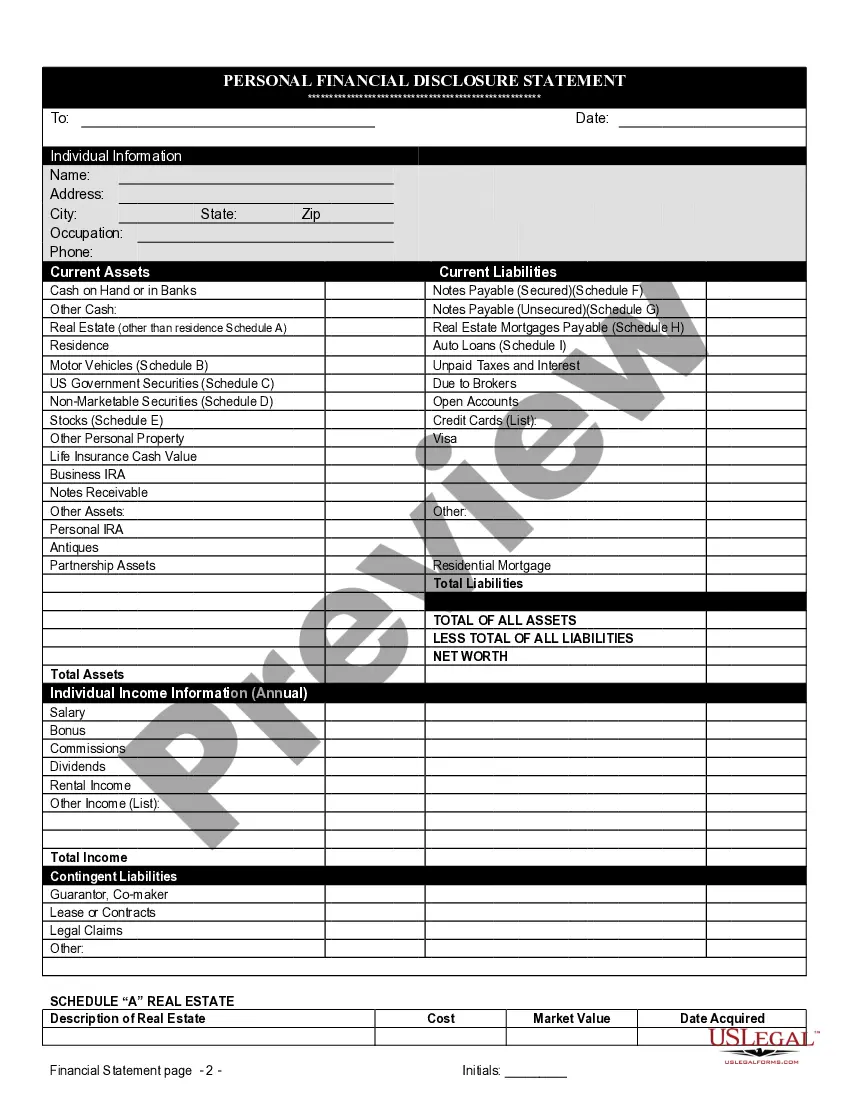

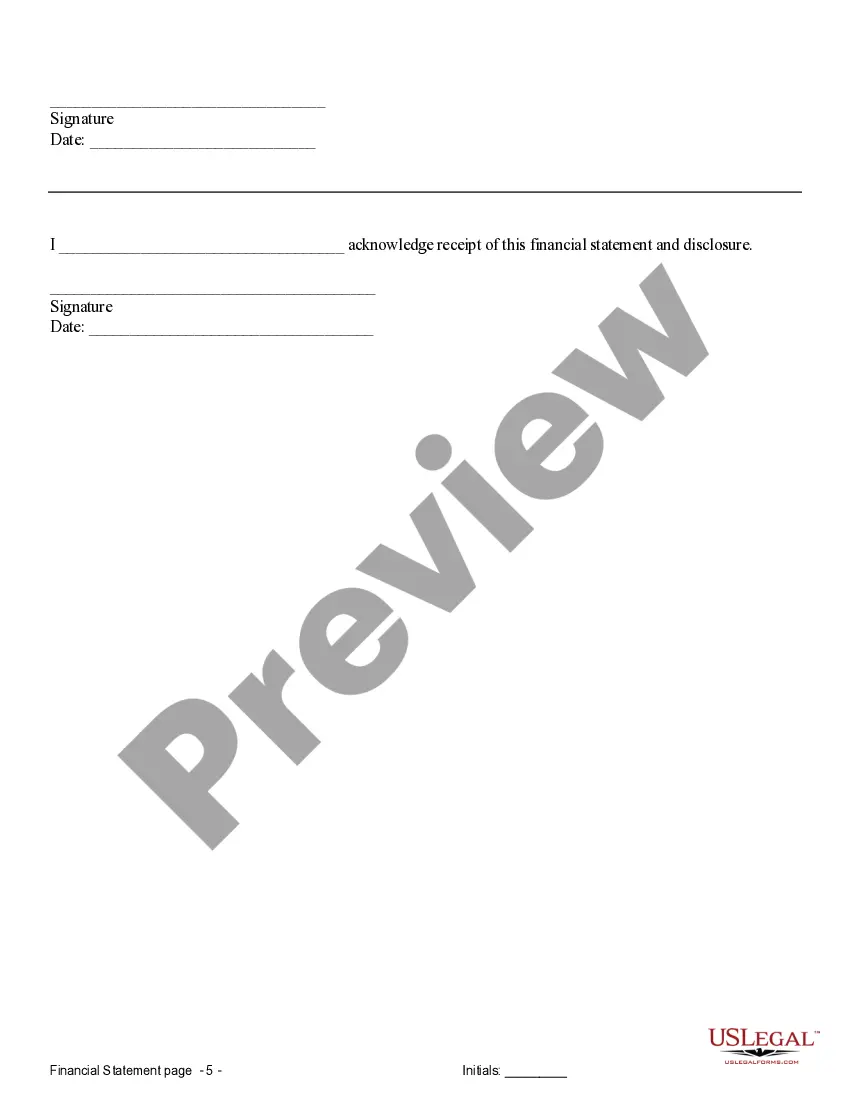

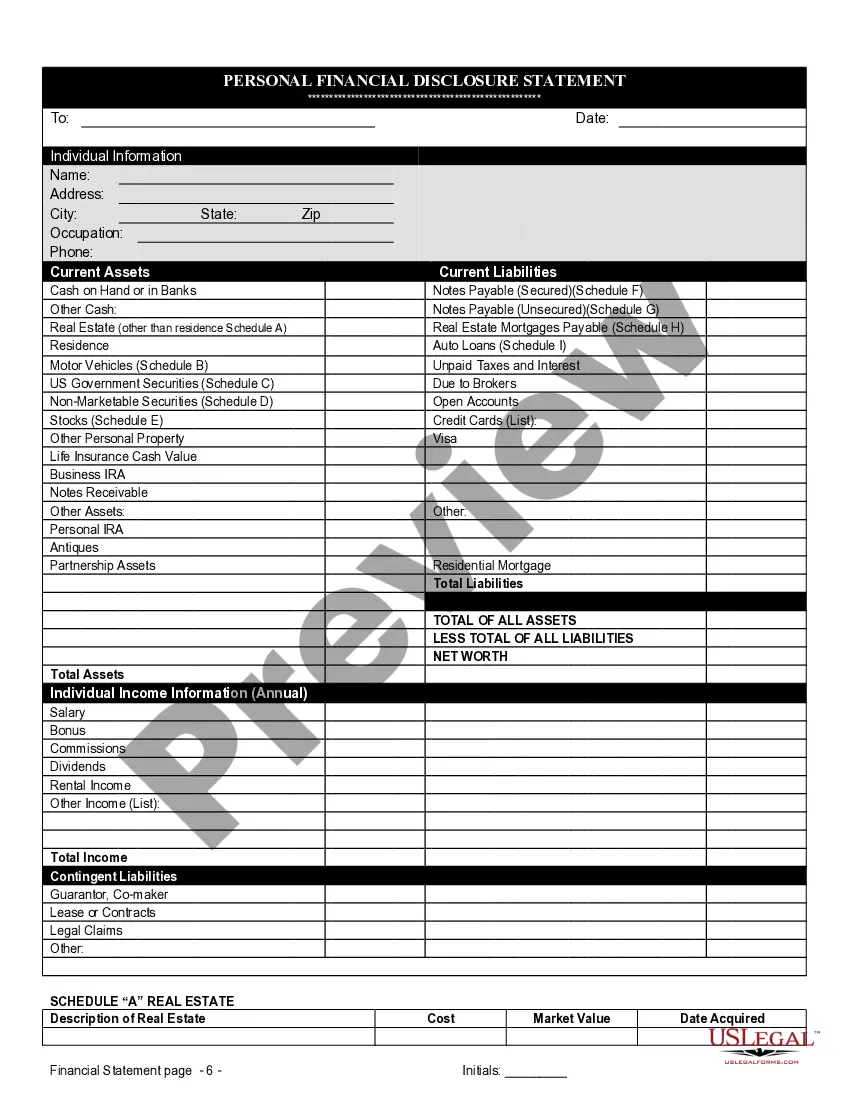

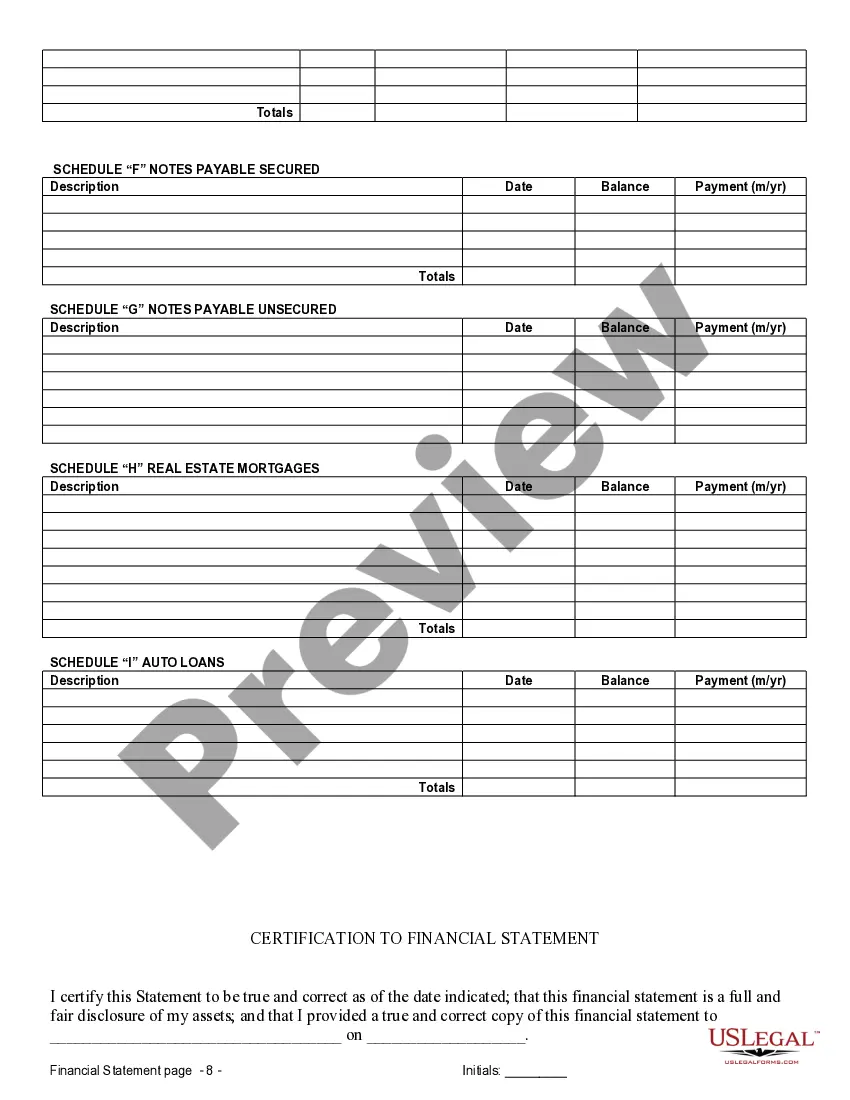

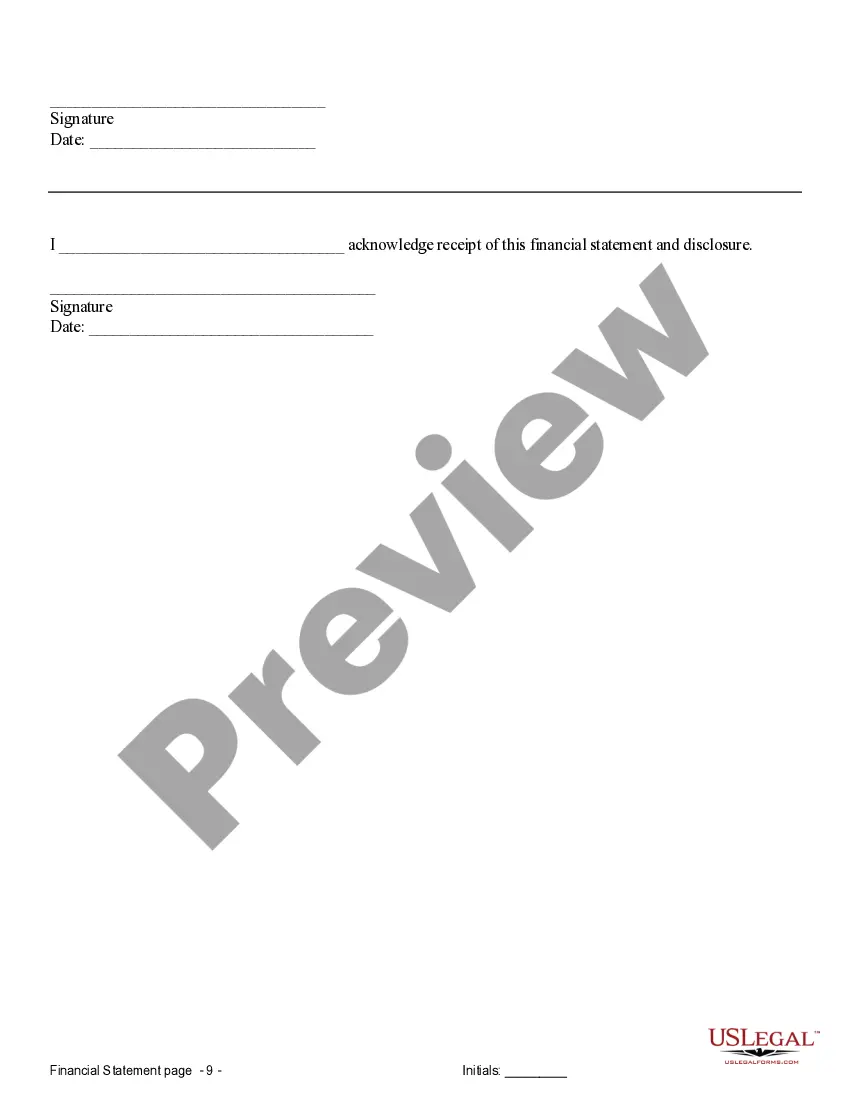

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

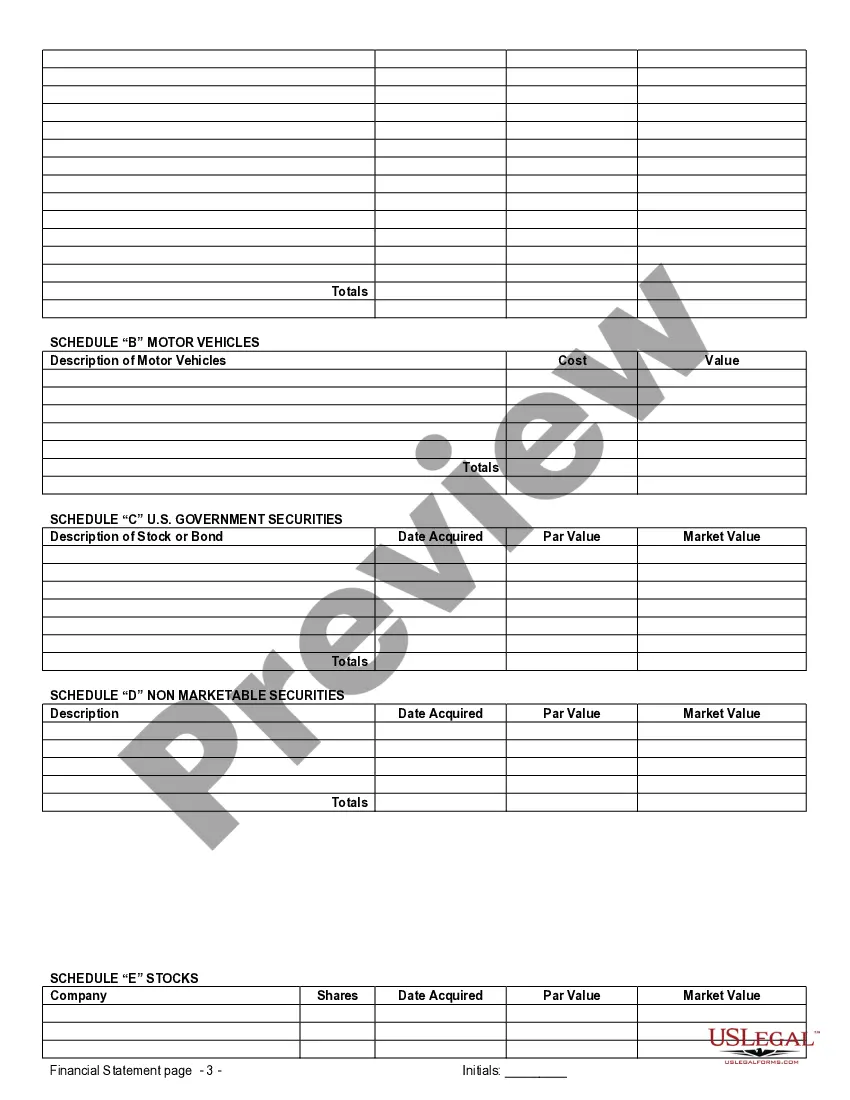

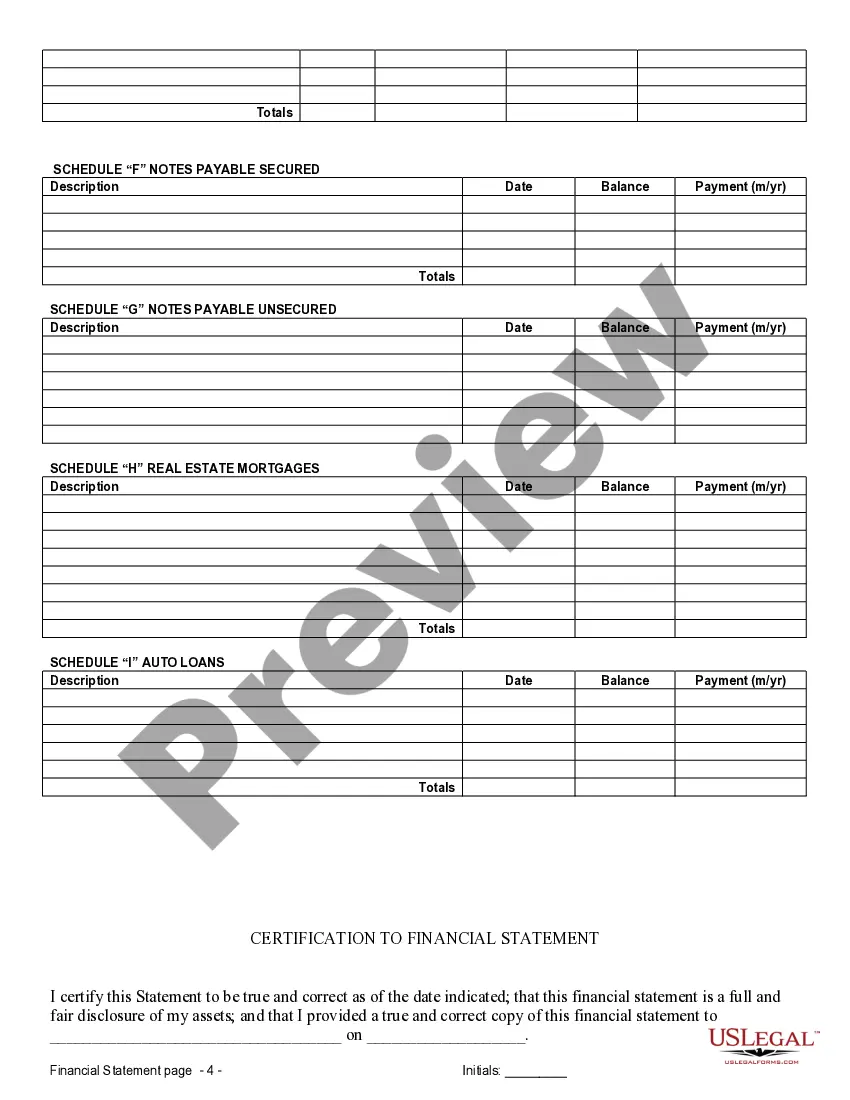

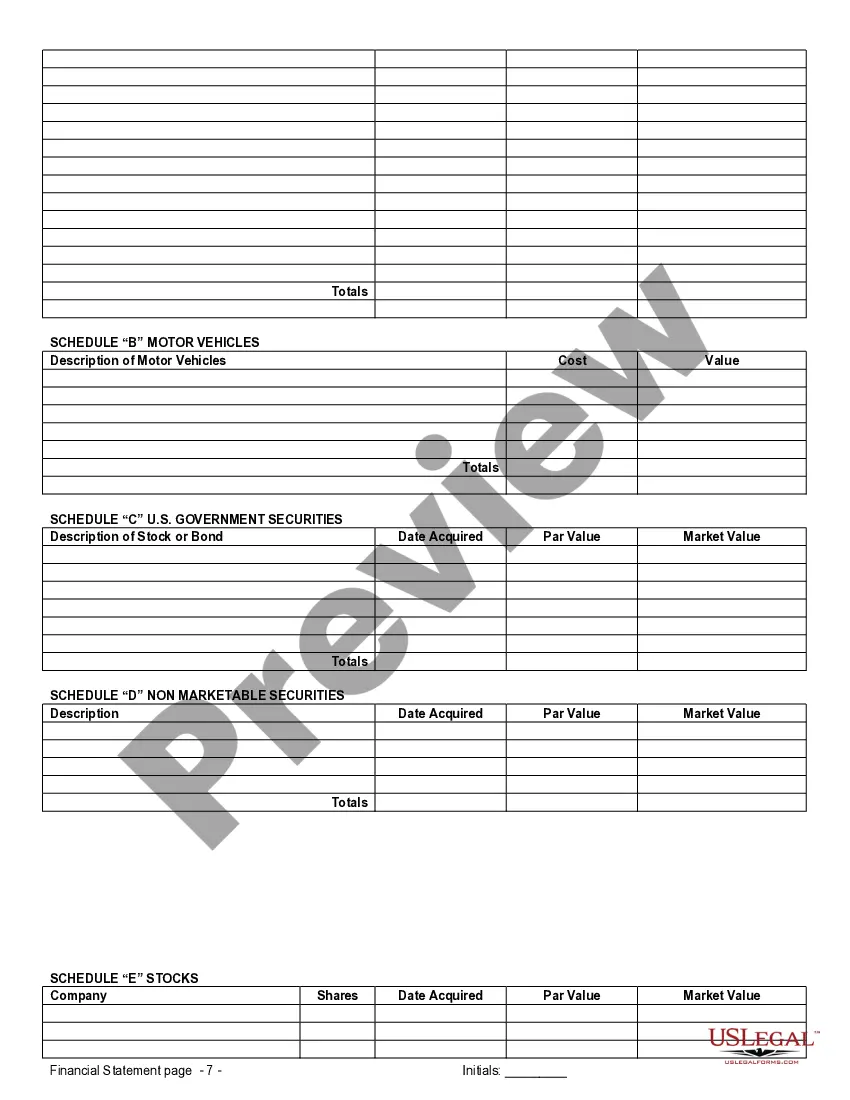

Palm Beach, Florida Financial Statements only in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in prenuptial or premarital agreements. They provide a comprehensive overview of each party's financial situation, ensuring transparency and protection of assets in case of a divorce or separation. In Palm Beach, Florida, specific types of financial statements are commonly used in connection with prenuptial or premarital agreements to ensure both parties' interests are safeguarded. Let's delve into these statements and their significance: 1. Personal Balance Sheet: A personal balance sheet outlines an individual's assets, liabilities, and net worth. It provides a comprehensive snapshot of their financial standing, including bank accounts, real estate properties, investments, retirement accounts, debts, and any business interests. By including this statement in a prenuptial agreement, both parties can understand the financial footing of their partner before entering into the marriage. 2. Income Statement: An income statement serves as a record of an individual's income, expenses, and net income over a specified period. Including an income statement in a financial statement for a prenuptial or premarital agreement allows both parties to understand the income flow, ensuring fair division of financial responsibilities during the marriage and in the event of a divorce. 3. Asset Documentation: In addition to financial statements, parties entering a prenuptial agreement may need to provide detailed documentation for their assets, such as property deeds, mortgage statements, vehicle registrations, investment portfolios, and business ownership documents. These documents substantiate ownership and are vital in determining the division of assets in the event of a divorce or separation. 4. Tax Returns: Tax returns reveal an individual's income, deductions, exemptions, and any potential tax obligations. In Palm Beach, Florida, tax returns are often requested as part of the financial statements in connection with prenuptial or premarital agreements. They provide an accurate representation of each party's financial situation and can help avoid disputes regarding income and tax liabilities during a divorce. 5. Business Financial Statements: If one or both parties own a business, specific business financial statements, such as profit and loss statements, cash flow statements, and balance sheets, may be required. These statements provide a detailed overview of the business's financial health, ensuring its separation from personal assets during divorce proceedings. It's crucial to consult with an experienced family law attorney or financial advisor in Palm Beach, Florida, who specializes in prenuptial or premarital agreements to ensure that all necessary financial statements and documentation are accurately prepared and included. This will help protect each party's interests and provide a clear roadmap for the division of assets, debts, and financial responsibilities, should the marriage come to an end.

Palm Beach, Florida Financial Statements only in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in prenuptial or premarital agreements. They provide a comprehensive overview of each party's financial situation, ensuring transparency and protection of assets in case of a divorce or separation. In Palm Beach, Florida, specific types of financial statements are commonly used in connection with prenuptial or premarital agreements to ensure both parties' interests are safeguarded. Let's delve into these statements and their significance: 1. Personal Balance Sheet: A personal balance sheet outlines an individual's assets, liabilities, and net worth. It provides a comprehensive snapshot of their financial standing, including bank accounts, real estate properties, investments, retirement accounts, debts, and any business interests. By including this statement in a prenuptial agreement, both parties can understand the financial footing of their partner before entering into the marriage. 2. Income Statement: An income statement serves as a record of an individual's income, expenses, and net income over a specified period. Including an income statement in a financial statement for a prenuptial or premarital agreement allows both parties to understand the income flow, ensuring fair division of financial responsibilities during the marriage and in the event of a divorce. 3. Asset Documentation: In addition to financial statements, parties entering a prenuptial agreement may need to provide detailed documentation for their assets, such as property deeds, mortgage statements, vehicle registrations, investment portfolios, and business ownership documents. These documents substantiate ownership and are vital in determining the division of assets in the event of a divorce or separation. 4. Tax Returns: Tax returns reveal an individual's income, deductions, exemptions, and any potential tax obligations. In Palm Beach, Florida, tax returns are often requested as part of the financial statements in connection with prenuptial or premarital agreements. They provide an accurate representation of each party's financial situation and can help avoid disputes regarding income and tax liabilities during a divorce. 5. Business Financial Statements: If one or both parties own a business, specific business financial statements, such as profit and loss statements, cash flow statements, and balance sheets, may be required. These statements provide a detailed overview of the business's financial health, ensuring its separation from personal assets during divorce proceedings. It's crucial to consult with an experienced family law attorney or financial advisor in Palm Beach, Florida, who specializes in prenuptial or premarital agreements to ensure that all necessary financial statements and documentation are accurately prepared and included. This will help protect each party's interests and provide a clear roadmap for the division of assets, debts, and financial responsibilities, should the marriage come to an end.