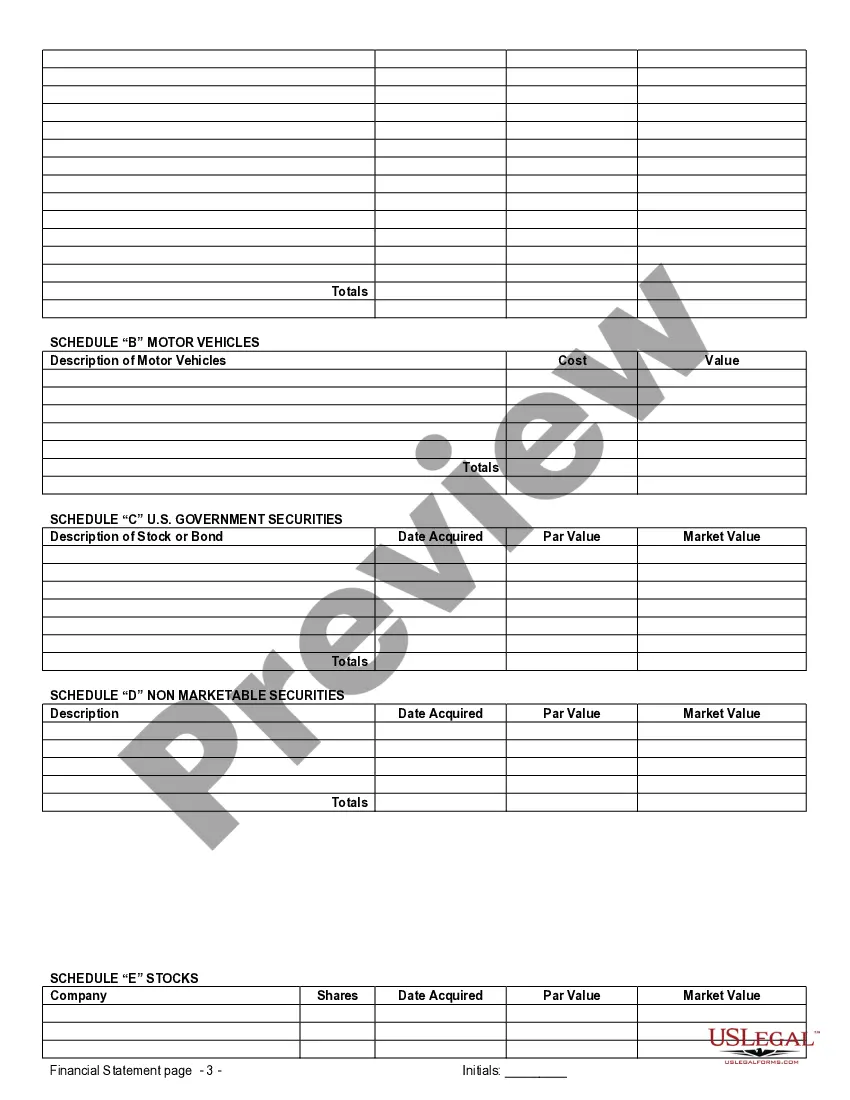

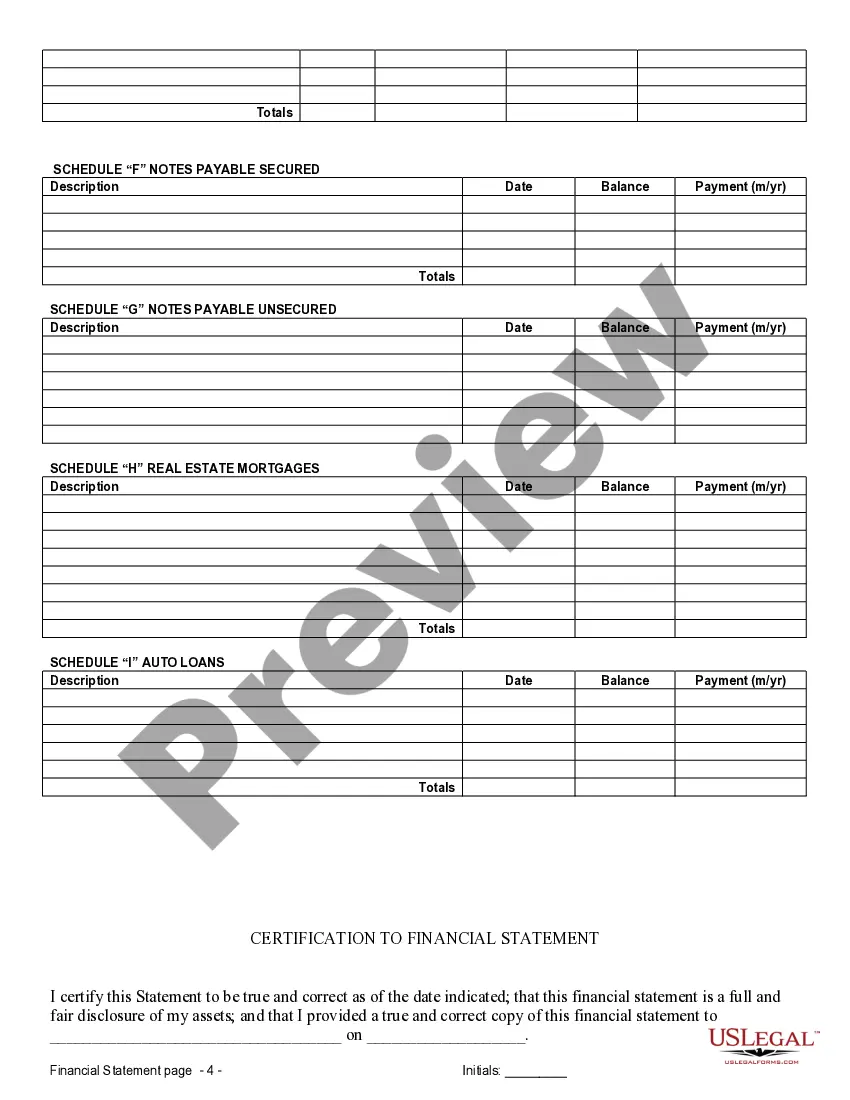

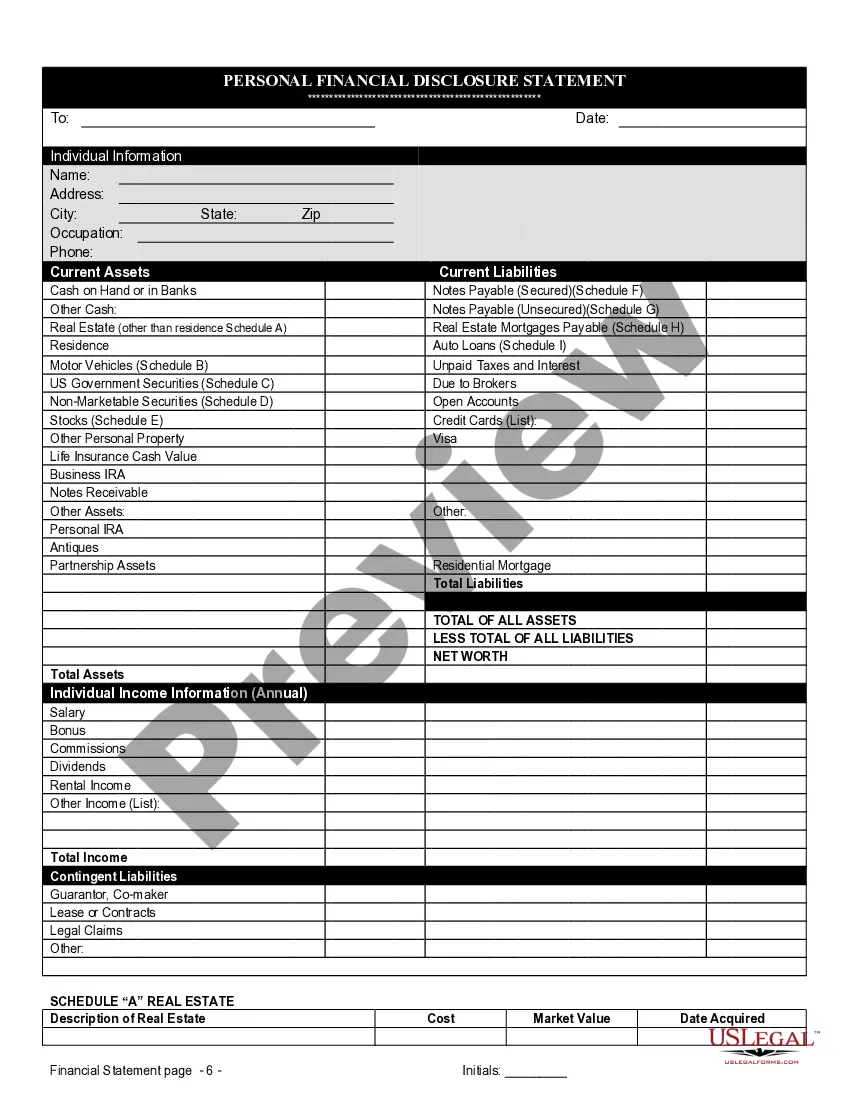

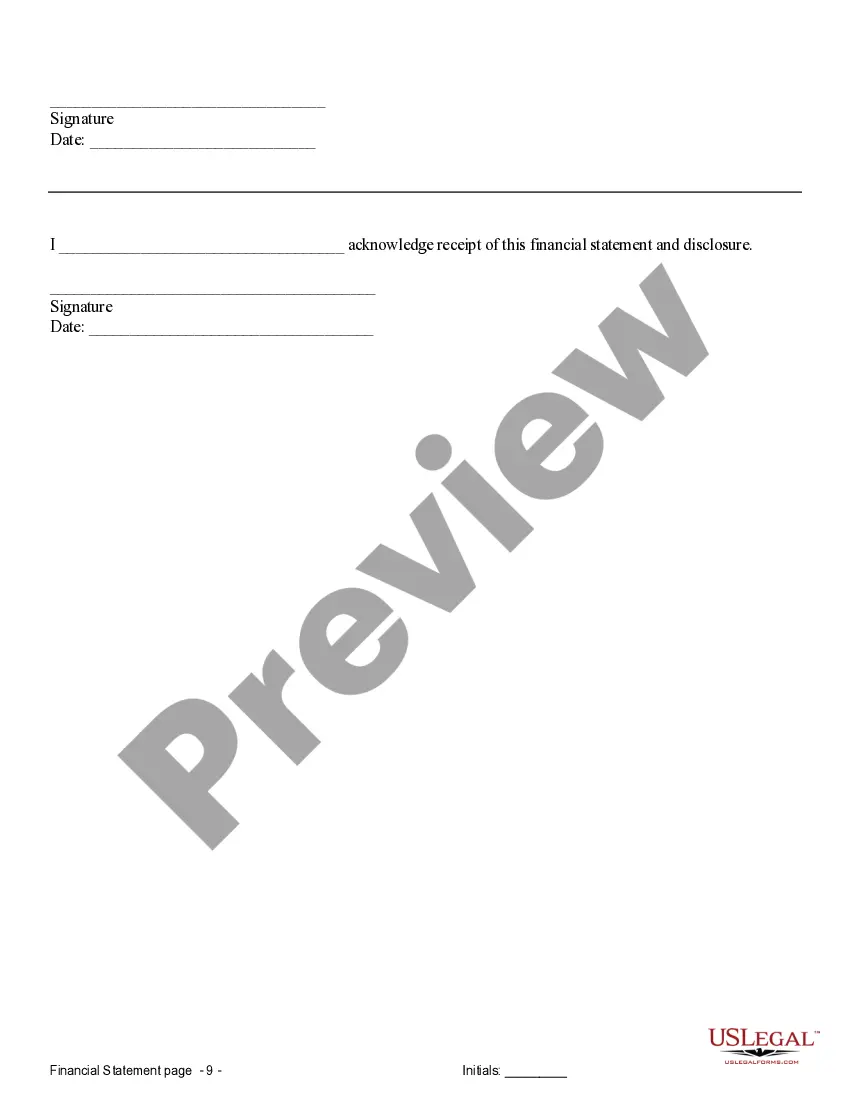

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

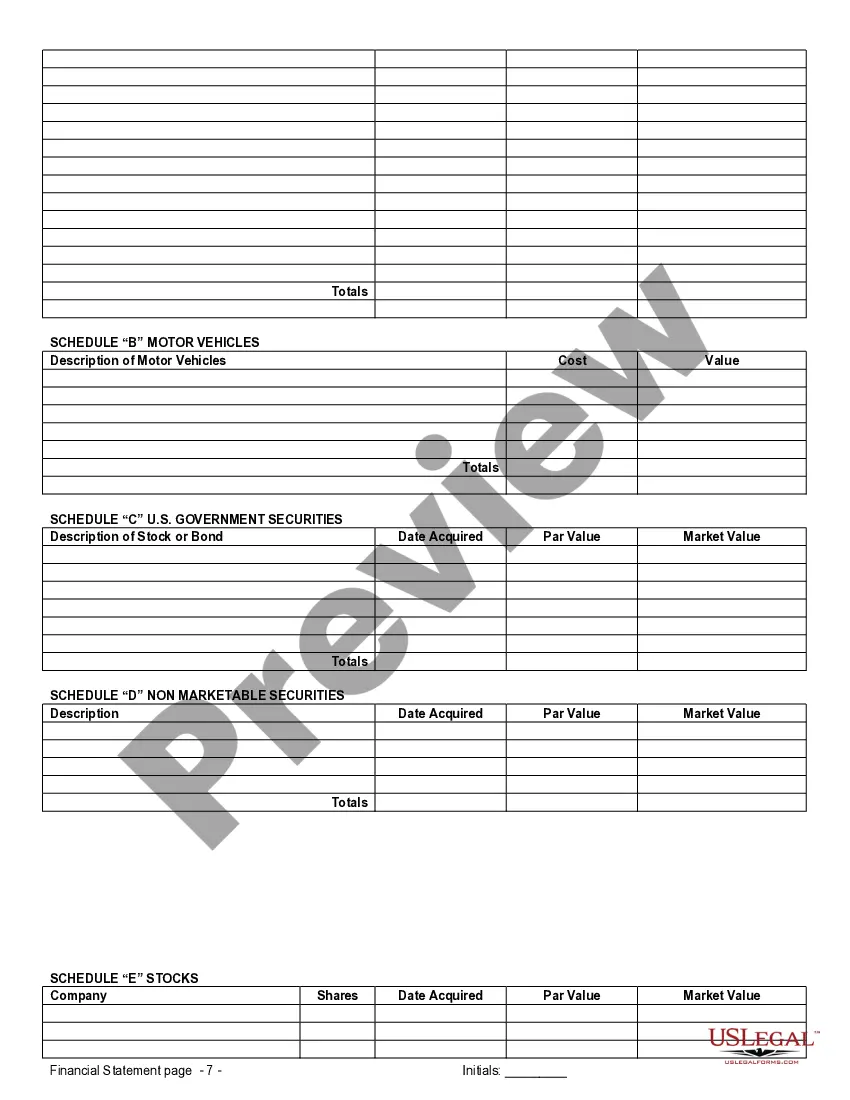

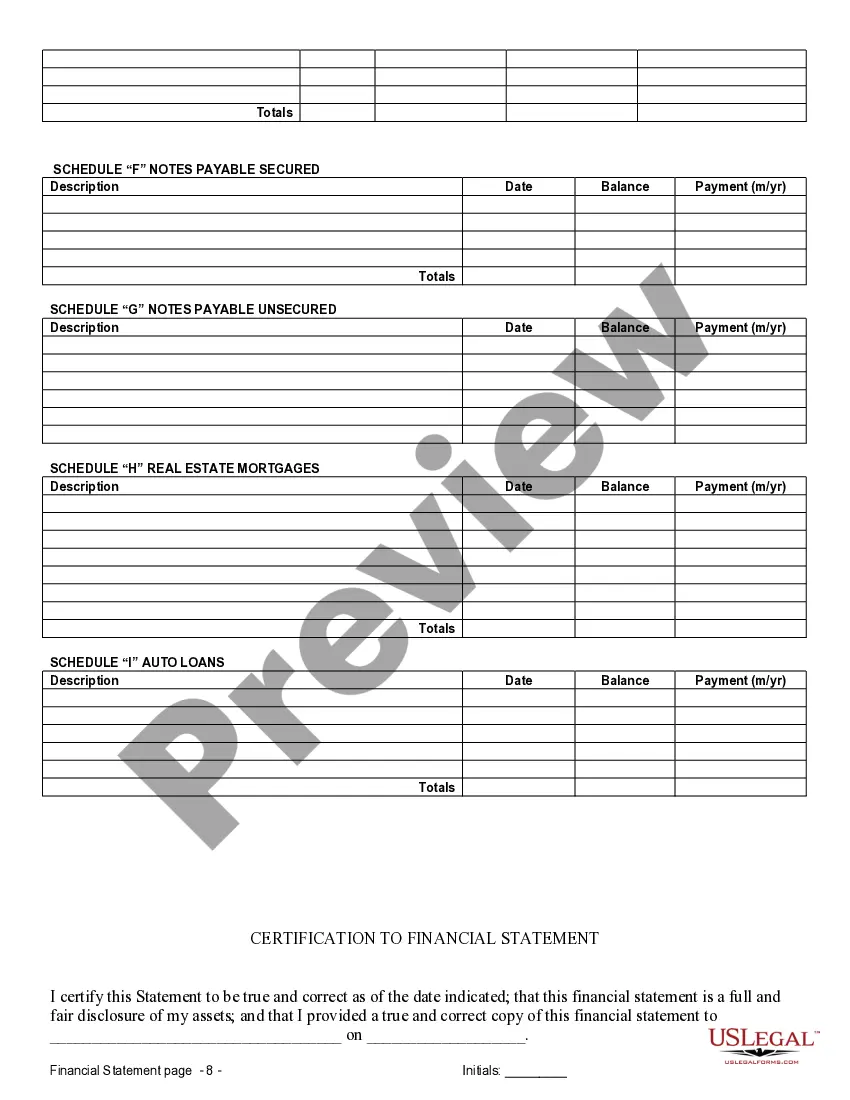

Orlando Florida Financial Statements in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role when considering a prenuptial or premarital agreement in Orlando, Florida. These statements provide a comprehensive view of the financial situation of each partner, ensuring transparency and establishing a solid foundation for the agreement. Here, we will explore the different types of financial statements commonly used in Orlando when drafting prenuptial or premarital agreements. 1. Personal Financial Statement: A personal financial statement provides a detailed overview of an individual's financial standing. It includes information about their assets, liabilities, income, expenses, and net worth. When preparing a prenuptial agreement, each partner is required to submit their personal financial statement to ensure a fair and equitable distribution of assets in case of divorce or separation. 2. Balance Sheet: A balance sheet offers a snapshot of an individual's financial condition at a specific point in time. It includes information about their assets, such as real estate, investments, bank accounts, vehicles, and personal belongings. Additionally, liabilities like mortgages, loans, credit card debt, and other obligations are listed. By analyzing the balance sheet, it becomes easier to determine how assets and debts will be divided in case of a divorce. 3. Income Statement: An income statement provides an overview of a person's income and expenses over a specific period, usually a year. It includes details about their salary, bonuses, dividends, rental income, and any other sources of revenue. This statement is crucial for understanding the earning potential and financial stability of each partner. It can help determine spousal support or alimony payments in the event of a divorce. 4. Tax Returns: Tax returns are an important piece of financial documentation. They provide a comprehensive view of an individual's income, deductions, and tax liabilities. Detailed tax returns for multiple years can offer insights into a person's financial history, allowing for a more accurate assessment of their financial standing. These tax returns become even more important when high net worth individuals or business owners are involved. 5. Business Financial Statements: If one or both partners own a business, business financial statements become necessary. These statements may include balance sheets, income statements, cash flow statements, and details about the business's assets, liabilities, revenue, expenses, and profits. Analyzing these statements helps assess the value of the business and determine how it will be handled in the prenuptial agreement. In conclusion, when drafting a prenuptial or premarital agreement in Orlando, Florida, having detailed financial statements is vital. Personal financial statements, balance sheets, income statements, tax returns, and business financial statements help ensure that the agreement accurately reflects the financial circumstances of each partner. Consulting with a qualified attorney specializing in family law and prenuptial agreements can provide further guidance and ensure that all legal requirements are met.

Orlando Florida Financial Statements in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role when considering a prenuptial or premarital agreement in Orlando, Florida. These statements provide a comprehensive view of the financial situation of each partner, ensuring transparency and establishing a solid foundation for the agreement. Here, we will explore the different types of financial statements commonly used in Orlando when drafting prenuptial or premarital agreements. 1. Personal Financial Statement: A personal financial statement provides a detailed overview of an individual's financial standing. It includes information about their assets, liabilities, income, expenses, and net worth. When preparing a prenuptial agreement, each partner is required to submit their personal financial statement to ensure a fair and equitable distribution of assets in case of divorce or separation. 2. Balance Sheet: A balance sheet offers a snapshot of an individual's financial condition at a specific point in time. It includes information about their assets, such as real estate, investments, bank accounts, vehicles, and personal belongings. Additionally, liabilities like mortgages, loans, credit card debt, and other obligations are listed. By analyzing the balance sheet, it becomes easier to determine how assets and debts will be divided in case of a divorce. 3. Income Statement: An income statement provides an overview of a person's income and expenses over a specific period, usually a year. It includes details about their salary, bonuses, dividends, rental income, and any other sources of revenue. This statement is crucial for understanding the earning potential and financial stability of each partner. It can help determine spousal support or alimony payments in the event of a divorce. 4. Tax Returns: Tax returns are an important piece of financial documentation. They provide a comprehensive view of an individual's income, deductions, and tax liabilities. Detailed tax returns for multiple years can offer insights into a person's financial history, allowing for a more accurate assessment of their financial standing. These tax returns become even more important when high net worth individuals or business owners are involved. 5. Business Financial Statements: If one or both partners own a business, business financial statements become necessary. These statements may include balance sheets, income statements, cash flow statements, and details about the business's assets, liabilities, revenue, expenses, and profits. Analyzing these statements helps assess the value of the business and determine how it will be handled in the prenuptial agreement. In conclusion, when drafting a prenuptial or premarital agreement in Orlando, Florida, having detailed financial statements is vital. Personal financial statements, balance sheets, income statements, tax returns, and business financial statements help ensure that the agreement accurately reflects the financial circumstances of each partner. Consulting with a qualified attorney specializing in family law and prenuptial agreements can provide further guidance and ensure that all legal requirements are met.